Identity Fraud Losses $24 Billion (USD) in the USA With Over 15 Million US Consumers Impacted – the Case for a Better Credit Card Using Biometric Fingerprint Security

Identity Fraud Losses $24 Billion (USD) in the USA With Over 15 Million US Consumers Impacted – the Case for a Better Credit Card Using Biometric Fingerprint Security

NEW YORK--(BUSINESS WIRE)--SmartMetric, Inc. (OTCQB: SMME): Fraud and Identity Theft in the USA to use a phrase, is going to the moon with a steep trajectory.

In 2021, traditional identity fraud losses—those involving any use of a consumer’s personal information to achieve illicit financial gain—amounted to $24 billion (USD) and ensnared 15 million U.S. consumers according to Javelin Research. 1

“With runaway fraud and its exponential growth in the USA, it is important that all touch points in the payment eco-system harden their security defenses,” said SmartMetric’s President & CEO, Chaya Hendrick.

Credit and debit cards that use outdated technology as highly vulnerable four (4) digit PIN’s are an obvious weak point of security for payment cards. “Adding biometric fingerprint identification for the card to work is layering a highly strong authentication and security to the credit and debit card using the power of biometrics,” said Chaya Hendrick.

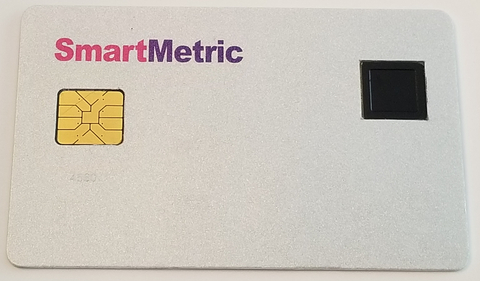

The SmartMetric biometric credit and debit card solution uses the SmartMetric developed miniature fingerprint scanner and reader that sits inside the credit and debit card. This is used to instantly identify the card user and in turn activate the card for use in a transaction.

Using advanced battery and a SmartMetric developed power management system, the SmartMetric card is the only biometric credit/debit card that is able to be used at ATM’s and Gas pumps that use readers that “swallow” the card for a transaction. Inferior biometric payments cards rely on drawing the power from the card reader in order for the card to do a fingerprint match, but of course this prohibits the card from being used in contact card readers that take in the card, not allowing the card holder to hold the card with their finger on the card’s sensor.

The SmartMetric biometric credit card solution is without a doubt without peer in the world of biometric cards. Years of research and development with a clear objective of creating a best in class biometric card solution with a user centric focus, has given SmartMetric an unbelievable new credit card category product.

“Bringing a brand-new type of credit card into existence and that meets the approval and licensing requirements of the credit card industry is no small feat. However, we are excited with the incredible prospects for the company as we move forward with our amazing next generation credit card with its built-in biometric fingerprint security,” said SmartMetric’s President and CEO, Chaya Hendrick.

SmartMetric believes it has created the most advanced biometric credit card solution in the world. “While others may try to imitate, none have come even close to achieving the advances, such as our card to be used in all types of credit card readers, in all card usage situations,” said Chaya Hendrick.

SmartMetric’s Biometric card addresses the multibillion existing chip-based credit and debit card market. Figures published by EMVCo 2 reveal that by year end of 2020, 10.8 billion EMV chip cards have been issued by financial institutions and were in global circulation – a massive increase of nearly 1 billion credit and debit EMV® cards compared to the previous twelve months.

1 2022 Identity Fraud Study: The Virtual Battleground | Javelin (javelinstrategy.com)

To view the company website: www.smartmetric.com

Safe Harbor Statement: Forward-Looking Statements in this press release, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Also such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, if we are unable to access the capital necessary to fund current operations or implement our plans for growth; changes in the competitive environment in our industry and the markets where we operate; our ability to access the capital markets; and other risks discussed in the Company's filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K, which filings are available from the SEC. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this press release. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Investors and security holders are urged to carefully review and consider each of SmartMetric Inc. public filings with the SEC, including but not limited to, if applicable, Annual Reports on Form 10-K, proxy statements, Current Reports on Form 8-K and Quarterly Reports on Form 10-Q.

Contacts

SmartMetric, Inc.

Chaya Hendrick

Tel: (702) 990-3687 or (305) 607-3910

ceo@smartmetric.com

www.smartmetric.com