Corporación América Airports S.A. Reports July 2024 Passenger Traffic

Corporación América Airports S.A. Reports July 2024 Passenger Traffic

Total passenger traffic down 4.2% YoY, or 1.8% YoY ex-Natal

International passenger traffic up 7.6% YoY

LUXEMBOURG--(BUSINESS WIRE)--Corporación América Airports S.A. (NYSE: CAAP), (“CAAP” or the “Company”), one of the leading private airport operators in the world, reported today a 4.2% year-on-year (YoY) decrease in passenger traffic in July 2024. Excluding Natal for comparison purposes, total traffic in July decreased by 1.8% YoY.

Passenger Traffic, Cargo Volume and Aircraft Movements Highlights (2024 vs. 2023) |

||||||||

Statistics |

Jul'24 |

Jul'23 |

% Var. |

|

YTD’24 |

YTD'23 |

% Var. |

|

Domestic Passengers (thousands) |

3,663 |

4,225 |

-13.3% |

|

23,000 |

25,904 |

-11.2% |

|

International Passengers (thousands) |

3,022 |

2,808 |

7.6% |

|

17,464 |

15,873 |

10.0% |

|

Transit Passengers (thousands) |

659 |

635 |

3.8% |

|

4,058 |

4,117 |

-1.4% |

|

Total Passengers (thousands)1 |

7,344 |

7,668 |

-4.2% |

|

44,521 |

45,894 |

-3.0% |

|

Cargo Volume (thousand tons) |

30.4 |

30.8 |

-1.5% |

|

213.4 |

206.7 |

3.2% |

|

Total Aircraft Movements (thousands) |

73.4 |

76.3 |

-3.9% |

|

468.0 |

491.1 |

-4.7% |

|

1 Excluding Natal for comparison purposes, total passenger traffic was down 1.8% in July and 0.9% YTD. |

||||||||

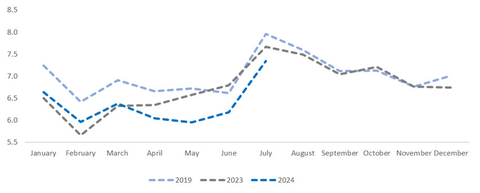

Passenger Traffic Overview

Total passenger traffic declined 4.2% in July compared to the same month of 2023, or 1.8% when adjusting for the discontinuation of the Natal airport. This resulted in a sequential improvement compare to the year-over-year (YoY) decline of 8.9%, or 6.7% Ex-Natal, posted in June. Domestic passenger traffic was down 13.3% YoY, or 9.4% when excluding Natal, mainly impacted by weaker performances in Argentina and, to a lesser extent, Ecuador. International traffic was up 7.6%, mainly driven by increases in Argentina, Italy and Uruguay.

In Argentina, total passenger traffic declined 5.5% YoY, driven by weaker performance in domestic traffic, which was down by 11.5% YoY, improving from the 22.3% decline posted in June. Domestic traffic, which last year benefited from incentives provided by a government program called 'Previaje' to boost domestic tourism, continued to be impacted by the prevailing recession in the country. However, some tourist destinations, such as Bariloche, Iguazú and Mendoza, performed well in July. International passenger traffic continued to perform well, increasing by 14.4% YoY. During July, JetSmart inaugurated a new route from Ezeiza to Curitiba, Aerolineas Argentinas inaugurated the route Cordoba to Rio de Janeiro (GIG), and GOL increased the frequency of its route from Ezeiza to Bogota.

In Italy, passenger traffic grew by 5.5% compared to the same month in 2023. International passenger traffic, which accounted for over 80% of the total traffic, increased by 5.8% YoY, with strong performances at both Pisa and Florence airports. Domestic passenger traffic increased by 4.3% YoY, driven by a 6.2% increase at Pisa airport which was partially offset by a slight decline of 0.4% at Florence airport.

In Brazil, total passenger traffic decreased by 9.6% YoY, or increased by 3.3% YoY when adjusting for the discontinuation of Natal Airport. These results reflect an improvement in traffic trends despite the still challenging aviation context and aircraft constraints in the country, along with the positive impact of the temporary closure of Porto Alegre airport. Domestic traffic, which accounted for almost 60% of the total traffic, was down 22.5% YoY, or 5.4% when excluding Natal, while transit passengers were up 14.3% YoY. As a reminder, following the friendly termination process concluded in February 2024, CAAP no longer operates Natal Airport, effective February 19, 2024. Therefore, statistics for Natal are available up to February 18, 2024.

In Uruguay, total passenger traffic, predominantly international, continued its recovery and increased by a strong 15.1% YoY. JetSMART Airlines inaugurated a new route between Montevideo and Buenos Aires with two daily frequencies, which started operating on May 29, positively impacting July traffic.

In Ecuador, passenger traffic decreased by 5.1% YoY as the slight increase in international traffic was more than offset by weak performance in domestic traffic. International passenger traffic increased by 0.8% YoY, while domestic traffic decreased by 10.4% YoY, mainly driven by the exit of the local airline Equair and high airfare prices.

In Armenia, passenger traffic decreased by 2.2% YoY, following a strong recovery experienced in 2023, which benefited from the introduction of new airlines and routes, along with a higher number of flight frequencies. The introduction of new routes continued into 2024.

Cargo Volume and Aircraft Movements

Cargo volume decreased by 1.5% compared to the same month in 2023, with negative YoY contributions from Argentina (-2.1%), Uruguay (-11.9%), Armenia (-7.7%) and, to a lesser extent, Brazil (-0.5%), which were partially offset by positive YoY variances in Ecuador (+12.9%) and Italy (+4.0%). Argentina, Brazil, and Ecuador accounted for 80% of the total volume in July.

Aircraft movements decreased by 3.9% YoY, with negative YoY contributions from Armenia (-11.3%), Brazil (-7.8%) and Argentina (-4.3%), which were partially offset by positive YoY variances in Uruguay (+3.7%), Ecuador (+3.1%) and Italy (+0.8%). Argentina, Brazil, and Italy accounted for more than 80% of total aircraft movements in July.

Summary Passenger Traffic, Cargo Volume and Aircraft Movements (2024 vs. 2023) |

|||||||

|

Jul'24 |

Jul'23 |

% Var. |

|

YTD'24 |

YTD'23 |

% Var. |

Passenger Traffic (thousands) |

|

|

|

|

|

|

|

Argentina |

3,761 |

3,979 |

-5.5% |

|

23,642 |

24,511 |

-3.5% |

Italy |

996 |

944 |

5.5% |

|

5,118 |

4,553 |

12.4% |

Brazil (1) |

1,386 |

1,533 |

-9.6% |

|

8,799 |

9,905 |

-11.2% |

Uruguay |

191 |

166 |

15.1% |

|

1,311 |

1,095 |

19.7% |

Ecuador |

423 |

446 |

-5.1% |

|

2,707 |

2,830 |

-4.4% |

Armenia |

587 |

601 |

-2.2% |

|

2,943 |

2,999 |

-1.9% |

TOTAL |

7,344 |

7,668 |

-4.2% |

|

44,521 |

45,894 |

-3.0% |

(1) Following the friendly termination process concluded in February 2024, CAAP no longer operates Natal airport. Statistics for Natal are available up to February 18, 2024. |

|||||||

| Cargo Volume (tons) | |||||||

Argentina |

15,501 |

15,828 |

-2.1% |

|

109,598 |

106,515 |

2.9% |

Italy |

1,183 |

1,137 |

4.0% |

|

7,542 |

7,872 |

-4.2% |

Brazil |

5,549 |

5,576 |

-0.5% |

|

36,447 |

37,109 |

-1.8% |

Uruguay |

2,169 |

2,461 |

-11.9% |

|

17,383 |

18,411 |

-5.6% |

Ecuador |

3,271 |

2,897 |

12.9% |

|

22,365 |

18,831 |

18.8% |

Armenia |

2,681 |

2,903 |

-7.7% |

|

20,023 |

18,005 |

11.2% |

TOTAL |

30,353 |

30,802 |

-1.5% |

|

213,358 |

206,742 |

3.2% |

Aircraft Movements |

|

|

|

|

|

|

|

Argentina |

39,017 |

40,777 |

-4.3% |

|

253,640 |

263,918 |

-3.9% |

Italy |

9,053 |

8,979 |

0.8% |

|

47,275 |

44,021 |

7.4% |

Brazil |

12,224 |

13,260 |

-7.8% |

|

82,081 |

92,914 |

-11.7% |

Uruguay |

2,254 |

2,174 |

3.7% |

|

18,821 |

18,731 |

0.5% |

Ecuador |

6,779 |

6,578 |

3.1% |

|

44,183 |

46,255 |

-4.5% |

Armenia |

4,061 |

4,580 |

-11.3% |

|

22,021 |

25,227 |

-12.7% |

TOTAL |

73,388 |

76,348 |

-3.9% |

|

468,021 |

491,066 |

-4.7% |

About Corporación América Airports

Corporación América Airports acquires, develops and operates airport concessions. Currently, the Company operates 52 airports in 6 countries across Latin America and Europe (Argentina, Brazil, Uruguay, Ecuador, Armenia and Italy). In 2023, Corporación América Airports served 81.1 million passengers, 23.7% above the 65.6 million passengers served in 2022 and 3.6% below the 84.2 million served in 2019. The Company is listed on the New York Stock Exchange where it trades under the ticker “CAAP”. For more information, visit http://investors.corporacionamericaairports.com.

Contacts

Investor Relations Contact

Patricio Iñaki Esnaola

Email: patricio.esnaola@caairports.com

Phone: +5411 4899-6716