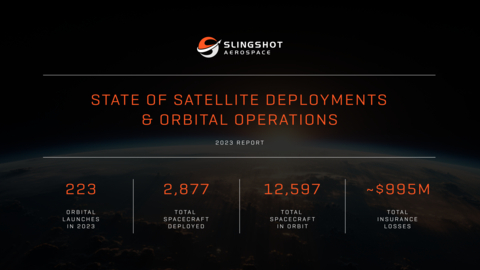

Slingshot Aerospace Report Reveals Increasing Risks of Operating in Space: 12,597 Satellites in Orbit; Nearly $1 Billion in Space Insurance Losses

Slingshot Aerospace Report Reveals Increasing Risks of Operating in Space: 12,597 Satellites in Orbit; Nearly $1 Billion in Space Insurance Losses

The inaugural report shows there are 3,356 inactive satellites in orbit

219 satellites became inactive in 2023: 86% of inactive GEO satellites were sent to a graveyard orbit; thousands of inactive satellites are taking up valuable space in LEO

EL SEGUNDO, Calif.--(BUSINESS WIRE)--Slingshot Aerospace, Inc., the leader in AI-powered solutions for satellite tracking, space traffic coordination, and space modeling and simulation, today released its inaugural State of Satellite Deployments & Orbital Operations report which examines the evolution of the satellite market through the lens of the satellite lifecycles from launch to end of life. The report was compiled based on data from the Slingshot Seradata satellite and launch database, and analysis was conducted by Slingshot Seradata analysts and the Slingshot Aerospace science team.

“The industry has been saying space is becoming more congested for years, but now reality is setting in and the pressure is on to address the increasing risk in orbit,” said Melissa Quinn, General Manager, Slingshot Aerospace Ltd. “We need to come together as an industry to make meaningful progress to coordinate the safe and sustainable use of space.”

Among the key trends highlighted in the report:

-

Increased space activity:

- Spacecraft in orbit: 12,597 spacecraft in orbit, including 3,356 inactive satellites as of December 31, 2023

- Orbital launches: 223 orbital launches in 2023, a 19.9% increase from 2022

- Satellites deployed: 2,877 satellites deployed in 2023, a 14.6% increase from 2022

- Growth in commercial sector satellites: Dominating over both civil and military satellites, commercial satellites represent 89% of all satellites in space, there has been an 18.4% growth in commercial sector satellites since 2022

- Growth in communication satellites: 2,285 communication satellites were deployed in 2023, resulting in a dominance of 79% of all deployed spacecraft in 2023

- Record losses for the space insurance market: there were $995 million in total losses paid out across the space industry in 2023 yet space insurers only collected approximately $557 million in premiums in the same year

- End-of-life satellite disposal: 508 Geosynchronous (GEO) satellites are in a graveyard orbit; of the 29 GEO satellites that were retired in 2023, 25 were retired to a graveyard orbit

- GEO orbit continues to become more crowded: the average distance between satellites in GEO orbit decreased ~33% since 2010, and is predicted to continue decreasing as new spacecraft continue to be deployed

Further details on these key trends include:

Increased space activity: 19.9% increase in orbital launches, and 12.4% increase in satellite deployments; 12,597 active and inactive satellites in orbit

The consistent success of SpaceX’s Falcon 9 and Falcon Heavy family contributes to the industry's stability and growth. There were 223 orbital launches in 2023, a 19.9% increase from 2022.

Further, the report reveals a significant surge in satellite deployments, fueled by constellations like Starlink, the satellite internet constellation operated by SpaceX, as well as other increased LEO activity. 2,877 satellites were deployed in 2023, a 14.6% increase when compared to 2022. 79% of 2023 deployments were communication satellites, shaping the overall industry landscape and continuing to account for most of the launch volume. Additionally, commercial sector satellite launches have experienced 18.4% growth since 2022; they represent 89% of satellites in orbit, far greater than the number of both civil and military satellites. As of December 31, 2023, there are a total of 12,597 active and inactive satellites in orbit.

“You often see the number of active satellites being reported, however, we need to also look at the 3,356 inactive satellites because they are taking up valuable space,” said Quinn. “The confluence of launch programs that carry satellites to space, technological advancements that reduce the cost of developing and launching satellites, and the anticipated growth of space activity, paint a vivid picture of the speed at which we can get satellites to space. However, it’s equally important that we monitor the pace at which they’re removed from operational orbits at the end-of-life.”

Record losses for the space insurance market: $995 million in total losses across the industry

In 2023, space insurers collected approximately $557 million in premiums, but paid out $995 million in insurance claims, resulting in a record-breaking net loss of $438 million. The most significant claim was the $445 million claim for Viasat-3 Americas, followed by Inmarsat’s $348 million claim, when its 6-F2 communications satellite experienced a battery failure.

As a result, underwriting practices have been adjusted and premium rates are markedly increasing. At the beginning of 2023, the premium for a typical GEO satellite aboard a Falcon 9 rocket might have commanded a rate of less than 6% of the insured value for launch + one year. Today, insuring that same satellite will cost around 10%. The cost of annual in-orbit insurance was similarly affected, with rates nearly doubling from 0.6% to 1.2%.

“The losses in the space insurance market are unsustainable,” noted Quinn. “Some insurers are exiting the space industry, while the ones who remain are substantially increasing premiums to hedge against the record losses in the industry. While anomalies in the early part of a satellite’s life account for most of the major losses, the increased cost of insurance for overall operations is also meaningful.”

End-of-life satellite disposal: 219 total satellites became inactive in 2023; 508 GEO satellites in a graveyard orbit, including 25 added in 2023

There is a consistent upward trajectory in the annual number of spacecraft added to a graveyard orbit, which is where defunct GEO satellites are sustainably retired. At the end of 2023, there were a total of 508 satellites in a graveyard orbit. While the average age of satellites entering a graveyard orbit is currently 15.8 years, the average age is expected to increase over time as technological advancements extend the useful lives of satellites. The trend is expected to continue as spacecraft are launched to GEO with no alternative retirement plans.

In 2023, 187 LEO satellites, 29 GEO satellites, and 3 MEO satellites were retired. Although some LEO satellites have sustainable end-of-life plans, not all do. If left alone, a LEO satellite can take years to decay naturally depending on its orbit, which adds to the congestion problem currently faced in LEO.

“A graveyard orbit is where defunct GEO satellites are sustainably ‘buried,’” said Quinn. “Of the 29 GEO satellites that were retired in 2023, 86% of them were moved to a graveyard orbit, which underscores the industry's efforts towards sustainable practices. However, there are still thousands of inactive satellites hanging out in LEO. With LEO becoming more crowded than ever, there is a real risk to satellites that provide valuable services including internet, weather forecasting, and land-use tracking. This presents a critical need to work together in order to protect everyday life on Earth.”

GEO orbit continues to become more crowded: ~33% decrease in average separation between satellites in GEO

GEO is following suit of LEO and becoming significantly more populated. The trend toward closer proximity among the roughly half-billion-dollar satellites in GEO, which includes spacecraft that are responsible for critical infrastructure on Earth, is expected to continue as more satellites enter orbit.

“The data shows that a congestion problem is brewing in GEO,” said Quinn. “Among the increased number of objects in GEO are satellites that maneuver more regularly than is traditionally seen in this more stable regime. This anomalous behavior clearly demonstrates an increasing need for precise space domain awareness in GEO to ensure operators have insights to both their satellites and neighboring satellites.”

From rapid growth in orbital activity to technological advancements that are driving more launches and increasing satellite lifespans, the report highlights the ways in which space is becoming more crowded. For example, the International Telecommunication Union received filings for more than 300 constellations (Source: Science), representing more than 1 million satellites by the beginning of 2023. Further complicating matters are the mounting challenges of dealing with space debris and the complexities associated with the costs of insuring spacecraft. Collectively, the report confirms the need for ongoing vigilance and adaptation to ensure the sustainability of space operations.

Slingshot Seradata is the premier satellite and launch database, offering comprehensive data on every launch attempt and deployed spacecraft. Updated on a daily basis with new satellite, launch, and space market data, it stands as the industry's go-to resource for analysis of launch and satellite industry activity, trends, failure rates, market share, insurance claims, and more – providing unparalleled insight into the space sector for space operators, insurers, analysts, and investors. The insights shared in this report are a result of data collected up until the end of 2023, and all data can be attributed to Slingshot Aerospace. To see the complete findings and analysis contained in the Slingshot Aerospace State of Satellite Deployments & Orbital Operations report, click here. For media who would like a further analysis of the report or more detailed data, please contact: stacy.morris@futuristacommunications.com.

About Slingshot Aerospace

Slingshot Aerospace provides government and commercial partners around the world with AI-powered solutions for satellite tracking, space traffic coordination, and space modeling and simulation. The Slingshot Platform transforms disparate space data into a common operating picture of the space domain by leveraging advanced space object tracking, artificial intelligence, astrodynamics, and data fusion. Slingshot’s platform combines data from the Slingshot Global Sensor Network, the Slingshot Seradata satellite and launch database, satellite owner-operators, and other third-party space data providers to create a holistic and dynamic view of space for training, planning, and operations. This unified representation of space activities – past, present, and predicted – enhances operators' space situational awareness, improves operational efficiency, and reduces risk for space operators. Slingshot is driven by its mission to make space safe, sustainable, and secure. The company was launched in 2017 and has locations in California, Colorado, and the UK.

Visit slingshot.space and follow Slingshot Aerospace on X and LinkedIn for the latest information.

The Slingshot Aerospace media kit, including photos, can be found HERE.

Contacts

Stacy Morris

310-415-9188, stacy.morris@futuristacommunications.com