Westphalia Dev. Corp. Reports Third Quarter 2024 Fiscal Results

Westphalia Dev. Corp. Reports Third Quarter 2024 Fiscal Results

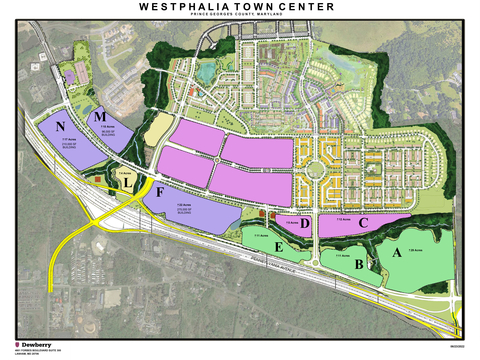

SCOTTSDALE, Ariz.--(BUSINESS WIRE)--Westphalia Dev. Corp. (the “Corporation”) announced today its results for the third quarter ending September 30, 2024. The Corporation was formed in March 2012, for the development of a 310-acre Westphalia property located in Prince George’s County, Maryland, United States. The Corporation is managed by Walton Global (the “Manager”).

Material Event:

- There is material going concern uncertainty as the Manager has informed the Board that it will not fund on a go forward basis, unless a plan is put in place to address the liquidity of the Corporation and to make a definitive plan to pay the outstanding debt, unsecured creditors, and the Manager.

- The Board and the Manager have made a commitment to construct and implement a plan as soon as possible to deal with these matters, which will include a restructuring of the Corporation.

- The Manager (and its affiliates) are owed ~$10,000,000+ and has not been paid a management fee since 2016.

Financial Results

- Operating expenses for this quarter remained consistent with Q2 2024.

- On August 27, 2024, the Corporation signed the First Amendment to the Amended New Loan Program which extends the maturity date of the loan to July 31, 2025.

- On August 27, 2024, The Corporation also signed the First Amendment to the WTCF Loan which provides a second advance of $6,761,678 USD, with a maturity date of June 30, 2025.

- On November 19, 2024, The Corporation exercised their option to extend the maturity date of the first WTCF Loan advance to December 31, 2025.

- The Manager and its affiliates continue to fund monetary shortfalls.

Development and Sales Activities

- The Westphalia Interchange TIF project located at the intersection of Pennsylvania Avenue (Route 4) and Woodyard Route (Route 223) is substantially complete. The General Contractor is preparing to finish the remaining State Highway Administration punch list items by Q2 2025.

- The Presidential Parkway East TIF project is substantially complete. We are in discussions with the local County for final acceptance. A contract to complete the final punch out landscaping is being finalized with anticipated completion in Q4 2024/Q1 2025.

- The Presidential Parkway West TIF project has work remaining. Management has a plan to complete all work, except utility dependent work, by the end of Q2 2025.

- The Manager has received multiple purchase offers for Parcels A & B from best-in-class retail developers to build a first-class mixed-use commercial development. Deal terms are currently being negotiated and we expect to have an agreement in place within 90 days.

- The Manager has completed Purchase and Sale Agreements for Parcels F, N, and M totaling approximately 50 acres. Settlements are anticipated to occur between Q1 and Q3 2025.

- The Manager received unanimous approval of our Detailed Site Plan (DSP Infrastructure) from The Maryland-National Capital Park and Planning Commission for Parcels A & B. This plan approval streamlines and accelerates the approval timeline for the future mixed-use development to be located on these parcels.

- The Manager has hired a best-in-class engineering and planning firm to complete the entitlements for the remaining approximately 96 acres, which includes the adjacent land to the north owned by a related party. The expectation is that this work will take 2 to 3 years to complete and receive full approval.

The Corporation’s unaudited interim consolidated financial statements and management’s discussion and analysis for the third quarter ended September 30, 2024, are available under the Corporation’s SEDAR profile at www.sedar.com.

Walton Global is a privately-owned, leading land asset management and global real estate investment company that concentrates on the research, acquisition, administration, planning, and development of land. With more than 45 years of experience, Walton has a proven track record of administering land investment projects within the fastest growing metropolitan areas in North America. The company manages and administers US$4.37 billion in assets on behalf of its global investors, builders and developer clients and industry business partners. Walton has more than 90,000 acres of land under ownership, management and administration in the United States and Canada with business lines ranging from exit-focused pre-development land investments, builder land financing and build-to-rent. For more information visit walton.com.

This news release, required by Canadian laws, does not constitute an offer of securities, and is not for distribution or dissemination outside Canada. This news release contains forward looking information, and actual future results may differ from what is disclosed in this news release. Forward-looking information is based on the current expectations, estimates and projections of the Corporation at the time the statements are made. They involve a number of known and unknown risks and uncertainties which would cause actual results or events to differ materially from those presently anticipated. The risks, uncertainties and other factors that could cause the Corporation's actual results and performance in future periods to differ materially from the forward looking information contained in this news release include, among other things, the development of Westphalia Town Center, general economic and market factors, including interest rates, a decline in the real estate market, changes in government policies and regulations or in tax laws, changes in municipal planning strategies and whether certain development approvals are obtained and changes in the Canadian/U.S. dollar exchange rate, in addition to those factors discussed or referenced in documents filed with Canadian securities regulatory authorities and available online at www.sedar.com.

Except as otherwise noted, all amounts are in Canadian dollars, and are based on unaudited condensed interim consolidated financial statements for the nine months ended September 30, 2024, and related notes, prepared in accordance with International Financial Reporting Standards.

Contacts

Allison+Partners

waltonglobal@allisonpr.com