SAN FRANCISCO--(BUSINESS WIRE)--A new study from Embroker found that 79% of tech companies report being cautious about using AI-driven tools, but despite this hesitancy, 69% report already using the technology. The study, titled “2024 Tech Risk Index: AI Enters the Chat as Many Employees (Are Forced to) Leave It,” examines the risks tech companies currently face and how they mitigate them.

Embroker, the digital insurance company radically simplifying the insurance buying experience for businesses, conducted an anonymous survey of more than 200 U.S. tech companies in May 2024 for the report. The findings reveal that tech companies understand the risks associated with implementing new technology, but are doing it anyway.

CAUTION: AI Uncertainty Ahead

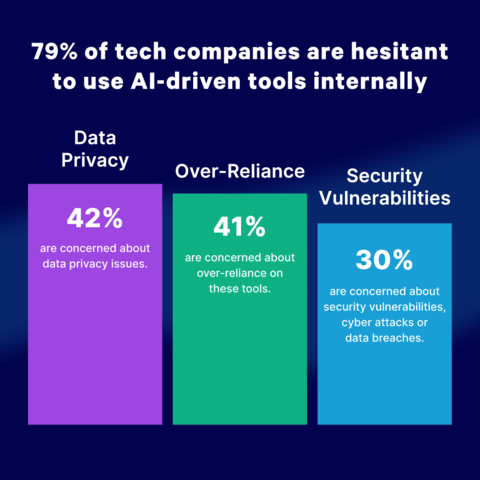

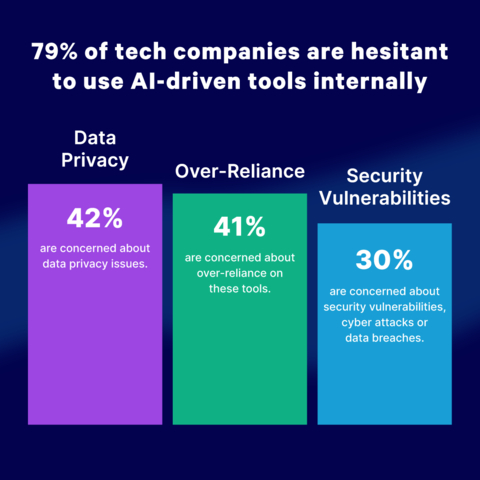

Tech companies are some of the most fervent adopters of AI, citing applications like customer service automation, analyzing data, product recommendations and writing web content. But AI integration doesn’t come without concern, as many are still worried about its potential fallout. Companies cited potential pitfalls like data privacy issues (42%), over-reliance on AI-driven tools (41%) and security vulnerabilities like cyberattacks or data breaches (30%).

“Cyber / Tech E&O insurance is not just a nice-to-have — it’s a need-to-have. Especially given the rapid growth of AI across the tech industry,” said Gene Linetsky, CTO at Embroker. “Businesses aren’t the only ones looking to use AI; cybercriminals are keen to take advantage of these tools, too. While organizations are using it to simplify processes and cut costs, cybercriminals are leveraging AI for the worse, using the technology to launch more sophisticated attacks on businesses. Tech companies need to be protected with up-to-date insurance policies, just in case.”

Tech companies express a deep need for cyber insurance policies to give them the assurance to move forward with implementing AI in business operations; 33% don’t believe or don’t know if their current insurance policies would cover them against a potential data breach, such as a ransomware attack.

Despite the looming threat of more sophisticated breaches, concern for cyber attacks has dropped significantly for tech companies. In 2023, tech companies ranked cyber attacks in their top three risks. In 2024, it didn’t even break into the top five reported concerns, and very few reported experiencing a breach, indicating that this is not a deep concern for them going forward.

Prioritizing People Amidst Major Layoffs

From the biggest tech companies to the smallest startups, the tech industry has spared no one this year, with more than 60,000 layoffs as of June 2024, reported by TechCrunch. But, companies still report that they’re prioritizing remaining staff and even looking for new talent at all levels.

When asked about internal risks in 2023 and 2024, the Embroker report found that 44% of tech companies are struggling with employee retention and 41% are struggling with hiring key executives. Looking forward, 39% of tech companies believe employees, hiring and retention to be a top business need and priority, ranked third behind infrastructure (45%) and revenue/sales growth (43%).

“The business of technology is always full of risk. But in the last 12-18 months, layoffs, inflation, emerging AI models, and the rising cost of business have compounded the challenges for founders and leaders,” said Ben Jennings, CEO at Embroker. “Leaders at tech companies are natural risk-takers, but that doesn’t mean they run into these issues with reckless abandon. The companies that take the proactive, thoughtful steps to understand and get out in front of risk will be best positioned to avoid pitfalls and take full advantage of the benefits that come from being prepared in a high-risk market.”

Stay Positive, Stay Afloat

The tech industry is grappling with significant cash-flow concerns. A majority (59%) report struggling with the rising cost of business due to inflation and climbing interest rates, despite the fact that funding was only a priority for 20% of companies this year. And financial woes aren’t going away anytime soon — concern for inflation and interest rates is up +14% YoY, the leading threats for 2024.

Worries aside, 82% of tech companies are optimistic for the future due to promising financial performances in H1 and potential market growth in the near-term. Respondents predict economic conditions to improve in the coming months, and nearly half (49%) anticipate new products pulling them through the rest of the year.

The full Tech Risk Index report is available on Embroker’s website for download here.

About Embroker

Embroker is a digital-first insurance company helping businesses manage risk with a radically simple approach. Embroker is enhancing the legacy and manually intensive technology of the commercial insurance industry with an end-to-end digital insurance platform that intelligently recommends industry-tailored coverage programs, all in minutes. Through Embroker Access, Embroker provides partner agencies and wholesalers with the capability to offer all of Embroker’s industry-leading insurance products to their customers. Founded in 2015, Embroker is headquartered in San Francisco and has raised more than $140M in funding from leading Fintech and Insurtech investors. With a Net Promoter Score (NPS) of 70+, Embroker is also the highest-rated business insurance company in the market. Visit www.embroker.com for more information.