AUSTIN, Texas--(BUSINESS WIRE)--Abrigo, a leading provider of financial crime prevention and risk management solutions for U.S. financial institutions, today announced the launch of Abrigo Fraud Detection, a new platform that combines AI-powered inspection and check image analysis with a smart, configurable fraud decision engine. Abrigo’s innovative hybrid approach protects banks and credit unions from crippling financial losses by increasing the accuracy of fraud detection, uncovering threats missed by traditional tools and manual reviews, and automating fraud department workflows.

In a pilot program with a Southeastern U.S. bank, Abrigo Fraud Detection correctly identified 93% of the bank’s total fraudulent check value, equating to more than $330,000 in potential fraud loss avoidance.

“Banks and credit unions of every size need transformational tools to fight financial crime amid radically powerful, pervasive, and diverse new threats,” said Jay Blandford, CEO of Abrigo. “Abrigo Fraud Detection offers our 2,400 existing customers, and new customers, enhanced fraud detection accuracy and efficiency. Our mission is to help financial institutions and their communities thrive, and our new platform does that by detecting sophisticated fraud patterns fast and combating financial crimes that cost millions and impact reputation.”

With check fraud soaring, banks need intelligent tech

Despite the increasing popularity of digital payment channels, checks are still the most common form of B2B payment — with 81% of businesses still paying other firms with paper checks. At the same time, check fraud is increasing dramatically. According to fraud strategists, check fraud is projected to soar to $24 billion in 2024. And FinCEN reported that Suspicious Activity Report (SAR) filings for check fraud in 2022 exceeded 680,000, nearly doubling the number of filings the previous year.

“The battle against check fraud is a race against evolving criminal tactics,” said Datos Insights strategic advisor Becki LaPorte. “Fraudsters use this to their advantage and wield sophisticated tools. It is imperative for community financial institutions to adopt innovative technology solutions that protect customer funds without impacting the customer experience.”

Enhanced check fraud detection through Abrigo-Mitek strategic partnership

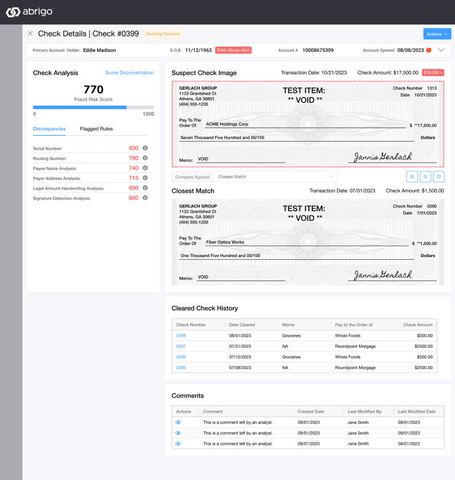

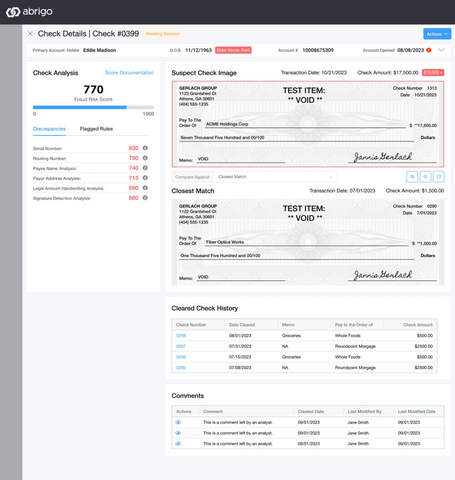

In November 2023, Abrigo announced a strategic partnership with Mitek, a global leader in mobile deposit and fraud prevention. Abrigo Fraud Detection leverages Mitek’s Check Fraud Defender, a nationwide consortium of check fraud data, powerful AI and ML image analysis, and Abrigo’s configurable fraud decision engine — including step-up authentication capabilities to pinpoint a higher rate of altered items, forgeries, and fraudulent checks. Tailored to each institution’s needs, the Abrigo platform automates processes and streamlines workflows to increase efficiency and prioritize higher-risk activities.

“Our approach blends AI and rules-based detection, ensuring our customers are equipped with transparency and a robust and adaptable fraud prevention system, safeguarding their assets and maintaining customer trust in an increasingly digital world,” said Abrigo CTO Ravi Nemalikanti. “Abrigo Fraud Detection stands out by offering a highly configurable yet user-friendly interface, allowing financial institutions to tailor fraud detection to their specific needs.”

Learn more about Abrigo Fraud Detection

Abrigo Fraud Detection has launched today with check fraud detection, and capabilities will expand to detect fraud across additional transaction types, including wire and FedNow, throughout 2024.

For more information and to try out Abrigo Fraud Detection, visit our website.

About Abrigo

Abrigo is a leading provider of financial crime prevention, risk management, and lending software and services that help more than 2,400 financial institutions manage risk and drive growth in a rapidly changing world. We deliver transformational technology and product innovation, world-class support, and unparalleled expertise so that our customers can face complex challenges and make big things happen. Visit abrigo.com to learn more.