CHICAGO--(BUSINESS WIRE)--Driving growth is the top-cited strategic priority for public company board directors in the year ahead, according to the 2024 BDO Board Survey. With monetary policy (33%) and inflation (31%) noted as directors’ top issues in the 2024 presidential election, increased investing in emerging technologies and artificial intelligence (AI) appears to emerge as a strategy to offset financial pressures and drive top line growth.

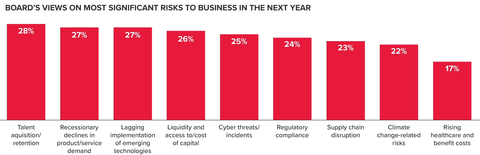

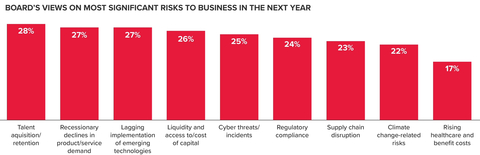

The survey of nearly 250 directors finds that innovation represents both a significant organizational opportunity and risk, and boards are taking action to address both: Seventeen percent of directors indicate that advancing the use of emerging technology is a top strategic priority, while lagging implementation of emerging technology (27%) is a top-cited risk. At the same time, a majority of directors (51%) will increase investment in emerging technology and 41% will increase investment in cybersecurity, data privacy, and governance over the next year. One quarter say cyberthreats and incidents are a significant risk to their business.

"Directors have both the opportunity and responsibility to guide management’s execution of strategy to deliver on sustainable growth metrics while minimizing risk to the organization," said Amy Rojik, National Managing Principal, Corporate Governance, of BDO USA. "For most, the path to achieving these objectives will include investment in emerging technologies to optimize operations and competitive status but not without careful consideration of implementation impacts on the organization."

Talent and Financial Risk in Focus as Oversight Responsibilities Expand

When asked about the governance process boards expect to spend the most time on in 2025, 31% of directors say enterprise risk management (ERM), closely followed by 30% who say innovating the corporate strategy. Regarding ERM, boards cite a wide range of significant concerns for the year ahead, including talent acquisition (28%), recessionary declines in demand (27%), and liquidity or access to capital concerns (26%). Financial health remains top of mind across boardrooms as directors seek to fund numerous mission-critical priorities and secure the right talent to drive growth in a still uncertain economic climate.

As significant business risks and opportunities continue to evolve, a highly functioning and intentionally structured board is critical. Directors report spending an annual average of 285 hours on their most challenging board, with roughly 30% of that time in board and committee meetings, 30% reviewing materials and researching issues, and 40% engaging with others outside of the boardroom.

Generative AI Risk & Reward

Generative AI is also a governance focus, with directors pursuing valuable use cases and mitigating a wide range of risks. Roughly one third of directors (31%) selected customer experience (16%) or product/service development (15%) as the greatest opportunity for generative AI, indicating boards see value in building top-line growth and customer loyalty. When it comes to risk, boards are highly concerned about improper, inaccurate, or biased use of the data, models, and outputs, including violations of data privacy laws. Fear of job loss and damage to employee morale and company loyalty (15%) is also a top cited risk. Boards and management teams can help offset risk by establishing sound governance practices while allaying fears by communicating strategies for upskilling and identifying where AI can create opportunities for career growth.

Working to Solidify a Culture of Compliance

A challenging economic environment heightens the risk of fraud and organizations’ ever-increasing reliance on digital technologies can act as an accelerant. Setting a strong tone at the top for fraud compliance is the responsibility of all directors and management teams.

When asked to describe all of the activities their board engaged in as part of its oversight of the prevention and detection of fraud, the top three most cited include regularly reviewing and discussing compliance materials in board meetings (43%), monitoring and investigating whistleblower reporting mechanisms (41%), and discussing company-specific factors that may increase the likelihood that fraud may occur (40%).

To access the complete results and data in the 2024 BDO Board Survey, download the full report here.

About the 2024 BDO Board Survey

In its tenth year, the 2024 BDO Board Survey examined the opinions of nearly 250 corporate directors of public company boards in July and August 2024. Respondents sit on public boards across a variety of industries including but not limited to technology, retail, nonprofit, manufacturing, financial services, energy, healthcare, life sciences, real estate, education, and hospitality.

About BDO USA

Our purpose is helping people thrive, every day. Together, we are focused on delivering exceptional and sustainable outcomes and value for our people, our clients and our communities. BDO is proud to be an ESOP company, reflecting a culture that puts people first. BDO professionals provide assurance, tax and advisory services for a diverse range of clients across the U.S. and in over 160 countries through our global organization.

BDO is the brand name for the BDO network and for each of the BDO Member Firms. BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. For more information, please visit: www.bdo.com.