BOSTON--(BUSINESS WIRE)--The macroeconomic picture at the end of 2024 looks positive, inflation is on the decline, and interest rates are coming down. Yet despite this, valuations (50%) and volatility (47%) are still the top portfolio concerns for Canadian institutional investors* in 2025, according to new survey findings published today by Natixis Investment Managers (Natixis IM).

Natixis IM surveyed 500 institutional investors who collectively manage $28.3 trillion in assets globally, including $2.1 trillion in Canada, for public and private pensions, insurers, foundations, endowments, and sovereign wealth funds around the world.

After a two-year bull market in which much of the gains have been concentrated in tech stocks, Canadian institutional investors name valuations their number one market risk (50%), with 81% of institutional investors believing that equity valuations do not currently reflect the fundamentals. Yet, institutions are optimistic with almost three quarters (72%) believing that 2025 will be the year that markets realise that valuations matter, even though 78% say the sustainability of the current market rally will be determined by central bank policy.

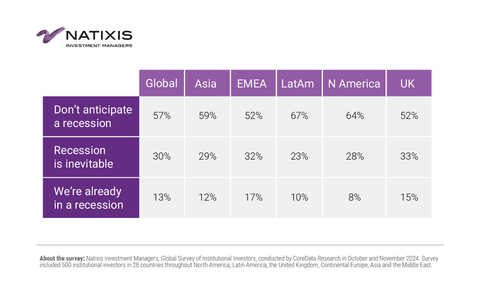

Fears of a recession has faded

Sentiment has improved drastically over this year, with the number of Canadian institutions who think recession is inevitable falling from 63% in 2024 to 44% in 2025. Forty-one percent of Canadian institutions don’t anticipate a recession at all in 2025. However, one in five (22%) still worry that recession will kill the current rally. When it comes down to it, over half (56%) of those surveyed are calling for a soft landing in their home region and only 19% are worried about a hard landing. Fewer still project no landing (16%), and or worry about stagflation (9%).

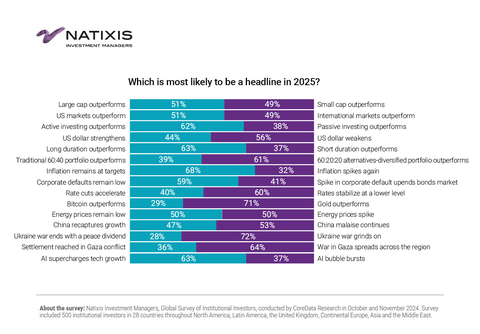

Equally, institutions are more positive on inflation, with 41% saying inflation will decline and 56% saying it will remain at current levels in 2025. Overall, 81% are confident that inflation will hit target levels in the year ahead, and just under one in five people (19%) remain worried that the global economy could experience inflation spikes in 2025.

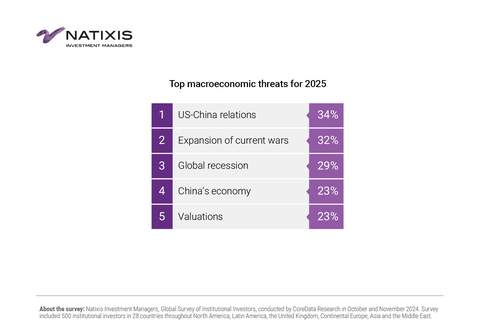

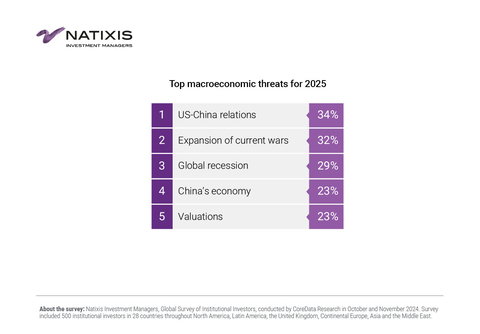

Economic threats

Despite this optimism, Canadian institutional investors still see a wide range of economic threats for the year ahead, with their biggest concerns being expansion of current wars (50%) and US/China relations (44%).

While their market outlook may be optimistic, institutional investors are realistic, despite the relatively smooth ride in key asset classes during 2024, many institutions project an uptick for volatility for stocks (59%), bonds (59%), and unemployment (50%) in 2025.

However, portfolio plans show a high level of confidence, with the number of institutions who say they are actively de-risking their portfolios stayed the same at 50% from 52% in 2024. What’s more, four out of ten (41%) go so far as to say they are actively taking on more risk in 2025.

Elsewhere, while positive sentiment on cryptocurrency has increased (31% compared to 8% in 2024), given the speculative nature of crypto investing and the accompanying volatility, 72% say cryptocurrency is not appropriate for most investors and another 63% believe crypto is not a legitimate investment options for institutions.

Dave Goodsell, Executive Director of Natixis Center for Investor Insight, said, “Institutional investors are heading into 2025 with a more optimistic outlook. Although they acknowledge a range of risks on the horizon, they remain confident in their ability – and the market’s – to weather geopolitical challenges and adapt to macroeconomic shifts. While most are staying committed to their long-term strategies, many are making tactical adjustments to strengthen their positions. Ultimately, their success will depend on how well they navigate today’s macroeconomic and market conditions.”

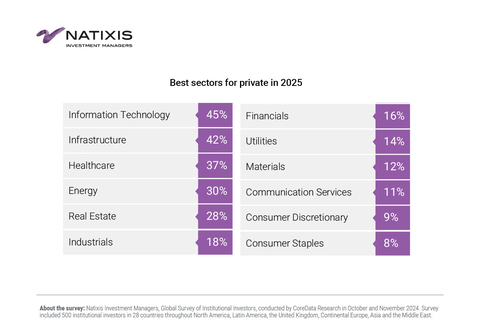

Private market boom?

Alternative investment will play an important role in institutional portfolios in 2025 as 78% anticipate that a 60:20:20 portfolio diversified with alternative investments will outperform the traditional 60:40 stock and bond mix. In terms of where they’ll invest that 20% allocation, institutions are clear that they want to add more private assets to portfolios.

Of all their choices, over three quarters (78%) of institutional investors are bullish on private equity in 2025, an increase over the 75% who felt the same a year ago. Nine in ten (91%) believe rate cuts will improve deal flow in private markets and three in four (75%) believe more private debt will be issued in 2025 to meet growing borrower demand.

In terms of how they are approaching private investments, 47% say they have increased allocations to private markets. Overall, 79% say they are looking at new areas of interest – such as AI related opportunities.

Emerging markets conscious de-coupling with China

Emerging markets have been hindered recently due to the deteriorating Chinese economy, in fact, 84% believe that a lower growth environment will be the new normal in China. Three-quarters believe that economic malaise in China will hold back growth in emerging markets.

However, emerging market investments are looking more positive for the year ahead with 56% of institutions saying that they are poised to take off in 2025. For this to happen, three quarters (75%) say that there will need to be easing monetary policy in the developed world to help accelerate growth.

Three quarters (75%) think a conscious de-coupling with China will result in an opportunity for other emerging markets to climb the global ladder. Over half (53%) say that Asia Ex-China will be the best Emerging Market opportunity for 2025, while 31% say they only invest in broad emerging market equities.

Markets favor active management

Nearly three quarters (72%) of Canadian institutional investors say that the markets will favour active management in 2025, and two thirds (66%) said that their actively managed investments outperformed their benchmarks in the last 12 months.

Given the changing interest rate and credit environment, institutions will likely benefit from active investing. Overall, three quarters (75%) say that active management is essential to fixed income investing.

A full copy of the report on the Natixis Investment Managers Institutional Investor 2025 Market Outlook can be found here: https://www.im.natixis.com/en-intl/insights/investor-sentiment/2024/institutional-outlook

Methodology

Natixis Investment Managers, Global Survey of Institutional Investors conducted by CoreData Research in October and November 2024. Survey included 500 institutional investors in 28 countries throughout North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1.4 trillion assets under management2 (€1.2 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris | Oakmark; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Survey respondents ranked by Investment & Pensions Europe/Top 500 Asset Managers 2024 ranked Natixis Investment Managers as the 19th largest asset manager in the world based on assets under management as of December 31, 2023. |

2 Assets under management (AUM) of current affiliated entities measured as of September 30, 2024, are $1,427.2 billion (€1,279.0 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of nonregulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers. |

3 A brand of DNCA Finance. |

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed-income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

NIM-12022024-1fgbw85l