AUSTIN, Texas--(BUSINESS WIRE)--Core Scientific, Inc. (NASDAQ: CORZ), a leader in digital infrastructure for bitcoin mining and HPC, today announced financial results for the fiscal third quarter of 2024. Net loss was $455.3 million, as compared to a net loss of $41.1 million for the same period in 2023. Total revenue was $95.4 million, as compared to $112.9 million for the same period last year. Operating loss was $41.2 million, as compared to a loss of $12.0 million for the same period in 2023. Adjusted EBITDA was $10.1 million, as compared to $27.8 million for the same period in the prior year. Third quarter net loss resulted from a net $408.5 million mark-to-market adjustment in the value of our tranche 1 and tranche 2 warrants and other contingent value rights required as a result of the significant quarter-over-quarter increase in the value of our equity.

“During the third quarter, we continued to grow our HPC business, both in terms of contracted power and total capacity,” said Adam Sullivan, Core Scientific Chief Executive Officer. “To date, we have contracted approximately 500 megawatts of revenue generating, critical IT load that we expect to generate a total of $8.7 billion over the life of the contracts. We were also able to reallocate 100 megawatts of infrastructure previously designated for bitcoin mining to our HPC business, increasing our total HPC hosting capacity to 800 megawatts, with 400 megawatts still designated to our bitcoin mining business. We expanded our infrastructure further by securing a new data center in Alabama with 11 megawatts of critical IT load and the potential for expansion to 66 megawatts, and we progressed in transitioning two existing data center sites from bitcoin mining to HPC hosting.

“We view our updated 800 megawatts of gross infrastructure available for HPC hosting as the foundation for our data center business, which we will continue to expand by securing additional power at some of our existing sites and by acquiring new powered sites that we can contract to new clients. Based on our existing pipeline of new site opportunities and growing list of potential new clients, we believe we now have line of sight to a total of more than one gigawatt of critical IT load to contract, significantly expanding the value we can create for our shareholders.”

Fiscal Third Quarter Financial and Operational Achievements

- Total revenue of $95.4 million, a decrease of $17.6 million compared to third quarter 2023

- Net loss of $455.3 million, an increase of $414.1 million over third quarter 2023

- Operating loss of $41.2 million, an increase of $29.2 million over third quarter 2023

- Adjusted EBITDA of $10.1 million, a decrease of $17.6 million over third quarter 2023

- Strengthened the balance sheet, ending the quarter with cash and cash equivalents of $253.0 million as of September 30, 2024

- Operated total hash rate of 23.4 EH/s, consisting of 20.4 EH/s self-mining and 3.0 EH/s hosting

- Improved average actual self-mining fleet energy efficiency to 24.5 joules per terahash

Fiscal Third Quarter 2024 Financial Results (Compared to Fiscal Third Quarter 2023)

Total revenue for the fiscal third quarter of 2024 was $95.4 million, and consisted of $68.1 million in Digital asset self-mining revenue, $16.9 million in digital asset hosted mining revenue and $10.3 million in HPC hosting revenue.

Digital asset self-mining gross (loss) profit for the fiscal third quarter of 2024 was a gross loss of $6.4 million ((9)% gross margin), as compared to gross profit of $10.5 million (13% gross margin) for the same period in the prior year, a decrease of $16.9 million. The decrease in Digital asset self-mining gross profit was primarily driven by a 62% decrease in bitcoin mined due to the halving and higher network difficulty, partially offset by a 117% increase in the price of bitcoin and higher depreciation expense from new more efficient miners being put into service.

Digital asset hosted mining revenue in excess of hosting cost of revenue for the fiscal third quarter of 2024 was $5.0 million (29% gross margin), as compared to $5.0 million (17% gross margin) for the same period in the prior year. The increase in Digital asset hosted mining gross margin was primarily due to lower Digital asset hosted mining revenue driven by the termination of contracts with several customers since September 30, 2023. This was due primarily to our shift to HPC hosting, offset by lower power costs from lower rates and reduced allocation of power to hosted customers.

HPC hosting revenue in excess of HPC hosting cost of revenue for the fiscal third quarter of 2024 was $1.3 million (13% gross margin). HPC hosting started operations during the fiscal second quarter of 2024. HPC hosting costs consisted primarily of lease expense, power costs, payroll and benefits expense and stock-based compensation expense.

Operating expenses for the fiscal third quarter of 2024 totaled $40.3 million, as compared to $26.8 million for the same period in the prior year. The increase of $13.5 million was primarily attributable to a $4.2 million increase in personnel and related expenses, $3.7 million of HPC site startup costs incurred during the current period, higher stock-based compensation of $2.5 million and a $2.1 million increase in bankruptcy advisor fees.

Net loss for the fiscal third quarter of 2024 was $455.3 million, as compared to a net loss of $41.1 million for the same period in the prior year. Net loss for the fiscal third quarter of 2024 increased by $414.1 million driven primarily by a net $408.5 million mark-to-market adjustment on our warrants and other contingent value rights comprising a $414.5 million increase in the fair value of warrant liabilities, partially offset by a $6.0 million decrease in fair value of contingent value rights. These mark-to-market adjustments were driven by the increase in our stock price during the period. Also contributing to the increase in net loss was a $4.9 million increase in Interest expense, net resulting from the Bankruptcy Court ordered stay on payment of pre-petition obligations, including interest during the same period in 2023, partially offset by $28.3 million in Reorganization items, net with no comparable activity for the same period in fiscal 2024 due the Company’s emergence from bankruptcy during the first quarter 2024.

Non-GAAP Adjusted EBITDA for the fiscal third quarter 2024 was $10.1 million, as compared to Non-GAAP Adjusted EBITDA of $27.8 million for the same period in the prior year. This $17.6 million decrease was driven by a $17.6 million decrease in total revenue, a $5.4 million increase in cash operating expenses, a $1.6 million increase in HPC site startup costs, a $0.4 million decrease in gain from sales of digital assets, and a $0.2 million decrease in the change in fair value of digital assets, partially offset by a $6.9 million decrease in cash cost of revenue and a $0.7 million decrease in impairment of digital assets.

Fiscal Year-to-Date 2024 Financial Results (Compared to Fiscal Year-to-Date 2023)

Total revenue for the nine months ended September 30, 2024 was $415.7 million, and consisted of $328.8 million in digital asset self-mining revenue, $71.1 million in digital asset hosted mining revenue and $15.9 million in HPC hosting revenue.

Digital asset self-mining revenue in excess of mining cost of revenue for the nine months ended September 30, 2024 was $92.7 million (28% gross margin), as compared to $66.0 million (24% gross margin) for the same period in the prior year, an increase of $26.7 million. The increase in Digital asset self-mining revenue in excess of Digital asset self-mining cost of revenue was primarily due to a 18% increase in mining revenue driven by a 128% increase in the price of bitcoin, a 36% increase in our self-mining hash rate, driven by our fleet mix and efficiency, and an increase in the number of mining units deployed, partially offset by a 48% decrease in bitcoin mined due to the halving and higher network difficulty.

Digital asset hosted mining revenue in excess of hosting cost of revenue for the nine months ended September 30, 2024 was $21.7 million (30% gross margin), as compared to $18.1 million (22% gross margin) for the same period in the prior year, an increase of $3.5 million. The increase in Digital asset hosted mining revenue in excess of Digital asset hosted mining cost of revenue was primarily due to due to lower Cost of Digital asset hosted mining services primarily driven by lower power costs from lower rates and usage, partially offset by decreased Digital asset hosted mining revenue from related parties as there were no related party transactions during fiscal 2024 and by the termination of contracts with several customers since September 30, 2023, due primarily to our shift to HPC hosting.

HPC hosting revenue in excess of HPC hosting cost of revenue for the nine months ended September 30, 2024 was $1.9 million (12% gross margin). HPC hosting started operations during the fiscal second quarter of 2024. HPC hosting costs consisted primarily of lease expense, direct electricity costs, payroll and benefits expense and stock-based compensation expense.

Operating expenses for the nine months ended September 30, 2024 totaled $88.7 million, as compared to $78.1 million for the same period in the prior year. The increase of $10.5 million was primarily attributable a $15.3 million increase in personnel and related expenses, $4.6 million of HPC advisory startup costs and $3.7 million site startup costs incurred during the current period, $2.2 million of bankruptcy advisory fees and a $1.8 million increase in corporate taxes, partially offset by lower stock-based compensation of $17.6 million due to cancellations and forfeitures of equity-based awards.

Net loss for the nine months ended September 30, 2024 was $1.05 billion, as compared to a net loss of $50.8 million for the same period in the prior year. Net loss for the nine months ended September 30, 2024 increased by $1.00 billion driven primarily by a net $1.14 billion mark-to-market adjustment on our warrants and other contingent value rights comprising a $1.22 billion increase in the fair value of warrant liabilities, partially offset by a $79.3 million decrease in fair value of contingent value rights. These mark-to-market adjustments were driven by the increase in our stock price during the period. Also contributing to the increase in net loss was a $33.6 million increase in Interest expense, net resulting from the Bankruptcy Court ordered stay on payment of pre-petition obligations, including interest during the same period in 2023, and a $21.6 million decrease in gain on extinguishment of debt compared to the same period in the prior year, partially offset by a decrease of $189.7 million in Reorganization items, net, which included gains on extinguishment of pre-emergence obligations of $143.8 million.

Non-GAAP Adjusted EBITDA for the nine months ended September 30, 2024 was $144.2 million, as compared to Non-GAAP Adjusted EBITDA of $112.9 million for the same period in the prior year. This $31.3 million increase was driven by a $55.3 million increase in total revenue and a $2.9 million decrease in impairment of digital assets, partially offset by a $17.2 million increase in cash operating expenses, a $5.0 million increase in realized losses on energy derivatives, a $2.4 million decrease in gain from sales of digital assets, a $1.6 million increase in HPC site startup costs, a $0.3 million increase in cash cost of revenue, and a $0.2 million decrease in change in fair value of digital assets.

CONFERENCE CALL AND LIVE WEBCAST

In conjunction with this release, Core Scientific, Inc. will host a conference call today, Wednesday, November 6, 2024, at 4:30 p.m. Eastern Time that will be webcast live. Adam Sullivan, Chief Executive Officer; Denise Sterling, Chief Financial Officer; and Steven A. Gitlin, Senior Vice President Investor Relations, will host the call.

Investors may dial into the call by using the following telephone numbers: +1 (877) 407-1875 (U.S. toll free) or +1 (215) 268-9909 (U.S. local) five to ten minutes prior to the start time to allow for registration.

Investors with Internet access may listen to the live audio webcast via the Investor Relations page of the Core Scientific, Inc. website, http://investors.corescientific.com or by using the following link https://event.choruscall.com/mediaframe/webcast.html?webcastid=HW5MvP6u. Please allow 10 minutes prior to the call to download and install any necessary audio software. A replay of the audio webcast will be available for one year.

A supplementary investor presentation for the fiscal third quarter 2024 may be accessed at https://investors.corescientific.com/investors/events-and-presentations/default.aspx.

AUDIO REPLAY

An audio replay of the event will be archived on the Investor Relations section of the Company's website at http://investors.corescientific.com and via telephone by dialing +1 (877) 660-6853 (U.S. toll free) or +1 (201) 612-7415 (U.S. local) and entering Access Code 13749193.

ABOUT CORE SCIENTIFIC

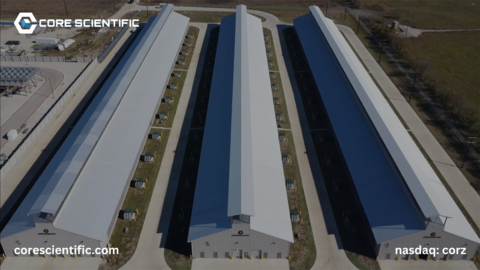

Core Scientific, Inc. (“Core Scientific” or the “Company”) is a leader in digital infrastructure for bitcoin mining and high-performance computing. We operate dedicated, purpose-built facilities for digital asset mining and are a premier provider of digital infrastructure to our third-party customers. We employ our own large fleet of computers (“miners”) to earn digital assets for our own account and to provide hosting services for large bitcoin mining customers, and we are in the process of allocating and converting a significant portion of our nine operational data centers in Alabama (1), Georgia (2), Kentucky (1), North Carolina (1), North Dakota (1) and Texas (3), and our facility in development in Oklahoma to support artificial intelligence-related workloads under a series of contracts that entail the modification of certain of our data centers to deliver hosting services for high-performance computing (“HPC”). We derive the majority of our revenue from earning bitcoin for our own account (“self-mining”). To learn more, visit www.corescientific.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the Company’s ability to scale, grow its business and execute on its growth plans and hosting contracts, source energy at reasonable rates, the advantages, expected growth, and anticipated future revenue of the Company, and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to earn digital assets profitably and to attract customers for our digital asset and high performance compute hosting capabilities; our ability to perform under our existing colocation agreements, our ability to maintain our competitive position in our existing operating segments, the impact of increases in total network hash rate; our ability to raise additional capital to continue our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential failure in our critical systems, facilities or services we provide; the physical risks and regulatory changes relating to climate change; potential significant changes to the method of validating blockchain transactions; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting high performance computing, the blockchain industry and the blockchain hosting market; the identification of material weaknesses in our internal control over financial reporting; price volatility of digital assets and bitcoin in particular; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the increasing likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; increasing scrutiny and changing expectations with respect to ESG policies; the effectiveness of our compliance and risk management methods; the adequacy of our sources of recovery if the digital assets held by us are lost, stolen or destroyed due to third-party digital asset services; the effects of our emergence from bankruptcy and our substantial level of indebtedness and our current liquidity constraints affecting our financial condition and ability to service our indebtedness. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Core Scientific, Inc. Condensed Consolidated Balance Sheets (in thousands, except par value) (Unaudited) |

|||||||

|

September 30,

|

|

December 31,

|

||||

Assets |

|

|

|

||||

Current Assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

253,019 |

|

|

$ |

50,409 |

|

Restricted cash |

|

783 |

|

|

|

19,300 |

|

Accounts receivable |

|

6,244 |

|

|

|

1,001 |

|

Digital assets |

|

— |

|

|

|

2,284 |

|

Prepaid expenses and other current assets |

|

17,810 |

|

|

|

24,022 |

|

Total Current Assets |

|

277,856 |

|

|

|

97,016 |

|

Property, plant and equipment, net |

|

550,432 |

|

|

|

585,431 |

|

Operating lease right-of-use assets |

|

74,733 |

|

|

|

7,844 |

|

Other noncurrent assets |

|

18,830 |

|

|

|

21,865 |

|

Total Assets |

$ |

921,851 |

|

|

$ |

712,156 |

|

Liabilities and Stockholders’ Deficit |

|

|

|

||||

Current Liabilities: |

|

|

|

||||

Accounts payable |

$ |

6,504 |

|

|

$ |

154,751 |

|

Accrued expenses and other current liabilities |

|

31,726 |

|

|

|

179,636 |

|

Deferred revenue |

|

9,944 |

|

|

|

9,830 |

|

Operating lease liabilities, current portion |

|

7,486 |

|

|

|

77 |

|

Finance lease liabilities, current portion |

|

2,380 |

|

|

|

19,771 |

|

Notes payable, current portion |

|

17,941 |

|

|

|

124,358 |

|

Contingent value rights, current portion |

|

533 |

|

|

|

— |

|

Total Current Liabilities |

|

76,514 |

|

|

|

488,423 |

|

Operating lease liabilities, net of current portion |

|

65,335 |

|

|

|

1,512 |

|

Finance lease liabilities, net of current portion |

|

4 |

|

|

|

35,745 |

|

Convertible and other notes payable, net of current portion |

|

474,596 |

|

|

|

684,082 |

|

Contingent value rights, net of current portion |

|

6,458 |

|

|

|

— |

|

Warrant liabilities |

|

1,017,299 |

|

|

|

— |

|

Other noncurrent liabilities |

|

11,040 |

|

|

|

— |

|

Total liabilities not subject to compromise |

|

1,651,246 |

|

|

|

1,209,762 |

|

Liabilities subject to compromise |

|

— |

|

|

|

99,335 |

|

Total Liabilities |

|

1,651,246 |

|

|

|

1,309,097 |

|

Commitments and contingencies |

|

|

|

||||

Stockholders’ Deficit: |

|

|

|

||||

Preferred stock; $0.00001 par value; 2,000,000 and nil shares authorized at September 30, 2024 and December 31, 2023, respectively; none issued and outstanding at September 30, 2024 and December 31, 2023 |

|

— |

|

|

|

— |

|

Common stock; $0.00001 par value; 10,000,000 shares authorized at September 30, 2024 and December 31, 2023; 279,821 and 386,883 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively |

|

3 |

|

|

|

36 |

|

Additional paid-in capital |

|

2,740,279 |

|

|

|

1,823,260 |

|

Accumulated deficit |

|

(3,469,677 |

) |

|

|

(2,420,237 |

) |

Total Stockholders’ Deficit |

|

(729,395 |

) |

|

|

(596,941 |

) |

Total Liabilities and Stockholders’ Deficit |

$ |

921,851 |

|

|

$ |

712,156 |

|

Core Scientific, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share amounts) (Unaudited) |

|||||||||||||||

|

Three Months Ended

|

|

Nine Months Ended

|

||||||||||||

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

||||||||

Digital asset self-mining revenue |

$ |

68,138 |

|

|

$ |

83,056 |

|

|

$ |

328,840 |

|

|

$ |

278,164 |

|

Digital asset hosted mining revenue from customers |

|

16,878 |

|

|

|

27,020 |

|

|

|

71,050 |

|

|

|

72,245 |

|

Digital asset hosted mining revenue from related parties |

|

— |

|

|

|

2,828 |

|

|

|

— |

|

|

|

10,062 |

|

HPC hosting revenue |

|

10,338 |

|

|

|

— |

|

|

|

15,857 |

|

|

|

— |

|

Total revenue |

|

95,354 |

|

|

|

112,904 |

|

|

|

415,747 |

|

|

|

360,471 |

|

Cost of revenue: |

|

|

|

|

|

|

|

||||||||

Cost of digital asset self-mining |

|

74,555 |

|

|

|

72,603 |

|

|

|

236,120 |

|

|

|

212,125 |

|

Cost of digital asset hosted mining services |

|

11,914 |

|

|

|

24,882 |

|

|

|

49,388 |

|

|

|

64,187 |

|

Cost of HPC hosting services |

|

9,041 |

|

|

|

— |

|

|

|

13,932 |

|

|

|

— |

|

Total cost of revenue |

|

95,510 |

|

|

|

97,485 |

|

|

|

299,440 |

|

|

|

276,312 |

|

Gross (loss) profit |

|

(156 |

) |

|

|

15,419 |

|

|

|

116,307 |

|

|

|

84,159 |

|

Change in fair value of digital assets |

|

(206 |

) |

|

|

— |

|

|

|

(247 |

) |

|

|

— |

|

Gain from sale of digital assets |

|

— |

|

|

|

363 |

|

|

|

— |

|

|

|

2,358 |

|

Impairment of digital assets |

|

— |

|

|

|

(681 |

) |

|

|

— |

|

|

|

(2,864 |

) |

Change in fair value of energy derivatives |

|

— |

|

|

|

— |

|

|

|

(2,757 |

) |

|

|

— |

|

Loss on disposal of property, plant and equipment |

|

(509 |

) |

|

|

(340 |

) |

|

|

(4,061 |

) |

|

|

(514 |

) |

Operating expenses: |

|

|

|

|

|

|

|

||||||||

Research and development |

|

2,841 |

|

|

|

2,253 |

|

|

|

6,814 |

|

|

|

5,308 |

|

Sales and marketing |

|

3,151 |

|

|

|

1,041 |

|

|

|

7,099 |

|

|

|

3,133 |

|

General and administrative |

|

34,356 |

|

|

|

23,511 |

|

|

|

74,742 |

|

|

|

69,671 |

|

Total operating expenses |

|

40,348 |

|

|

|

26,805 |

|

|

|

88,655 |

|

|

|

78,112 |

|

Operating (loss) income |

|

(41,219 |

) |

|

|

(12,044 |

) |

|

|

20,587 |

|

|

|

5,027 |

|

Non-operating (income) expenses, net: |

|

|

|

|

|

|

|

||||||||

Loss (gain) on debt extinguishment |

|

317 |

|

|

|

(374 |

) |

|

|

487 |

|

|

|

(21,135 |

) |

Interest expense, net |

|

7,072 |

|

|

|

2,196 |

|

|

|

35,934 |

|

|

|

2,317 |

|

Reorganization items, net |

|

— |

|

|

|

28,256 |

|

|

|

(111,439 |

) |

|

|

78,270 |

|

Change in fair value of warrant and contingent value rights |

|

408,520 |

|

|

|

— |

|

|

|

1,144,441 |

|

|

|

— |

|

Other non-operating (income) expense, net |

|

(2,003 |

) |

|

|

(1,090 |

) |

|

|

144 |

|

|

|

(3,978 |

) |

Total non-operating expenses, net |

|

413,906 |

|

|

|

28,988 |

|

|

|

1,069,567 |

|

|

|

55,474 |

|

Loss before income taxes |

|

(455,125 |

) |

|

|

(41,032 |

) |

|

|

(1,048,980 |

) |

|

|

(50,447 |

) |

Income tax expense |

|

134 |

|

|

|

114 |

|

|

|

484 |

|

|

|

347 |

|

Net loss |

$ |

(455,259 |

) |

|

$ |

(41,146 |

) |

|

$ |

(1,049,464 |

) |

|

$ |

(50,794 |

) |

Net loss per share: |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

(1.17 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.71 |

) |

|

$ |

(0.13 |

) |

Diluted |

$ |

(1.17 |

) |

|

$ |

(0.11 |

) |

|

$ |

(3.71 |

) |

|

$ |

(0.13 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

||||||||

Basic |

|

292,486 |

|

|

|

382,483 |

|

|

|

253,058 |

|

|

|

378,107 |

|

Diluted |

|

292,486 |

|

|

|

382,483 |

|

|

|

253,058 |

|

|

|

378,107 |

|

Core Scientific, Inc. Segment Results (in thousands, except percentages) (Unaudited) |

|||||||||||||||

|

Three Months Ended

|

|

Nine Months Ended

|

||||||||||||

|

2024 |

|

2023 |

|

2024 |

|

2023 |

||||||||

Digital Asset Self-Mining Segment |

(in thousands, except percentages) |

||||||||||||||

Digital asset self-mining revenue |

$ |

68,138 |

|

|

$ |

83,056 |

|

|

$ |

328,840 |

|

|

$ |

278,164 |

|

Cost of digital asset self-mining |

|

74,555 |

|

|

|

72,603 |

|

|

|

236,120 |

|

|

|

212,125 |

|

Digital Asset Self-Mining gross (loss) profit |

$ |

(6,417 |

) |

|

$ |

10,453 |

|

|

$ |

92,720 |

|

|

$ |

66,039 |

|

Digital Asset Self-Mining gross margin |

|

(9 |

)% |

|

|

13 |

% |

|

|

28 |

% |

|

|

24 |

% |

|

|

|

|

|

|

|

|

||||||||

Digital Asset Hosted Mining Segment |

|

|

|

|

|

|

|

||||||||

Digital asset hosted mining revenue from customers |

$ |

16,878 |

|

|

$ |

29,848 |

|

|

$ |

71,050 |

|

|

$ |

82,307 |

|

Cost of digital asset hosted mining services |

|

11,914 |

|

|

|

24,882 |

|

|

|

49,388 |

|

|

|

64,187 |

|

Digital Asset Hosted Mining gross profit |

$ |

4,964 |

|

|

$ |

4,966 |

|

|

$ |

21,662 |

|

|

$ |

18,120 |

|

Digital Asset Hosted Mining gross margin |

|

29 |

% |

|

|

17 |

% |

|

|

30 |

% |

|

|

22 |

% |

|

|

|

|

|

|

|

|

||||||||

HPC Hosting Segment |

|

|

|

|

|

|

|

||||||||

HPC hosting revenue |

$ |

10,338 |

|

|

$ |

— |

|

|

$ |

15,857 |

|

|

$ |

— |

|

Cost of HPC hosting services |

|

9,041 |

|

|

|

— |

|

|

|

13,932 |

|

|

|

— |

|

HPC Hosting gross profit |

$ |

1,297 |

|

|

$ |

— |

|

|

$ |

1,925 |

|

|

$ |

— |

|

HPC Hosting gross margin |

|

13 |

% |

|

|

— |

% |

|

|

12 |

% |

|

|

— |

% |

|

|

|

|

|

|

|

|

||||||||

Consolidated |

|

|

|

|

|

|

|

||||||||

Consolidated total revenue |

$ |

95,354 |

|

|

$ |

112,904 |

|

|

$ |

415,747 |

|

|

$ |

360,471 |

|

Consolidated cost of revenue |

$ |

95,510 |

|

|

$ |

97,485 |

|

|

$ |

299,440 |

|

|

$ |

276,312 |

|

Consolidated gross (loss) profit |

$ |

(156 |

) |

|

$ |

15,419 |

|

|

$ |

116,307 |

|

|

$ |

84,159 |

|

Consolidated gross margin |

|

— |

% |

|

|

14 |

% |

|

|

28 |

% |

|

|

23 |

% |

Core Scientific, Inc. and Subsidiaries

Non-GAAP Financial Measures

(Unaudited)

Adjusted EBITDA is a non-GAAP financial measure defined as our net income or (loss), adjusted to eliminate the effect of (i) interest income, interest expense, and other income (expense), net; (ii) provision for income taxes; (iii) depreciation and amortization; (iv) stock-based compensation expense; (v) Reorganization items, net; (vi) change in fair value of energy derivatives; (vii) change in the fair value of warrant and contingent value rights, (viii) business or site startup costs which are not reflective of the ongoing costs incurred after startup, (ix) bankruptcy advisory costs incurred related to reorganization which are not reflective of the ongoing costs incurred in post-emergence operations, and (x) certain additional non-cash items that do not reflect the performance of our ongoing business operations. For additional information, including the reconciliation of net income (loss) to Adjusted EBITDA, please refer to the table below. We believe Adjusted EBITDA is an important measure because it allows management, investors, and our Board of Directors to evaluate and compare our operating results, including our return on capital and operating efficiencies, from period-to-period by making the adjustments described above. In addition, it provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period comparisons of our business, as it removes the effect of net interest expense, taxes, certain non-cash items, variable charges and timing differences. Moreover, we have included Adjusted EBITDA in this earnings release because it is a key measurement used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, and perform strategic and financial planning.

The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature or because the amount and timing of these items are not related to the current results of our core business operations which renders evaluation of our current performance, comparisons of performance between periods and comparisons of our current performance with our competitors less meaningful. However, you should be aware that when evaluating Adjusted EBITDA, we may incur future expenses similar to those excluded when calculating this measure. Our presentation of this measure should not be construed as an inference that its future results will be unaffected by unusual items. Further, this non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). We compensate for these limitations by relying primarily on GAAP results and using Adjusted EBITDA on a supplemental basis. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies because not all companies calculate this measure in the same fashion. You should review the reconciliation of net loss to Adjusted EBITDA below and not rely on any single financial measure to evaluate our business.

The following table reconciles the non-GAAP financial measure to the most directly comparable U.S. GAAP financial performance measure, which is net loss, for the periods presented (in thousands):

|

Three Months Ended

|

|

Nine Months Ended

|

||||||||||||

|

|

2024 |

|

|

|

20231 |

|

|

|

2024 |

|

|

|

20231 |

|

Adjusted EBITDA |

|

|

|

|

|

||||||||||

Net loss |

$ |

(455,259 |

) |

|

$ |

(41,146 |

) |

|

$ |

(1,049,464 |

) |

|

$ |

(50,794 |

) |

Adjustments: |

|

|

|

|

|

|

|

||||||||

Interest expense, net |

|

7,072 |

|

|

|

2,196 |

|

|

|

35,934 |

|

|

|

2,317 |

|

Income tax expense |

|

134 |

|

|

|

114 |

|

|

|

484 |

|

|

|

347 |

|

Depreciation and amortization |

|

28,691 |

|

|

|

24,233 |

|

|

|

87,164 |

|

|

|

64,800 |

|

Stock-based compensation expense |

|

20,288 |

|

|

|

14,861 |

|

|

|

27,722 |

|

|

|

41,414 |

|

Unrealized fair value adjustment on energy derivatives |

|

— |

|

|

|

— |

|

|

|

(2,262 |

) |

|

|

— |

|

Loss on disposal of property, plant and equipment |

|

509 |

|

|

|

340 |

|

|

|

4,061 |

|

|

|

514 |

|

HPC advisory startup costs |

|

— |

|

|

|

— |

|

|

|

4,611 |

|

|

|

— |

|

Bankruptcy advisory costs |

|

1,863 |

|

|

|

— |

|

|

|

2,160 |

|

|

|

— |

|

Loss (gain) on debt extinguishment |

|

317 |

|

|

|

(374 |

) |

|

|

487 |

|

|

|

(21,135 |

) |

Reorganization items, net |

|

— |

|

|

|

28,256 |

|

|

|

(111,439 |

) |

|

|

78,270 |

|

Change in fair value of warrant and contingent value rights |

|

408,520 |

|

|

|

— |

|

|

|

1,144,441 |

|

|

|

— |

|

Other non-operating expenses (income), net |

|

(2,003 |

) |

|

|

(1,090 |

) |

|

|

144 |

|

|

|

(3,978 |

) |

Other |

|

— |

|

|

|

368 |

|

|

|

121 |

|

|

|

1,105 |

|

Adjusted EBITDA |

$ |

10,132 |

|

|

$ |

27,758 |

|

|

$ |

144,164 |

|

|

$ |

112,860 |

|

1 Certain prior year amounts have been reclassified for consistency with the current year presentation.

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

https://www.youtube.com/@Core_Scientific