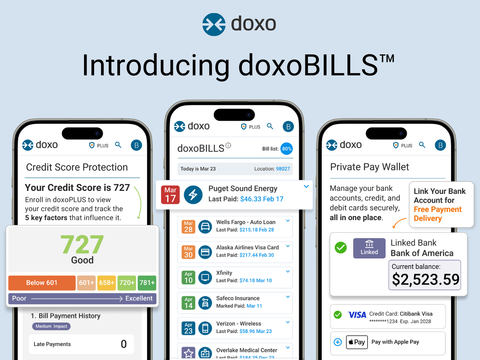

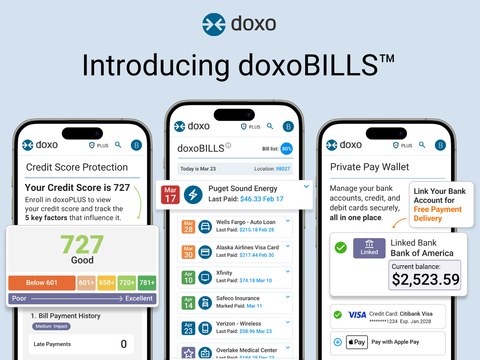

SEATTLE--(BUSINESS WIRE)--doxo today introduced doxoBILLS™, the next generation of its household bill pay platform that integrates the six essential elements of paying bills into one simple and safe consumer experience. doxoBILLS empowers consumers by placing them in the driver’s seat to manage all essential household bills, revolutionizing the bill pay experience for everyone. To learn more about doxoBILLS, please visit doxo.com/u/bills or watch the video here.

Built on doxo’s Bill Pay Operating System (Bill Pay OS™), doxoBILLS combines All-in-One Bill Pay, a Private Pay Wallet, Real-Time Bank Balance, Credit Score Protection, $1M Identity Theft Protection, and Insights into a single experience that allows users to organize and pay all their bills with one login, on any device, using any payment method. As the first truly customer-centered payment platform, doxoBILLS represents a new era of simplicity and sophistication for how consumers manage their bills and improve their financial health.

“We’re proud to introduce doxoBILLS, the next generation of our all-in-one bill pay product. doxoBILLS is the first and only solution to incorporate all six essential elements of paying bills into one simple and safe platform,” said doxo CEO and Co-Founder Steve Shivers. “This is a huge step for our continued mission to empower consumers in organizing and paying their household bills, which represent the most fundamental financial obligations of every American household. Legacy bill pay systems are fragmented – almost always organized around individual billers or individual financial institutions – but doxoBILLS puts the consumer in the driver’s seat, enabling a simple view of all bills and due dates, the ability to pay any bill with any financial institution, and integrates essential financial protections to improve credit, help reduce late fees and overdraft fees, and protect online security. Our holistic, customer-centered experience is steadfastly focused on making bill pay simpler and more accessible for consumers and is a key part of our effort to streamline and transform the Bill Pay Economy™.”

doxoBILLS Incorporates the Six Essential Elements of Paying Bills Into a Single Experience

The six essential elements of bill pay are as follows:

1. All-in-One Bill Pay

For consumers, the bill pay experience is typically very fragmented and frustrating. doxoBILLS makes it easy for a user to add all their billers to create one simple calendar of upcoming due dates, all through a single login without having to link away to different sites or manage various credentials for different bill pay providers. Users can set due date reminders, automatically schedule recurring payments, easily track their payments made through doxo and even keep track of bills paid outside of doxo. doxo enables payment to over 120,000 billers across the country.

2. Private Pay Wallet™

Protecting payment accounts is one of the most important ways to reduce risk for household finances. Traditional bill pay requires payment accounts to be shared with many different billers. But with doxo's Private Pay Wallet, users can pay any bill without ever sharing their bank or card information with their billers. A single, secure wallet makes it easy to make payments on any device, using a bank account, credit card, debit card, or Apple Pay. With Private Pay Wallet, anytime a bank or card account changes, users only need to update associated bill payments once and changes will be reflected throughout.

3. Real-Time Bank Balance (With a Linked Bank Account)

Bank overdraft fees cost consumers over $8 billion each year. doxo’s Private Pay Wallet enables users to link their bill pay account to see their current balance before every payment. Payments from a Linked Bank Account are also free on doxo, even to billers that might otherwise charge a fee for bill payments.

4. Credit Score Protection

Staying current on bills and debt payments are primary factors for strengthening credit. Credit Score Protection, a feature of doxoPLUS, helps users track and improve their credit scores by providing a simple dashboard that is built directly into the bill pay experience. Users also gain insight into the five key factors that affect credit score – bill payment history, credit card usage, loans and mortgages, length of credit history, and number of credit inquiries.

5. $1M Identity Theft Protection

Identity theft and fraud cost consumers $10 billion each year. doxo helps safeguard users from these losses by protecting their payment instruments and providing the ability to pay bills without managing many different passwords for different biller sites. Additionally, $1M Identity Theft Protection, a feature of doxoPLUS, provides users with valuable protection: Identity Theft Insurance of up to $1 Million in coverage for damages and expenses and Identity Restoration services to help users restore their online identity and credit.

6. Insights

Knowledge is power, especially when it comes to understanding how household bill expenses contribute to the cost of living. Designed to empower consumers, doxoINSIGHTS makes it easy to compare any type of bill or the total cost of bills in a user's local area or anywhere across the country. doxo’s Cost of Bills Index™ (COBI) provides a standard comparison index for the most fundamental cost of living expenses, adjusted for regional income levels, and enabling comparison at the state, county and city level.

The holistic, integrated features of doxoBILLS sets a new bar for the bill pay experience that finally puts the consumer in control, an experience that can not be matched by any individual biller or financial institution.

doxoBILLS Empowers Consumers to Take Control of Their Financial Health

The bill-pay market as it currently exists, is a tedious, high-friction, and extremely fragmented experience for consumers. Each year U.S. households spend over $4.46 trillion—about a third of all consumer spending—on recurring bill payments. With the average household paying 10 bills each month, it is no surprise that managing household finances is the number one cause of stress for consumers. doxoBILLS was launched to help consumers break free from this unnecessary bill pay burden, to protect their financial health, and to accomplish their financial goals.

This unnecessary complexity in managing and staying on top of bills contributes to huge, usually hidden costs of bill pay for U.S. households – comprised of identity theft, payment account fraud, late fees, overdraft fees, and detrimental credit impacts amounting to $196 billion, or $1,495 per household annually. The existing market structure falls short in serving the interest of consumers and is in desperate need of new alternatives and innovation for paying household bills.

doxo was founded more than fifteen years ago to solve this simple and obvious problem – empowering the consumer by providing a standard and secure checkout to pay over 120,000 billers across the country – allowing every bill to be paid the same way every time, with a single login, and without ever needing to share sensitive payment account data with any individual biller. To date, over ten million people have safely and efficiently paid bills through doxo’s unique model, which puts the consumer in the driver’s seat and empowers them to not only take control of their household finances, but to avoid or eliminate the hidden costs associated with paying bills.

With the launch of doxoBILLS, doxo becomes the first and only consumer bill pay platform to combine the six essential elements of paying bills into one straightforward product that empowers consumers through numerous cost savings and financial health benefits.

Pricing and Availability

doxoBILLS is available now for all users in the U.S. as a mobile and desktop solution. Users can sign up for doxoBILLS at doxo.com/u/bills, and access the many standard benefits for free, including the ability to pay any bill for free with a Linked Bank Account. Additional premium features can be unlocked through a doxoPLUS subscription, which adds the key benefits of $1M Identity Theft Protection, Credit Score Protection, and Late Fee and Overdraft Protection, all for just $5.99 per month (plus tax where applicable). Learn more about the details of doxoPLUS at doxo.com/u/doxoplus.

To learn more about doxoBILLS, please visit doxo.com/u/bills or watch the video here.

About doxo

doxo delivers innovation that transforms the Bill Pay Economy™ for consumers, billers and financial technology providers. For over 10M consumers, doxo’s all-in-one bill pay makes it simple to organize and pay any bill on any device through a secure checkout. For billers, doxo’s network-driven platform enables online and mobile payments with a ridiculously simple integration, radically lower costs, and game-changing features that are unavailable with legacy bill pay vendors. For fintech partners, doxo delivers financial innovations to consumers across 97% of US Zip Codes, paying from more than 5,000 financial institutions to over 120,000 billers in 45+ service categories. For employees, doxo is a creative, ever-learning team that is passionate about building fintech tools that dramatically improve the bill pay experience. For investors, doxo provides an extraordinary opportunity to invest alongside Jackson Square Ventures, MDV, and Bezos Expeditions to disrupt a market that accounts for over $4T of US Household spend. To learn more about America’s leading bill pay network, visit doxo.com.