LOS ALTOS, Calif.--(BUSINESS WIRE)--Daffy.org, the modern platform for charitable giving, announces the launch of its groundbreaking Private Stock Donation Program, a first-of-its-kind workplace initiative aimed at unlocking billions in private stock for charity. This program will allow employees at companies like Figma to turn their private stock into a force for good, making it easier than ever to donate shares to charitable causes.

Over the past 20 years, the number of public U.S. companies has declined by more than 50%1, while the number of private, pre-market companies has surged, with over 700 unicorns in the U.S. alone, valued at more than $2.2 trillion.2 Companies are staying private for longer—according to a recent study, the median age for an IPO increased by over 65% from 2000 to 2023.3

With the rise of private companies, more employees are receiving private stock as part of their compensation, yet many find it difficult to meet their financial obligations while the stock cannot be sold. In response, companies are increasingly conducting tender offers and secondary opportunities to help provide liquidity. In fact, in Q4 2023 and Q1 2024, six of the top 10 most highly valued startups in the world have disclosed participation in, tender offerings including ByteDance, SpaceX, OpenAI, Stripe, Databricks, and Canva.4 Daffy’s Private Stock Donation Program offers a unique benefit, allowing employees to donate their shares either ad-hoc or after these liquidity events, transforming private stock into impactful charitable contributions and tax savings.

“As more private companies conduct tender offers to provide liquidity to their teams, every company should offer a private stock donation program,” said Adam Nash, Co-founder and CEO of Daffy. “This not only improves employees’ financial outcomes, but also unlocks billions for charity—meeting the demands of today’s cause-driven workforce.”

Historically, donating private company stock has been limited to a small number of wealthy and connected people–founders, board members, and venture capitalists–due to high minimum thresholds and complex processes. Daffy’s turn-key solution simplifies this, making it accessible to a much broader range of employees. Many people donate appreciated stock to help fund their charitable giving and reap the tax benefits, but this opportunity hasn't been broadly available to employees of private companies.

"Giving Figmates more ways to support causes they care about makes an impact that extends beyond our company and community,” said Praveer Melwani, CFO of Figma. “Daffy’s new private stock donation program gives Figmates a simple and high-impact way to contribute to the charities and causes that matter most to them.”

Employee Benefits of the Program

With Daffy’s Private Stock Donation Program, employees can:

- Maximize charitable impact: Donating private stock allows individuals to contribute the full fair market value of the stock to charity, increasing the total amount given without having to first convert it to cash.

- Receive a significant tax deduction: Individuals can qualify for an immediate income tax deduction at the current fair market value of shares held for more than one year.

- Avoid capital gains taxes: By donating appreciated private stock, individuals can avoid capital gains taxes on the appreciation.

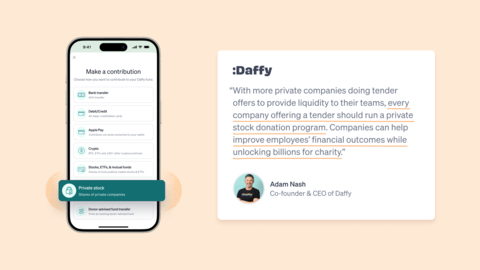

- Access a modern donor-advised fund: With a native iOS app and responsive web experience, Daffy makes it easy for employees to contribute additional assets to their account, grow those funds tax-free, and give any time they're inspired.

The Daffy Private Stock Donation Program is an extension of Daffy for Work, enabling employers to provide employees with access to a donor-advised fund (DAF), a tax-advantaged account for charitable giving. Through Daffy for Work, companies can also match donations or gift-specific amounts directly into employee DAFs, offering an easy and impactful way to support charitable causes.

Daffy for Work was recognized as one of Fast Company’s 2024 World Changing Ideas and is used by innovative companies like Acorns, Grindr, OpenAI, Titan, and XYZ.

How The Program Works

Daffy’s Private Stock Donation Program makes the process simple for companies and employees alike:

- Establish terms and timing with the company.

- Obtain board approval.

- Solicit interest from employees.

- Execute stock transfers to Daffy.

- Allow employees to donate from the proceeds after stock sales are completed.

To learn more about unlocking private stock for charity and supporting employees through the Daffy Private Stock Donation Program, visit daffy.org/private-stock-donation-program. For details on Daffy for Work, go to daffy.org/work.

About Daffy

Daffy, named one of Fast Company’s “Most Innovative Companies of 2024,” is the Donor-Advised Fund for You™—a modern, easy-to-use platform for charitable giving. With no minimum to get started and industry-low fees, anyone can contribute using cash, stock, or over 200 types of crypto. Daffy makes it easy to set aside money, watch it grow tax-free, and donate to over 1.7 million charities. It’s like a 401(k) for giving. With fundraising capabilities, features for families to give together, and a real-time feed of members’ philanthropic activity, Daffy taps into the inherently social nature of giving, helping people discover, inspire, and support the causes they care about most. Since launching in September 2021, the Daffy community has grown to thousands with members’ account sizes ranging from $10 to over $10M. To give with Daffy, visit daffy.org or search “Daffy” in the App Store.

1CRSP (Center for Research in Security Prices). (2024, Q2). IPO Report Q2 2024. University of Chicago. https://www.crsp.org/wp-content/uploads/CRSP-IPO-Report-Q2-2024.pdf. |

|

2 CB Insights. (2024, September 30). Global Unicorn Club: Private Companies Valued at $1B+. https://www.cbinsights.com/research-unicorn-companies. |

|

3Ritter, Jay. (2024, May 10). Initial Public Offerings: Updated Statistics. Warrington College of Business, University of Florida. https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf. |

|

4American Bar Association. (2024, April 26). Generating Liquidity from Illiquid Assets: A Guide to Private Company Tender Offers. https://www.americanbar.org/groups/business_law/resources/newsletters/2024-spring-pevc/generating-liquidity-from-illiquid-assets-a-guide/. |