VANCOUVER, British Columbia--(BUSINESS WIRE)--Northisle Copper and Gold Inc. (TSX-V: NCX) (“Northisle” or the “Company”) is pleased to announce the release of an integrated resource estimate for its 100% owned North Island Project (the “Resource Estimate”) which integrates the Hushamu, Red Dog and Northwest Expo deposits. The Resource Estimate will be used for the development of an updated preliminary economic assessment (“PEA”) on the North Island Project which is now anticipated in early Q1 2025.

Sam Lee, President & CEO of Northisle stated “We have reached yet another milestone at the North Island Project with the updated global resource which is a culmination of our focused exploration program over the past four years. The project now boasts over 3 billion pounds of copper and nearly 7 million ounces of gold in Indicated resources, making it one of the largest copper and gold porphyries in Canada not currently owned by a major. These results form the basis for the completion of the new PEA on the North Island Project and allow us to contemplate a phased project with lower initial capital intensity that can bridge to a potentially larger project and longer life of mine.”

The updated Resource Estimate contains an Indicated Resource of 906 million tonnes grading 0.16% Cu and 0.24g/t Au, 75 ppm Mo and 0.42ppm Re, for total contained metal of 6.3 billion lbs Cu Eq. (recovery adjusted), plus an additional 214 million tonnes Inferred Resource grading 0.12% Cu, 0.22g/t Au, 52ppm Mo and 0.31ppm Re for 1.3 billion lbs Cu Eq. (recovery adjusted), at an $11.50/tonne NSR cut-off.

The Resource Estimate is summarized in Table 1 below. The Resource Estimate was prepared by Sue Bird, P.Eng. of Moose Mountain Technical Services (“MMTS”) who is independent of Northisle. Metallurgical test work which is referenced in the Design Basis (as defined below) was completed under the supervision of Peter Mehrfert, P.Eng. of Ausenco Engineering Canada ULC (“Ausenco”). A technical report prepared in accordance with NI43-101 (the “Technical Report”) will be filed on the Company’s website and SEDAR+ within 45 days of the date of this press release.

Key assumptions reflected in the Resource Estimate are detailed below for each deposit and will be further described in the Technical Report. With the release of the Resource Estimate, the Company’s previous technical reports, including the Amended 2021 North Island Copper and Gold Project Preliminary Economic Assessment filed June 2022 are no longer current and should not be relied upon.

The $11.50/tonne NSR cut-off was selected as having reasonable prospects of eventual economic extraction as this value covers preliminary estimated Phase 2 processing and G&A costs as detailed in the Design Basis below.

Table 1: 2024 Integrated North Island Project Resource Estimate ($11.50 NSR cut-off) |

|||||||||||||

|

|

Grade |

Contained Metal |

|

NSR |

||||||||

|

Tonnes |

Cu |

Au |

Mo |

Re |

Cu Eq. |

Cu |

Au |

Mo |

Re |

Cu Eq. |

($/T) |

|

|

(000 T) |

(%) |

(g/t) |

(ppm) |

(ppm) |

% |

mm lbs |

000s oz |

mm lbs |

000 lbs |

mm lbs |

||

Indicated |

|

|

|

||||||||||

Hushamu |

777,749 |

0.16% |

0.21 |

87 |

0.49 |

0.29% |

2,663 |

5,326 |

149 |

847 |

5,034 |

23.00 |

|

Red Dog |

83,129 |

0.18% |

0.25 |

n/a |

n/a |

0.35% |

336 |

679 |

0 |

0 |

650 |

33.14 |

|

Northwest Expo |

45,044 |

0.11% |

0.64 |

n/a |

n/a |

0.65% |

108 |

933 |

0 |

0 |

646 |

54.15 |

|

Total Indicated |

905,922 |

0.16% |

0.24 |

75 |

0.42 |

0.31% |

3,107 |

6,939 |

149 |

847 |

6,330 |

25.48 |

|

|

|

|

|||||||||||

Inferred |

|

|

|

||||||||||

Hushamu |

168,459 |

0.13% |

0.16 |

66 |

0.40 |

0.23% |

472 |

860 |

24 |

147 |

852 |

17.77 |

|

Red Dog |

9,808 |

0.14% |

0.18 |

n/a |

n/a |

0.26% |

30 |

56 |

0 |

0 |

56 |

24.18 |

|

Northwest Expo |

35,611 |

0.09% |

0.53 |

n/a |

n/a |

0.53% |

69 |

609 |

0 |

0 |

412 |

44.88 |

|

Total Inferred |

213,878 |

0.12% |

0.22 |

52 |

0.31 |

0.28% |

571 |

1,525 |

24 |

147 |

1,320 |

22.58 |

|

Notes to the Resource Table:

1. Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

2. The effective date of the Resource Estimate is September 23, 2024.

3. The Mineral Resources have been confined by open pits with "reasonable prospects of eventual economic extraction" using the 125% pit case and the assumptions outlined in the Design Basis in Table 4 and the metallurgical recoveries in Table 5 below.

4. The NSR is calculated as follows:

- Hushamu chlorite-magnetite-silica altered mineralization (“CMG”): NSR($/t)=(Cu(%)*77.8%*$4.72*2204.62)+(Au(gpt)*59%*$70.35/g)+(Mo(%)*49%*$25.32*2204.62)+(Re(%)*39.3%*$530.29*2204.6)

- Hushamu non-CMG (based on silica-clay-pyrite (“SCP”) and applied to all other domains): NSR(C$/t)=(Cu(%)*75.4%*$4.70*2204.62)+(Au(gpt)*54%*$70.01/g)+(Mo(%)*45%*$25.32*2204.62)+(Re(%)*35.7%*$530.29*2204.6)

- Northwest Expo CMG: NSR($/t)=(Cu(%)*73%*$4.89*2204.62)+(Au(gpt)*91%*$76.85/g)

- Northwest Expo non-CMG: NSR($/t)=(Cu(%)*88%*$4.91*2204.62)+(Au(gpt)*91%*$77.06/g)

- Red Dog: NSR($/t)=(Cu(%)*89.7%*$4.72*2204.62)+(Au(gpt)*85%*$74.08/g)

5. Copper Equivalents are calculated as follows, which reflect the differences in recoveries, payables and metal prices between the deposits:

- Northwest Expo CMG: Cu Eq. = Cu + Au*0.888; Non-CMG: Cu Eq. = Cu + Au*0.737

- Red Dog: Cu Eq. = Cu + Au*0.675

- Hushamu CMG: Cu Eq. = Cu + Au*0.512 + Mo*0.00034 + Re*0.00567; Non-CMG: Cu Eq. = Cu + Au*0.484 + Mo*0.00032 + Re*0.00534

6. Gold Equivalent for Northwest Expo is calculated as follows: CMG: Au Eq. = Au + 1.126*Cu%; Non-CMG Au Eq. = Au + 1.358*Cu%

7. The specific gravity for each deposit and domain ranges from 2.62-2.86 depending on alteration and is assumed to be 1.5 in overburden

8. The combined Resource Estimate incorporates a strip ratio of approximately 0.7:1 waste to above cut-off mineralization

9. Amounts may not add due to rounding

These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The Qualified Person(s) are of the opinion that issues relating to all relevant technical and economic factors likely to influence the prospects of eventual economic extraction can be resolved with further work. These factors may include environmental permitting, infrastructure, sociopolitical, marketing, or other relevant factors.

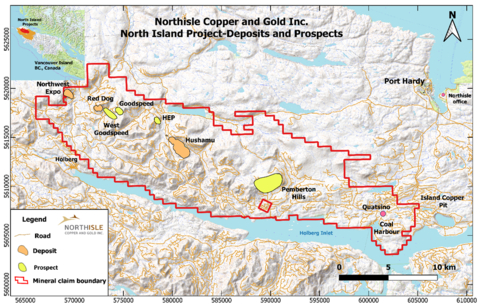

Figure 1 shows the location of the deposits within the North Island Project in the context of regional infrastructure.

2024 Catalysts

The Company continues to advance the North Island Project, with multiple development and exploration catalysts leading to measurable impacts for shareholders including the following:

- COMPLETED - Geophysics results from Northwest Expo and West Goodspeed

- COMPLETED - Northwest Expo metallurgical testing and initial resource estimate

- COMPLETED - Final 2023 Pemberton Hills Drill Results

- COMPLETED - Commencement of 2024 drilling program

- COMPLETED - Preliminary Project Trade-offs

- COMPLETED - Commencement of advanced economic and technical studies

- COMPLETED - Initial drill results from West Goodspeed

- COMPLETED - Integrated North Island Project Mineral Resource Estimate Update

- Early Q4 2024 - Additional West Goodspeed Exploration Results

- Q4 2024 – Northwest Expo Exploration Results

- Early Q1 2025 - North Island Project 2024 PEA

- Q1 2025 – Final 2024 West Goodspeed Exploration Results

- Ongoing - Continued positive engagement with indigenous rightsholders and local stakeholders

Details of Hushamu Resource Estimate

The Hushamu Resource Estimate includes a total of 162 diamond drill holes totalling 40,468 meters drilled by Northisle and previous operators through the end of 2023, of which 30 holes totalling 13,791 meters were completed under the direction of Northisle between 2011 and 2023.

Table 2 below summarizes the Hushamu Resource Estimate and shows the sensitivity of the estimate to cut-off assumptions.

Table 2: 2024 Hushamu Mineral Resource Estimate |

||||||||||||||

NSR Cutoff |

Class |

In Situ Tonnage and Grade |

Cu Metal mm lbs |

Au Metal 000s oz |

Mo Metal mm lbs |

Re Metal 000s lbs |

Cu Eq. Metal mm lbs |

Strip |

||||||

Tonnage |

Cu |

Au |

Mo |

Re |

Cu Eq. |

NSR |

||||||||

($/T) |

(000 T) |

(%) |

(gpt) |

(ppm) |

(ppm) |

(%) |

($/t) |

Ratio |

||||||

$10.00 |

Indicated Inferred |

837,870 |

0.15 |

0.21 |

87 |

0.49 |

0.28 |

$22.12 |

2,736 |

5,544 |

160 |

908 |

5,218 |

0.44 |

187,107 |

0.12 |

0.15 |

66 |

0.39 |

0.22 |

$17.09 |

502 |

912 |

27 |

161 |

910 |

|||

$11.50 |

Indicated Inferred |

777,749 |

0.16 |

0.21 |

87 |

0.49 |

0.29 |

$23.00 |

2,663 |

5,326 |

149 |

847 |

5,034 |

0.56 |

168,459 |

0.13 |

0.16 |

66 |

0.40 |

0.23 |

$17.77 |

472 |

860 |

24 |

147 |

852 |

|||

$15.00 |

Indicated Inferred |

615,819 |

0.18 |

0.23 |

88 |

0.50 |

0.33 |

$25.56 |

2,396 |

4,631 |

119 |

676 |

4,420 |

1.02 |

115,696 |

0.14 |

0.18 |

70 |

0.43 |

0.26 |

$19.78 |

361 |

664 |

18 |

109 |

650 |

|||

$20.00 |

Indicated Inferred |

403,021 |

0.21 |

0.27 |

89 |

0.50 |

0.38 |

$29.87 |

1,875 |

3,506 |

79 |

445 |

3,371 |

2.30 |

44,889 |

0.17 |

0.22 |

81 |

0.51 |

0.30 |

$23.62 |

166 |

312 |

8 |

51 |

301 |

|||

Please See Table 1 for Notes to the Resource Table

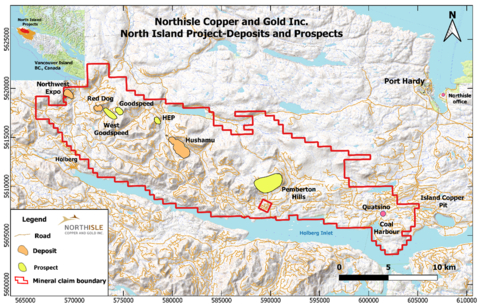

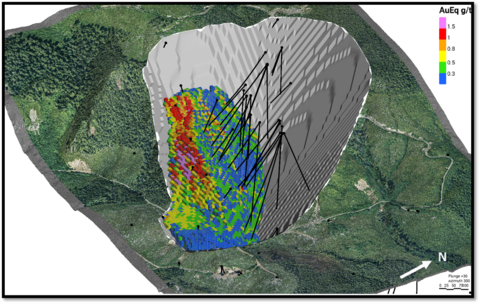

Figure 2 shows the resource pit shell and copper equivalent (“Cu Eq.”) modelled block grades for the Hushamu deposit showing the Cu Eq. grade above the $11.50 cut-off.

Details of Red Dog Resource Estimate

The Red Dog Resource Estimate includes a total of 50 diamond drill holes totalling 8,852 meters drilled by Northisle and previous operators through the end of 2023, of which 9 holes totalling 2,175 meters were completed under the direction of Northisle between 2011 and 2023.

Table 3 below summarizes the Red Dog Resource Estimate and shows the sensitivity of the estimate to cut-off assumptions.

Table 3: 2024 Red Dog Mineral Resource Estimate |

||||||||||

NSR Cutoff |

Class |

In Situ Tonnage and Grade |

Cu Metal (mm lbs) |

Au Metal (000 Ozs) |

Cu Eq. Metal (mm lbs) |

Strip |

||||

Tonnage |

Cu |

Au |

Cu Eq. |

NSR |

||||||

($/T) |

(000 T) |

(%) |

(gpt) |

(%) |

($/t) |

Ratio |

||||

$10.00 |

Indicated Inferred |

85,069 |

0.18 |

0.25 |

0.35 |

$32.63 |

339 |

684 |

655 |

0.37 |

10,204 |

0.14 |

0.18 |

0.25 |

$23.66 |

30 |

57 |

57 |

|||

$11.50 |

Indicated Inferred |

83,129 |

0.18 |

0.25 |

0.35 |

$33.14 |

336 |

679 |

650 |

0.40 |

9,808 |

0.14 |

0.18 |

0.26 |

$24.18 |

30 |

56 |

56 |

|||

$15.00 |

Indicated Inferred |

76,653 |

0.19 |

0.27 |

0.37 |

$34.81 |

326 |

657 |

629 |

0.54 |

7,954 |

0.15 |

0.20 |

0.29 |

$26.69 |

27 |

50 |

50 |

|||

$20.00 |

Indicated Inferred |

63,762 |

0.21 |

0.29 |

0.41 |

$38.30 |

299 |

600 |

576 |

0.89 |

5,233 |

0.19 |

0.23 |

0.34 |

$31.57 |

21 |

38 |

39 |

|||

Please See Table 1 for Notes to the Resource Table.

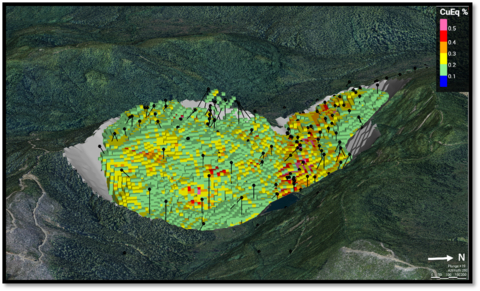

Figure 3 shows the resource pit shell and modelled block grades for the Red Dog deposit showing the Cu Eq. grade above the $11.50 cut-off.

Details of Northwest Expo Resource Estimate

The Northwest Expo Resource Estimate includes a total of 30 diamond drill holes totalling 14,337 meters drilled by Northisle and previous operators from 2005 through the end of 2023, of which 19 holes totalling 9,371 meters were completed by Northisle between 2021 and 2023. The Northwest Expo estimate has not changed in methodology other than to apply updated prices, recoveries, smelter terms and a $11.50/tonne cut-off to better reflect the potential for the contemplated integrated development of the North Island Project.

Table 4 below summarizes the Northwest Expo Resource Estimate and shows the sensitivity of the estimate to cut-off assumptions.

Table 4: 2024 Northwest Expo Mineral Resource Estimate |

||||||||||||

NSR Cutoff |

Class |

In Situ Tonnage and Grade |

Cu Metal (mm lbs) |

Au Metal (000 Ozs) |

Cu Eq. Metal (mm lbs) |

Au Eq. Metal (000 Ozs) |

Strip |

|||||

Tonnage |

Cu |

Au |

Cu Eq. |

Au Eq. |

NSR |

|||||||

($/T) |

(000 T) |

(%) |

(gpt) |

(%) |

(gpt) |

($/t) |

Ratio |

|||||

$10.00 |

Indicated Inferred |

45,463 |

0.11 |

0.64 |

0.65 |

0.77 |

$53.75 |

108 |

935 |

647 |

1,123 |

2.60 |

36,438 |

0.09 |

0.52 |

0.52 |

0.63 |

$44.10 |

70 |

612 |

414 |

738 |

|||

$11.50 |

Indicated Inferred |

45,044 |

0.11 |

0.64 |

0.65 |

0.77 |

$54.15 |

108 |

933 |

646 |

1,120 |

2.65 |

35,611 |

0.09 |

0.53 |

0.53 |

0.64 |

$44.88 |

69 |

609 |

412 |

734 |

|||

$15.00 |

Indicated Inferred |

43,771 |

0.11 |

0.66 |

0.67 |

0.79 |

$55.34 |

107 |

927 |

642 |

1,113 |

2.85 |

32,813 |

0.09 |

0.56 |

0.56 |

0.68 |

$47.57 |

68 |

596 |

404 |

717 |

|||

$20.00 |

Indicated Inferred |

41,438 |

0.12 |

0.68 |

0.69 |

0.82 |

$57.47 |

105 |

911 |

632 |

1,094 |

3.20 |

28,727 |

0.10 |

0.62 |

0.61 |

0.74 |

$51.84 |

64 |

570 |

387 |

684 |

|||

Please See Table 1 for Notes to the Resource Table.

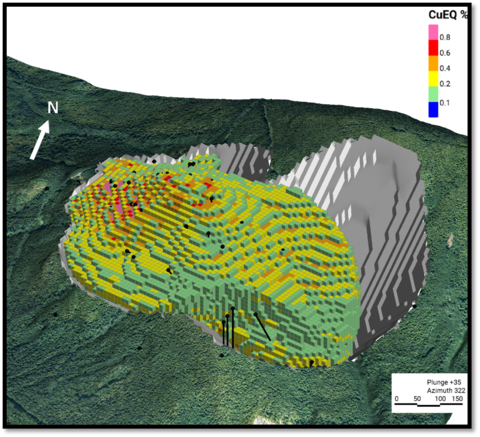

Figure 4 shows the resource shell and modelled gold equivalent (“Au Eq.”) block grades within the Northwest Expo deposit above the $11.50 cut-off.

Design Basis

The following Design Basis was established for the purpose of the Resource Estimate. The economic assumptions presented here may change during the completion of the ongoing preliminary economic assessment for the North Island Project. The Design Basis assumes the staged development of an integrated mining and processing facility. Blocks with an estimated net smelter return of more than the Phase 2 cost, and less than the Phase 1 cost, are assumed to be stockpiled for Phase 2 processing.

Table 5: Design Basis Key Assumptions |

||

|

||

Assumption |

Units |

Quantity |

Copper Price |

US$/lb |

$4.00 |

Gold Price |

US$/oz |

$1,910 |

Molybdenum Price |

US$/lb |

$21.00 |

Foreign Exchange |

C$/US$ |

1.32 |

Concentrate Moisture |

% |

9% |

Cu Concentrate Treatment Charge |

US$/DMT |

$75.00 |

Cu Payable |

% |

96.5% |

Au Payable – NW Expo & Red Dog |

% |

97.0% |

Au Payable – Hushamu |

% |

92.0% |

Cu Refining Charge |

US$/lb |

$0.075 |

Gold Refining Charge |

US$/oz |

$5.00 |

Molybdenum Payable |

% |

98.0% |

Rhenium Payable |

% |

50.0% |

Molybdenum Refining Charge |

US$/lb |

$1.30 |

Concentrate Transport Charge |

$/WMT |

$85.00 |

NSR Royalty – NW Expo and Hushamu |

% |

0% |

NSR Royalty – Red Dog |

% |

1%* |

Phase 1 Processing and G&A Cost |

$/T |

$17.50 |

Phase 2 Processing and G&A Cost |

$/T |

$11.50 |

* Assumes repurchase of 2% of the outstanding 3% NSR for $2 million.

Table 6: Metallurgical Recoveries and Concentrate Grades |

|||||

|

Northwest Expo CMG |

Northwest Expo SCP |

Red Dog |

Hushamu CMG |

Hushamu SCP |

Copper Process Recovery |

73.0% |

88.0% |

89.7% |

77.8% |

75.4% |

Gold Process Recovery* |

91.0% |

91.0% |

85.0% |

59.0% |

54.0% |

Cu Con Copper Grade |

22% |

25% |

25% |

22% |

22% |

Cu Con Gold Grade (g/t) |

106 |

125 |

21 |

17 |

13 |

Mo Process Recovery |

0% |

0% |

0% |

49% |

45% |

Mo Con Mo Grade |

0% |

0% |

0% |

50% |

50% |

* Combined flotation and leach recovery

Summary of Metallurgical Testing Procedures and Results:

During 2023 and 2024, Northisle completed a metallurgical testing program on the Hushamu and Northwest Expo deposits which informed the Design Basis and will further be incorporated into the in-progress preliminary economic assessment for the North Island Project. No additional testing was completed on the Red Dog deposit as metallurgical data obtained from test programs conducted prior to 2021 was referenced. The Company continues to optimize the flowsheet and results may be refined further during the completion of future technical studies on the North Island Project.

The recent test program was developed and managed by Ausenco and K-met Consultants Inc. who are both independent of Northisle. Base Metallurgical Laboratories Ltd. (“BaseMet”) performed the test work in Kamloops, BC and is also independent of Northisle. The qualified person confirms that the QA/QC measures applied by BaseMet conform to industry standards for metallurgical testing laboratories. These include appropriate checks and controls throughout the sample preparation, bench scale testing and test product analysis components of the test program.

The Hushamu portion of the recent test program built on the metallurgical knowledge developed in previous test programs and investigated coarser primary grind sizing as well as cyanide leaching of cleaner tails streams. The test program was conducted on master composites of SCP and CMG alteration material assembled from 9 drill holes in the 2021/2022 drill campaign. The composites were assembled to more closely represent LOM feed grades, averaging 0.19% Cu and 0.27 g/t Au.

The recent Hushamu results were analyzed along with test data from two earlier metallurgical programs (BaseMet BL0059 – 2016, ALS Metallurgy KM3409 – 2012) which tested composites with feed grades averaging 0.25 % Cu and 0.27 g/t Au. Rougher results were averaged for tests with similar feed grades, chemical conditions and primary grind size to determine expected rougher recoveries for CMG and SCP materials. Cleaner circuit recoveries were averaged from locked cycle tests on each alteration, conducted within the same test programs, and achieved final concentrate grades averaging 21% Cu.

Hushamu cleaner tails generated from locked cycle tests in the recent test program were leached using 3000 ppm sodium cyanide for 24 hours, achieving gold extractions of 48% and 44% for CMG and SCP materials, respectively. Sodium cyanide leaching of the Hushamu rougher tails was not considered due to the relatively low gold content. The Hushamu metallurgical results used for the design basis are presented in Table 7.

Table 7: Summary of Hushamu Metallurgical Results |

|||||||||||

Material |

Grind Size µm P80 |

Feed Grades |

Flotation Distribution |

CN Leach Ext. |

Net Au Leach Rec % |

MRE Recoveries |

|||||

Primary |

Regrind |

Cu (%) |

Au (gpt) |

Stream |

Cu (%) |

Au (%) |

Au (%) |

Cu (%) |

Au (%) |

||

CMG |

150 |

15 |

0.22 |

0.22 |

Concentrate |

77.8 |

44.5 |

77.8 |

59.2 |

||

Cleaner Tail |

7.2 |

27.9 |

52.5 |

14.6 |

|||||||

Rougher Tail |

15.0 |

27.6 |

|||||||||

SCP |

150 |

15 |

0.22 |

0.28 |

Concentrate |

75.4 |

31.8 |

75.4 |

54.4 |

||

Cleaner Tail |

15.1 |

49.7 |

45.4 |

22.6 |

|||||||

Rougher Tail |

9.5 |

18.5 |

|||||||||

Locked cycle flotation tests were conducted on master composites of CMG and SCP alteration material from the NW Expo deposit. Bottle roll leach tests using sodium cyanide were conducted on both the rougher tails and cleaner tails from these tests, to demonstrate the potential for additional gold recovery. This test work was previously described in Northisle’s press release titled “Northisle Announces Recoveries of 90% Gold and 80% Copper at Northwest Expo and accelerates 2024 Project Development Timeline” dated February 29, 2024.

Red Dog metallurgical performance is based on locked cycle flotation testing conducted by SGS in 2020. Bottle roll leach tests conducted by BaseMet in 2016 on rougher and cleaner tails generated from similar feed samples and flotation conditions were used as the basis for gold leaching extractions. The sample tested by BaseMet was a composite of ¼ HQ drill core samples selected from 4 drill holes in the 2016 campaign. The current design considers processing both Red Dog and Northwest Expo material with a flowsheet that utilizes froth flotation to generate a copper concentrate followed by separate rougher and cleaner tails gold leach circuits.

It is proposed that bulk copper concentrate generated from Hushamu material would be processed through a Cu-Mo separation circuit to recovery a molybdenum concentrate. No Cu-Mo separation circuit testing has been completed to demonstrate the metallurgical performance of this process, however Mo recovery of 90% across the circuit has been estimated as a reasonable industry standard for porphyry Cu-Mo deposits. Rhenium is expected to be associated with molybdenite, therefore Re recovery to the final Mo concentrate is expected to match molybdenum recovery. An additional 90% factor is applied to the final Re recovery to reflect downstream processing losses. The molybdenum feed grades of the Northwest Expo and Red Dog deposits are lower than Hushamu, so bulk copper concentrates from these deposits are not considered for Cu-Mo separation processing at this time.

A summary of recoveries estimated for all three deposits is presented in Table 8.

Table 8: Summary of Metallurgical Recoveries for the Integrated North Island Project |

||||||

Deposit |

|

Hushamu |

Northwest Expo |

Red Dog |

||

Alteration |

|

CMG |

SCP |

CMG |

SCP |

All |

Flotation Recovery to Bulk Con |

Cu % |

77.8 |

75.4 |

72.7 |

87.7 |

89.7 |

Mo % |

54.6 |

49.5 |

- |

- |

- |

|

Au % |

44.5 |

31.8 |

59.3 |

64.8 |

52.8 |

|

Au deportment to Clnr Tail |

Au % |

27.9 |

49.7 |

16.7 |

17.7 |

17.1 |

Au deportment to Ro Tail |

Au % |

27.6 |

18.5 |

24.0 |

20.3 |

30.1 |

Au Extraction Clnr Tail |

Au % |

52.5 |

45.4 |

79.0 |

60.9 |

44.5 |

Au Extraction Ro Tail |

Au % |

- |

- |

75.8 |

77.1 |

79.9 |

Cu-Mo Separation - Mo Rec |

Mo % |

90.0 |

90.0 |

- |

- |

- |

Net Process Recovery |

Cu % |

77.8 |

75.4 |

72.7 |

87.7 |

89.7 |

Mo % |

49.2 |

44.6 |

- |

- |

- |

|

Au % |

59.2 |

54.3 |

90.7 |

91.2 |

84.5 |

|

Upcoming Investor Events

The Company will continue to be active in investor outreach. Northisle will be attending several external investor events including the following events during Q4 2024 / Q1 2025:

- October 16 – 17: Red Cloud Fall Mining Summit, Toronto, ON, Canada

- November 20 – 21: Swiss Mining Institute, Zurich, Switzerland

- January 14 – 16, 2025: TD Annual Global Mining Conference, Toronto, ON, Canada

- January 19 – 20, 2025: Vancouver Resource Investment Conference, Vancouver, BC, Canada

- January 20 – 23, 2025: AME Roundup, Vancouver, BC, Canada

- February 3, 2025: Canadian Critical Minerals Opportunities Forum, New York, United States

- March 2 – 5, 2025: Prospectors & Developers Association of Canada (PDAC), Toronto, ON, Canada

Additional Technical Details

Details of Resource Estimation Methodology

At each deposit, three-dimensional solids have been created of the alteration / lithologies to aid in the orientation and extent of the mineralized domains used to confine the resource grade interpolations.

Cumulative probability plots are used to define capping values and potential outlier restrictions during interpolations.

Compositing has been done by three meter intervals honoring the domain boundary for each element. Three meters was selected because it is the length of the longest assays. Values less than 1.5m have been added to the composite above to avoid small composite lengths.

Ordinary Kriging interpolations have been used for Au, Cu, Mo and Re interpolations. Search distances and orientations for each metal are based on the variography and will be fully described in the supporting technical report.

Resource classification is based on the distance between drillholes with criteria based on the variography using the following process.

- All interpolated blocks are initially classified as Inferred.

- Blocks are upgraded to Indicated using the criteria summarized in the following table:

Table 9: Summary of Resource Classification Criteria |

|||

Deposit |

Hushamu |

NW Expo |

Red Dog |

Average Distance to 2 DHs |

250 |

65 |

150 |

Maximum distance to DH |

350 |

na |

212 |

- At Northwest Expo, blocks were then examined and those near surface were downgraded to Inferred due to lack of near-surface drilling and extrapolation in this area.

- A small number of blocks of isolated Indicated were downgraded to Inferred and of isolated Inferred upgraded to Indicated to ensure continuity of classification.

The modelled tonnage and grades have been validated by comparison with the de-clustered composite data, swath plots, grade-tonnage curves and visual validations on section and in plan.

Additional details on the methodology will be provided in the Technical Report relating to the Resource Estimate.

Qualified Persons and Data Verification

Robin Tolbert, P.Geo., Vice President Exploration of Northisle, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release.

Sue Bird, P. Eng, V.P. of MMTS, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release relating to the Resource Estimate. Ms. Bird has verified the data incorporated in the Resource Estimate by certificate checks, standards, blank and duplicate plots. Ms. Bird experienced no limitations with respect to data verification activities related to the North Island Project.

The information in this press release relating to metallurgical test work results has been reviewed and verified by Peter Mehrfert, P.Eng., (Ausenco). Mr. Mehrfert is a Qualified Person under NI 43-101. Mr. Mehrfert has verified the metallurgical recoveries incorporated in the Resource Estimate by reviewing the test data and the laboratory’s QA/QC protocols. Mr. Mehrfert experienced no limitations with respect to data verification activities related to the North Island Project.

About Northisle

Northisle Copper and Gold Inc. is a Vancouver-based company whose mission is to become Canada’s leading sustainable mineral resource company for the future. Northisle, through its 100% owned subsidiary North Island Mining Corp., owns the North Island Project, which is one of the most promising copper and gold porphyry projects in Canada. The North Island Project is located near Port Hardy, British Columbia on a more than 34,000-hectare block of mineral titles 100% owned by Northisle stretching 50 kilometers northwest from the now closed Island Copper Mine operated by BHP Billiton. Northisle completed an updated preliminary economic assessment for the North Island Project in 2021 and is now focused on advancement of the project through a prefeasibility study while continuing exploration within this highly prospective land package.

For more information on Northisle please visit the Company’s website at www.northisle.ca.

Cautionary Statements regarding Forward-Looking Information

Certain information in this news release constitutes forward-looking statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend” and similar expressions. Forward-looking statements in this news release include, but are not limited to, statements relating to the Resource Estimate, plans and expectations regarding the 2024 exploration program, plans and expectations regarding future project development, timing of key catalysts; planned activities, including further drilling, at the North Island Project; the Company’s anticipated exploration activities; and the Company’s plans for advancement of the North Island Project. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, Northisle’s ability to implement its business strategies; risks associated with mineral exploration and production; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and other risks. Readers are cautioned that the foregoing list is not exhaustive.

Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions, or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this news release represent the expectations of management of Northisle as of the date of this news release, and, accordingly, are subject to change after such date. Northisle does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.