Yelp Economic Average Uncovers a Drop in Total Business Closures and a Rise in Permanent Closures During the Second Quarter

Yelp Economic Average Uncovers a Drop in Total Business Closures and a Rise in Permanent Closures During the Second Quarter

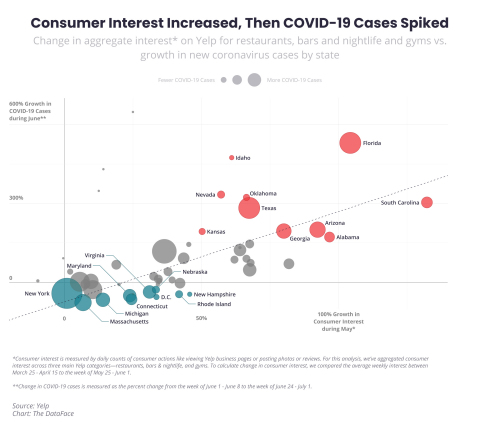

The report finds a correlation between consumer interest in restaurants, bars and nightlife, and gyms in May and COVID-19 cases in June

SAN FRANCISCO--(BUSINESS WIRE)--Yelp Inc. (NYSE: YELP), the company that connects people with great local businesses, today released second quarter data for the Yelp Economic Average (YEA) report, a benchmark of local economic strength in the U.S., which has been adapted to reveal the dramatic impact COVID-19 has had on local economies. YEA uncovers longer term trends, including a correlation between increased interest in restaurants, bars and nightlife, and gyms to a spike in COVID-19 cases across hotspot states. The report also shows a declining trend in total business closures, however, permanent closures now account for 55% of all closed businesses since March 1, a 14% increase from June. Additionally, YEA finds slower, but still consistent changes in consumers getting back to pre-pandemic activities, as well as sustained interest in supporting Black-owned businesses.

YEA reflects data from millions of local businesses and tens of millions of users on Yelp’s platform measuring U.S. business closures, as well as consumer interest via page views, reviews and photos. According to researchers, Yelp provides a timely and accurate measure of a huge swath of the economy that is often missed by many major indicators.

“As U.S. cities struggle to balance reopening their local economies and avoid becoming the next COVID-19 hotspot, we’ve seen U.S. business closure data reflect an unstable economy. Yelp data found a decrease in total business closures, but the rate of permanent closures has actually risen 14% between June 15 and July 10,” said Justin Norman, Yelp’s vice president of data science. “Cities such as San Francisco and Honolulu, which have had some of the nation’s strictest stay-at-home orders, are now seeing the highest numbers of closures relative to the number of businesses in their respective cities.”

Increased Consumer Activity in May Correlates with Increased COVID-19 Cases in June

In mid-to-late March, Yelp reported a swift and uniform drop in consumer activity across the nation. In May, some states maintained lower levels of consumer interest, but many started to see interest increase back to pre-pandemic levels. In many states, when this consumer interest increased, an increase in COVID-19 cases was to follow. YEA found a statistically significant correlation between an increase of consumer interest in restaurants, bars and nightlife, and gyms in May and a rise in COVID-19 cases in June.

Considering states with at least three total cases per 1,000 population, the ten states with the largest increase in COVID-19 cases in June, including Florida, Nevada, South Carolina, Texas and Georgia, all saw a significant increase (more than 50%) in consumer interest in restaurants, bars and nightlife, and gyms, in May, relative to the shutdown level of activity in late March and early April. In the ten states with the largest decrease in COVID-19 cases in June, including Massachusetts, New York, Connecticut, Michigan and Maryland, consumer interest in the same activities remained more flat in May, increasing less than 50% relative to the shutdown in all ten states.

As outbreaks worsened through late June, consumer interest in these categories started to decrease in states like Florida, Texas, South Carolina, and Arizona — emphasizing the strong correlation between the pandemic and consumer behavior. When there's a major outbreak, Yelp data suggests it negatively impacts consumer interest in businesses where social distancing may be harder to enforce. Alternatively, if COVID-19 cases remain flat or decrease in a state, consumer behavior and local policies tend to revert towards the pre-pandemic norm, leaving the state vulnerable to another outbreak in the near future.

Business Closures Fluctuate Across the Nation

In June, Yelp’s Local Economic Impact report found a decrease in business closures with 140,000 permanent and temporary closures on Yelp from March 1 to June 15. This increased to more than 147,000 total business closures on June 29 and then dropped again to just more than 132,500 total business closures as of July 10. This rapidly changing number of closures reflects rapidly evolving situations at the local level, as some states with rising cases start to close again, while others continue to reopen. In April, Yelp reported more than 175,000 business closures indicating that only 24% of businesses that were closed in April have now reopened.

Even as total closures fall, permanent closures have increased to 72,842 businesses as of July 10, an increase of 15,742 permanent closures since June 15. Permanent closures now account for 55% of all closed businesses since March 1, an increase of 14% from June when Yelp reported 41% of closures as permanent.

Most states have seen a plateau of temporary closures, while Arizona, Texas, and Florida have started to see a recent increase again due to spikes in COVID-19 cases. California, Texas, and New York have the highest total number of closures (29,351, 11,118 and 8,731, total closed businesses, respectively). On a metro level, Las Vegas is suffering from the highest rate of permanently closed businesses with 861 businesses permanently closed, as the city reacts to a decrease in tourism. Meanwhile, Los Angeles has the most closures with 11,342 total temporary and permanent business closures.

Permanent Closures Continue to Increase Across Restaurants, Retail and Other Industries

While some industries have been able to slowly bounce back with fewer temporary closures, many are still enduring an increasing number of permanently closed businesses. The restaurant industry now reflects the highest total business closures, recently surpassing retail. As of July 10, there have been 26,160 total restaurant closures, of which 60% have permanently closed (15,770 permanent closures) — accounting for a 23% increase since June 15. Meanwhile, bars and nightlife, an industry 6X smaller than restaurants, have endured an especially high closure rate, with 5,454 total business closures, of which 44% are permanent closures (2,429).

Many retail businesses shifted their operating models and started offering curbside pickup and online ordering, unfortunately those measures aren’t always enough to sustain their businesses long term. Shopping and retail businesses have endured 26,119 total business closures, of which 48% are permanent (12,454 permanent closures). The data shows 1,544 retail businesses have reopened since June 15, however an even higher number have been forced to shut their doors permanently, accounting for a 29% increase in permanent retail closures in the last month. Both the beauty and fitness industries follow a similar trend as the retail industry with a decrease in temporary closures and an increase in permanent closures.

While many businesses are struggling right now, there are a few that have been able to withstand the economic downturn. Professional services such as lawyers and accountants are seeing fewer closures. Online services like web design and graphic design are also doing well during the pandemic as many businesses have shifted to remote work. Health services such as physicians, counseling and mental health services, and health coaches are also closing at lower rates – all critical resources during this time. Education businesses have also had success weathering the storm, including private tutors, as people look for resources to learn new skills and parents seek resources to supplement distance learning.

Consumer Interest Steadily Returns to Pre-Pandemic Activities

Consumer interest has continued to shift since May, but less rapidly than we saw in March and April. Interest for alcohol-related experiences has increased since June 1, relative to other food activities, with a rise in consumer interest for wineries (up 51%), cideries (up 39%), breweries (up 24%) and distilleries (up 19%). Meanwhile, grocery related businesses are on the decline as people spend less time at home. This includes beer, wine and spirit stores (down 21%), community supported agriculture (down 23%), and organic stores (down 11%).

Within restaurants, German cuisine, live and raw food, French cuisine and steakhouses have all seen an increase in consumer interest since June 1, relative to other restaurant categories, up 35%, 36%, 21% and 20%, respectively. As people head back into restaurants, fast casual and common delivery foods continue to decline at a slow rate, including fast food (down 19%), cheesesteaks (down 8%), chicken wings (down 15%) and pizza (down 7%).

As the weather gets warmer people are turning to public markets (up 73%) to do their shopping, as well as flea markets (up 28%) and outlet stores (up 13%). Formal wear (up 46%) and bridal shops (up 26%) continue to slowly increase as people feel more comfortable gathering for celebrations. Meanwhile, previous retail categories that gained traction, including hunting and fishing supplies, and outdoor gear, are starting to decline in consumer interest, down 40% and 29%. Yelp data also shows people heading back indoors for activities like axe throwing (up 51%), escape games (up 45%), and boxing (up 13%), while some people continue to flock to outdoor activities, like ziplining (up 44%), ATV rentals (up 37%), and amusement parks (up 6%).

We also see the impact of rising COVID-19 cases on health and wellness categories on Yelp, with a recent spike in interest for urgent care (up 42%) and emergency rooms (up 21%), since June 1, while interest declined in skilled nursing (down 22%) and retirement homes (down 14%).

Support for Black-Owned Businesses Remains High

People’s interest in supporting the Black community by spending at Black-owned businesses continues to remain high. From May 25 to July 10, there has been a 7,043% year-over-year increase in searches for Black-owned businesses on Yelp — in total, 2,500,000 searches. Washington D.C. and Maryland both had more than 1% of all searches on Yelp for “Black-owned” since May 25th, a 39% increase in Maryland and a 24% increase in Washington D.C. year-over-year.

While searches for Black-owned restaurants have remained particularly popular (up 2,508%), most recently, people have also been searching for more specific Black-owned businesses. Searches for Black-owned boutiques have increased by 331% compared to the same time last year, while searches for Black-owned bakeries and ice cream shops has grown by 56%. Searches for Black doctors rose by 183% and Black-owned coffee shops has increased by 161%. Black-owned bookstores have seen a particularly high increase in consumer interest, with searches up 1,437% year-over-year, as people look to find resources from Black authors, possibly to better educate themselves on anti-Black racism, police brutality and other social justice issues that have plagued the Black community.

See all of our Yelp Economic Average reports and other resources at yelpeconomicaverage.com. Yelp is regularly updating its Local Economic Impact Report to outline how local economies continue to fare in these uncertain times.

Please find more assets and images here. For more information and Yelp’s latest company metrics, visit: https://www.yelp-press.com/company/fast-facts/default.aspx

Methodology

Business Closures

On each date, starting with March 1, we count U.S. businesses that were open on March 1 and were closed on that day. Closure can be permanent or temporary, and is signaled by a business owner marking the business as closed, including by changing its hours or through a COVID-19 banner on its Yelp page. Closure counts are likely an estimate of the businesses most impacted, with many others not counted because they remain open with curtailed hours and staffing, or because they have not yet updated their Yelp business pages to reflect closures. Additionally, we only count closures that have been vetted by our User Ops team or have been updated directly by a business owner. Closures are counted by state, metro area, and category; some businesses are in more than one category. One-day closures that appear to be unrelated to the pandemic, such as for Easter, are not counted. Businesses can also set automatic reopening dates on Yelp, which are counted as reopenings unless the business updates their information.

Consumer Interest Correlations with COVID-19 Cases

Consumer Interest: We start by measuring consumer interest in terms of actions users take on Yelp, split by business category and state. We adjust for seasonality by measuring the year over year change in interest for each state and category. Baseline levels of interest during the initial “shutdown” were measured between March 25 and April 15, corresponding to the time where most locations had their minimum level of consumer interest. We now measure consumer interest levels normalized by their average value over the baseline.

COVID-19 Cases: We gathered COVID-19 data provided by the New York Times. We only consider states with at least 3 total cases per 1000 people over the course of the pandemic, allowing us to measure a robust relative change in new cases (this eliminates Alaska, Hawaii, Maine, Montana, Oregon, West Virginia, Wyoming). This ensures enough cases to make the percent change in new cases a consistent and fair metric, but we note that our findings generally still hold if all states are included as well.

Correlations: For several categories (including restaurants, bars, nightlife, and gyms) we observe a statistically significant correlation between a state’s normalized consumer interest in the last week of May and the state’s relative increase in new COVID-19 cases between the first and last weeks of June. We combine the interest in these categories into a single consumer interest measure. Of note, correlation and causation are not equivalent, and we are not claiming that most COVID-19 cases are happening due to visiting restaurants or gyms. Increasing consumer interest in these categories – relative to the “shutdown” level of interest – is a good general indicator of consumer behavior reverting to the norm and a state being more active economically and socially. This general reversion towards pre-pandemic consumer behavior in the month of May could very plausibly result in a spike in COVID-19 cases in June, and this signal is clear from our data.

Consumer Interest By Business Category

We measure daily consumer interest, in terms of seasonally adjusted daily U.S. counts of a few of the many actions people take to connect with businesses on Yelp: viewing business pages or posting photos or reviews. We start with the biggest U.S. categories by consumer actions. Among those, we select the biggest gainers and biggest decliners in terms of their share of all root category consumer actions since June 1. Then we choose representative ones to show the trend, which we’re charting from June 1 through July 10.

Consumer searches for Black-Owned Businesses

We count the number of searches with words “Black owned” (and related words, like “Black-owned” or “Black business”) between May 25 and July 10th in 2019 and 2020. Additionally, we count the frequency of searches for particular types of Black owned business over the same time period.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local businesses. With unmatched local business information, photos and review content, Yelp provides a one-stop local platform for consumers to discover, connect and transact with local businesses of all sizes by making it easy to request a quote, join a waitlist, and make a reservation, appointment or purchase. Yelp was founded in San Francisco in July 2004. Since then, Yelp has taken root in major metros in more than 30 countries.

Contacts

Yelp Inc.

Julianne Rowe

jrowe@yelp.com