Subscription Business Revenue Grows 437% Over Nearly a Decade as Consumer Buying Preferences Shift from Ownership to Usership

Subscription Business Revenue Grows 437% Over Nearly a Decade as Consumer Buying Preferences Shift from Ownership to Usership

New research from the Subscribed Institute shows that subscription businesses have consistently outperformed sales revenue growth of non-subscription businesses

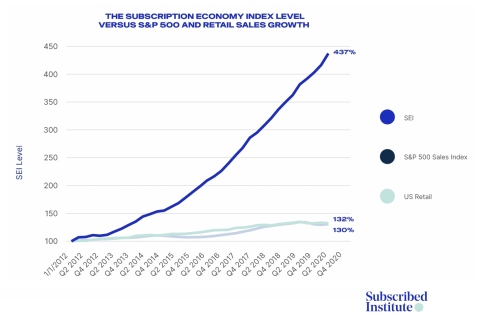

REDWOOD CITY, Calif.--(BUSINESS WIRE)--Zuora, Inc., (NYSE:ZUO) the leading subscription management platform provider, today released its bi-annual Subscription Economy Index™ (SEI) which shows that subscription businesses have grown nearly 6x faster than the S&P 500 over the last 9 years, driven by an increase in consumer demand for the use of subscription services, according to a new survey1.

Conducted online by The Harris Poll on behalf of Zuora’s Subscribed Institute, the survey of 13,626 adults across 12 countries reveals the growing consumer preferences for use of subscription services over the ownership of physical products. Results found within the End of Ownership report include:

- Use of subscription services is growing. 78% of international adults currently have subscription services (significantly higher than 71% in 2018), and 75% believe that in the future, people will subscribe to more services and own less physical 'stuff'.

- Subscriptions increase brand connection. Nearly two-thirds of subscribers (64%) feel more connected to companies with whom they have a direct subscription experience versus companies whose products they simply purchase as one-off transactions.

- Consumers want to pay for what they use. Nearly three-quarters of international adults (72%) would prefer the ability to pay for what they use, rather than just a flat fee.

- Convenience, cost savings, and variety are top subscription benefits. Convenience (42%) tops the list of benefits for subscribing to a product or service instead of owning it, followed by cost savings (35%) and variety (35%, up from 32% in 2018).

As a result of this burgeoning consumer lifestyle trend, subscription businesses have grown. For the first time since its inception in January 2012, the SEI growth rate reached 437% growth as it analyzed the impact of subscription businesses by sector, comparing subscription businesses in Software as a Service (SaaS), Internet of Things (IoT), Manufacturing, Publishing, Media, Telecommunications, Education, Healthcare and Business Services to their respective S&P 500 Industry benchmarks.

When looking only at the year 2020 the Subscribed Institute found that:

- Subscription business revenue outpaced that of their product-based peers. Last year, revenues of subscription companies in the SEI grew 11.6%, while the S&P 500 sales declined -1.6%. In Q4 alone, subscription businesses experienced revenue growth at a rate of 21%, seven times faster than S&P 500 companies’ growth rate of 3%.

- Revenue per subscriber surpassed the 2019 rate. Subscription businesses in Q4 2020 had an 18% average revenue per user rate, compared to 14% in Q4 2019. The increase indicates that subscription businesses in the SEI are deepening relationships with customers and delivering services that increase in value over time.

- Subscription companies in the SEI performed better compared to regional stock markets. In Q1 2020, lockdowns and other safety measures seemed to slow subscription revenue growth (in APAC, revenue even contracted), but when lockdowns returned in Q4, subscription revenue growth accelerated, indicating that subscription companies were effective in adapting their offerings quickly.

“The time is now for companies to embrace the subscription business model,” said Amy Konary, Founder and Chair of the Subscribed Institute at Zuora. “Our bi-annual Subscription Economy Index suggests that brands can increase value to their customers through the ongoing delivery of services when and where they’re needed.”

Download the Subscription Economy Index and the End of Ownership reports for more subscription business and consumer trends across industries.

“Global organizations are propelling their businesses forward by embracing technology, broadening access to services, and placing the power in the hands of their subscribers,” continued Konary. “We recommend that businesses design their offerings for ultimate consumer flexibility and freedom, so that customers can tap into them anytime, anywhere, to whatever extent that they choose.”

To learn more from Subscription Economy thought leaders on the shift from ownership to usership, register for The Subscription Experience, a global broadcast event March 23-25, 2021.

About Zuora, Inc.

Zuora provides the leading cloud-based subscription management platform that functions as a system of record for subscription businesses across all industries. Powering the Subscription Economy®, the Zuora platform was architected specifically for dynamic, recurring subscription business models and acts as an intelligent subscription management hub that automates and orchestrates the entire subscription order-to-revenue process seamlessly across billing and revenue recognition. Zuora serves more than 1,000 companies around the world, including Box, Ford, Penske Media Corporation, Schneider Electric, Siemens, Xplornet, and Zoom. Headquartered in Silicon Valley, Zuora also operates offices around the world in the U.S., EMEA and APAC. To learn more about the Zuora platform, please visit www.zuora.com.

© 2021 Zuora, Inc. All Rights Reserved. Zuora is a trademark or registered trademark of Zuora, Inc. Third party trademarks mentioned above are owned by their respective companies.

About The Harris Poll

The Harris Poll is one of the longest running surveys in the U.S. tracking public opinion, motivations and social sentiment since 1963 that is now part of Harris Insights & Analytics, a global consulting and market research firm that delivers social intelligence for transformational times. We work with clients in three primary areas; building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. To learn more, please visit www.theharrispoll.com

Forward-Looking Statements

This press release contains forward-looking statements that involve a number of risks, uncertainties, and assumptions, including but not limited to statements regarding the expected growth and trends of subscription-based companies (including companies in the SEI report) and non-subscription based companies. Any statements that are not statements of historical fact may be deemed to be forward-looking statements, and actual results could differ materially from those stated or implied in forward-looking statements. This report also includes market data and certain other statistical information and estimates from industry analysts and/or market research firms. Zuora believes these third party reports to be reputable, but has not independently verified the underlying data sources, methodologies, or assumptions. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties and may differ materially from actual events or circumstances.

1 End of Ownership Report, Zuora, 2021

SOURCE: Zuora Financial

Contacts

Jayne Gonzalez

press@zuora.com

408-348-1087