Strategy Analytics: Notebook PC Delivered Strong Q1 2021 as Hybrid Work Model Emerges

Strategy Analytics: Notebook PC Delivered Strong Q1 2021 as Hybrid Work Model Emerges

Gaming, Chromebooks, commercial and consumer demand stay hot as the return to work and school is slow and pointing to a hybrid approach long-term

BOSTON--(BUSINESS WIRE)--With remote and hybrid work options and e-learning continuing worldwide, demand for Notebook PCs is at its highest, driving 81% year-on-year shipment growth, according to a new report by Strategy Analytics. Work-from-home demand and the notebook PC upgrade cycle were the main driving factors for commercial demand, while the consumer segment contributed with strong e-learning and gaming activity from home in the first quarter. All of this occurred despite supply chain shortages, meaning that there is still pent-up demand going forward in 2021.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Notebook PC Shipments and Market Share: Q1 2020 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-notebook-pc-market-q1-2021-results

Chirag Upadhyay, Industry Analyst added, “Chromebooks continued to dominate the education sector as primary education sector demand is still high in developed markets. The SMB market is also responding well to the cost competitiveness and manageability of the Chrome ecosystem, giving the OS a growing share of shipments in this segment and giving vendors a crucial chance to slowly raise prices and add features for the SMB/commercial world.”

Eric Smith, Director – Connected Computing added, “Vendors managed to deliver notebooks despite the ongoing components shortage and big vendors managed to fulfil large orders before their original delivery date. The emerging hybrid work pattern as well as the continuing need for learn-from-home devices added to consumer upgrade sales, making Q1 2021 the strongest first quarter after many years. The favorable comparison to the dire situation last year also helped with the strong growth figures.”

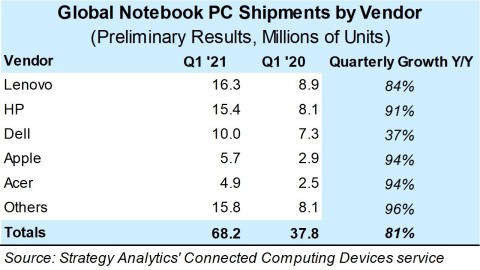

Exhibit 1: Vendor Results Were Higher Across the Board as Market Grew 81%1

Global Notebook PC Shipments by Vendor

|

||||

Vendor |

Q1 '21 |

Q1 '20 |

Quarterly Growth Y/Y |

|

Lenovo |

16.3 |

8.9 |

84% |

|

HP |

15.4 |

8.1 |

91% |

|

Dell |

10.0 |

7.3 |

37% |

|

Apple |

5.7 |

2.9 |

94% |

|

Acer |

4.9 |

2.5 |

94% |

|

Others |

15.8 |

8.1 |

96% |

|

Totals |

68.2 |

37.8 |

81% |

|

|

|

|

|

|

Global Notebook PC Market Share by Vendor

|

||||

Vendor |

Q1 '21 |

Q1 '20 |

||

Lenovo |

23.9% |

23.5% |

||

HP |

22.6% |

21.3% |

||

Dell |

14.6% |

19.2% |

||

Apple |

8.4% |

7.8% |

||

Acer |

7.2% |

6.7% |

||

Others |

23.2% |

21.4% |

||

Totals |

100.0% |

100.0% |

||

Source: Strategy Analytics' Connected Computing Devices service |

||||

Exhibit 2: Chromebooks Are in High Demand Due to e-Learning Needs1

Global Notebook PC Shipments by Operating System

|

||||

Operating System |

Q1 '21 |

Q1 '20 |

Quarterly Growth Y/Y |

|

Windows |

49.8 |

30.1 |

66% |

|

Chrome |

12.1 |

4.4 |

174% |

|

MacOS |

5.7 |

2.9 |

94% |

|

Others |

0.6 |

0.4 |

69% |

|

Totals |

68.2 |

37.8 |

81% |

|

|

|

|

|

|

Global Notebook PC Market Share by Operating System

|

||||

Operating System |

Q1 '21 |

Q1 '20 |

||

Windows |

73.0% |

79.6% |

||

Chrome |

17.7% |

11.7% |

||

MacOS |

8.4% |

7.8% |

||

Others |

0.9% |

0.9% |

||

Totals |

100.0% |

100.0% |

||

Source: Strategy Analytics' Connected Computing Devices service |

||||

1 All figures are rounded

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com

Source: Strategy Analytics, Inc.

Contacts

For more information about Strategy Analytics

Connected Computing Devices: Click here

Americas Contact: Eric Smith, +1 617 614 0752, esmith@strategyanalytics.com

EMEA Contact: Chirag Upadhyay, +44 1908 423 643, cupadhyay@strategyanalytics.com