Dealership-Based Auto Finance Faces Permanent Challenge as Digital and Direct Financing Options Increase During Pandemic, J.D. Power Finds

Dealership-Based Auto Finance Faces Permanent Challenge as Digital and Direct Financing Options Increase During Pandemic, J.D. Power Finds

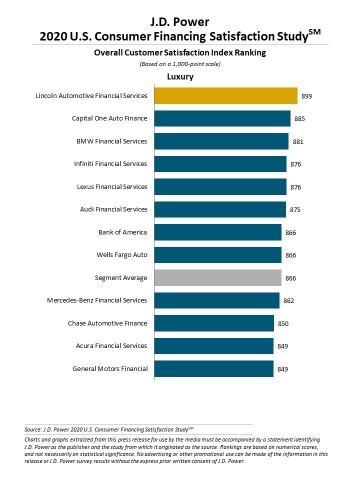

Lincoln Automotive Financial Services, BB&T now Truist Rank Highest in Respective Segments

TROY, Mich.--(BUSINESS WIRE)--That meeting with the auto dealership’s finance department—the one in which vehicle buyers are presented with the dealer’s recommended financing options and offered add-ons—is evolving to more of a digital experience and is being dictated by consumer demand. According to the J.D. Power 2020 U.S. Consumer Financing Satisfaction Study,SM released today, more vehicle buyers than ever have turned to digital channels when it comes to pre-transaction research and lining up financing options for a new vehicle. A growing percentage are securing direct financing prior to their purchase. While some of this behavior has been driven by the COVID-19 pandemic, an increasing number of buyers say they prefer a digital loan origination process for their next vehicle purchase.

"The pandemic accelerated a trend toward digital auto loan origination that has been developing for some time," said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. "Many buyers who have secured financing digitally had a great experience and won’t go back to the old way of doing things—even when COVID-19 is no longer a factor. To improve satisfaction and lower the cost to serve during these changing times and beyond, providers need to build a robust digital platform that addresses borrower needs, from research and origination through account management and billing."

Following are key findings of the 2020 study:

-

More consumers complete digital credit applications, and like it: Nearly one-third (32%) of auto loan borrowers completed a digital credit application, with 22% using the lender’s website and 10% using a mobile app. The frequency of digital loan applications has increased eight percentage points from last year. The average customer satisfaction score for those applying for an auto loan digitally is 887 (on a 1,000-point scale), while the average customer satisfaction score for those applying at a dealership is 842.

-

A trend that signals staying power beyond the pandemic: A total of 40% of borrowers say they prefer at least part of the loan origination process to be digital when they purchase their next vehicle. The number of borrowers who say they will apply for financing digitally (via website or mobile app) in the future is up three percentage points from 2019, while the number of borrowers who say they will secure financing through the dealership is down four percentage points year over year.

-

Direct financing gains traction, led by luxury segment: While 85% of auto loan customers still secure their financing through the dealership, more borrowers than ever are pursuing direct financing. A total of 15% of borrowers in this year’s study secured direct financing, up three percentage points from a year ago. In the luxury segment, that number is up six percentage points to 26% of all borrowers.

- Digital account management and bill pay improves customer satisfaction: A growing number of borrowers also are turning to digital channels for loan account management and bill pay. During the past two years, use of lender mobile apps for account management has increased eight percentage points and use of the website has increased two percentage points, while offline account management has declined three percentage points. Customers have the highest levels of overall satisfaction (884) when using lender’s mobile app.

Study Rankings

Lincoln Automotive Financial Services ranks highest in customer satisfaction among luxury brands, with a score of 899. Capital One Auto Finance (885) ranks second and BMW Financial Services (881) ranks third.

BB&T now Truist ranks highest among mass market brands, with a score of 879. Capital One Auto Finance (870) and Ford Credit (870) rank second in a tie.

The J.D. Power U.S. Consumer Financing Satisfaction Study measures overall customer satisfaction in five factors (listed alphabetically): billing and payment process; mobile app experience; onboarding process; origination process; and website experience. The study was fielded in July-August 2020 and is based on responses from 10,103 customers who financed a new or used vehicle through a loan or lease within the past three years.

For more information about the J.D. Power U.S. Consumer Financing Satisfaction Study, visit https://www.jdpower.com/business/resource/us-consumer-financing-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020153.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com