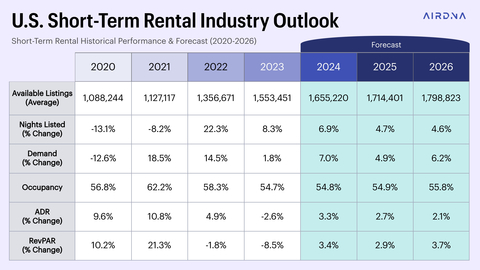

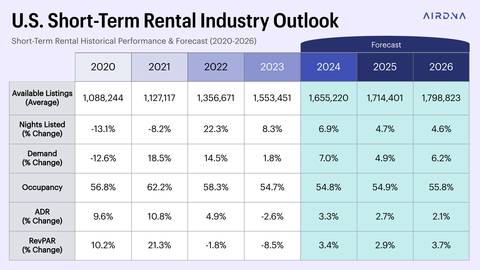

DENVER--(BUSINESS WIRE)--AirDNA, the leading provider of short-term rental (STR) data and analytics, today released its 2025 Outlook Report, forecasting stabilized growth for the U.S. STR industry. Occupancy is expected to rebound to pre-pandemic levels of 54.9% by the end of 2025, driven by sustained demand growth and a slowdown in new supply.

2024: A Rebound Year

After two years of declining unit-level performance, 2024 marked a turning point for the U.S. STR market. Supply growth, which peaked at 22.3% year-over-year (YOY) in 2022, slowed significantly to 6.9% in 2024 as high interest rates and housing prices curtailed new listings. Meanwhile, demand surged by 7.0% YOY, fueled by pent-up traveler interest and a stabilizing economic backdrop.

“2024 gave the market a much-needed breather,” said Bram Gallagher, PhD Economist at AirDNA. “This rebalancing not only halted declining occupancy but also drove the first Revenue per Available Room (RevPAR) gains since 2021 (3.4%), improving market conditions for STR operators with a more manageable competitive landscape and an opportunity to strengthen performance.”

Industry Outlook for 2025

The U.S. STR market is expected to build on 2024’s momentum, with incremental improvements in occupancy and revenue through 2026. Supported by rising real incomes and steady economic conditions, demand is expected to grow by 4.9% in 2025, driving RevPAR gains of 2.9% and outpacing supply growth, projected to slow further to 4.7%.

On a granular level, small and rural markets, which saw significant growth during the pandemic, are expected to stabilize in 2025 as demand plateaus and supply aligns more closely with pre-pandemic trends. Urban markets are poised for occupancy and RevPAR gains as limited new listings and regulatory constraints restrict supply growth, particularly in cities like New York, Washington, D.C., San Francisco and Atlanta. Nationally, the increasing popularity of group-friendly, larger homes will continue to boost ADRs, and contribute to revenue growth across various market types.

For investors, the report highlights that while high interest rates are likely to persist, stronger cash flow, steady home value appreciation, and predictable market conditions provide solid opportunities for long-term returns. “2025 will be a dynamic year for growth,” said Jamie Lane, SVP of Economics at AirDNA. “As the market matures, the winners will be those who leverage precise, data-driven insights to adapt to shifting trends and capitalize on the strongest opportunities.”

About AirDNA

AirDNA is a global authority in short-term rental data, offering comprehensive insights and analytics to empower businesses in the short-term rental industry. AirDNA helps vacation rental hosts, managers, and investors make smarter decisions in any market or economic climate. For every short-term rental question, AirDNA has the answer.