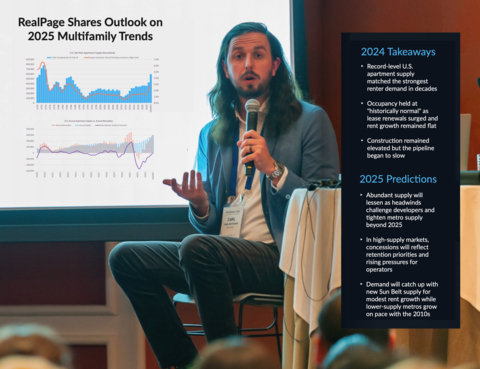

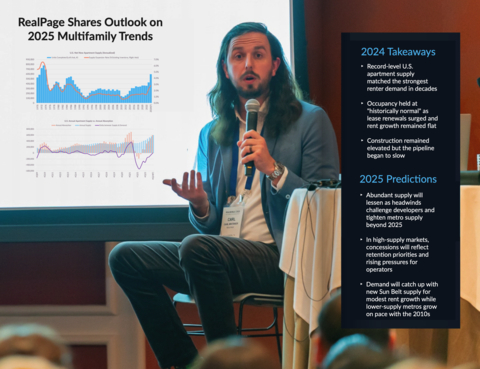

RICHARDSON, Texas--(BUSINESS WIRE)--RealPage®, a leading global provider of AI-enabled software platforms to the real estate industry, announced today its 2024 year-end review of the multifamily housing market and key indicators to watch in 2025. Overall, the multifamily sector stabilized in 2024 with apartment demand matching a 50-year supply peak. In 2025, supply will remain a key factor to watch with the expected delivery of approximately 500,000 new apartment units.

2024 Industry Takeaways

- Robust U.S. apartment supply — more than any year since 1974 — has matched the strongest renter demand in three decades besides 2021.

- The national occupancy rate held slightly below a “historically normal” level, averaging around 94.3%. Resident retention surged with lease renewals reaching a rarely seen 55%, while U.S. annual rent growth remained flat overall (less than 1%).

- Elevated apartment development saw 60% more units under construction than the 2010s-decade norm, but the pipeline began to slow with the fewest number of starts since early 2013.

2025 Industry Predictions

- Supply is the key theme for 2025. Initially, abundant supply is expected to lessen through the year as economic headwinds challenge developers. Easing supply will likely give way to an environment where housing shortages challenge some metro areas beyond 2025.

- Renters in high-supply markets will see concessions as supply remains a heavy force on the market. As a result, retention will be a priority for operators looking to mitigate rising turnover and marketing costs.

- Demand will continue to catch up with the wave of new supply delivery throughout the Sun Belt, where rental rate growth is likely to be modest. Meanwhile, based on supply-demand factors, rents in lower-supply metro areas are expected to grow at a pace similar to the 2010s decade.

“The multifamily housing industry has found its footing, with renter demand as strong as it’s ever been, and new housing supply has been robust enough to meet that demand, as seen by the nation’s stabilizing, healthy occupancy rate,” said Carl Whitaker, Chief Economist, RealPage. “We expect this to be the year of the resident based on the increased emphasis on retention, improving affordability and new construction coming online — giving renters more options when choosing their next apartment homes.”

Demand Drivers & Shifting Supply

As the U.S. economy has slowly added to the employment base, strong wage growth has outpaced slowing rent growth for two consecutive years. This has helped increase apartment affordability, which is fueling more renter demand. While new lease traffic has been supported by cooling inflationary pressures, resident retention has increased as single-family home price growth trends ahead of rental rate growth. Altogether, the expectation is that demand remains strong going into 2025, closely mirroring trends seen in 2024.

At the same time, record-setting supply in 2024 is at near-equilibrium with demand. The nation saw a net increase of more than 500,000 apartment units in 2024, closely mirroring supply trends. However, with new multifamily starts plummeting to their lowest level in over a decade, the available inventory of rental housing units may quickly tighten. The rapid reduction in new construction could suggest that 2026 and beyond begin to see the nation challenged by housing undersupply.

“Rent growth in previous years has largely been driven by demand exceeding longstanding supply shortages in multifamily markets. When demand exceeds supply, we see rents grow faster – and we’ve been seeing recently that the reverse is also true,” explained Whitaker. “The past two years of new supply hitting the market to match overall demand resulted in slowing rent growth, such as in Sun Belt metros where a wave of new supply is creating some rent relief as it outpaces demand. In the next 12 months, we expect to see more than half-a-million new apartment units deliver much-needed housing supply that matches strong demand to maintain moderation in rent prices.”

Detailed Data & Discussion

Later today at 2:00 p.m. CT, RealPage will present and discuss the past year’s performance and expectations for the New Year in an interactive webcast, “Multifamily Talks LIVE: 2024 Recap and Expectations for 2025,” hosted by Chief Economist Carl Whitaker and RealPage Industry Principal Krista Hurley. Join us here: https://www.linkedin.com/events/multifamilytalkslive-2024recapa7269791424521408512/

About RealPage, Inc.:

RealPage is the leading global provider of AI-enabled software platforms to the real estate industry. By using RealPage solutions for operational excellence in the front office and throughout property operations, many leading property owners, operators and investors gain transparency into asset performance with data insights, enhancing experiences with customized tools and improving efficiencies to generate incremental yield. In 2021, 2022, 2023 and 2024, RealPage was recognized as ENERGY STAR® Partner of the Year for Sustained Excellence from the Environmental Protection Agency (EPA) and the U.S. Department of Energy. In 2024, RealPage was recognized as one of America’s Best Employers by Forbes and America’s Best Employers for Women by Forbes and one of America’s Greatest Workplaces for Women by Newsweek. Founded in 1998 and headquartered in Richardson, Texas, RealPage joined the ThomaBravo portfolio of market-leading enterprise software firms in 2021 to realize faster growth and innovation in serving more than 24 million rental units from offices in North America, Europe and Asia. RealPage has been certified as a Great Place to Work™ in India, the Philippines, the UK and the U.S. For more information, visit RealPage.