BOSTON--(BUSINESS WIRE)--Institutional investors are heading into the new year with the expectation that 2024’s positive market conditions will continue, but they are keeping their eyes on a wide range of economic threats, according to new survey findings published today by Natixis Investment Managers (Natixis IM).

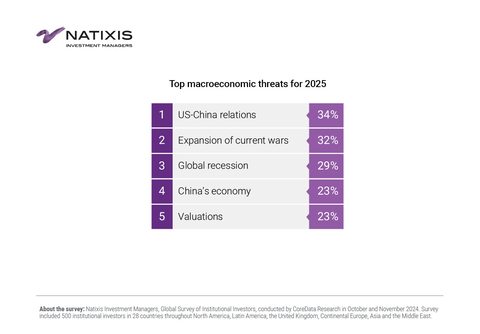

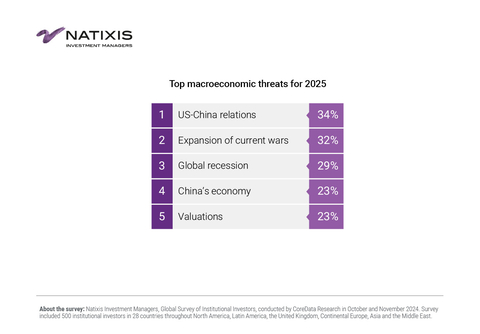

Institutional investors across the globe see a wide range of economic threats on the horizon, with US/China tensions driving the most concerns (34%) followed by the expansions of current wars (32%), underlying economic concerns including global recession (29%) and China’s economy (23%). In the US, institutional investors’ fears are focused more on the expansion of current wars (33%) persistent inflation (30%) and valuations (30%) than US/China relations (26%).

Natixis IM surveyed 500 institutional investors in October 2024 who collectively manage $28.3 trillion in assets for public and private pensions, insurers, foundations, endowments, and sovereign wealth funds worldwide. Survey participants also include 86 institutional investors in the US responsible for managing $5 trillion in assets.

Despite these concerns, US institutional investors have an optimistic economic outlook:

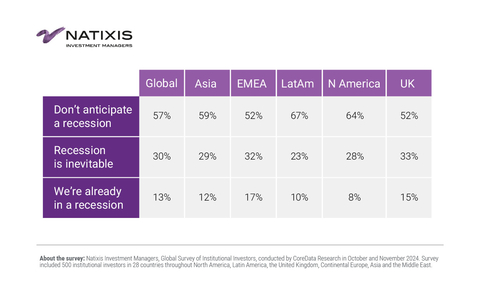

- US investors believe a recession is unlikely in 2025, with 73% saying they do not anticipate one. One year ago, 62% of US institutional investors believed a recession was inevitable in 2024.

- The significant shift in recession beliefs is due mainly to the Federal Reserve’s progress in navigating a soft landing – 71% of US investors believe the US economy will reach a soft landing in 2025, while 73% think we’re already in a soft-landing scenario.

- Most US investors (73%) anticipate between one and three rate cuts in 2025, with 55% saying inflation targets will be achieved in 2025.

“Subsiding recession fears in 2024 have given way to enthusiasm for strong returns on the horizon, but investors are still looking over their shoulder at the geopolitical and economic risks,” says Dave Goodsell, Executive Director of the Natixis Center for Investor Insight. “While the US election gives some clarity to institutional investors of the direction that economic and foreign policy could go, there is still a lot of ‘wait and see’ as investors calibrate their portfolios to account for the opportunities the market has to offer versus the risks it could see in 2025.”

Geopolitical Risks: Diverging Focuses for US and Global Investors

Institutional investors globally and in the US are concerned about the geopolitical landscape going into 2025, but the risks that concern them most vary depending on the region. In the US, institutions are worried about the expansion of current wars in Ukraine and Gaza (33%), while the rest of the world – including the UK (42%), France (38%), Germany (53%) and Singapore (53%) – list US/China relations as their top macroeconomic threat.

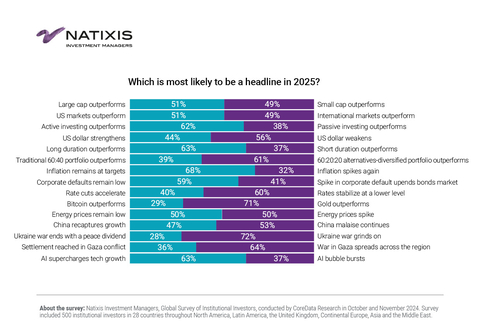

US institutional investors express pessimism around reaching a resolution to the current geopolitical conflicts. In the Ukraine war, 78% of US institutional investors believe it will grind on through 2025, while only 22% think it will end with a peace dividend. Regarding the Gaza war, 60% of US institutional investors believe it will spread across the region, while 40% believe a settlement will be reached. However, both US institutional investors (74%) and institutional investors across the globe (66%) believe the growing alliance between Russia, North Korea and Iran will lead to greater economic instability.

While 61% of global institutional investors express concern about a trade war, that number drops slightly to 58% of US institutional investors. China’s economic and regulatory environment has become less attractive for US institutional investors as:

- 91% say that regulatory uncertainties in China make the country a less attractive investment opportunity.

- 87% say a “conscious decoupling” from China presents an opportunity for new emerging markets to climb the global ladder.

- 79% say China’s geopolitical ambitions diminish its investing appeal, with 65% saying tensions in the South China Sea will become a more immediate threat to markets.

Beyond the immediate market implications of geopolitical conflict, US institutional investors see additional risks. Almost two-thirds (64%) of US investors believe geopolitical tensions will ratchet up disputes over new frontiers, such as space or the Arctic. In technology, 69% of US institutions believe that AI will open a new avenue of geopolitical risks to investors.

Economic and Sector Outlook Reflects Investors’ Measured Confidence in Markets

Despite geopolitical concerns, the positive economic backdrop – lowering inflation, anticipated rate cuts, etc – drives US institutions’ optimism about markets in 2025. US investors express bullishness across equity and bond markets.

- Going into 2025, US investors are 59% bullish on stocks. With 73% of US institutional investors projecting 1-3 rate cuts on the horizon, 40% say that the rate cuts will accelerate equity market upside.

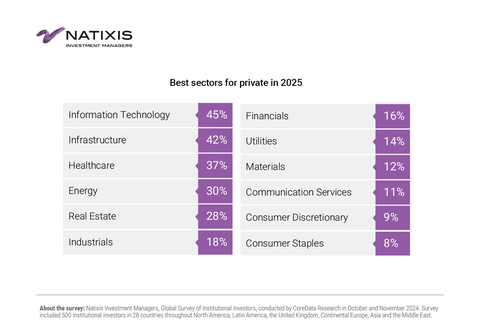

- Almost half (47%) of US institutional investors believe outperformance will be less concentrated and expect growth and outperformance from multiple sectors, including financials (48%) and energy (48%) healthcare (44%) and information technology (42%). Only 19% of US institutional investors believe consumer discretionary will outperform.

- US investors are divided on whether large caps (49%) or small caps (51%) will outperform in 2025. Forty percent say lower rates will enhance the performance of small caps.

- Regarding bond markets, 59% of US respondents had a positive outlook compared to 62% of global institutional investors.

- While global investors expressed concerns about defaults, 73% of US respondents believe the main bond headline in 2025 will be that corporate defaults remain low.

- However, US institutional investors want to remain vigilant in their duration management and credit monitoring, with 72% saying active management is essential in fixed income investing.

Valuations a top concern for portfolio allocations

While investors remain confident in the market, they have a healthy understanding of risks. After an extended run-up, valuations are a top portfolio concern, especially in the US, where almost two-thirds (63%) of US institutional investors say they are one of their top portfolio risks in 2025. Further, one in four (40%) of US intuitional investors see inflation as a top risk, and while 2024 markets provided a relatively smooth ride in key asset classes, US institutions project an uptick for volatility in stocks (57%), currencies (44%) and bonds (40%).

US institutions are looking for long-term performance, so little change is expected in their allocation projections for 2025 and the long term. Strategy remains focused on meeting an average long-term return assumption of 8.3%. In addition, key pressure has been alleviated by higher interest rates and US institutional liability ratios have settled at 86%.

Further, US institutional investors are approaching their portfolios by:

- Taking more risk: The number of institutions who said they are actively derisking their portfolios dropped to (51%) compared to 58% in 2024. Over a third (34%) are actively taking on more risks.

- Staying active: After a year in which three quarters (76%) of US institutional investors said their actively managed investments outperformed their benchmarks in 2024, 60% of US institutional investors believe that active investing will again outperform passive investing in 2025.

Investors Bullish on Private Markets but Opportunities are Hard to Find

Alternative assets remain of particular interest, especially private markets, with US investors 60% bullish on private equity and (59%) bullish on private debt. In fact, 65% of US institutional investors believe that a portfolio with 60% stocks, 20% bonds and 20% alternatives will outperform the traditional 60:40 portfolio. With rate cuts expected in 2025, 80% of US institutional investors are anticipating that they will improve deal flow in private markets, with 74% of US institutional investors believing that more private debt will be issued in 2025 to meet demand.

While excitement remains over private markets, over half (56%) of US institutional investors also find that the popularity of private is making it hard to find investment opportunities. Further, 67% of US institutional investors say that growing investment in private assets is increasing risks in institutional portfolios, resulting in 70% of US institutional investors confirming they have increased their due diligence on private assets has increased as they are concerned about deal quality.

On AI and technology, 71% of US institutional investors believe that using AI as an investment tool will unlock new investment opportunities that were otherwise undetectable. Further, three-quarters (76%) of US institutional investors believe US policy will foster AI growth at home to compete with China. However, US investors are a little more split on what AI’s market story will be in 2025: 59% believe the AI story for 2025 will be that it supercharges tech growth, but 41% see the story as the AI bubble bursts.

A full copy of the report on the Natixis Investment Managers Institutional Investor 2025 Market Outlook can be found here: https://www.im.natixis.com/en-us/insights/investor-sentiment/2024/institutional-outlook

Methodology

Natixis Investment Managers, Global Survey of Institutional Investors conducted by CoreData Research in October and November 2024. Survey included 500 institutional investors in 28 countries throughout North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East.

About the Natixis Center for Investor Insight

The Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1.4 trillion assets under management2 (€1.2 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris | Oakmark; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Survey respondents ranked by Investment & Pensions Europe/Top 500 Asset Managers 2024 ranked Natixis Investment Managers as the 19th largest asset manager in the world based on assets under management as of December 31, 2023. |

2 Assets under management (AUM) of current affiliated entities measured as of September 30, 2024, are $1,427.2 billion (€1,279.0 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of nonregulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers. |

3 A brand of DNCA Finance. |

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed-income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

NIM-11292024-krbpcdgn