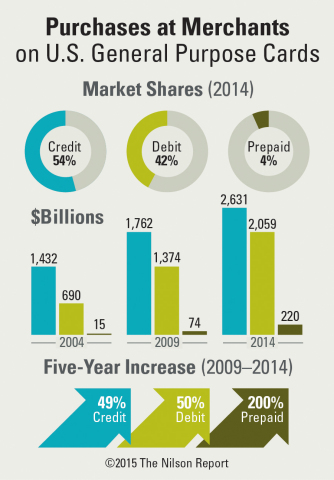

CARPINTERIA, Calif.--(BUSINESS WIRE)--Purchase volume at merchants for general purpose-type consumer and commercial credit, debit, and prepaid cards issued in the U.S. totaled $4.910 trillion, up 8.4% over 2013. Credit cards increased their market share in purchase volume over debit and prepaid cards to 53.59% in 2014, up from 52.95% in 2013. In 2009 credit card market share was 54.90%, and in 2004 credit cards held a market share of 67.01% according to the annual report on U.S. payment card spending at merchants published by The Nilson Report, the top trade newsletter covering the card and mobile payment industries.

Credit cards carrying the Visa, MasterCard, American Express, and Discover brands generated a combined $2.631 trillion in 2014, up 9.7% over 2013. Debit and prepaid cards carrying those brands as well as the brands of EFT networks such as Accel, Interlink, Nyce, Pulse, and Star generated a combined $2.279 trillion, up 6.9% over 2013.

In the top 10, 3 issuers gained share, led by JPMorgan Chase. Its consumer and commercial credit, debit (including EFT network), and prepaid cards combined to generate $703.32 billion in purchase volume in 2014. Chase cards accounted for 14.32% of all spending at merchants last year, an increase of 20 basis points. Wells Fargo’s share increased 18 basis points to 7.41%, while Capital One’s share increased 3 basis points to 4.13%.

The other 7 issuers in the top 10 had market share declines. American Express slipped 2 basis points to 13.43%, Bank of America was down 55 basis points to 11.55%, Citi was down 15 basis points to 5.02%, U.S. Bank was down less than 1 basis point to 3.21%, Discover was down 7 basis points to 2.35%, PNC Bank was down 3 basis points to 1.64%, and USAA was down 2 basis points to 1.63%.

American Express remained the largest issuer based on credit card purchase volume only.

Bank of America continued as the largest issuer based on debit and prepaid card purchase volume only.

About The Nilson Report

The Nilson Report is a highly respected source of global news and analysis of the card and mobile payment industries. The subscription newsletter provides in-depth rankings and statistics on the current status of the industry, as well as company, personnel, and product updates. David Robertson, Publisher of The Nilson Report and a recognized expert in the field, is a frequent speaker at industry conferences and is regularly quoted in publications worldwide. Over 18,000 readers in 90 countries value The Nilson Report. Contact Lori Fulmer at lfulmer@nilsonreport.com for a complete copy of this report in the current issue of the newsletter.