SEATTLE--(BUSINESS WIRE)--TappAlpha, a fintech company aiming to make powerful investing accessible, today announced the second monthly income distribution for the TappAlpha SPY Growth & Daily Income ETF (NASDAQ: TSPY).

Distribution Amount: $0.27655 per share

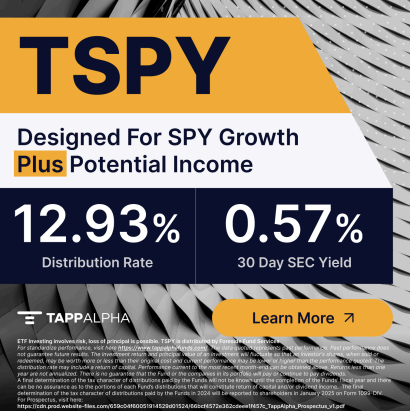

Distribution Rate (as of 11/5/24): 12.93%

30-day SEC Yield (as of 11/5/24): 0.57%

Ex-Date - Wednesday, 11/6/24

Payable Date - Thursday, 11/7/24

Launched on August 15, 2024, TSPY seeks to generate current income while maintaining prospects for capital appreciation. The ETF integrates the S&P 500’s growth with a daily covered call strategy, helping to provide enhanced income with market participation. This innovative strategy is designed for those seeking portfolio diversification, additional income potential and effective risk management.

TSPY issued its first monthly distribution on October 3, 2024. TSPY is currently offered at a management fee of 0.68% and has $6,931,386 in net assets as of 11/6/24.

To learn more about TappAlpha and TSPY, please visit TappAlphaFunds.com.

About TappAlpha

Founded in 2023, TappAlpha is a Seattle-based fintech company committed to making advanced financial tools and education accessible to everyone. By making investing simple, actionable, and transparent, TappAlpha seeks to enable investors to unlock potential income and achieve their financial goals. The company is built on a foundation of empathy, trust, and transparency ensuring a customer-first approach in all of its initiatives.

Disclosures

For prospectus, click here: TSPY Prospectus

The Fund’s shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objectives. The Fund invests in options contracts that are based on the value of the Index, including SPX and XSP options. This subjects the Fund to certain of the same risks as if it owned shares of companies that comprised the Index, even though it does not own shares of companies in the Index. The Fund will have exposure to declines in the Index. The Fund is subject to potential losses if the Index loses value, which may not be offset by income received by the Fund. By virtue of the Fund’s investments in options contracts that are based on the value of the Index, the Fund may also be subject to an indirect investment risk, an index trading risk & an S&P 500 Index Risk.

Due to the short time until their expiration, 0DTE options are more sensitive to sudden price movements and market volatility than options with more time until expiration. Because of this, the timing of trades utilizing 0DTE options becomes more critical. Even a slight delay in the execution of 0DTE trades can significantly impact the outcome of the trade. 0DTE options may also suffer from low liquidity, making it more difficult for the Fund to enter into its positions each morning at desired prices. The bid-ask spreads on 0DTE options can be wider than with traditional options, increasing the Fund's transaction costs and negatively affecting its returns. These risks may negatively impact the performance of the fund.

The Distribution Rate is the annual rate an investor would receive if the most recent fund distribution remained the same going forward. The Distribution Rate represents a single distribution from the Fund and is not a representation of the Fund's total return. The Distribution Rate is calculated by multiplying the most recent distribution by 12 in order to annualize it, and then dividing by the Fund's NAV.

30-day SEC Yield is based on a formula mandated by the Securities and Exchange Commission (SEC) that calculates a fund's hypothetical annualized income, as a percentage of its assets. A security's income, for the purposes of this calculation, is based on the current market yield to maturity (in the case of bonds) or projected dividend yield (for stocks) of the fund's holdings over a trailing 30-day period. This hypothetical income will differ (at times, significantly) from the fund's actual experience; as a result, income distributions from the fund may be higher or lower than implied by the SEC yield.

Return of Capital (ROC) refers to a portion of a distribution that an ETF, mutual fund, or other investment may pay to investors that comes from the original principal (or initial investment) rather than from earnings, profits, or capital gains.

A final determination of the tax character of distributions paid by the Funds will not be known until the completion of the Funds’ fiscal year and there can be no assurance as to the portions of each Fund’s distributions that will constitute return of capital and/or dividend income. The final determination of the tax character of distributions paid by the Funds in 2024 will be reported to shareholders in January 2025 on Form 1099-DIV.

Investing in securities involves risk including the loss of principal.

Distributed by Foreside Fund Services, LLC, Member FINRA.