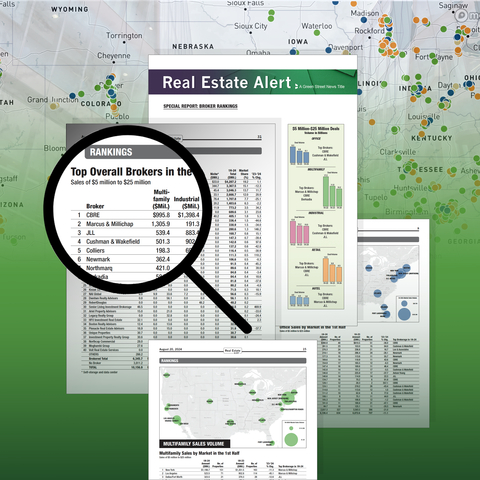

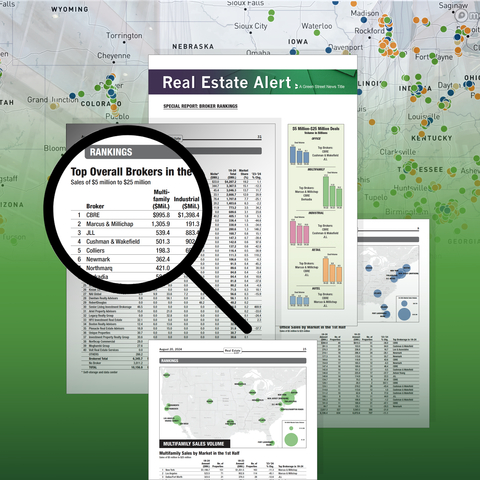

NEWPORT BEACH, Calif.--(BUSINESS WIRE)--Green Street’s Real Estate Alert has released its Mid-Year Broker Rankings of transactions valued between $5 million and $25 million in its recently published special supplement analyzing the private-capital segment. These rankings are based on responses from 38 brokerages to a nationwide survey, with additional data drawn from independent reporting, property records, published reports, press releases and other sources.

Trades of commercial real estate properties valued from $5 million to $25 million fell 10.7% to $39.58 billion from January to June, down from $44.32 billion in the first six months of 2023, according to Green Street’s Sales Comps Database. By comparison, sales activity in the $25 million-plus market was down only 8.6%. “That’s the first time since full-year 2021 that larger sales across property types outperformed the private-capital market,” Real Estate Alert reported.

However, that’s largely a result of several factors: fewer distressed deals in the smaller-sales space, private investors buying more expensive properties while institutions wait out volatility, and two massive apartment trades.

At midyear, CBRE leads the league table as the most active brokerage, putting it on pace to defend its 2023 full-year crown. Marcus & Millichap, last year’s runner-up and the 2022 winner, remains solidly in second place. JLL, Cushman & Wakefield, Colliers and Newmark round out the top six. No other brokerage has a market share of more than 3.5%.

According to the supplement, one reason for seemingly stronger sales volume in the larger-deal space is that distress doesn’t crop up as much in the private-capital market. Although the market for smaller property sales didn’t hold up as well in the first half as its institutional counterpart, brokers are already seeing a rebound afoot.

The supplement leverages Green Street’s proprietary data and analytics to provide unparalleled intelligence on U.S. commercial real estate. It also includes comprehensive analysis of private-capital transactions by property sector and market.

“Green Street’s Real Estate Alert has been the trusted authority on U.S. institutional investment sales for over two decades,” explained T.J. Foderaro, Editor-in-Chief of Real Estate Alert. “With five years of data, analysis and insights on the forces fueling smaller investment sales, we are rapidly emerging as the go-to source on the sub-$25 million private-capital segment as well.”

To receive a copy of Real Estate Alert’s new special supplement, click here.

To subscribe to Green Street’s Real Estate Alert and other exclusive news and related databases, click here.

About Green Street

Green Street is the preeminent provider of actionable commercial real estate research, news, data, analytics, and advisory services in the U.S., Canada, and Europe. For nearly 40 years, Green Street has delivered unparalleled intelligence and trusted data on the public and private real estate markets, helping investors, banks, lenders, and other industry participants optimize investment and strategic decisions. The firm delivers exclusive market information, conclusion-driven insights, and predictive analytics through a SaaS platform. To learn more, please visit www.greenstreet.com.