GREENWICH, Conn.--(BUSINESS WIRE)--GAMCO Asset Management Inc. (“GAMCO”), an affiliate of GAMCO Investors, Inc. (OTCQX: GAMI), on behalf of its clients and certain of its affiliates owns approximately 2,866,654 shares of Dril-Quip, Inc. (NYSE: DRQ), representing 8.32% of the 34,452,230 outstanding shares as reported in Dril-Quip’s most recently filed Form 10-Q for the quarter ended June 30, 2024. GAMCO’s Proxy Voting Committee (“PVC”) intends to vote “Against” the proposed merger with Innovex Downhole Solutions (“Innovex”).

On March 18, 2024, Dril-Quip announced its intention to acquire and merge with Innovex. At the time of the announcement, Dril-Quip’s stock price was $23.73. Since Dril-Quip’s announcement that it will acquire Innovex and through August 13, 2024, Dril-Quip's stock price has declined 37.5%, while the VanEck Oil Services ETF (OIH) has declined only 8.3%.

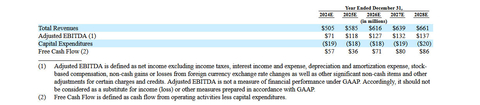

We believe Dril-Quip is worth more as a standalone company. We believe Dril-Quip's intrinsic value is worth more than its current stock price. However, the company is planning to issue new shares near its all-time lows to fund the Innovex acquisition. According to Dril-Quip's projections in its merger proxy document filed with the SEC on August 5, 2024, Dril-Quip's financials are improving. Between 2024 and 2028, Dril-Quip projects its EBITDA will increase from $71 million to $137 million and generate a cumulative free cash flow of $330 million (or almost $10/share). Dril-Quip currently has $189.2 million of cash (or $5.50 per share) on its balance sheet and no debt. If Dril-Quip achieves its financial targets provided in the proxy, it will have $519.2 million of cash by 2028 (or $15 per share), greater than its current market capitalization. Even though our internal earnings projections are more conservative relative to Dril-Quip's outlook, we estimate Dril-Quip's 2025 private market value (PMV) to be $39 per share.

Among other issues the PVC considered were that Innovex dilutes Dril-Quip's offshore franchise. Dril-Quip's current revenue mix is 60% offshore and 40% international land. In a normalized offshore environment, we estimate offshore revenue is closer to 75-80% of the revenue mix. Offshore activity is increasing, as evidenced by increased project FID, tree awards, and a tight floater market. Newco's revenue mix, however, will be less favorable as 39% of its revenue would be derived from offshore, 33% from U.S. land, and 29% from international land. As part of Newco, Dril-Quip will be increasing its exposure to the U.S. onshore market at a time when growth in U.S. activity is slowing or peaking.

Additionally, the merger weakens Dril-Quip's strong balance sheet. As of June 30, 2024, Dril-Quip had $189.2 million of cash and no debt on its balance sheet. Based on latest available financial information for Innovex, it had net debt of $35.6 million (consisting of $7.6 million of cash and $43.2 million of total debt). Before closing of the merger, Innovex will pay its Amberjack Capital Partners (a private equity firm that currently owns 95% of Innovex) a $75 million special dividend, which we find to be excessive. This special dividend will increase Innovex's net debt position to $110.6 million prior to the merger. Following the proposed merger, Innovex would have other existing commitments that will further weaken Newco's balance sheet, such as its intention to acquire the remaining 80% of Downhole Well Solutions (DWS) that it doesn’t already own.

For all of these reasons, our PVC intends to vote “Against” the proposed merger.

GAMCO Investors, Inc., through its subsidiaries, manages assets of private advisory accounts (GAMCO), mutual funds and closed-end funds (Gabelli Funds, LLC) and is known for its Private Market Value with a Catalyst™ style of investment.