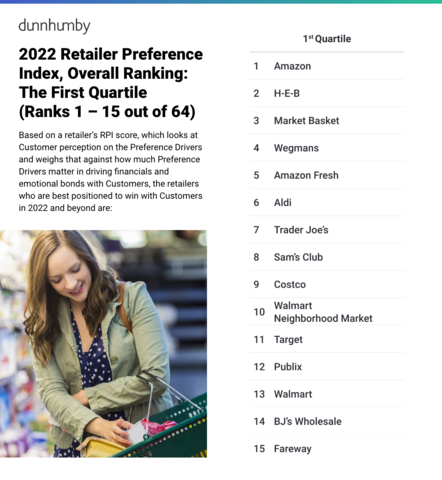

CHICAGO--(BUSINESS WIRE)--dunnhumby, the global leader in customer data science, today released the fifth annual dunnhumby Retailer Preference Index (RPI), a comprehensive, nationwide study that examines the approximately $1 trillion U.S. grocery market. In a second year dominated by Covid-19, Amazon cemented its leadership position, with H-E-B following in second place and Market Basket leap frogging three retailers to take the third spot away from Trader Joe’s. Wegmans held onto the fourth spot for a second year in a row.

In its first year in the RPI, Amazon Fresh vaulted past 55 other retailers to land in the fifth spot. The 10 additional retailers with the highest overall customer preference index scores are: 6) Aldi, 7) Trader Joe’s, 8) Sam’s Club, 9) Costco, 10) Walmart Neighborhood Market, 11) Target, 12) Publix, 13) Walmart, 14) BJs Wholesale and 15) Fareway.

“The pandemic has massively accelerated changes in how customers buy their groceries, and their behaviors are continuing to evolve,” said Grant Steadman, President of North America for dunnhumby. “2021 was the year that grocery retail became truly omni-channel. Retailers who delivered on their customers evolving needs in-store and online performed best. This was mostly the larger players, who used their advantages to consolidate their positions. The challenges for most other retailers are significant, but a number of mid-size grocers gained momentum by understanding their customers better and differentiating their offering accordingly. The report aims to provide some direction on why and how retailers can best position themselves to win with customers, in this era of the Great Reinvention.”

The overall RPI rankings are the result of a statistical model that predicts how retailer execution on various customer needs – preference drivers – impact both lasting emotional bonds formed with customers, as well as near-term and long-term financial performance. Each preference driver score and emotional connection score is measured with data gathered from a customized, online survey of 10,000 U.S. households per year. The seven drivers of customer preference are: price, quality, digital, operations, convenience, discounts, rewards & information and speed.

Key findings from the study:

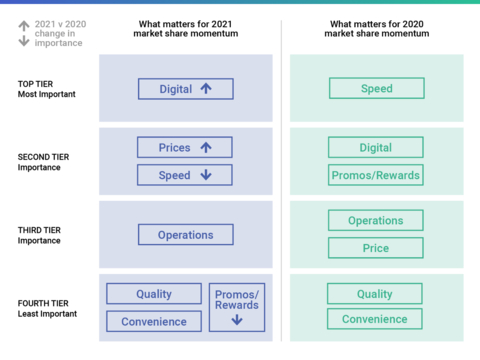

- Price and quality are no longer head and shoulders above all other customer preference drivers in securing superior, long-term sales growth and emotional connection with shoppers. Price now sits alone at the top in importance with Digital and Quality tied for second. For the fifth consecutive year, Aldi’s laser focus on price secured the discount retailer with the highest ranking on price.

- Retailers in the first quartile have long-term sales growth that is nine times higher than retailers in the fourth quartile, two times higher than retailers in the third quartile, and one and a half times higher than retailers in the second quartile. They also have superior short-term momentum to those in the other three quartiles, managing solid gains in 2021 surpassing even the height of the 2020 Covid boom, while some other retailers struggled to tread water.

-

Second-Quartile grocers have opportunities to also rise rapidly in the rankings by reinventing their relationships with their customers. Brookshires, Hy-Vee, Food Lion, the Giant Company and former second-quartile retailer BJs Wholesale made the biggest move up the rankings in 2021.

BJs Wholesale, the Giant Company and Food Lion focus on personalization of the customer experience, through promotions, rewards and the right assortment helped them rise rapidly in the rankings. All three also delivered well-run operations that minimize out-of-stocks and maximize price consistency and logic. And most importantly, these three retailers delivered all of the above attributes without letting base price perception get to far behind Walmart, Costco and Aldi.

Additionally, Brookshires and Hy-Vee also made big moves in the rankings due to their leadership in the omnichannel experience that saves customers’ time. They are among market leaders in both ease and customer service in eCommerce and speediness of the in-store shopping experience.

- Digital is king in driving momentum as Amazon has demonstrated over the last two years by being ranked as the top U.S. grocery retailer. Amazon is the top digital grocer followed by 2) Amazon Fresh, 3) Target, 4) Walmart and 5) Sam’s Club. These retailers clearly set themselves apart from the 2nd – 4th Quartiles in their omnichannel transformation journey. Amazon, Target, and Walmart achieve clear gaps between each other and everyone else in digital capabilities. The gap in Digital pillar score between Walmart (ranked 4th) and Kroger (ranked 13th) is as big as the gap between Kroger and the 59th ranked retailer.

- Grocery retail is now truly omnichannel, as Digital’s share of total grocery sales more than doubled during the pandemic, from 5% to 10% of sales, yet half of the U.S. grocery shopping population does not buy online and has no plans to. Nearly all online shoppers still buy in brick and mortar, where roughly 90% of all customer dollars are currently spent.

- Retailers who use their own eCommerce platform, versus using Instacart or other third party platforms, have better customer perception of both the eCommerce shopping and delivery phases and performed better financially.

The full RPI report can be downloaded today.

Retailers included in the RPI that are interested in receiving their individual banner profiles can speak with their dunnhumby account executive or contact dunnhumby at: https://www.dunnhumby.com/contact/.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First.

Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs over 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, Procter & Gamble and Raley’s.