HOUSTON--(BUSINESS WIRE)--Hewlett Packard Enterprise (NYSE: HPE) today announced financial results for the third quarter ended July 31, 2024.

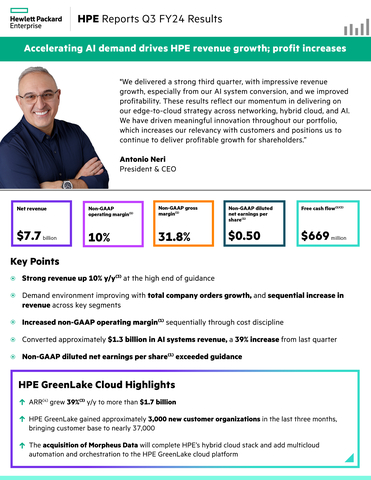

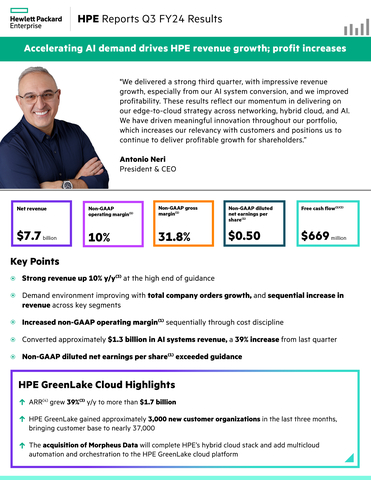

“We delivered a strong third quarter, with impressive revenue growth, especially from our AI system conversion, and we improved profitability,” said Antonio Neri, president and CEO of Hewlett Packard Enterprise. “These results reflect our momentum in delivering on our edge-to-cloud strategy across networking, hybrid cloud, and AI. We have driven meaningful innovation throughout our portfolio, which increases our relevancy with customers and positions us to continue to deliver profitable growth for shareholders.”

“In the third quarter, we executed well in a competitive macro environment to deliver strong revenue and EPS above the high end of our guidance,” said Marie Myers, executive vice president and CFO of Hewlett Packard Enterprise. “We are well positioned to capture share of the growing AI infrastructure market and expect to see the continuing benefit of our cost management efforts. We are confident in finishing the year strong and are raising EPS guidance as a result.”

Third Quarter Fiscal 2024 Financial Results

- Revenue: $7.7 billion, up 10% from the prior-year period in actual dollars and in constant currency(1)

- Annualized revenue run-rate (“ARR”)(2): $1.7 billion, up 35% from the prior-year period in actual dollars and 39% in constant currency(1)

-

Gross margins:

- GAAP of 31.6%, down 420 basis points from the prior-year period and down 140 basis points sequentially

- Non-GAAP(1) of 31.8%, down 410 basis points from the prior-year period and down 130 basis points sequentially

-

Diluted net earnings per share (“EPS”):

- GAAP of $0.38, up 9% from the prior-year period and up 58% sequentially, above our guidance range of $0.29 to $0.34

- Non-GAAP(1) of $0.50, up 2% from the prior-year period and up 19% sequentially, above our guidance range of $0.43 to $0.48

- Cash flow from operations: $1,154 million, a decrease of $371 million from the prior-year period

- Free cash flow (“FCF”)(1)(3): $669 million, a decrease of $286 million from the prior-year period

- Capital returns to shareholders: $221 million in the form of dividends and share repurchases

Third Quarter Fiscal 2024 Segment Results

- Server revenue was $4.3 billion, up 35% from the prior-year period in actual dollars and in constant currency(1), with 10.8% operating profit margin, compared to 10.1% from the prior-year period.

- Intelligent Edge revenue was $1.1 billion, down 23% from the prior-year period in actual dollars and in constant currency(1), with 22.4% operating profit margin, compared to 27.6% in the prior-year period.

- Hybrid Cloud revenue was $1.3 billion, down 7% from the prior-year period in actual dollars and in constant currency(1), with 5.1% operating profit margin, compared to 5.4% from the prior-year period.

- Financial Services revenue was $879 million, up 1% from the prior-year period in actual dollars and in constant currency(1), with 9.0% operating profit margin, compared to 8.2% from the prior-year period. Net portfolio assets of $13.2 billion, down 2.7% from the prior-year period in actual dollars and down 0.6% in constant currency(1). The business delivered return on equity of 17.4%, up 1.7 points from the prior-year period.

Dividend

The HPE Board of Directors declared a regular cash dividend of $0.13 per share on the company’s common stock, payable on October 18, 2024, to stockholders of record as of the close of business on September 19, 2024.

Fiscal 2024 Fourth Quarter Outlook

HPE estimates revenue to be in the range of $8.1 billion to $8.4 billion. HPE estimates GAAP diluted net EPS to be in the range of $0.76 to $0.81 and non-GAAP diluted net EPS(1) to be in the range of $0.52 to $0.57. Fiscal 2024 fourth quarter non-GAAP diluted net EPS excludes net after-tax gain of approximately $0.24 per diluted share primarily related to H3C income, and adjustments related to the sale of H3C, offset by acquisition, disposition and other related charges, stock-based compensation expense, amortization of intangible assets, and transformation costs.

Fiscal 2024 Outlook

HPE estimates fiscal 2024 revenue growth of 1% to 3%, in constant currency(1)(5), and fiscal 2024 GAAP operating profit growth to be in the range of 2% to 6% and non-GAAP operating profit(1)(4) growth to be flat to 2%. HPE estimates GAAP diluted net EPS to be in the range of $1.68 and $1.73 and non-GAAP diluted net EPS(1) to be in the range of $1.92 and $1.97. Fiscal 2024 non-GAAP diluted net EPS estimates exclude net after-tax adjustments of approximately $0.24 per diluted share, primarily related to stock-based compensation expense, acquisition, disposition and other related charges, amortization of intangible assets, and transformation costs, offset by H3C income, and adjustments related to the sale of H3C. HPE estimates free cash flow(1)(3)(5) of $1.9 billion.

H3C Technologies Co., Limited Update

HPE also notes that on September 4, 2024, the company received proceeds of approximately $2.1 billion from the partial sale of its equity position in H3C Technologies Co., Limited (representing 30% of all H3C shares) from Unisplendour International Technology Limited. The financial impact of this transaction will be reflected in HPE’s Q4 FY24 and full year FY24 earnings announcement later this year.

1 A description of HPE’s use of non-GAAP financial information is provided below under “Use of non-GAAP financial information and key performance metrics.”

2 Annualized Revenue Run-Rate (“ARR”) is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake edge-to-cloud platform services revenue, related financial services revenue (which includes rental income from operating leases and interest income from finance leases), and software-as-a-Service, software consumption revenue, and other as-a-Service offerings, recognized during a quarter and multiplied by four. We use ARR as a performance metric. ARR should be viewed independently of net revenue and is not intended to be combined with it.

3 Free cash flow represents cash flow from operations, less net capital expenditures (investments in property, plant & equipment (“PP&E”) and software assets less proceeds from the sale of PP&E), and adjusted for the effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash.

4 FY24 non-GAAP operating profit excludes costs of approximately $1.0 billion primarily related to stock-based compensation expense, acquisition, disposition and other related charges, amortization of intangible assets, and transformation costs, offset by H3C income, and adjustments related to the sale of H3C.

5 Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, Hewlett Packard Enterprise is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have a material impact on the Company’s reported GAAP results for the guidance period. Refer to the discussion of non-GAAP financial measures below for more information.

About Hewlett Packard Enterprise

Hewlett Packard Enterprise (NYSE: HPE) is the global edge-to-cloud company that helps organizations accelerate outcomes by unlocking value from all of their data, everywhere. Built on decades of reimagining the future and innovating to advance the way people live and work, HPE delivers unique, open and intelligent technology solutions as a service. With offerings spanning Cloud Services, Server, Intelligent Edge, Software, and Hybrid Cloud, HPE provides a consistent experience across all clouds and edges, helping customers develop new business models, engage in new ways, and increase operational performance. For more information, visit: www.hpe.com.

Use of non-GAAP financial information and key performance metrics

To supplement Hewlett Packard Enterprise’s condensed consolidated financial statement information presented on a generally accepted accounting principles (“GAAP”) basis, Hewlett Packard Enterprise provides financial measures, including revenue on a constant currency basis (including at the business segment level), non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating profit (non-GAAP earnings from operations), non-GAAP operating profit margin (non-GAAP earnings from operations as a percentage of net revenue), non-GAAP income tax rate, non-GAAP net earnings, non-GAAP diluted net earnings per share and free cash flow (“FCF”). Hewlett Packard Enterprise also provides forecasts of revenue growth on a constant currency basis, non-GAAP diluted net earnings per share, non-GAAP operating profit growth, and FCF. Reconciliations of each of these non-GAAP financial measures to their most directly comparable GAAP measures for this quarter and prior periods are included in the tables below or elsewhere in the materials accompanying this news release. In addition an explanation of the ways in which Hewlett Packard Enterprise’s management uses these non-GAAP measures to evaluate its business, the substance behind Hewlett Packard Enterprise’s decision to use these non-GAAP measures, the material limitations associated with the use of these non-GAAP measures, the manner in which Hewlett Packard Enterprise’s management compensates for those limitations, and the substantive reasons why Hewlett Packard Enterprise’s management believes that these non-GAAP measures provide supplemental useful information to investors is included further below. This additional non-GAAP financial information is not meant to be considered in isolation or as a substitute for revenue, gross profit, gross profit margin, operating profit (earnings from operations), operating profit margin (earnings from operations as a percentage of net revenue), net earnings, diluted net earnings per share, and cash flow from operations prepared in accordance with GAAP.

In addition to the supplemental non-GAAP financial information, Hewlett Packard Enterprise also presents annualized revenue run-rate (“ARR”) as performance metric. ARR is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake edge-to-cloud platform services revenue, related financial services revenue (which includes rental income for operating leases and interest income from finance leases), and software-as-a-service (“SaaS”), software consumption revenue, and other as-a-service offerings, recognized during a quarter and multiplied by four. ARR should be viewed independently of net revenue and deferred revenue and are not intended to be combined with any of these items.

Forward-looking statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks, uncertainties, and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of Hewlett Packard Enterprise Company and its consolidated subsidiaries ("Hewlett Packard Enterprise") may differ materially from those expressed or implied by such forward-looking statements and assumptions. The words "believe", "expect", "anticipate", "optimistic", "intend", "guide", "will", "estimate", "may", "could", “aim”, "should", and similar expressions are intended to identify such forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to any anticipated financial or operational benefits associated with the segment realignment that became effective as of the beginning of the first quarter of fiscal 2024; any projections, estimations, or expectations of addressable markets and their sizes, revenue (including annualized revenue run rate), margins, expenses (including stock-based compensation expenses), investments, effective tax rates, interest rates, investments, net earnings, net earnings per share, cash flows, liquidity and capital resources, inventory, order backlog, share repurchases, dividends, currency exchange rates, repayments of debts, amortization of intangible assets, or other financial items; any projections or estimations of future orders, including as-a-service orders; any statements of the plans, strategies, and objectives of management for future operations, as well as the execution and consummation of corporate transactions or contemplated acquisitions (including but not limited to our proposed acquisition of Juniper Networks, Inc.) and dispositions (including but not limited to the disposition of our H3C shares and the receipt of proceeds therefrom), research and development expenditures, and any resulting benefit, cost savings, charges, or revenue or profitability improvements; any statements concerning the expected development, performance, market share, or competitive performance relating to products or services; any statements concerning technological and market trends, the pace of technological innovation, and adoption of new technologies, including artificial intelligence-related and other products and services offered by Hewlett Packard Enterprise; any statements regarding current or future macroeconomic trends or events and the impact of those trends and events on Hewlett Packard Enterprise and our financial performance, including but not limited to supply chain, demand for our products and services, and access to liquidity, and our actions to mitigate such impacts on our business; any statements concerning the relationship between China and the U.S., and our actions in response thereto; any statements of expectation or belief, including those relating to future guidance and the financial performance of Hewlett Packard Enterprise; and any statements of assumptions underlying any of the foregoing.

Risks, uncertainties and assumptions include the need to address the many challenges facing Hewlett Packard Enterprise's businesses; the competitive pressures faced by Hewlett Packard Enterprise's businesses; risks associated with executing Hewlett Packard Enterprise's strategy; the impact of macroeconomic and geopolitical trends and events, including but not limited to supply chain constraints, the use and development of artificial intelligence, the inflationary environment, the ongoing conflicts between Russia and Ukraine and in the Middle East, and the relationship between China and the U.S.; the need to effectively manage third-party suppliers and distribute Hewlett Packard Enterprise's products and services; the protection of Hewlett Packard Enterprise's intellectual property assets, including intellectual property licensed from third parties and intellectual property shared with its former parent; risks associated with Hewlett Packard Enterprise's international operations (including public health crises, such as pandemics or epidemics, and geopolitical events, such as, but not limited to, those mentioned above); the development of and transition to new products and services and the enhancement of existing products and services to meet customer needs and respond to emerging technological trends; the execution of Hewlett Packard Enterprise’s transformation and mix shift of its portfolio of offerings; the execution and performance of contracts by Hewlett Packard Enterprise and its suppliers, customers, clients, and partners, including any impact thereon resulting from macroeconomic or geopolitical events, such as, but not limited to, those mentioned above; the prospect of a shutdown of the U.S. federal government; the hiring and retention of key employees; the execution, integration, consummation, and other risks associated with business combination, disposition, and investment transactions, including but not limited to the risks associated with the disposition of H3C shares and the receipt of proceeds therefrom and completion of our proposed acquisition of Juniper Networks, Inc. and our ability to integrate and implement our plans, forecasts, and other expectations with respect to the consolidated business; the impact of changes to privacy, cybersecurity, environmental, global trade, and other governmental regulations; changes in our product, lease, intellectual property, or real estate portfolio; the payment or non-payment of a dividend for any period; the efficacy of using non-GAAP, rather than GAAP, financial measures in business projections and planning; the judgments required in connection with determining revenue recognition; impact of company policies and related compliance; utility of segment realignments; allowances for recovery of receivables and warranty obligations; provisions for, and resolution of, pending investigations, claims, and disputes; the impacts of tax law changes and related guidance or regulations; and other risks that are described herein, including but not limited to the risks described in Hewlett Packard Enterprise’s Annual Report on Form 10-K for the fiscal year ended October 31, 2023, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and in other filings made by Hewlett Packard Enterprise from time to time with the Securities and Exchange Commission.

As in prior periods, the financial information set forth in this press release, including tax-related items, reflects estimates based on information available at this time. While Hewlett Packard Enterprise believes these estimates to be reasonable, these amounts could differ materially from reported amounts in the filings made by Hewlett Packard Enterprise from time to time with the Securities and Exchange Commission. Hewlett Packard Enterprise assumes no obligation and does not intend to update these forward-looking statements, except as required by applicable law.

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Condensed Consolidated Statements of Earnings (Unaudited) |

||||||||||||

|

|

|||||||||||

|

For the three months ended |

|||||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|||||||

|

In millions, except per share amounts |

|||||||||||

Net revenue |

$ |

7,710 |

|

|

$ |

7,204 |

|

|

$ |

7,002 |

|

|

Costs and Expenses: |

|

|

|

|

|

|||||||

Cost of sales |

|

5,271 |

|

|

|

4,828 |

|

|

|

4,492 |

|

|

Research and development |

|

547 |

|

|

|

590 |

|

|

|

578 |

|

|

Selling, general and administrative |

|

1,229 |

|

|

|

1,215 |

|

|

|

1,302 |

|

|

Amortization of intangible assets |

|

60 |

|

|

|

67 |

|

|

|

72 |

|

|

Transformation costs |

|

14 |

|

|

|

33 |

|

|

|

65 |

|

|

Disaster charges |

|

5 |

|

|

|

— |

|

|

|

1 |

|

|

Acquisition, disposition and other related charges |

|

37 |

|

|

|

46 |

|

|

|

21 |

|

|

Total costs and expenses |

|

7,163 |

|

|

|

6,779 |

|

|

|

6,531 |

|

|

Earnings from operations |

|

547 |

|

|

|

425 |

|

|

|

471 |

|

|

Interest and other, net(1) |

|

(12 |

) |

|

|

(22 |

) |

|

|

(8 |

) |

|

Earnings from equity interests |

|

73 |

|

|

|

42 |

|

|

|

73 |

|

|

Earnings before provision for taxes |

|

608 |

|

|

|

445 |

|

|

|

536 |

|

|

Provision for taxes |

|

(96 |

) |

|

|

(131 |

) |

|

|

(72 |

) |

|

Net earnings |

$ |

512 |

|

|

$ |

314 |

|

|

$ |

464 |

|

|

Net Earnings Per Share: |

|

|

|

|

|

|||||||

Basic |

$ |

0.39 |

|

|

$ |

0.24 |

|

|

$ |

0.36 |

|

|

Diluted |

$ |

0.38 |

|

|

$ |

0.24 |

|

|

$ |

0.35 |

|

|

Cash dividends declared per share |

$ |

0.13 |

|

|

$ |

0.13 |

|

|

$ |

0.12 |

|

|

Weighted-average Shares Used to Compute Net Earnings Per Share: |

|

|

|

|

|

|||||||

Basic |

|

1,312 |

|

|

|

1,311 |

|

|

|

1,299 |

|

|

Diluted |

|

1,332 |

|

|

|

1,325 |

|

|

|

1,316 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Condensed Consolidated Statements of Earnings (Unaudited) |

||||||||

|

|

|||||||

|

For the nine months ended |

|||||||

|

July 31, 2024 |

|

July 31, 2023 |

|||||

|

In millions, except per share amounts |

|||||||

Net revenue |

$ |

21,669 |

|

|

$ |

21,784 |

|

|

Costs and Expenses: |

|

|

|

|||||

Cost of sales |

|

14,397 |

|

|

|

14,104 |

|

|

Research and development |

|

1,719 |

|

|

|

1,771 |

|

|

Selling, general and administrative |

|

3,660 |

|

|

|

3,828 |

|

|

Amortization of intangible assets |

|

198 |

|

|

|

216 |

|

|

Transformation costs |

|

67 |

|

|

|

227 |

|

|

Disaster charges |

|

5 |

|

|

|

5 |

|

|

Acquisition, disposition and other related charges |

|

126 |

|

|

|

51 |

|

|

Total costs and expenses |

|

20,172 |

|

|

|

20,202 |

|

|

Earnings from operations |

|

1,497 |

|

|

|

1,582 |

|

|

Interest and other, net(1) |

|

(122 |

) |

|

|

(81 |

) |

|

Earnings from equity interests |

|

161 |

|

|

|

180 |

|

|

Earnings before provision for taxes |

|

1,536 |

|

|

|

1,681 |

|

|

Provision for taxes |

|

(323 |

) |

|

|

(298 |

) |

|

Net earnings |

$ |

1,213 |

|

|

$ |

1,383 |

|

|

Net Earnings Per Share: |

|

|

|

|||||

Basic |

$ |

0.93 |

|

|

$ |

1.06 |

|

|

Diluted |

$ |

0.92 |

|

|

$ |

1.05 |

|

|

Cash dividends declared per share |

$ |

0.39 |

|

|

$ |

0.36 |

|

|

Weighted-average Shares Used to Compute Net Earnings Per Share: |

|

|

|

|||||

Basic |

|

1,308 |

|

|

|

1,300 |

|

|

Diluted |

|

1,325 |

|

|

|

1,317 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP measures (Unaudited) |

||||||||||||

|

|

|

|

|

|

|||||||

|

For the three months ended |

|||||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|||||||

|

Dollars in millions |

|||||||||||

GAAP net revenue |

$ |

7,710 |

|

|

$ |

7,204 |

|

|

$ |

7,002 |

|

|

GAAP cost of sales |

|

5,271 |

|

|

|

4,828 |

|

|

|

4,492 |

|

|

GAAP gross profit |

|

2,439 |

|

|

|

2,376 |

|

|

|

2,510 |

|

|

Non-GAAP Adjustments |

|

|

|

|

|

|||||||

Stock-based compensation expense |

|

9 |

|

|

|

14 |

|

|

|

9 |

|

|

Disaster recovery |

|

(7 |

) |

|

|

(7 |

) |

|

|

(3 |

) |

|

Divestiture related exit costs |

|

9 |

|

|

|

— |

|

|

|

— |

|

|

Non-GAAP gross profit |

$ |

2,450 |

|

|

$ |

2,383 |

|

|

$ |

2,516 |

|

|

|

|

|

|

|

|

|||||||

GAAP gross profit margin |

|

31.6 |

% |

|

|

33.0 |

% |

|

|

35.8 |

% |

|

Non-GAAP adjustments |

|

0.2 |

% |

|

|

0.1 |

% |

|

|

0.1 |

% |

|

Non-GAAP gross profit margin |

|

31.8 |

% |

|

|

33.1 |

% |

|

|

35.9 |

% |

|

|

|

|

|

|||||

|

|

|

|

|||||

|

For the nine months ended |

|||||||

|

July 31, 2024 |

|

July 31, 2023 |

|||||

|

Dollars in millions |

|||||||

GAAP net revenue |

$ |

21,669 |

|

|

$ |

21,784 |

|

|

GAAP cost of sales |

|

14,397 |

|

|

|

14,104 |

|

|

GAAP gross profit |

$ |

7,272 |

|

|

$ |

7,680 |

|

|

Non-GAAP Adjustments |

|

|

|

|||||

Stock-based compensation expense |

|

39 |

|

|

|

38 |

|

|

Disaster recovery |

|

(39 |

) |

|

|

(3 |

) |

|

Divestiture related exit costs |

|

9 |

|

|

|

— |

|

|

Non-GAAP gross profit |

$ |

7,281 |

|

|

$ |

7,715 |

|

|

|

|

|

|

|||||

GAAP gross profit margin |

|

33.6 |

% |

|

|

35.3 |

% |

|

Non-GAAP adjustments |

|

— |

% |

|

|

0.1 |

% |

|

Non-GAAP gross profit margin |

|

33.6 |

% |

|

|

35.4 |

% |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP measures (Unaudited) |

||||||||||||

|

|

|

|

|

|

|||||||

|

For the three months ended |

|||||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|||||||

|

Dollars in millions |

|||||||||||

GAAP earnings from operations |

$ |

547 |

|

|

$ |

425 |

|

|

$ |

471 |

|

|

Non-GAAP Adjustments |

|

|

|

|

|

|||||||

Amortization of intangible assets |

|

60 |

|

|

|

67 |

|

|

|

72 |

|

|

Transformation costs |

|

14 |

|

|

|

33 |

|

|

|

65 |

|

|

Disaster recovery |

|

(2 |

) |

|

|

(7 |

) |

|

|

(2 |

) |

|

Stock-based compensation expense |

|

80 |

|

|

|

120 |

|

|

|

91 |

|

|

Divestiture related exit costs |

|

35 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition, disposition and other related charges |

|

37 |

|

|

|

46 |

|

|

|

21 |

|

|

Non-GAAP earnings from operations |

$ |

771 |

|

|

$ |

684 |

|

|

$ |

718 |

|

|

|

|

|

|

|

|

|||||||

GAAP operating profit margin |

|

7.1 |

% |

|

|

5.9 |

% |

|

|

6.7 |

% |

|

Non-GAAP adjustments |

|

2.9 |

% |

|

|

3.6 |

% |

|

|

3.6 |

% |

|

Non-GAAP operating profit margin |

|

10.0 |

% |

|

|

9.5 |

% |

|

|

10.3 |

% |

|

|

|

|

|

|||||

|

|

|

|

|||||

|

For the nine months ended |

|||||||

|

July 31, 2024 |

|

July 31, 2023 |

|||||

|

Dollars in millions |

|||||||

GAAP earnings from operations |

$ |

1,497 |

|

|

$ |

1,582 |

|

|

Non-GAAP Adjustments |

|

|

|

|||||

Amortization of intangible assets |

|

198 |

|

|

|

216 |

|

|

Transformation costs |

|

67 |

|

|

|

227 |

|

|

Disaster (recovery) charges |

|

(34 |

) |

|

|

2 |

|

|

Stock-based compensation expense |

|

341 |

|

|

|

357 |

|

|

Divestiture related exit costs |

|

35 |

|

|

|

— |

|

|

Acquisition, disposition and other related charges |

|

126 |

|

|

|

51 |

|

|

Non-GAAP earnings from operations |

$ |

2,230 |

|

|

$ |

2,435 |

|

|

|

|

|

|

|||||

GAAP operating profit margin |

|

6.9 |

% |

|

|

7.3 |

% |

|

Non-GAAP adjustments |

|

3.4 |

% |

|

|

3.9 |

% |

|

Non-GAAP operating profit margin |

|

10.3 |

% |

|

|

11.2 |

% |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP measures (Unaudited) |

||||||||||||||||||||||||

|

For the three months ended |

|||||||||||||||||||||||

|

July 31, 2024 |

|

Diluted net earnings per share |

|

April 30, 2024 |

|

Diluted net earnings per share |

|

July 31, 2023 |

|

Diluted net earnings per share |

|||||||||||||

|

Dollars in millions, except per share amounts |

|||||||||||||||||||||||

GAAP net earnings |

$ |

512 |

|

|

$ |

0.38 |

|

|

$ |

314 |

|

|

$ |

0.24 |

|

|

$ |

464 |

|

|

$ |

0.35 |

|

|

Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Amortization of intangible assets |

|

60 |

|

|

|

0.05 |

|

|

|

67 |

|

|

|

0.05 |

|

|

|

72 |

|

|

|

0.05 |

|

|

Transformation costs |

|

14 |

|

|

|

0.01 |

|

|

|

33 |

|

|

|

0.03 |

|

|

|

65 |

|

|

|

0.05 |

|

|

Disaster recovery |

|

(2 |

) |

|

|

— |

|

|

|

(7 |

) |

|

|

(0.01 |

) |

|

|

(2 |

) |

|

|

— |

|

|

Stock-based compensation expense |

|

80 |

|

|

|

0.06 |

|

|

|

120 |

|

|

|

0.09 |

|

|

|

91 |

|

|

|

0.07 |

|

|

Divestiture related exit costs |

|

35 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition, disposition and other related charges |

|

37 |

|

|

|

0.03 |

|

|

|

46 |

|

|

|

0.04 |

|

|

|

21 |

|

|

|

0.02 |

|

|

Earnings from equity interests |

|

(44 |

) |

|

|

(0.04 |

) |

|

|

(42 |

) |

|

|

(0.03 |

) |

|

|

2 |

|

|

|

— |

|

|

Gain on equity investments, net |

|

(14 |

) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjustments for taxes |

|

(21 |

) |

|

|

(0.01 |

) |

|

|

31 |

|

|

|

0.02 |

|

|

|

(32 |

) |

|

|

(0.02 |

) |

|

Other adjustments(2) |

|

4 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

(0.01 |

) |

|

|

(42 |

) |

|

|

(0.03 |

) |

|

Non-GAAP net earnings |

$ |

661 |

|

|

$ |

0.50 |

|

|

$ |

561 |

|

|

$ |

0.42 |

|

|

$ |

639 |

|

|

$ |

0.49 |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

For the nine months ended |

|||||||||||||||

|

July 31, 2024 |

|

Diluted net earnings per share |

|

July 31, 2023 |

|

Diluted net earnings per share |

|||||||||

|

Dollars in millions, except per share amounts |

|||||||||||||||

GAAP net earnings |

$ |

1,213 |

|

|

$ |

0.92 |

|

|

$ |

1,383 |

|

|

$ |

1.05 |

|

|

Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|||||||||

Amortization of intangible assets |

|

198 |

|

|

|

0.15 |

|

|

|

216 |

|

|

|

0.16 |

|

|

Transformation costs |

|

67 |

|

|

|

0.05 |

|

|

|

227 |

|

|

|

0.17 |

|

|

Disaster (recovery) charges |

|

(34 |

) |

|

|

(0.03 |

) |

|

|

2 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

341 |

|

|

|

0.26 |

|

|

|

357 |

|

|

|

0.28 |

|

|

Divestiture related exit costs |

|

35 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition, disposition and other related charges |

|

126 |

|

|

|

0.10 |

|

|

|

51 |

|

|

|

0.04 |

|

|

Earnings from equity interests |

|

(132 |

) |

|

|

(0.10 |

) |

|

|

16 |

|

|

|

0.01 |

|

|

Loss on equity investments, net |

|

47 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

|

Adjustments for taxes |

|

(6 |

) |

|

|

(0.01 |

) |

|

|

(52 |

) |

|

|

(0.04 |

) |

|

Other adjustments(2) |

|

5 |

|

|

|

— |

|

|

|

(48 |

) |

|

|

(0.04 |

) |

|

Non-GAAP net earnings |

$ |

1,860 |

|

|

$ |

1.40 |

|

|

$ |

2,152 |

|

|

$ |

1.63 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP measures (Unaudited)

|

||||||||||||

|

|

|

|

|

|

|||||||

|

For the three months ended |

|||||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|||||||

|

In millions |

|||||||||||

Net cash provided by operating activities |

$ |

1,154 |

|

|

$ |

1,093 |

|

|

$ |

1,525 |

|

|

Investment in property, plant and equipment and software assets |

|

(543 |

) |

|

|

(560 |

) |

|

|

(671 |

) |

|

Proceeds from sale of property, plant and equipment |

|

62 |

|

|

|

122 |

|

|

|

102 |

|

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

(4 |

) |

|

|

(45 |

) |

|

|

(1 |

) |

|

Free cash flow |

$ |

669 |

|

|

$ |

610 |

|

|

$ |

955 |

|

|

|

|

|

|

|||||

|

For the nine months ended |

|||||||

|

July 31, 2024 |

|

July 31, 2023 |

|||||

|

In millions |

|||||||

Net cash provided by operating activities |

$ |

2,311 |

|

|

$ |

1,585 |

|

|

Investment in property, plant and equipment and software assets |

|

(1,759 |

) |

|

|

(2,153 |

) |

|

Proceeds from sale of property, plant and equipment |

|

280 |

|

|

|

347 |

|

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

(35 |

) |

|

|

138 |

|

|

Free cash flow |

$ |

797 |

|

|

$ |

(83 |

) |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Condensed Consolidated Balance Sheets |

||||||||

|

|

|||||||

|

As of |

|||||||

|

July 31, 2024 |

|

October 31, 2023 |

|||||

|

(Unaudited) |

|

(Audited) |

|||||

|

In millions, except par value |

|||||||

ASSETS |

|

|

|

|||||

Current Assets: |

|

|

|

|||||

Cash and cash equivalents |

$ |

3,642 |

|

|

$ |

4,270 |

|

|

Accounts receivable, net of allowances |

|

3,857 |

|

|

|

3,481 |

|

|

Financing receivables, net of allowances |

|

3,705 |

|

|

|

3,543 |

|

|

Inventory |

|

7,679 |

|

|

|

4,607 |

|

|

Assets held for sale |

|

6 |

|

|

|

— |

|

|

Other current assets |

|

3,516 |

|

|

|

3,047 |

|

|

Total current assets |

|

22,405 |

|

|

|

18,948 |

|

|

Property, plant and equipment, net |

|

5,738 |

|

|

|

5,989 |

|

|

Long-term financing receivables and other assets |

|

11,926 |

|

|

|

11,377 |

|

|

Investments in equity interests |

|

2,318 |

|

|

|

2,197 |

|

|

Goodwill and intangible assets |

|

18,465 |

|

|

|

18,642 |

|

|

Total assets |

$ |

60,852 |

|

|

$ |

57,153 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|||||

Current Liabilities: |

|

|

|

|||||

Notes payable and short-term borrowings |

$ |

3,864 |

|

|

$ |

4,868 |

|

|

Accounts payable |

|

10,085 |

|

|

|

7,136 |

|

|

Employee compensation and benefits |

|

1,166 |

|

|

|

1,724 |

|

|

Taxes on earnings |

|

150 |

|

|

|

155 |

|

|

Deferred revenue |

|

3,803 |

|

|

|

3,658 |

|

|

Accrued restructuring |

|

86 |

|

|

|

180 |

|

|

Liabilities held for sale |

|

59 |

|

|

|

— |

|

|

Other accrued liabilities |

|

4,652 |

|

|

|

4,161 |

|

|

Total current liabilities |

|

23,865 |

|

|

|

21,882 |

|

|

Long-term debt |

|

7,939 |

|

|

|

7,487 |

|

|

Other non-current liabilities |

|

6,914 |

|

|

|

6,546 |

|

|

|

|

|

|

|||||

Stockholders’ Equity |

|

|

|

|||||

Common stock, $0.01 par value (9,600 shares authorized; 1,298 and 1,283 shares issued and outstanding as of July 31, 2024 and October 31, 2023, respectively) |

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

28,361 |

|

|

|

28,199 |

|

|

Accumulated deficit |

|

(3,240 |

) |

|

|

(3,946 |

) |

|

Accumulated other comprehensive loss |

|

(3,057 |

) |

|

|

(3,084 |

) |

|

Total HPE stockholders’ equity |

|

22,077 |

|

|

|

21,182 |

|

|

Non-controlling interests |

|

57 |

|

|

|

56 |

|

|

Total stockholders’ equity |

|

22,134 |

|

|

|

21,238 |

|

|

Total liabilities and stockholders’ equity |

$ |

60,852 |

|

|

$ |

57,153 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Condensed Consolidated Statements of Cash Flows (Unaudited) |

||||||||

|

For the nine months ended |

|||||||

|

July 31, 2024 |

|

July 31, 2023 |

|||||

|

In millions |

|||||||

Cash Flows from Operating Activities: |

|

|

|

|||||

Net earnings |

$ |

1,213 |

|

|

$ |

1,383 |

|

|

Adjustments to Reconcile Net Earnings to Net Cash Provided by Operating Activities: |

|

|

|

|||||

Depreciation and amortization |

|

1,924 |

|

|

|

1,961 |

|

|

Stock-based compensation expense |

|

341 |

|

|

|

357 |

|

|

Provision for inventory and credit losses |

|

125 |

|

|

|

189 |

|

|

Restructuring charges |

|

20 |

|

|

|

133 |

|

|

Deferred taxes on earnings |

|

16 |

|

|

|

(2 |

) |

|

Earnings from equity interests |

|

(161 |

) |

|

|

(180 |

) |

|

Dividends received from equity investees |

|

43 |

|

|

|

34 |

|

|

Other, net |

|

160 |

|

|

|

(7 |

) |

|

Changes in Operating Assets and Liabilities, Net of Acquisitions: |

|

|

|

|||||

Accounts receivable |

|

(383 |

) |

|

|

623 |

|

|

Financing receivables |

|

(311 |

) |

|

|

(870 |

) |

|

Inventory |

|

(3,195 |

) |

|

|

491 |

|

|

Accounts payable |

|

3,002 |

|

|

|

(3,146 |

) |

|

Taxes on earnings |

|

108 |

|

|

|

26 |

|

|

Restructuring |

|

(144 |

) |

|

|

(201 |

) |

|

Other assets and liabilities |

|

(447 |

) |

|

|

794 |

|

|

Net cash provided by operating activities |

|

2,311 |

|

|

|

1,585 |

|

|

Cash Flows from Investing Activities: |

|

|

|

|||||

Investment in property, plant and equipment and software assets |

|

(1,759 |

) |

|

|

(2,153 |

) |

|

Proceeds from sale of property, plant and equipment |

|

280 |

|

|

|

347 |

|

|

Purchases of investments |

|

(16 |

) |

|

|

(10 |

) |

|

Proceeds from maturities and sales of investments |

|

5 |

|

|

|

8 |

|

|

Financial collateral posted |

|

(728 |

) |

|

|

(1,410 |

) |

|

Financial collateral received |

|

638 |

|

|

|

793 |

|

|

Payments made in connection with business acquisitions, net of cash acquired |

|

— |

|

|

|

(761 |

) |

|

Net cash used in investing activities |

|

(1,580 |

) |

|

|

(3,186 |

) |

|

Cash Flows from Financing Activities: |

|

|

|

|||||

Short-term borrowings with original maturities less than 90 days, net |

|

(50 |

) |

|

|

(54 |

) |

|

Proceeds from debt, net of issuance costs |

|

2,156 |

|

|

|

3,886 |

|

|

Payment of debt |

|

(2,794 |

) |

|

|

(3,062 |

) |

|

Cash settlement for derivative hedging debt |

|

— |

|

|

|

(7 |

) |

|

Net payments related to stock-based award activities |

|

(69 |

) |

|

|

(100 |

) |

|

Repurchase of common stock |

|

(100 |

) |

|

|

(366 |

) |

|

Cash dividends paid to non-controlling interests, net of contributions |

|

(8 |

) |

|

|

— |

|

|

Cash dividends paid to shareholders |

|

(507 |

) |

|

|

(465 |

) |

|

Net cash used in financing activities |

|

(1,372 |

) |

|

|

(168 |

) |

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

(35 |

) |

|

|

138 |

|

|

Decrease in cash, cash equivalents and restricted cash |

|

(676 |

) |

|

|

(1,631 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

4,581 |

|

|

|

4,763 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

3,905 |

|

|

$ |

3,132 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Segment Information (Unaudited) |

||||||||||||

|

|

|

||||||||||

|

|

For the three months ended |

||||||||||

|

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

||||||

|

|

In millions |

||||||||||

Net Revenue: |

|

|

|

|

|

|

||||||

Server(3) |

|

$ |

4,280 |

|

|

$ |

3,867 |

|

|

$ |

3,168 |

|

Hybrid Cloud(3) |

|

|

1,300 |

|

|

|

1,256 |

|

|

|

1,397 |

|

Intelligent Edge(3) |

|

|

1,121 |

|

|

|

1,086 |

|

|

|

1,456 |

|

Financial Services |

|

|

879 |

|

|

|

867 |

|

|

|

873 |

|

Corporate Investments and other(3) |

|

|

262 |

|

|

|

252 |

|

|

|

246 |

|

Total segment net revenue |

|

|

7,842 |

|

|

|

7,328 |

|

|

|

7,140 |

|

Elimination of intersegment net revenue |

|

|

(132 |

) |

|

|

(124 |

) |

|

|

(138 |

) |

Total consolidated net revenue |

|

$ |

7,710 |

|

|

$ |

7,204 |

|

|

$ |

7,002 |

|

|

|

|

|

|

|

|

||||||

Earnings Before Taxes(3): |

|

|

|

|

|

|

||||||

Server |

|

$ |

464 |

|

|

$ |

426 |

|

|

$ |

319 |

|

Hybrid Cloud |

|

|

66 |

|

|

|

10 |

|

|

|

75 |

|

Intelligent Edge |

|

|

251 |

|

|

|

237 |

|

|

|

402 |

|

Financial Services |

|

|

79 |

|

|

|

81 |

|

|

|

72 |

|

Corporate Investments and other |

|

|

(4 |

) |

|

|

(9 |

) |

|

|

(20 |

) |

Total segment earnings from operations |

|

|

856 |

|

|

|

745 |

|

|

|

848 |

|

|

|

|

|

|

|

|

||||||

Unallocated corporate costs and eliminations |

|

|

(85 |

) |

|

|

(61 |

) |

|

|

(130 |

) |

Stock-based compensation expense |

|

|

(80 |

) |

|

|

(120 |

) |

|

|

(91 |

) |

Amortization of intangible assets |

|

|

(60 |

) |

|

|

(67 |

) |

|

|

(72 |

) |

Transformation costs |

|

|

(14 |

) |

|

|

(33 |

) |

|

|

(65 |

) |

Disaster recovery |

|

|

2 |

|

|

|

7 |

|

|

|

2 |

|

Divestiture related exit costs |

|

|

(35 |

) |

|

|

— |

|

|

|

— |

|

Acquisition, disposition and other related charges |

|

|

(37 |

) |

|

|

(46 |

) |

|

|

(21 |

) |

Interest and other, net(1) |

|

|

(12 |

) |

|

|

(22 |

) |

|

|

(8 |

) |

Earnings from equity interests |

|

|

73 |

|

|

|

42 |

|

|

|

73 |

|

Total pretax earnings |

|

$ |

608 |

|

|

$ |

445 |

|

|

$ |

536 |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Segment Information (Unaudited) |

||||||||

|

|

|

||||||

|

|

For the nine months ended |

||||||

|

|

July 31, 2024 |

|

July 31, 2023 |

||||

|

|

In millions |

||||||

Net Revenue: |

|

|

|

|

||||

Server(3) |

|

$ |

11,499 |

|

|

$ |

10,787 |

|

Hybrid Cloud(3) |

|

|

3,804 |

|

|

|

4,152 |

|

Intelligent Edge(3) |

|

|

3,408 |

|

|

|

3,969 |

|

Financial Services |

|

|

2,619 |

|

|

|

2,604 |

|

Corporate Investments and other(3) |

|

|

752 |

|

|

|

722 |

|

Total segment net revenue |

|

|

22,082 |

|

|

|

22,234 |

|

Elimination of intersegment net revenue |

|

|

(413 |

) |

|

|

(450 |

) |

Total consolidated net revenue |

|

$ |

21,669 |

|

|

$ |

21,784 |

|

|

|

|

|

|

||||

Earnings Before Taxes(3): |

|

|

|

|

||||

Server |

|

$ |

1,273 |

|

|

$ |

1,470 |

|

Hybrid Cloud |

|

|

123 |

|

|

|

181 |

|

Intelligent Edge |

|

|

841 |

|

|

|

961 |

|

Financial Services |

|

|

234 |

|

|

|

211 |

|

Corporate Investments and other |

|

|

(23 |

) |

|

|

(61 |

) |

Total segment earnings from operations |

|

|

2,448 |

|

|

|

2,762 |

|

|

|

|

|

|

||||

Unallocated corporate costs and eliminations |

|

|

(218 |

) |

|

|

(327 |

) |

Stock-based compensation expense |

|

|

(341 |

) |

|

|

(357 |

) |

Amortization of intangible assets |

|

|

(198 |

) |

|

|

(216 |

) |

Transformation costs |

|

|

(67 |

) |

|

|

(227 |

) |

Disaster recovery (charges) |

|

|

34 |

|

|

|

(2 |

) |

Divestiture related exit costs |

|

|

(35 |

) |

|

|

— |

|

Acquisition, disposition and other related charges |

|

|

(126 |

) |

|

|

(51 |

) |

Interest and other, net(1) |

|

|

(122 |

) |

|

|

(81 |

) |

Earnings from equity interests |

|

|

161 |

|

|

|

180 |

|

Total consolidated earnings before taxes |

|

$ |

1,536 |

|

|

$ |

1,681 |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Segment Information (Unaudited) |

||||||||||||||||

|

|

|

|

|||||||||||||

|

For the three months ended |

|

Change (%) |

|||||||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|

Q/Q |

|

Y/Y |

|||||||

|

Dollars in millions |

|||||||||||||||

Net Revenue: |

|

|

|

|

|

|

|

|

|

|||||||

Server(3) |

$ |

4,280 |

|

|

$ |

3,867 |

|

|

$ |

3,168 |

|

|

11% |

|

35% |

|

Hybrid Cloud(3) |

|

1,300 |

|

|

|

1,256 |

|

|

|

1,397 |

|

|

4 |

|

(7) |

|

Intelligent Edge(3) |

|

1,121 |

|

|

|

1,086 |

|

|

|

1,456 |

|

|

3 |

|

(23) |

|

Financial Services |

|

879 |

|

|

|

867 |

|

|

|

873 |

|

|

1 |

|

1 |

|

Corporate Investments and other(3) |

|

262 |

|

|

|

252 |

|

|

|

246 |

|

|

4 |

|

7 |

|

Total segment net revenue |

|

7,842 |

|

|

|

7,328 |

|

|

|

7,140 |

|

|

7 |

|

10 |

|

Elimination of intersegment net revenue |

|

(132 |

) |

|

|

(124 |

) |

|

|

(138 |

) |

|

7 |

|

(4) |

|

Total consolidated net revenue |

$ |

7,710 |

|

|

$ |

7,204 |

|

|

$ |

7,002 |

|

|

7% |

|

10% |

|

|

|

|

|

|

|

|||||

|

For the nine months ended |

|||||||||

|

July 31, 2024 |

|

July 31, 2023 |

|

Y/Y |

|||||

|

Dollars in millions |

|||||||||

Net Revenue: |

|

|

|

|

|

|||||

Server(3) |

$ |

11,499 |

|

|

$ |

10,787 |

|

|

7% |

|

Hybrid Cloud(3) |

|

3,804 |

|

|

|

4,152 |

|

|

(8) |

|

Intelligent Edge(3) |

|

3,408 |

|

|

|

3,969 |

|

|

(14) |

|

Financial Services |

|

2,619 |

|

|

|

2,604 |

|

|

1 |

|

Corporate Investments and other(3) |

|

752 |

|

|

|

722 |

|

|

4 |

|

Total segment net revenue |

|

22,082 |

|

|

|

22,234 |

|

|

(1) |

|

Elimination of intersegment net revenue |

|

(413 |

) |

|

|

(450 |

) |

|

(8) |

|

Total consolidated net revenue |

$ |

21,669 |

|

|

$ |

21,784 |

|

|

(1%) |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Segment Operating Margin Summary Data (Unaudited) |

||||||||||

|

|

|

|

|

|

|

|

|||

|

For the three months ended |

|

Change in operating profit margin (pts) |

|||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

|

Q/Q |

|

Y/Y |

|

Segment Operating Profit Margin(3): |

|

|

|

|

|

|

|

|

|

|

Server |

10.8 % |

|

11.0 % |

|

10.1 % |

|

(0.2) |

|

0.7 |

|

Hybrid Cloud |

5.1 % |

|

0.8 % |

|

5.4 % |

|

4.3 |

|

(0.3) |

|

Intelligent Edge |

22.4 % |

|

21.8 % |

|

27.6 % |

|

0.6 |

|

(5.2) |

|

Financial Services |

9.0 % |

|

9.3 % |

|

8.2 % |

|

(0.3) |

|

0.8 |

|

Corporate Investments and other |

(1.5 %) |

|

(3.6 %) |

|

(8.1 %) |

|

2.1 |

|

6.6 |

|

Total segment operating profit margin |

10.9 % |

|

10.2 % |

|

11.9 % |

|

0.7 |

|

(1.0) |

|

|

|

|

|

|

|

|

|

For the nine months ended |

|

Change in operating profit margin (pts) |

|||

|

July 31, 2024 |

|

July 31, 2023 |

|

Y/Y |

|

Segment Operating Profit Margin(3): |

|

|

|

|

|

|

Server |

11.1 % |

|

13.6 % |

|

(2.5) |

|

Hybrid Cloud |

3.2 % |

|

4.4 % |

|

(1.2) |

|

Intelligent Edge |

24.7 % |

|

24.2 % |

|

0.5 |

|

Financial Services |

8.9 % |

|

8.1 % |

|

0.8 |

|

Corporate Investments and other |

(3.1 %) |

|

(8.4 %) |

|

5.3 |

|

Total segment operating profit margin |

11.1 % |

|

12.4 % |

|

(1.3) |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES Calculation of Diluted Net Earnings Per Share (Unaudited) |

|||||||||

|

|

||||||||

|

For the three months ended |

||||||||

|

July 31, 2024 |

|

April 30, 2024 |

|

July 31, 2023 |

||||

|

In millions, except per share amounts |

||||||||

Numerator: |

|

|

|

|

|

||||

GAAP net earnings |

$ |

512 |

|

$ |

314 |

|

$ |

464 |

|

Non-GAAP net earnings |

$ |

661 |

|

$ |

561 |

|

$ |

639 |

|

|

|

|

|

|

|

||||

Denominator: |

|

|

|

|

|

||||

Weighted-average shares used to compute basic net earnings per share |

|

1,312 |

|

|

1,311 |

|

|

1,299 |

|

Dilutive effect of employee stock plans |

|

20 |

|

|

14 |

|

|

17 |

|

Weighted-average shares used to compute diluted net earnings per share |

|

1,332 |

|

|

1,325 |

|

|

1,316 |

|

|

|

|

|

|

|

||||

GAAP Net Earnings Per Share |

|

|

|

|

|

||||

Basic |

$ |

0.39 |

|

$ |

0.24 |

|

$ |

0.36 |

|

Diluted |

$ |

0.38 |

|

$ |

0.24 |

|

$ |

0.35 |

|

|

|

|

|

|

|

||||

Non-GAAP Net Earnings Per Share |

|

|

|

|

|

||||

Basic |

$ |

0.50 |

|

$ |

0.43 |

|

$ |

0.49 |

|

Diluted |

$ |

0.50 |

|

$ |

0.42 |

|

$ |

0.49 |

|

|

For the nine months ended |

|||||

|

July 31, 2024 |

|

July 31, 2023 |

|||

|

In millions, except per share amounts |

|||||

Numerator: |

|

|

|

|||

GAAP net earnings |

$ |

1,213 |

|

$ |

1,383 |

|

Non-GAAP net earnings |

$ |

1,860 |

|

$ |

2,152 |

|

|

|

|

|

|||

Denominator: |

|

|

|

|||

Weighted-average shares used to compute basic net earnings per share |

|

1,308 |

|

|

1,300 |

|

Dilutive effect of employee stock plans |

|

17 |

|

|

17 |

|

Weighted-average shares used to compute diluted net earnings per share |

|

1,325 |

|

|

1,317 |

|

|

|

|

|

|||

GAAP Net Earnings Per Share |

|

|

|

|||

Basic |

$ |

0.93 |

|

$ |

1.06 |

|

Diluted |

$ |

0.92 |

|

$ |

1.05 |

|

|

|

|

|

|||

Non-GAAP Net Earnings Per Share |

|

|

|

|||

Basic |

$ |

1.42 |

|

$ |

1.66 |

|

Diluted |

$ |

1.40 |

|

$ |

1.63 |

|

|

(1) |

|

Interest and other, net includes tax indemnification and other adjustments, non-service net periodic benefit cost, and interest and other, net. |

|

(2) |

|

Other adjustments includes non-service net periodic benefit cost and tax indemnification and other adjustments. |

|

(3) |

|

As previously disclosed, effective as of the beginning of the first quarter of fiscal 2024, in order to align the segment financial reporting more closely with its business structure, the Company established two new reportable segments, Hybrid Cloud and Server. Hybrid Cloud includes the historical Storage segment, HPE GreenLake Flex Solutions (which provides flexible as-a-service IT infrastructure through the HPE GreenLake edge-to-cloud platform and was previously reported under the Compute and the High Performance Computing & Artificial Intelligence ("HPC & AI") segments), Private Cloud, and Software (previously reported under the Corporate Investments and Other segment). The Server segment combines the previously separately reported Compute and HPC & AI segments, with adjustments for certain product lines that are now reported in Hybrid Cloud. Additionally, certain products and services previously reported in the financial results for the HPC & AI segment were moved to be reported in the Hybrid Cloud segment, and the Athonet business and certain components of the Communications and Media Solutions business, both previously reported in the financial results for Corporate Investments and Other, moved to be reported in the Intelligent Edge segment. |

|

|

As a result, the Company’s new organizational structure consists of the following segments: (i) Server; (ii) Hybrid Cloud; (iii) Intelligent Edge; (iv) Financial Services; and (v) Corporate Investments and Other. The Company began reporting under this re-aligned segment structure beginning with the results of the first quarter of fiscal 2024. |

||

|

|

The Company has reflected these changes to its segment information retrospectively to the earliest period presented, which primarily resulted in the realignment of net revenue and operating profit for each of the segments as described above. These changes had no impact on Hewlett Packard Enterprise’s previously reported consolidated net revenue, net earnings, net earnings per share or total assets. |

|

Use of non-GAAP financial measures

To supplement Hewlett Packard Enterprise’s condensed consolidated financial statement information presented on a GAAP basis, Hewlett Packard Enterprise provides non-GAAP financial measures including revenue on a constant currency basis (including at the business segment level), non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating profit (non-GAAP earnings from operations), non-GAAP operating profit margin (non-GAAP earnings from operations as a percentage of net revenue), non-GAAP income tax rate, non-GAAP net earnings, non-GAAP diluted net earnings per share, and FCF. Hewlett Packard Enterprise also provides forecasts of revenue growth on a constant currency basis, non-GAAP diluted net earnings per share, non-GAAP operating profit growth, and FCF.

These non-GAAP financial measures are not computed in accordance with, or as an alternative to, GAAP in the United States. The GAAP measure most directly comparable to net revenue on a constant currency basis is net revenue. The GAAP measure most directly comparable to non-GAAP gross profit is gross profit. The GAAP measure most directly comparable to non-GAAP gross profit margin is gross profit margin. The GAAP measure most directly comparable to non-GAAP operating profit (non-GAAP earnings from operations) is earnings from operations. The GAAP measure most directly comparable to non-GAAP operating profit margin (non-GAAP earnings from operations as a percentage of net revenue) is operating profit margin (earnings from operations as a percentage of net revenue). The GAAP measure most directly comparable to non-GAAP income tax rate is income tax rate. The GAAP measure most directly comparable to non-GAAP net earnings is net earnings. The GAAP measure most directly comparable to non-GAAP diluted net earnings per share is diluted net earnings per share. The GAAP measure most directly comparable to FCF is cash flow from operations. Reconciliations of each of these non-GAAP financial measures to their most directly comparable GAAP measures for this quarter and prior periods are included in the tables above or elsewhere in the materials accompanying this news release.

Usefulness of non-GAAP financial measures to investors

Hewlett Packard Enterprise believes that providing the non-GAAP financial measures stated above, in addition to the related GAAP measures provides investors with greater transparency to the information used by Hewlett Packard Enterprise’s management in its financial and operational decision making and allows investors to see Hewlett Packard Enterprise’s results “through the eyes” of management. Hewlett Packard Enterprise further believes that providing this information provides Hewlett Packard Enterprise’s investors with a supplemental view to understand the Company’s historical and prospective operating performance and to evaluate the efficacy of the methodology and information used by Hewlett Packard Enterprise’s management to evaluate and measure such performance. Disclosure of these non-GAAP financial measures also facilitates the comparisons of Hewlett Packard Enterprise’s operating performance with the performance of other companies in the same industry that supplement their GAAP results with non-GAAP financial measures that may be calculated in a similar manner.

Economic substance of and material limitations associated with non-GAAP financial measures used by Hewlett Packard Enterprise

Net revenue on a constant currency basis assumes no change to the foreign exchange rate utilized in the comparable prior-year period. This measure assists investors with evaluating the Company’s past and future performance, without the impact of foreign exchange rates, as more than half of our revenue is generated outside of the U.S. Non-GAAP gross profit and non-GAAP gross profit margin are defined to exclude charges related to the stock-based compensation expense, disaster (recovery) charges, and divestiture related exit costs. Non-GAAP operating profit (non-GAAP earnings from operations) and non-GAAP operating profit margin (non-GAAP earnings from operations as a percentage of net revenue) consist of earnings from operations or earnings from operations as a percentage of net revenue excluding the items mentioned above and charges relating to the amortization of intangible assets, transformation costs, and acquisition, disposition and other related charges. Non-GAAP net earnings and non-GAAP diluted net earnings per share consist of net earnings or diluted net earnings per share excluding the charges previously stated, as well as earnings from equity interests, gain or loss on equity investments, other adjustments, and adjustments for taxes. The Adjustments for taxes line item includes certain income tax valuation allowances and separation taxes, the impact of tax reform, structural rate adjustment, excess tax benefit from stock-based compensation, and adjustments for additional taxes or tax benefits associated with each non-GAAP item.

Hewlett Packard Enterprise believes that excluding the items mentioned above from the non-GAAP financial measures provides a supplemental view to management and investors of its consolidated financial performance and presents the financial results of the business without costs that Hewlett Packard Enterprise’s management does not believe to be reflective of ongoing operating results. Exclusion of these items can have a material impact on the equivalent GAAP measure and cash flows thus limiting their use as analytical tools. These limitations are discussed below or elsewhere in the materials accompanying this news release. More specifically, Hewlett Packard Enterprise’s management excludes each of those items mentioned above for the following reasons:

- Hewlett Packard Enterprise incurs charges relating to the amortization of intangible assets and excludes these charges for purposes of calculating these non-GAAP measures. Such charges are significantly impacted by the timing and magnitude of Hewlett Packard Enterprise’s acquisitions. Hewlett Packard Enterprise excludes these charges for the purpose of calculating these non-GAAP measures, primarily because they are non-cash expenses and the Company’s internal benchmarking analyses evidence that many industry participants and peers present non-GAAP financial measures excluding intangible asset amortization. Although this does not directly affect Hewlett Packard Enterprise’s cash position, the loss in value of intangible assets over time can have a material impact on the equivalent GAAP earnings measure.