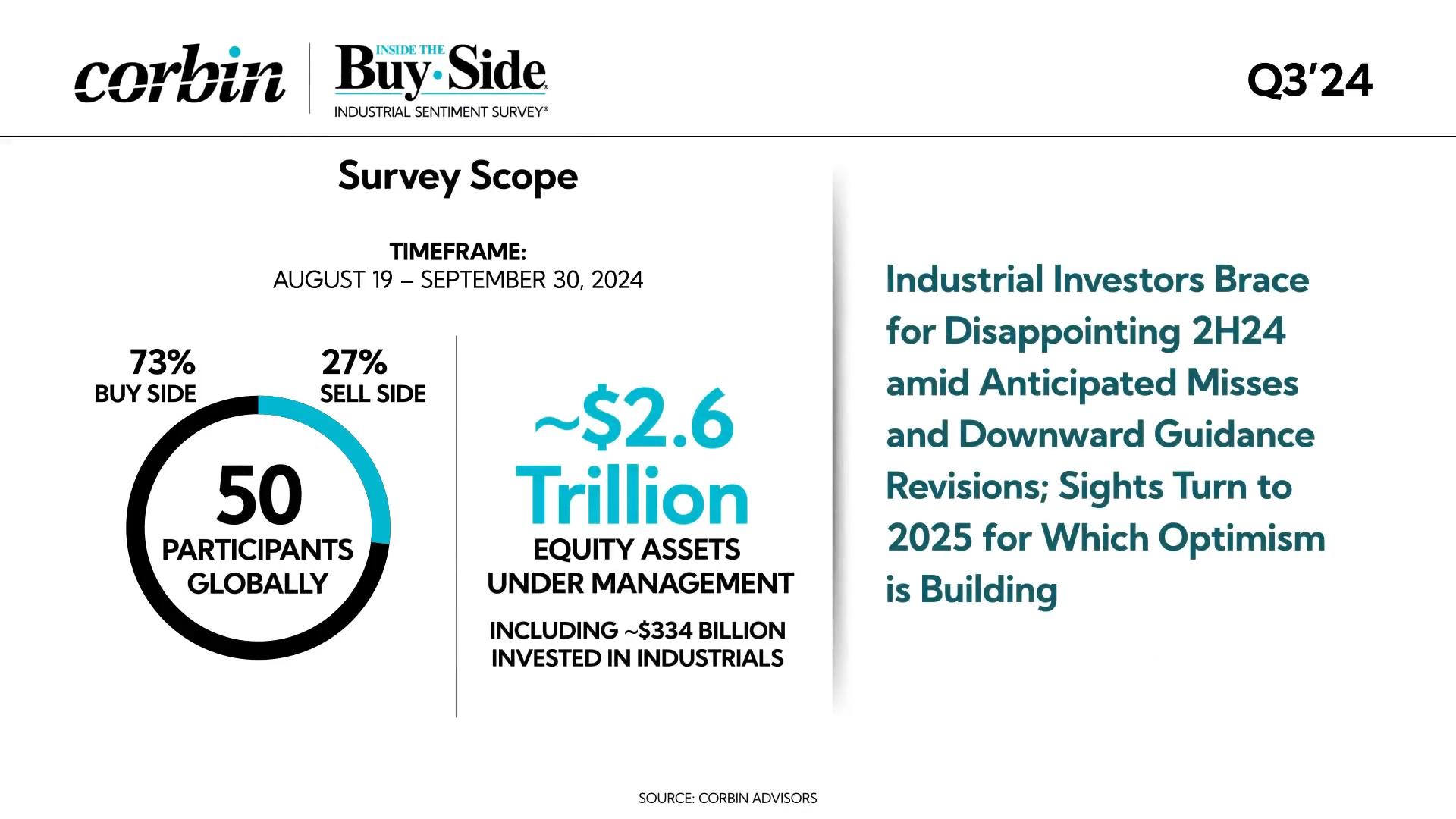

HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a strategic consultancy accelerating value realization globally, today released its quarterly Industrial Sentiment Survey®. The survey, part of Corbin Advisors’ Inside The Buy-Side® flagship research publication, was conducted from August 19 to September 30, 2024, and is based on responses from 50 institutional investors and sell-side analysts globally who actively cover the Industrial Sector. Participating buy-side firms manage ~$2.6 trillion in assets with ~$334 billion invested in Industrials collectively.

Following last quarter’s survey, which found a pullback in sentiment toward a more neutral stance, the Voice of Investor® captured in this survey reveals diverging views, but with a notable increase in bears, as more investors brace for misses and lower top- and bottom-line guides. To that end, 40% characterize their sentiment as Bullish or Neutral to Bullish, up from 31% last quarter, citing government stimulus, reshoring in the U.S., and the potential for short-cycle recovery in demand. At the same time, those expressing downbeat views increased to 30% from 22%, the highest level of bearishness captured since June 2023, driven by skepticism of stimulus benefits and the belief it will not be enough to offset a weak economy and political uncertainty.

“With Industrial earnings on the horizon, our survey this quarter identifies growing unease toward second half results, continuing a meaningful downshift in sentiment revealed last quarter. Investor bearishness hit its highest level since December 2022, and executive tone is also characterized as the most downbeat in nearly two years, with expectations for broad-based earnings misses and downward guidance revisions,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. “As a result, margins and balance sheet strength remain en vogue as industrial weakness persists, albeit at lower perceived levels. Notably, optimism is building for 2025, as industrial investors anticipate global capex to strengthen post-U.S. election, short-cycle order rates to accelerate over the next six months, and Global PMI to also improve over the same timeframe. While AI and infrastructure see support, our channel checks indicate optimism for a recovery may be building prematurely. Topics of focus for earnings calls include demand and order rate trends, margins and pricing, disinflation, labor trends, and capital deployment.”

With regard to Q3’24, more, 44% anticipate earnings results to be Worse Than consensus, the highest level in three years, while 39% expect In Line prints. A higher number expect stronger YoY Revenue and FCF performances, while EPS sees a notable step down in confidence, and Margins are largely anticipated to remain stable QoQ. Greater than half expect companies to lower annual Revenue and EPS guides. This comes as 64% report seeing broad-based industrial weakness at this time, down meaningfully from 94% last quarter, but still above the recent low of 47% registered in Q1’24. As a result, 61% are prioritizing margins over growth at this time, up from 48% last quarter, and the highest level registered in a year, while Debt Paydown jumps to the second-preferred cash usage, rising to 50% from 32% last quarter.

Supporting positive 2025 views, 69% believe we have moved past destocking, up from 57% QoQ and a higher number, 67%, expect short-cycle order rates to accelerate over the next six months, up from 33% last quarter. Global PMI and Global Capex are also expected to materially improve post-U.S. Presidential Election.

“Certain parts of the economy have been supported by government stimulus and those things that are in the later innings of the spending impact are not going to be as much as people think. For spaces not being held up by fiscal stimulus effectively, I am more positive because we have gone through the destock and some of the economic reset. We are closer to a recovery phase rather than another shutdown,” commented a portfolio manager whose firm has over $6.0 billion invested across the Industrial sector.

Regarding sub-sector industry views, Defense, Building Products, and Distribution see the highest level of bullishness, while Water and Commercial Aero are the only sub-sector industries to see an increase in bears. Government Policy, Reshoring/Nearshoring, and Robotics/Automation are seen as the most compelling investment themes, while pure plays are preferred over conglomerates at this time, as are Mid- and Small-caps. While AI has yet to manifest as a material industrial theme, 54% report seeing some level of adoption across their coverage universe.

About Corbin Advisors

Since 2007, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-Side® and other research on real-time investor sentiment, IR best practices, and case studies at CorbinAdvisors.com.

Corbin is a leading investor research and investor communications advisory firm accelerating value realization globally. We engage deeply with our clients — companies ranging from pre-IPO to over $500 billion in market cap across all sectors globally — to increase equity market value. We deliver research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset. We have a long track record of delivering successful client outcomes, most notably through rerating and compounding equity valuations through our Voice of Investor® research and counsel.

Inside The Buy-Side®,our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit CorbinAdvisors.com.