Redfin Survey: 38% of People Who Already Voted Say Housing Affordability Impacted Their Presidential Pick

Redfin Survey: 38% of People Who Already Voted Say Housing Affordability Impacted Their Presidential Pick

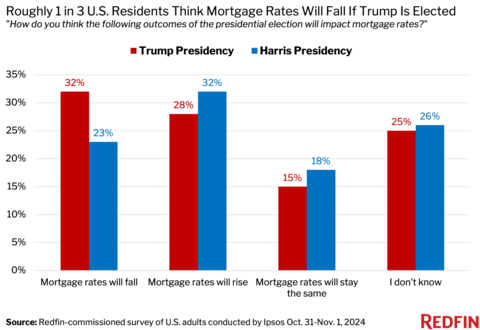

Roughly one-third of respondents think mortgage rates will fall if Trump is elected. About one-quarter think rates will fall if Harris is elected.

SEATTLE--(BUSINESS WIRE)--(NASDAQ: RDFN) — Just under two in five (38%) U.S. residents who had already voted as of November 1 say housing affordability impacted their presidential pick. That’s according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage.

The findings in this report are from a Redfin-commissioned survey conducted by Ipsos on Oct. 31-Nov. 1, 2024. The nationally representative survey was fielded to 1,002 U.S. adults.

Kamala Harris voters were much more likely than Donald Trump voters to say housing affordability factored into their decision: 43% of respondents who already voted for Harris say affordability impacted their pick, compared to 29% of respondents who already voted for Trump.

Overall, people who already voted, regardless of who they voted for, were less likely to factor housing affordability into their presidential decision than most other issues Redfin asked about. Eleven of the 14 issues listed in the survey were more likely than housing affordability to impact votes.

The leading concern for early voters was the economy (63%), followed by inflation (59%), and protecting democracy (56%). Next came immigration (55%), healthcare (52%), crime and safety (47%), access to abortion (45%), U.S. involvement in foreign wars (41%), freedom of speech (41%), gun violence (40%) and the United States’ standing in the world (38%).

The only issues less likely to impact early voters’ presidential pick than housing affordability were climate change (36%) and access to gender affirming care (19%).

While voters who have already cast their ballot were more likely to cite issues other than housing affordability, it’s still an important factor for many voters. It has become much more difficult to afford to buy or rent a home since the pandemic-driven moving boom, which drove up housing costs. It’s worth noting that homes in traditionally blue parts of the country are typically quite expensive, which is likely one reason Harris voters were more likely to say housing affordability impacted their vote than Trump voters.

For Local Races, About 40% of Early Voters Say Housing Affordability Impacted Their Decision

Housing affordability ranks higher when it comes to voting for local elected officials than for president.

Two in five (40%) U.S. residents who have already voted say housing affordability factored into their pick for local races.

Crime and safety was the most important consideration, with 50% of early voters saying it impacted their decision on who to vote for. It’s followed by the economy (46%) and inflation (41%), then housing affordability.

Moving on to local ballot measures, 37% of people who already voted say housing affordability factored into their vote.

The economy was the most important issue in regards to local ballot measures/proposals/initiatives, with nearly half (47%) of those who already cast a ballot saying it impacted their decisions. Next were crime and safety (44%) and inflation (42%).

Roughly One-Third of U.S. Residents Think Mortgage Rates Will Fall If Trump Is Elected, While About One-Quarter Think Rates Will Fall If Harris Is Elected

Nearly one-third (32%) of U.S. residents think mortgage rates will fall if Donald Trump is elected president, while less than one-quarter (23%) think rates will fall if Kamala Harris is elected. This is according to the same Redfin-commissioned survey.

Similarly, U.S. residents are more likely to think mortgage rates will increase if Harris becomes president; 32% think rates will rise if Harris wins, while 28% think rates will rise if Trump wins.

Many people are torn; one-quarter of respondents (25%) say they don’t know what will happen with mortgage rates if Trump wins, and roughly the same share (26%) don’t know what will happen with rates if Harris wins.

Mortgage rates are primarily influenced by economic conditions and the Federal Reserve, which is politically independent, though Congress and the president of the United States are able to influence the long-term direction of the economy through policy changes.

Mortgage rates rose to 7% for the first time since early July last week, causing homebuyers to lose $33,000 in purchasing power. The Federal Reserve cut interest rates in September and outlined plans for future cuts, but mortgage rates continue to rise as investors try to gauge the odds of increased tariffs and government spending after the election.

To view the full report, including charts and methodology, please visit:

https://www.redfin.com/news/will-mortgage-rates-fall-under-trump-harris-survey

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, rentals, lending, title insurance, and renovations services. We run the country's #1 real estate brokerage site. Our customers can save thousands in fees while working with a top agent. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can have our renovations crew fix it up to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1.6 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity Home Loans®, Rent.™, Apartment Guide®, Title Forward® and WalkScore®.

For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin's press release distribution list, email press@redfin.com. To view Redfin's press center, click here.

Contacts

Contact Redfin

Redfin Journalist Services:

Isabelle Novak

press@redfin.com