NEW YORK--(BUSINESS WIRE)--With the recent easing monetary policy driving home purchases and refinancings, Figure Technology Solutions, Inc. (“Figure”), a technology platform powering a more efficient and liquid marketplace for financial products, today announced the nationwide launch of its Piggyback HELOC platform to address a growing swath of first-time and existing homeowners.

The Piggyback HELOC is available via Figure’s growing partner network that includes lenders, home builders, banks, credit unions and other financing institutions. The product builds on the popularity of Figure’s original HELOC, which made the Company the nation’s largest non-bank provider of home equity lines of credit. To date, Figure has enabled more than 150,000 households to unlock over $12 billion in equity from their homes.

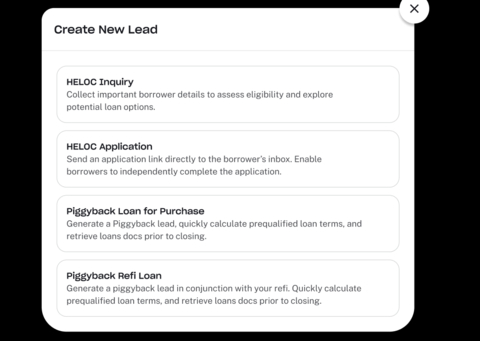

The Piggyback HELOC was designed with two powerful use cases:

For homebuyers, the piggyback provides streamlined access to lower down payments while avoiding the cost of mortgage insurance or high jumbo loan rates.

For homeowners, the piggyback offers a timely opportunity for cash-out refinances, especially for borrowers with less home equity or recently-originated mortgages. Borrowers facing the Agency 80% max CLTV cap for cash-out refinances can benefit from the added flexibility of a second-lien HELOC, while those who bought homes with more than 80% LTV and are still paying mortgage insurance can transition to a lower-cost alternative.

“Offering a piggyback is in direct response to partner feedback,” said Michael Tannenbaum, Chief Executive Officer of Figure. “We’ve become known for a 5-day digital HELOC that boasts low costs and high customer satisfaction, and our growing number of lending partners made it clear they want to embed our new piggyback to better meet their customers’ needs.”

Tannenbaum continued, “Our piggyback product is a perfect example of how Figure is an innovative platform that’s creating technology-driven opportunities by challenging the status quo.”

“With Figure’s piggyback rates and quick approval, fixed-rate HELOC, we have more options to better serve our clients' full financial needs amidst current market conditions,” said Bill Cosgrove, CEO of Union Home Mortgage. “We are building a great partnership between UHM and Figure, ensuring speed and ease to help more Americans achieve their dream of homeownership.”

Figure’s Piggyback HELOC launch follows the Company’s HELOC expansion into New York and Delaware earlier this month, bringing its availability to 49 states and Washington DC.

About Figure Technology Solutions

Founded in 2018, Figure Technology Solutions (“Figure”) is a disruptive and scaled technology platform built to enhance efficiency and transparency in financial services. Its subsidiary, Figure Lending LLC, is the largest non-bank provider of home equity lines of credit; its software has been used to originate more than $12B of home equity lines of credit. Figure’s technology is embedded across a broad network of loan originators and capital markets buyers, and is used directly as well by homeowners in 49 states and Washington, DC. With Figure, homeowners can receive approval for a HELOC in as fast as five minutes and receive funding in as few as five days.

To date, Figure has embedded its HELOC in more than 135 partners; in addition to Union Home Mortgage and The Loan Store, partners include CMG Financial, CrossCountry Mortgage, Fairway Independent Mortgage, Guaranteed Rate, Movement Mortgage, Synergy One, and many others.

If you’re interested in joining our partnership ecosystem, please visit https://www.figure.com/partner-heloc/ or email partners@figure.com.