ZURICH--(BUSINESS WIRE)--Regulatory News:

UBS (NYSE:UBS) (SWX:UBSN):

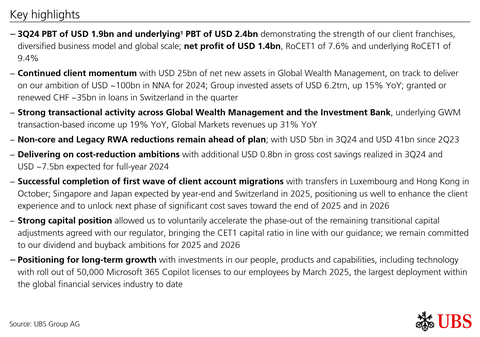

Key highlights

- 3Q24 PBT of USD 1.9bn and underlying1 PBT of USD 2.4bn demonstrating the strength of our client franchises, diversified business model and global scale; net profit of USD 1.4bn, RoCET1 of 7.6% and underlying RoCET1 of 9.4%

- Continued client momentum with USD 25bn of net new assets in Global Wealth Management, on track to deliver on our ambition of USD ~100bn in NNA for 2024; Group invested assets of USD 6.2trn, up 15% YoY; granted or renewed CHF ~35bn in loans in Switzerland in the quarter

- Strong transactional activity across Global Wealth Management and the Investment Bank, underlying GWM transaction-based income up 19% YoY, Global Markets revenues up 31% YoY

- Non-core and Legacy RWA reductions remain ahead of plan; with USD 5bn in 3Q24 and USD 41bn since 2Q23

- Delivering on cost-reduction ambitions with additional USD 0.8bn in gross cost savings realized in 3Q24 and USD ~7.5bn expected for full-year 2024

- Successful completion of first wave of client account migrations with transfers in Luxembourg and Hong Kong in October; Singapore and Japan expected by year-end and Switzerland in 2025, positioning us well to enhance the client experience and to unlock next phase of significant cost saves toward the end of 2025 and in 2026

- Strong capital position allowed us to voluntarily accelerate the phase-out of the remaining transitional capital adjustments agreed with our regulator, bringing the CET1 capital ratio in line with our guidance; we remain committed to our dividend and buyback ambitions for 2025 and 2026

- Positioning for long-term growth with investments in our people, products and capabilities, including technology with roll out of 50,000 Microsoft 365 Copilot licenses to our employees by March 2025, the largest deployment within the global financial services industry to date

“Our performance in the third quarter demonstrates the power of our unique client franchises, global scale and diversified business model. Against a market backdrop that, while constructive, still exhibited periods of high volatility and dislocation, our businesses delivered impressive revenue growth as we maintained strong client momentum, particularly in the Americas and APAC. We continue to significantly mitigate execution risk as we progress on the integration of Credit Suisse while remaining disciplined in driving our cost and efficiency targets. At the same time, we are investing in our people, products and capabilities, including technology, to enhance client experience, improve productivity and achieve sustainably profitable growth.” Sergio P. Ermotti, Group CEO

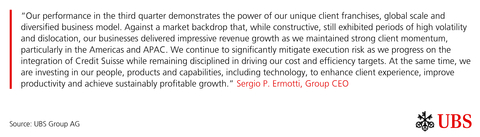

Selected financials for 3Q24

Profit before tax 1.9 USD bn |

Cost/income ratio 83.4 % |

RoCET1 capital 7.6 % |

Net profit 1.4 USD bn |

CET1 capital ratio 14.3 % |

Underlying1

2.4 USD bn |

Underlying1

78.5 % |

Underlying1

9.4 % |

Diluted

0.43 USD |

CET1

4.6 % |

Information in this news release is presented for UBS Group AG on a consolidated basis unless otherwise specified. |

||||

1 Underlying results exclude items of profit or loss that management believes are not representative of the underlying performance. Underlying results are a non-GAAP financial measure and alternative performance measure (APM). Refer to “Group Performance” and “Appendix-Alternative Performance Measures” in the financial report for the third quarter of 2024 for a reconciliation of underlying to reported results and definitions of the APMs. |

||||

Group summary

Strong financial performance

In 3Q24, we reported PBT of USD 1,929m and underlying PBT of USD 2,386m. Net profit attributable to shareholders was USD 1,425m and return on CET1 capital was 7.6%, or 9.4% on an underlying basis.

Reported revenues were USD 12,334m, up 5% YoY. On an underlying basis, revenues increased by 9% YoY to USD 11,672m, as strong transactional activity and recurring fee income driven by higher average invested assets more than offset the expected net interest income headwinds. Reported Group operating expenses decreased by 12% YoY to USD 10,283m. On an underlying basis, operating expenses decreased by 4% YoY to USD 9,165m as we continued to execute on our integration and efficiency plans.

Continued franchise strength and client momentum

During the third quarter, we remained close to our clients, guiding them through a market environment that while constructive, also showed signs of dislocation and volatility. Clients continue to value the investment opportunities we provide across our advice platform, as demonstrated by USD 25bn in net new assets in GWM. We remain on track to deliver on our ambition of USD ~100bn in NNA in 2024. We also generated USD 15bn of net new fee generating assets in the quarter, reflecting strong discretionary mandate sales in all regions with disciplined pricing. Group invested assets increased by 15% YoY to USD 6.2trn.

As a leading provider of credit to Swiss companies and the economy, we are also delivering on our commitments to our home market. In the quarter, we granted or renewed CHF ~35bn of loans in Switzerland.

Transactional activity was strong during the quarter across both private and institutional clients. In GWM, underlying transaction-based income increased by 19% YoY with strong momentum across all regions, led by the Americas and APAC. In the IB, Global Markets delivered revenues of USD 1.9bn, up 31% YoY, mainly driven by higher client activity and the strength of our expanded franchise, with gains across all regions, particularly in the Americas.

In Global Banking, underlying revenues increased 21% YoY with strong M&A performance in Asia and the US.

Ahead of plan on financial and operational integration priorities

We continue to execute on our integration plans, de-risking our balance sheet, and delivering on our cost reduction ambitions.

In 3Q24, we further reduced NCL RWA by USD 5bn, primarily through active unwinds across the loan and securitized products portfolios, bringing the total RWA reduction in NCL to USD 41bn since 2Q23. Similarly, NCL LRD decreased by 69% since 2Q23, including USD 11bn in the third quarter. Since last June, we have closed 52% of active books, around a year ahead of our original schedule.

In the quarter, we maintained our cost optimization momentum across the Group, delivering an additional USD 0.8bn in gross cost saves. By the end of 2024 we expect to achieve USD ~7.5bn of gross cost savings, or ~58% of our total cumulative gross cost save ambition.

Since June, we have also significantly advanced our work on migrating wealth management client accounts and data to UBS platforms. In October, we successfully achieved another milestone, moving all client accounts serviced out of Luxembourg and Hong Kong, a key booking hub in APAC. We are on track to complete the ongoing account transitions in Singapore and Japan by the end of this year, and will be in position to commence the next phase of transfers in Switzerland in the second quarter of 2025.

With this we are well positioned to enhance the client experience and to unlock further cost reductions toward the end of 2025 and into 2026, as we deliver on our ambition of USD ~13bn in gross cost saves by the end of 2026.

Maintaining strong capital position; expecting to operate at ~14% CET1 capital ratio; remain committed to capital returns ambitions

In the third quarter of 2024, reflecting our strong capital position, completion of legal entity mergers, overall progress on the integration and the winding down of NCL, we voluntarily accelerated the amortization of the remaining transitional purchase price allocation (PPA) adjustments for common equity tier 1 (CET1) capital purposes. This resulted in a USD 3.4bn decrease in CET1 capital and a CET1 capital ratio of 14.3%. Excluding this adjustment, the CET1 capital ratio would have been 14.9%.

In connection with the acquisition of the Credit Suisse Group in 2023, the Swiss Financial Market Supervisory Authority (FINMA) had approved neutralizing a CET1 capital effect of USD 5.0bn (net of tax) of interest-rate and own-credit-driven fair value adjustments for UBS Group AG that are expected to fully reverse into income and be accretive to CET1 capital over time. The transitional treatment was subject to linear amortization at the rate of USD 0.3bn per quarter through 30 June 2027. This quarterly amortization was eliminated upon fully amortizing the transitional treatment in the third quarter of 2024.

As these transitional adjustments only applied to UBS Group AG, the regulatory capital position of UBS AG was not impacted by the decision to fully amortize them. On a standalone basis as of 30 September 2024, UBS AG’s fully applied CET1 capital ratio is expected to be around 13.3%.

We expect that the adoption of the final Basel III standards in January 2025 will lead to a low single-digit percentage increase in the UBS Group’s RWA, reducing the CET1 capital ratio by around 30 basis points. This estimate is based on our current understanding of the relevant standards as we are in an active dialogue with FINMA regarding various aspects of the final rules. We continue to expect to operate with a CET1 capital ratio of around 14% after the implementation of the final Basel III standards.

We expect to complete our planned USD 1bn of share repurchases in the fourth quarter of 2024. Our ambition to continue share repurchases in 2025 and for our capital returns in 2026 to exceed pre-acquisition levels is unchanged. Our ambitions beyond 2025 are subject to our assessment of any proposed requirements from Switzerland’s ongoing review of its capital regime.

Investing for long-term growth in our people, products and capabilities

In addition to meeting the current needs of our clients, executing the integration, and delivering on short term plans, we remain focused on positioning UBS for long-term growth. We continue to self-fund our investments in our people, products and capabilities to further develop our client offerings across all of our businesses, including our growth regions, Americas and APAC.

This includes building on our long-standing AI expertise and industry-leading cloud position to accelerate development and adoption of GenAI solutions that benefit clients and employees.

With the rollout of 50,000 Copilot licenses between now and the end of March 2025, UBS is currently implementing the largest Microsoft 365 Copilot deployment within the global financial services industry to date. Another example is Red, a proprietary new AI assistant that will provide 20,000 employees in Switzerland, Hong Kong, and Singapore with easy access to UBS product information and investment research. In the Investment Bank, we are piloting a proprietary AI algorithm that researches and compiles potential merger and acquisition buy-side targets.

In these, and the many other AI deployments that are underway across the entire firm, we are focused on responsible AI. For example, all employees Group-wide are currently completing a ‘Responsible use of Generative AI’ training.

Outlook

In the third quarter of 2024 we saw strong client activity against a market backdrop that, while constructive, still exhibited periods of high volatility and dislocation.

Entering the fourth quarter, we see a continuation of these market conditions sustained by the prospects of a soft landing in the US economy. However, the macroeconomic outlook in the rest of the world remains clouded. In addition to seasonality, the ongoing geopolitical conflicts and the upcoming US elections are creating uncertainties that are likely to affect investor behavior.

In the fourth quarter, we anticipate a mid-single digit decline in net interest income in Global Wealth Management and a low single-digit decline in Personal & Corporate Banking. Non-core and Legacy is expected to generate a quarterly pre-tax loss in line with our earlier guidance.

The Group’s non-personnel costs are expected to show a seasonal sequential uptick. The Group’s quarterly tax rate is expected to be around 35%. Integration-related expenses are expected to be around USD 1.2bn and accretion of PPA effects to contribute around USD 0.5bn to the Group’s total revenues.

As we stay close to clients, helping them navigate this environment, and execute on our priorities, we will continue to invest to drive sustainable long-term value for our stakeholders while maintaining a balance sheet for all seasons.

Third quarter 2024 performance overview – Group

Group PBT USD 1,929m, underlying PBT USD 2,386m

PBT of USD 1,929m included PPA effects and other integration items of USD 662m and integration-related expenses and PPA effects of USD 1,119m. Underlying PBT was USD 2,386m, including net credit loss expenses of USD 121m. The cost/income ratio was 83.4%, and 78.5% on an underlying basis. Net profit attributable to shareholders was USD 1,425m, with diluted earnings per share of USD 0.43. Return on CET1 capital was 7.6%, and 9.4% on an underlying basis.

Global Wealth Management (GWM) PBT USD 1,085m, underlying PBT USD 1,280m

Total revenues increased by 4% to USD 6,199m, largely driven by higher recurring net fee and transaction-based income, partly offset by lower net interest income. Excluding PPA effects and other integration items of USD 224m, underlying total revenues were USD 5,975m, an increase of 7%. Net credit loss expenses were USD 2m, compared with net expenses of USD 10m in the third quarter of 2023. Operating expenses increased by 2% to USD 5,112m, largely due to an increase in personnel expenses, which resulted from higher financial advisor compensation reflecting an increase in compensable revenues. Excluding integration-related expenses and PPA effects of USD 419m, underlying operating expenses were USD 4,693m, an increase of 3%. The cost/income ratio was 82.5%, and 78.5% on an underlying basis. Invested assets increased by USD 221bn sequentially to USD 4,259bn. Net new assets were USD 24.7bn.

Personal & Corporate Banking (P&C) PBT CHF 728m, underlying PBT CHF 659m

Total revenues decreased by 8% to CHF 2,056m, largely reflecting lower net interest income. Excluding PPA effects and other integration items of CHF 239m, underlying total revenues were CHF 1,818m. Net credit loss expenses were CHF 71m, compared with net expenses of CHF 147m in the third quarter of 2023. Operating expenses increased by 1% to CHF 1,258m. Excluding integration-related expenses and PPA effects of CHF 170m, underlying operating expenses were CHF 1,088m. The cost/income ratio was 61.2%, and 59.9% on an underlying basis.

Asset Management (AM) PBT USD 151m, underlying PBT USD 237m

Total revenues increased by 13% to USD 873m, mainly reflecting a USD 72m net gain from both the closing of the remaining portion of the sale of our Brazilian real estate fund management business and the sale of our shareholding in Credit Suisse Insurance Linked Strategies Ltd. Operating expenses decreased by 2% to USD 722m. Excluding integration-related expenses of USD 86m, underlying operating expenses were USD 636m, an increase of 4% driven by higher personnel expenses, reflecting higher revenues, and higher expenses for litigation, regulatory and similar matters. The cost/income ratio was 82.7%, and 72.8% on an underlying basis. Invested assets increased by USD 96bn sequentially to USD 1,797bn. Net new money was USD 2.0bn, and USD (4.8bn) excluding money market flows and associates.

Investment Bank (IB) PBT USD 405m, underlying PBT USD 377m

Total revenues increased by 22% to USD 2,645m, due to higher Global Markets and Global Banking revenues. Excluding PPA effects of USD 185m, underlying total revenues were USD 2,461m, an increase of 29%. Net credit loss expenses were USD 9m, compared with net expenses of USD 4m in the third quarter of 2023. Operating expenses decreased by 7% to USD 2,231m, largely due to a decrease in integration-related expenses. Excluding integration-related expenses of USD 156m, underlying operating expenses were USD 2,076m, an increase of 2%. The cost/income ratio was 84.4% on both a reported and an underlying basis. Return on attributed equity was 9.5%, and 8.8% on an underlying basis.

Non-core and Legacy (NCL) PBT USD (603m), underlying PBT USD (333m)

Total revenues decreased by 29% to USD 262m, mainly due to lower net interest income and trading revenues as a result of portfolio reductions, and included a USD 67m gain from the sale of our investment in an associate. Net credit loss expenses were USD 28m, compared with net expenses of USD 59m in the third quarter of 2023. Operating expenses decreased by 60% to USD 837m, mainly due to decreases in integration-related expenses, professional fees, outsourcing expenses and personnel expenses, and included releases of USD 84m of IFRS 3 acquisition-related contingent liabilities following settlements reached in the third quarter of 2024. Excluding integration-related expenses of USD 270m, underlying operating expenses were USD 567m, a decrease of 51%.

Group Items PBT USD 45m, underlying PBT USD 60m

UBS’s sustainability highlights

We are guided by our ambition to be a global leader in sustainability. We remain committed to supporting our clients in the transition to a low-carbon world, leading by example in our own operations, and sharing our lessons learned along the way.

In September, MSCI reaffirmed our AA ESG rating and we increased our S&P Global Corporate Sustainability Assessment score. These are our first fully consolidated ESG ratings post the acquisition of Credit Suisse.

To build on our strong foundation, we are evolving our sustainability strategy, based on three pillars:

− Protect: manage our business aligned to our sustainable, long-term strategy;

− Grow: continue to expand our sustainability and impact offering for our clients to meet their evolving needs; and

− Attract: be the bank of choice for clients and employees.

We will communicate further details on our approach in our 2024 Sustainability Report, which will be published on 17 March 2025.

Selected financial information of the business divisions and Group Items |

|||||||

|

For the quarter ended 30.9.24 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

6,199 |

2,394 |

873 |

2,645 |

262 |

(39) |

12,334 |

of which: PPA effects and other integration items1 |

224 |

278 |

|

185 |

|

(25) |

662 |

Total revenues (underlying) |

5,975 |

2,116 |

873 |

2,461 |

262 |

(14) |

11,672 |

Credit loss expense / (release) |

2 |

83 |

0 |

9 |

28 |

0 |

121 |

Operating expenses as reported |

5,112 |

1,465 |

722 |

2,231 |

837 |

(84) |

10,283 |

of which: integration-related expenses and PPA effects2 |

419 |

198 |

86 |

156 |

270 |

(11) |

1,119 |

Operating expenses (underlying) |

4,693 |

1,267 |

636 |

2,076 |

567 |

(74) |

9,165 |

Operating profit / (loss) before tax as reported |

1,085 |

846 |

151 |

405 |

(603) |

45 |

1,929 |

Operating profit / (loss) before tax (underlying) |

1,280 |

766 |

237 |

377 |

(333) |

60 |

2,386 |

|

|||||||

|

For the quarter ended 30.6.24 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

6,053 |

2,272 |

768 |

2,803 |

401 |

(392) |

11,904 |

of which: PPA effects and other integration items1 |

233 |

246 |

|

310 |

|

(8) |

780 |

Total revenues (underlying) |

5,820 |

2,026 |

768 |

2,493 |

401 |

(384) |

11,124 |

Credit loss expense / (release) |

(1) |

103 |

0 |

(6) |

(1) |

0 |

95 |

Operating expenses as reported |

5,183 |

1,396 |

638 |

2,332 |

807 |

(15) |

10,340 |

of which: integration-related expenses and PPA effects2 |

523 |

182 |

98 |

245 |

325 |

(2) |

1,372 |

Operating expenses (underlying) |

4,660 |

1,213 |

540 |

2,087 |

481 |

(13) |

8,969 |

Operating profit / (loss) before tax as reported |

871 |

773 |

130 |

477 |

(405) |

(377) |

1,469 |

Operating profit / (loss) before tax (underlying) |

1,161 |

710 |

228 |

412 |

(80) |

(371) |

2,060 |

|

|||||||

|

For the quarter ended 30.9.233 |

||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Total |

Total revenues as reported |

5,953 |

2,517 |

775 |

2,162 |

366 |

(78) |

11,695 |

of which: PPA effects and other integration items1 |

388 |

333 |

|

251 |

|

(14) |

958 |

Total revenues (underlying) |

5,565 |

2,184 |

775 |

1,911 |

366 |

(64) |

10,737 |

Credit loss expense / (release) |

10 |

160 |

0 |

4 |

59 |

5 |

239 |

Operating expenses as reported |

5,017 |

1,400 |

738 |

2,412 |

2,068 |

6 |

11,640 |

of which: integration-related expenses and PPA effects2 |

448 |

174 |

126 |

368 |

920 |

(5) |

2,031 |

of which: acquisition-related costs |

|

|

|

|

|

26 |

26 |

Operating expenses (underlying) |

4,569 |

1,226 |

612 |

2,043 |

1,149 |

(15) |

9,583 |

Operating profit / (loss) before tax as reported |

926 |

957 |

37 |

(254) |

(1,762) |

(89) |

(184) |

Operating profit / (loss) before tax (underlying) |

986 |

798 |

163 |

(136) |

(842) |

(55) |

914 |

1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

|

|||||||

Selected financial information of the business divisions and Group Items (continued) |

||||||||

|

Year-to-date 30.9.24 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

|

Total |

Total revenues as reported |

18,395 |

7,089 |

2,416 |

8,199 |

1,664 |

(786) |

|

36,976 |

of which: PPA effects and other integration items1 |

691 |

780 |

|

787 |

|

(37) |

|

2,221 |

Total revenues (underlying) |

17,705 |

6,308 |

2,416 |

7,412 |

1,664 |

(749) |

|

34,755 |

Credit loss expense / (release) |

(2) |

229 |

0 |

34 |

63 |

(2) |

|

322 |

Operating expenses as reported |

15,340 |

4,265 |

2,025 |

6,728 |

2,655 |

(132) |

|

30,880 |

of which: integration-related expenses and PPA effects2 |

1,347 |

540 |

255 |

543 |

837 |

(12) |

|

3,511 |

Operating expenses (underlying) |

13,993 |

3,725 |

1,770 |

6,185 |

1,817 |

(120) |

|

27,370 |

Operating profit / (loss) before tax as reported |

3,057 |

2,594 |

392 |

1,437 |

(1,054) |

(652) |

|

5,773 |

Operating profit / (loss) before tax (underlying) |

3,713 |

2,354 |

647 |

1,193 |

(216) |

(627) |

|

7,063 |

|

||||||||

|

Year-to-date 30.9.233,4 |

|||||||

USD m |

Global Wealth Management |

Personal & Corporate Banking |

Asset Management |

Investment Bank |

Non-core and Legacy |

Group Items |

Negative goodwill |

Total |

Total revenues as reported |

16,002 |

5,604 |

1,861 |

6,562 |

551 |

(602) |

|

29,979 |

of which: PPA effects and other integration items1 |

574 |

477 |

|

306 |

|

(20) |

|

1,336 |

Total revenues (underlying) |

15,428 |

5,128 |

1,861 |

6,257 |

551 |

(582) |

|

28,643 |

Negative goodwill |

|

|

|

|

|

|

27,264 |

27,264 |

Credit loss expense / (release) |

174 |

398 |

1 |

142 |

178 |

7 |

|

901 |

Operating expenses as reported |

12,663 |

2,996 |

1,649 |

6,302 |

3,304 |

422 |

|

27,336 |

of which: integration-related expenses and PPA effects2 |

516 |

211 |

140 |

529 |

1,024 |

342 |

|

2,763 |

of which: acquisition-related costs |

|

|

|

|

|

202 |

|

202 |

Operating expenses (underlying) |

12,147 |

2,785 |

1,509 |

5,773 |

2,279 |

(122) |

|

24,371 |

Operating profit / (loss) before tax as reported |

3,165 |

2,210 |

211 |

118 |

(2,930) |

(1,031) |

27,264 |

29,006 |

Operating profit / (loss) before tax (underlying) |

3,107 |

1,945 |

351 |

341 |

(1,906) |

(467) |

|

3,371 |

1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 4 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

|

||||||||

Our key figures |

|

|

|

|

|

|

|

|

|

|

As of or for the quarter ended |

|

As of or year-to-date |

||||

USD m, except where indicated |

|

30.9.24 |

30.6.24 |

31.12.231 |

30.9.231 |

|

30.9.24 |

30.9.231 |

Group results |

|

|

|

|

|

|

|

|

Total revenues |

|

12,334 |

11,904 |

10,855 |

11,695 |

|

36,976 |

29,979 |

Negative goodwill |

|

|

|

|

|

|

|

27,264 |

Credit loss expense / (release) |

|

121 |

95 |

136 |

239 |

|

322 |

901 |

Operating expenses |

|

10,283 |

10,340 |

11,470 |

11,640 |

|

30,880 |

27,336 |

Operating profit / (loss) before tax |

|

1,929 |

1,469 |

(751) |

(184) |

|

5,773 |

29,006 |

Net profit / (loss) attributable to shareholders |

|

1,425 |

1,136 |

(279) |

(715) |

|

4,315 |

27,645 |

Diluted earnings per share (USD)2 |

|

0.43 |

0.34 |

(0.09) |

(0.22) |

|

1.29 |

8.46 |

Profitability and growth3,4 |

|

|

|

|

|

|

|

|

Return on equity (%) |

|

6.7 |

5.4 |

(1.3) |

(3.4) |

|

6.8 |

52.1 |

Return on tangible equity (%) |

|

7.3 |

5.9 |

(1.4) |

(3.7) |

|

7.4 |

57.7 |

Underlying return on tangible equity (%)5 |

|

9.0 |

8.4 |

4.8 |

1.5 |

|

9.1 |

3.8 |

Return on common equity tier 1 capital (%) |

|

7.6 |

5.9 |

(1.4) |

(3.7) |

|

7.5 |

60.0 |

Underlying return on common equity tier 1 capital (%)5 |

|

9.4 |

8.4 |

4.8 |

1.5 |

|

9.2 |

4.0 |

Return on leverage ratio denominator, gross (%) |

|

3.1 |

3.0 |

2.6 |

2.8 |

|

3.1 |

3.0 |

Cost / income ratio (%)6 |

|

83.4 |

86.9 |

105.7 |

99.5 |

|

83.5 |

91.2 |

Underlying cost / income ratio (%)5,6 |

|

78.5 |

80.6 |

93.0 |

89.3 |

|

78.8 |

85.1 |

Effective tax rate (%) |

|

26.0 |

20.0 |

n.m.7 |

n.m.7 |

|

24.4 |

4.6 |

Net profit growth (%) |

|

n.m. |

(95.8) |

n.m. |

n.m. |

|

(84.4) |

362.5 |

Resources3 |

|

|

|

|

|

|

|

|

Total assets |

|

1,623,941 |

1,560,976 |

1,716,924 |

1,643,684 |

|

1,623,941 |

1,643,684 |

Equity attributable to shareholders |

|

87,025 |

83,683 |

85,624 |

83,265 |

|

87,025 |

83,265 |

Common equity tier 1 capital8 |

|

74,213 |

76,104 |

78,002 |

76,926 |

|

74,213 |

76,926 |

Risk-weighted assets8 |

|

519,363 |

511,376 |

546,505 |

546,491 |

|

519,363 |

546,491 |

Common equity tier 1 capital ratio (%)8 |

|

14.3 |

14.9 |

14.3 |

14.1 |

|

14.3 |

14.1 |

Going concern capital ratio (%)8 |

|

17.5 |

18.0 |

16.8 |

16.4 |

|

17.5 |

16.4 |

Total loss-absorbing capacity ratio (%)8 |

|

37.5 |

38.7 |

36.4 |

35.4 |

|

37.5 |

35.4 |

Leverage ratio denominator8 |

|

1,608,341 |

1,564,201 |

1,695,403 |

1,615,817 |

|

1,608,341 |

1,615,817 |

Common equity tier 1 leverage ratio (%)8 |

|

4.6 |

4.9 |

4.6 |

4.8 |

|

4.6 |

4.8 |

Liquidity coverage ratio (%)9 |

|

199.2 |

212.0 |

215.7 |

196.5 |

|

199.2 |

196.5 |

Net stable funding ratio (%) |

|

126.9 |

128.0 |

124.7 |

120.7 |

|

126.9 |

120.7 |

Other |

|

|

|

|

|

|

|

|

Invested assets (USD bn)4,10 |

|

6,199 |

5,873 |

5,714 |

5,373 |

|

6,199 |

5,373 |

Personnel (full-time equivalents) |

|

109,396 |

109,991 |

112,842 |

115,981 |

|

109,396 |

115,981 |

Market capitalization2,11 |

|

106,528 |

101,903 |

107,355 |

85,768 |

|

106,528 |

85,768 |

Total book value per share (USD)2 |

|

27.32 |

26.13 |

26.68 |

25.75 |

|

27.32 |

25.75 |

Tangible book value per share (USD)2 |

|

25.10 |

23.85 |

24.34 |

23.44 |

|

25.10 |

23.44 |

1 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 2 Refer to the “Share information and earnings per share” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 3 Refer to the “Targets, capital guidance and ambitions” section of the UBS Group Annual Report 2023, available under “Annual reporting” at ubs.com/investors, for more information about our performance targets. 4 Refer to “Alternative performance measures” in the appendix to the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for the definition and calculation method. 5 Refer to the “Group performance” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information about underlying results. 6 Negative goodwill is not used in the calculation as it is presented in a separate reporting line and is not part of total revenues. 7 The effective tax rate for the fourth and third quarters of 2023 is not a meaningful measure, due to the distortive effect of current unbenefited tax losses at the former Credit Suisse entities. 8 Based on the Swiss systemically relevant bank framework as of 1 January 2020. Refer to the “Capital management” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 9 The disclosed ratios represent quarterly averages for the quarters presented and are calculated based on an average of 65 data points in the third quarter of 2024, 61 data points in the second quarter of 2024, 63 data points in the fourth quarter of 2023 and 63 data points in the third quarter of 2023. Refer to the “Liquidity and funding management” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 10 Consists of invested assets for Global Wealth Management, Asset Management (including invested assets from associates) and Personal & Corporate Banking. Refer to “Note 32 Invested assets and net new money” in the “Consolidated financial statements” section of the UBS Group Annual Report 2023, available under “Annual reporting” at ubs.com/investors, for more information. 11 The calculation of market capitalization reflects total shares issued multiplied by the share price at the end of the period.

|

||||||||

Income statement |

|

|

|

|

|

|

|

|

|

|

|

|

For the quarter ended |

|

% change from |

|

Year-to-date |

||||

USD m |

|

30.9.24 |

30.6.24 |

30.9.231 |

|

2Q24 |

3Q23 |

|

30.9.24 |

30.9.231 |

Net interest income |

|

1,794 |

1,535 |

2,107 |

|

17 |

(15) |

|

5,270 |

5,202 |

Other net income from financial instruments measured at fair value through profit or loss |

|

3,681 |

3,684 |

3,226 |

|

0 |

14 |

|

11,547 |

8,425 |

Net fee and commission income |

|

6,517 |

6,531 |

6,056 |

|

0 |

8 |

|

19,540 |

15,790 |

Other income |

|

341 |

154 |

305 |

|

122 |

12 |

|

619 |

563 |

Total revenues |

|

12,334 |

11,904 |

11,695 |

|

4 |

5 |

|

36,976 |

29,979 |

Negative goodwill |

|

|

|

|

|

|

|

|

|

27,264 |

Credit loss expense / (release) |

|

121 |

95 |

239 |

|

28 |

(49) |

|

322 |

901 |

|

|

|

|

|

|

|

|

|

|

|

Personnel expenses |

|

6,889 |

7,119 |

7,567 |

|

(3) |

(9) |

|

20,957 |

17,838 |

General and administrative expenses |

|

2,389 |

2,318 |

3,124 |

|

3 |

(24) |

|

7,120 |

7,157 |

Depreciation, amortization and impairment of non-financial assets |

|

1,006 |

903 |

950 |

|

11 |

6 |

|

2,804 |

2,341 |

Operating expenses |

|

10,283 |

10,340 |

11,640 |

|

(1) |

(12) |

|

30,880 |

27,336 |

Operating profit / (loss) before tax |

|

1,929 |

1,469 |

(184) |

|

31 |

|

|

5,773 |

29,006 |

Tax expense / (benefit) |

|

502 |

293 |

526 |

|

71 |

(5) |

|

1,407 |

1,346 |

Net profit / (loss) |

|

1,428 |

1,175 |

(711) |

|

21 |

|

|

4,366 |

27,660 |

Net profit / (loss) attributable to non-controlling interests |

|

3 |

40 |

4 |

|

(92) |

(22) |

|

51 |

15 |

Net profit / (loss) attributable to shareholders |

|

1,425 |

1,136 |

(715) |

|

25 |

|

|

4,315 |

27,645 |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income |

|

3,910 |

1,614 |

(2,622) |

|

142 |

|

|

5,279 |

25,679 |

Total comprehensive income attributable to non-controlling interests |

|

27 |

18 |

(8) |

|

47 |

|

|

40 |

4 |

Total comprehensive income attributable to shareholders |

|

3,883 |

1,596 |

(2,614) |

|

143 |

|

|

5,239 |

25,675 |

1 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group third quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. |

||||||||||

Information about results materials and the earnings call

UBS’s third quarter 2024 report, news release and slide presentation are available from 06:45 CET on Wednesday, 30 October 2024, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its third quarter 2024 results on Wednesday, 30 October 2024. The results will be presented by Sergio P. Ermotti (Group Chief Executive Officer), Todd Tuckner (Group Chief Financial Officer) and Sarah Mackey (Head of Investor Relations).

Time

09:00 CET

08:00 GMT

04:00 US EDT

Audio webcast

The presentation for analysts can be followed live on ubs.com/quarterlyreporting with a simultaneous slide show.

Webcast playback

An audio playback of the results presentation will be made available at ubs.com/investors later in the day.

Cautionary statement regarding forward-looking statements

This news release contains statements that constitute “forward-looking statements”, including but not limited to management’s outlook for UBS’s financial performance, statements relating to the anticipated effect of transactions and strategic initiatives on UBS’s business and future development and goals or intentions to achieve climate, sustainability and other social objectives. While these forward-looking statements represent UBS’s judgments, expectations and objectives concerning the matters described, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from UBS’s expectations. In particular, the global economy may be negatively affected by shifting political circumstances, including as a result of elections, increased tension between world powers, growing conflicts in the Middle East, as well as the continuing Russia–Ukraine war. In addition, the ongoing conflicts may continue to cause significant population displacement, and lead to shortages of vital commodities, including energy shortages and food insecurity outside the areas immediately involved in armed conflict. Governmental responses to the armed conflicts, including, with respect to the Russia–Ukraine war, coordinated successive sets of sanctions on Russia and Belarus, and Russian and Belarusian entities and nationals, and the uncertainty as to whether the ongoing conflicts will further widen and intensify, may continue to have significant adverse effects on the market and macroeconomic conditions, including in ways that cannot be anticipated. UBS’s acquisition of the Credit Suisse Group has materially changed its outlook and strategic direction and introduced new operational challenges. The integration of the Credit Suisse entities into the UBS structure is expected to take between three and five years and presents significant risks, including the risks that UBS Group AG may be unable to achieve the cost reductions and other benefits contemplated by the transaction. This creates significantly greater uncertainty about forward-looking statements. Other factors that may affect UBS’s performance and ability to achieve its plans, outlook and other objectives also include, but are not limited to: (i) the degree to which UBS is successful in the execution of its strategic plans, including its cost reduction and efficiency initiatives and its ability to manage its levels of risk-weighted assets (RWA) and leverage ratio denominator (LRD), liquidity coverage ratio and other financial resources, including changes in RWA assets and liabilities arising from higher market volatility and the size of the combined Group; (ii) the degree to which UBS is successful in implementing changes to its businesses to meet changing market, regulatory and other conditions, including as a result of the acquisition of the Credit Suisse Group; (iii) increased inflation and interest rate volatility in major markets; (iv) developments in the macroeconomic climate and in the markets in which UBS operates or to which it is exposed, including movements in securities prices or liquidity, credit spreads, currency exchange rates, deterioration or slow recovery in residential and commercial real estate markets, the effects of economic conditions, including elevated inflationary pressures, market developments, increasing geopolitical tensions, and changes to national trade policies on the financial position or creditworthiness of UBS’s clients and counterparties, as well as on client sentiment and levels of activity; (v) changes in the availability of capital and funding, including any adverse changes in UBS’s credit spreads and credit ratings of UBS, Credit Suisse, sovereign issuers, structured credit products or credit-related exposures, as well as availability and cost of funding to meet requirements for debt eligible for total loss-absorbing capacity (TLAC), in particular in light of the acquisition of the Credit Suisse Group; (vi) changes in central bank policies or the implementation of financial legislation and regulation in Switzerland, the US, the UK, the EU and other financial centers that have imposed, or resulted in, or may do so in the future, more stringent or entity-specific capital, TLAC, leverage ratio, net stable funding ratio, liquidity and funding requirements, heightened operational resilience requirements, incremental tax requirements, additional levies, limitations on permitted activities, constraints on remuneration, constraints on transfers of capital and liquidity and sharing of operational costs across the Group or other measures, and the effect these will or would have on UBS’s business activities; (vii) UBS’s ability to successfully implement resolvability and related regulatory requirements and the potential need to make further changes to the legal structure or booking model of UBS in response to legal and regulatory requirements and any additional requirements due to its acquisition of the Credit Suisse Group, or other developments; (viii) UBS’s ability to maintain and improve its systems and controls for complying with sanctions in a timely manner and for the detection and prevention of money laundering to meet evolving regulatory requirements and expectations, in particular in current geopolitical turmoil; (ix) the uncertainty arising from domestic stresses in certain major economies; (x) changes in UBS’s competitive position, including whether differences in regulatory capital and other requirements among the major financial centers adversely affect UBS’s ability to compete in certain lines of business; (xi) changes in the standards of conduct applicable to its businesses that may result from new regulations or new enforcement of existing standards, including measures to impose new and enhanced duties when interacting with customers and in the execution and handling of customer transactions; (xii) the liability to which UBS may be exposed, or possible constraints or sanctions that regulatory authorities might impose on UBS, due to litigation, contractual claims and regulatory investigations, including the potential for disqualification from certain businesses, potentially large fines or monetary penalties, or the loss of licenses or privileges as a result of regulatory or other governmental sanctions, as well as the effect that litigation, regulatory and similar matters have on the operational risk component of its RWA, including as a result of its acquisition of the Credit Suisse Group, as well as the amount of capital available for return to shareholders; (xiii) the effects on UBS’s business, in particular cross-border banking, of sanctions, tax or regulatory developments and of possible changes in UBS’s policies and practices; (xiv) UBS’s ability to retain and attract the employees necessary to generate revenues and to manage, support and control its businesses, which may be affected by competitive factors; (xv) changes in accounting or tax standards or policies, and determinations or interpretations affecting the recognition of gain or loss, the valuation of goodwill, the recognition of deferred tax assets and other matters; (xvi) UBS’s ability to implement new technologies and business methods, including digital services and technologies, and ability to successfully compete with both existing and new financial service providers, some of which may not be regulated to the same extent; (xvii) limitations on the effectiveness of UBS’s internal processes for risk management, risk control, measurement and modeling, and of financial models generally; (xviii) the occurrence of operational failures, such as fraud, misconduct, unauthorized trading, financial crime, cyberattacks, data leakage and systems failures, the risk of which is increased with cyberattack threats from both nation states and non-nation-state actors targeting financial institutions; (xix) restrictions on the ability of UBS Group AG and UBS AG to make payments or distributions, including due to restrictions on the ability of its subsidiaries to make loans or distributions, directly or indirectly, or, in the case of financial difficulties, due to the exercise by FINMA or the regulators of UBS’s operations in other countries of their broad statutory powers in relation to protective measures, restructuring and liquidation proceedings; (xx) the degree to which changes in regulation, capital or legal structure, financial results or other factors may affect UBS’s ability to maintain its stated capital return objective; (xxi) uncertainty over the scope of actions that may be required by UBS, governments and others for UBS to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and industry and the possibility of conflict between different governmental standards and regulatory regimes; (xxii) the ability of UBS to access capital markets; (xxiii) the ability of UBS to successfully recover from a disaster or other business continuity problem due to a hurricane, flood, earthquake, terrorist attack, war, conflict (e.g. the Russia–Ukraine war), pandemic, security breach, cyberattack, power loss, telecommunications failure or other natural or man-made event, including the ability to function remotely during long-term disruptions such as the COVID-19 (coronavirus) pandemic; (xxiv) the level of success in the absorption of Credit Suisse, in the integration of the two groups and their businesses, and in the execution of the planned strategy regarding cost reduction and divestment of any non-core assets, the existing assets and liabilities of Credit Suisse, the level of resulting impairments and write-downs, the effect of the consummation of the integration on the operational results, share price and credit rating of UBS – delays, difficulties, or failure in closing the transaction may cause market disruption and challenges for UBS to maintain business, contractual and operational relationships; and (xxv) the effect that these or other factors or unanticipated events, including media reports and speculations, may have on its reputation and the additional consequences that this may have on its business and performance. The sequence in which the factors above are presented is not indicative of their likelihood of occurrence or the potential magnitude of their consequences. UBS’s business and financial performance could be affected by other factors identified in its past and future filings and reports, including those filed with the US Securities and Exchange Commission (the SEC). More detailed information about those factors is set forth in documents furnished by UBS and filings made by UBS with the SEC, including the UBS Group AG and UBS AG Annual Reports on Form 20- F for the year ended 31 December 2023. UBS is not under any obligation to (and expressly disclaims any obligation to) update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.

Rounding

Numbers presented throughout this news release may not add up precisely to the totals provided in the tables and text. Percentages and percent changes disclosed in text and tables are calculated on the basis of unrounded figures. Absolute changes between reporting periods disclosed in the text, which can be derived from numbers presented in related tables, are calculated on a rounded basis.

Tables

Within tables, blank fields generally indicate non-applicability or that presentation of any content would not be meaningful, or that information is not available as of the relevant date or for the relevant period. Zero values generally indicate that the respective figure is zero on an actual or rounded basis. Values that are zero on a rounded basis can be either negative or positive on an actual basis.

Websites

In this news release, any website addresses are provided solely for information and are not intended to be active links. UBS is not incorporating the contents of any such websites into this news release.