AUSTIN, Texas--(BUSINESS WIRE)--The Futurum Group’s research arm, Futurum Intelligence, today released its AI chipset market analysts and study, providing a 5-year market forecast and segment sizing. Focused on the industry’s $400B global data center market, the study analyzed the server segment where AI processing takes place, estimating this segment will be one of the fastest growing and the use of AI applications one of the largest.

Global data center investments have seen new growth drivers in the AI inferencing chip market which is set to grow significantly this year as generative AI models mature and chipmakers focus on inferencing support.

The significant study encompasses eighteen different chips vendors and determines their respective market share positions across the four primary product categories, GPUs, CPUs, XPUs (dedicated accelerators used in AI apps like Intel Gaudi, IBM Telum, Groq LPU, etc.) and Custom Cloud Accelerators such as Google TPU, AWS Trainium & Inferentia, Microsoft Maia.

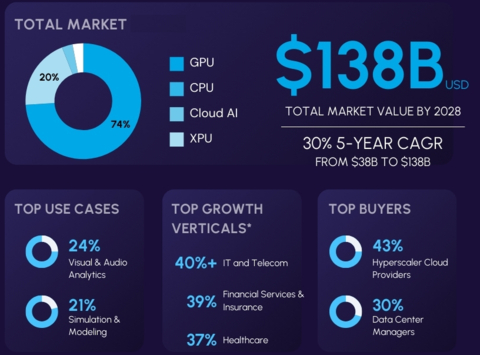

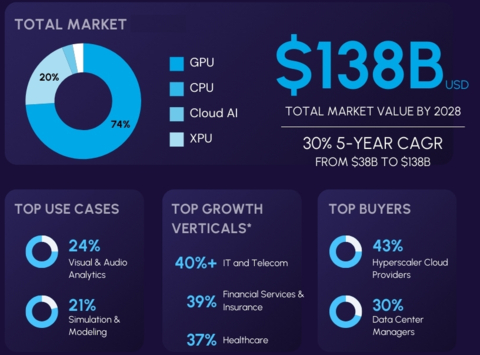

The semiconductor sector in the market accounts for ~30% of the S&P Index’s weight and its market cap reaches over $5T. The sector’s current YTD return in the market exceeds 66% while the S&P returned 16% YTD. Similar to its strong market performance, the study finds Nvidia has held 92% of the market share for GPUs in early 2024. The GPU market accounted for 74% of chipsets used in AI applications within data centers and is forecasted to grow by 30% CAGR over the next 5 years, reaching $102B by 2028, from $28B in 2023.

According to the study’s findings, Hyperscale Cloud Providers such as Google, AWS, Oracle, Microsoft and others drove 43% of the purchase decisions going into 2024 and are forecasted to be the leading buyers of AI processors and accelerators, growing to 50% by 2028. The market’s cloud segment indicated a 58% market share held by Google and a 21% market share by AWS, forecasted to grow by 35% CAGR up to $6B in 2028.

Processors and accelerators for AI excluded in the study were data center processing not available for public use. e.g. AI chipsets designed for and used by Meta, Tesla, Apple, etc.

“We are witnessing the most profound technological revolution with the advent of AI and its supporting semiconductors solutions,” said Daniel Newman, CEO of The Futurum Group. “As AI innovation evolves, companies like NVIDIA, AMD and Arm are seeing significant revenue growth, but the market's competitive landscape is expected to intensify with new entrants and startups poised to capture market shares and drive continued innovation. For that reason, I am very proud to continue and bring insightful and actionable intelligence to the market in a most substantive and timely manner,” he added.

Here are key highlights from the study:

- Despite challenging global trade dynamics, North America leads the AI chipset market with a 55% share, driven by its advanced data center infrastructure, followed by EMEA and APAC.

- CPUs have been and will continue to hold an important role in AI processing in data centers, holding 20% market share in 2023 and will experience 28% 5-year CAGR - growing from $7.7B in 2023 to $26B in 2028.

- Public Cloud AI Instance are important custom accelerators for hyperscalers and their customers. 3% market share in 2023 and will experience 35% 5-year CAGR - growing from $1.3B in 2023 to $6B in 2028.

- Entering 2024 in the custom-cloud AI instance segment, we estimate Google held a dominate 58% market share (Tensor), with AWS (Trainium & Inferentia) 21%.

- XPUs, generally available, dedicated accelerators are estimated to have 3% market share in 2023 and will experience 31% 5-year CAGR - growing from $1B in 2023 to $3.7B in 2028.

- While Data Center Managers are estimated to drive 30% of the decisions today, they will drop to 23% by 2028 and Enterprise IT Managers will surpass them to be 27% of those driving decisions by the end of the forecast period.

- Use Case: At 24%, Visual & Audio Analytics is the biggest use case today entering 2024, closely followed by Simulation & Modeling (21%). Object Identification, Detection, and Monitoring is the fastest growing (38% %-Year CAGR) closely followed by Conversational AI (36% 5-Year CAGR).

- Of 17 different verticals studied, use in each is very broad-based, with Manufacturing & Industrial and Media and Entertainment each holding 11% of the market share., however we estimate Information Technology and Telecom will grow the fastest at over 40% each - closely followed by Financial Services & Insurance (39% growth) and Healthcare (37% growth).

- The top three use cases by 2028 will be Visual & Audio Analytics, Simulation & Modeling and Text Generation, Analysis & Summary

The complete study includes detailed revenue and growth by product type through 2028, deployment type by year, 11 use cases sized by year and 17 vertical markets sized by year.

To download the full survey report, please visit its dedicated page here

Methodology

This report used primary and secondary sources of information to develop it. It focuses solely on market vendors offering AI processors and accelerators used in data centers for AI applications.

Data has been gathered and evaluated from annual filings/10K reports, investor presentations, industry publications, and other publicly available sources. A comprehensive assessment of major and secondary vendors was conducted to derive base-year revenue estimates. The forecasting model is constructed based on the historical growth of vendors providing AI processors and accelerators, macroeconomic factors, significant underlying trends in technology and mid-market companies, and small and midsize businesses (SMBs), which drive market growth. This includes chipsets that were announced in 2023 and come online (deployed) in 2024.

All revenues stated are from the technology vendor ("factory") and do not include channel/reseller markup ("retail"). We attempt to make our units clear in all figures and tables. Numbers in the tables may not add precisely to 100% due to rounding.

About Futurum Intelligence

At Futurum Intelligence, the research arm of The Futurum Group company, analysts, researchers, and advisors help business leaders worldwide anticipate tectonic shifts in their industries and leverage disruptive innovation.

Unlike traditional analysts, The Futurum Group works not only in analysis and research but also takes that insight and knowledge even further, engaging all the way through the go-to-market process. Futurum Research provides in-depth research and insights on global technology markets using advisory services, custom research reports, strategic consulting engagements, digital events, go-to-market planning, and message testing. It also creates, distributes, and amplifies rich media content that all stakeholders read, watch, and listen to.

See more details on The Futurum Group at futurumgroup.com