ST. PAUL, Minn.--(BUSINESS WIRE)--Imagine children learning the value of money and how to pay off a loan without the financial stress. Affinity Plus Federal Credit Union is making that possible for families with the newest update to its Affinity Plus Youth Banking App, which now includes a practice loan feature to teach kids the ins and outs of managing debt in a safe and supportive environment.

For many parents, handing over the latest gadget or funding a big-ticket item comes with a promise from their child to pay it back. Affinity Plus’s new practice loans feature turns those agreements into valuable lessons. From due dates to late fees, the new feature lets kids practice what it’s like to have real loan responsibilities while giving parents the tools to guide them through the process.

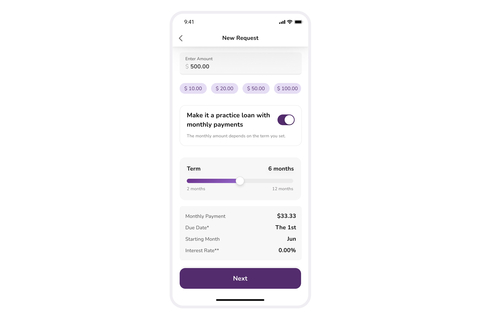

Parents can set up a practice loan with flexible terms ranging from two to 12 months. The app sends reminders when payments are due and even mimics the consequences of missed payments through virtual late fees paid to parents. Kids stay on track with push notifications, learning the importance of responsibility and planning ahead.

In addition to the new Practice Loans feature, the Affinity Plus Youth Banking App offers a suite of tools to help parents and kids manage money together. Parents can:

- Provide real-life experience by giving kids their own debit card

- Send money instantly for allowances or rewards

- Set spending limits and oversee purchases with real-time notifications

- Manage chores and automate allowance payments

- Help kids budget with spending categories and savings goals

“It has never been more important for parents to raise financially-savvy kids, but it can be tough to start those conversations,” said Dave Larson, president and CEO of Affinity Plus. “We hope this new feature helps parents turn everyday moments into teachable ones so kids can develop smart money habits early.”

The Affinity Plus Youth Banking App is available to all Affinity Plus members. The app supports up to five kids per account, each with their own debit card and personalized app experience. While the app is designed for kids and teens, parents can provide the oversight needed to help them build financial confidence. Affinity Plus plans to roll out additional features in the coming months, including interactive financial education modules.

As a not-for-profit, member-owned credit union, Affinity Plus focuses on accessible and impactful banking services that help members of all ages build a solid financial foundation. Beyond the Youth Banking App, Affinity Plus offers all members financial coaching, early pay options and access to resources that promote smart money management. To learn more about how Affinity Plus is helping kids take charge of their financial futures, visit affinityplus.org/youth-banking-app.

About Affinity Plus Credit Union

Based in St. Paul, Minn., Affinity Plus Federal Credit Union is a not-for-profit, financial cooperative that puts people first above profits. Members of Affinity Plus receive maximum value through competitive rates, minimal fees, and unique, member-centric products and programs. Established in 1930, Affinity Plus has 32 branches located throughout Minnesota and is owned by 275,000 members. Affinity Plus has more than $4.2 billion in assets. Additional information is available at www.affinityplus.org or by calling (800) 322-7228.