TORONTO--(BUSINESS WIRE)--Triple Flag Precious Metals Corp. (with its subsidiaries, “Triple Flag” or the “Company”) (TSX: TFPM, NYSE: TFPM) announced that it has entered into definitive agreements for the acquisition of 3% gold streams on each of the Agbaou and Bonikro mines operated by Allied Gold Corp. (“Allied”) for total cash consideration of $53 million. Unless otherwise noted, all dollar amounts in this news release are expressed in US dollars.

“The acquisition of new 3% gold streams on each of the Agbaou and Bonikro mines adds immediate cash flow to Triple Flag from two producing assets, with an operator that has already created significant value at these operations from exploration investments. We fully expect this exploration track record to continue and see significant upside potential for further growth in reserves and resources,” commented Shaun Usmar, CEO. “This deal will be partially funded by our credit facility and is expected to achieve full payback within the minimum delivery period in the current gold price environment.”

Key Terms

-

Triple Flag will have the right to purchase 3% of payable gold from each of Allied’s Agbaou mine (the “Agbaou Stream”) and Bonikro mine (the “Bonikro Stream” and, collectively, the “Streams”).

- Under the Agbaou Stream, the gold stream rate will step down to 2% of payable gold after the delivery of 29,000 ounces of gold.

- Under the Bonikro Stream, the gold stream rate will step down to 2% of payable gold after the delivery of 39,300 ounces of gold.

- Triple Flag will make ongoing payments of 10% of the spot gold price for each ounce delivered under the Streams.

- The Streams are subject to a period of minimum deliveries. From 2024 to 2027, an annual minimum of approximately 2.50 to 2.75 thousand gold equivalent ounces (“GEOs”) will be delivered under the Agbaou Stream and an annual minimum of 3.50 to 4.25 thousand GEOs will be delivered under the Bonikro Stream.

- The Streams will cover the existing mining and exploration licenses for the Agbaou and Bonikro mines.

- A parent guarantee will be provided by Allied on the Streams.

- Triple Flag will work with Allied to identify social programs in the communities surrounding Bonikro and Agbaou to support with separate additional investment.

- Closing of the transaction is expected by late August 2024.

Asset Background

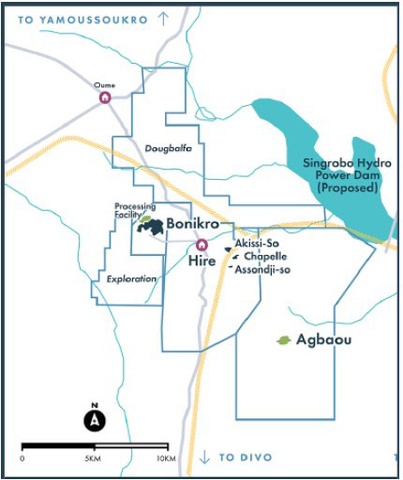

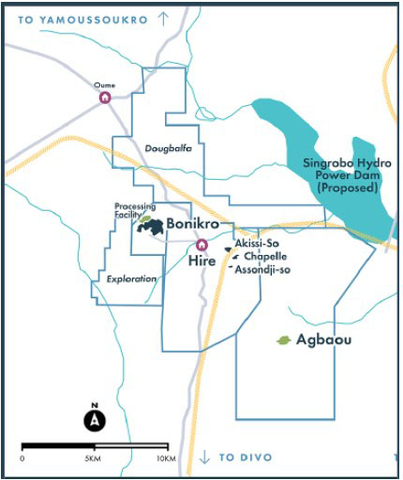

The Agbaou and Bonikro producing gold mines are located in Côte d’Ivoire within the Birimian Greenstone Belt, approximately 20 kilometers apart, and operated as a single complex. On a combined basis, Allied is targeting a production rate of 180 to 200 thousand ounces per annum and a greater than 10-year mine life from the complex, driven by an extensive exploration program.

The complex has a combined milling capacity of over 5 Mtpa to leverage the large prospective land package, with a 2024 exploration budget of $6 million and $10.5 million at Agbaou and Bonikro, respectively. Notably, the current exploration campaign at Agbaou is the largest in the asset’s operating history, with a near-term opportunity to boost oxide feed from Agbalé. At Bonikro, the operator sees significant upside potential from Oume, with planned drilling at Oume West and North, as well as resource drilling at Akissi-So.

Agbaou

Agbaou is an open pit, producing gold mine with conventional gravity and CIL processing. Endeavour Mining began construction of the mine in 2012 and commenced operations in 2013. Allied subsequently acquired the mine in 2021, which has produced over 1.3 million ounces of gold since start-up. Triple Flag owns a separate 2.5% NSR royalty interest in Agbaou, acquired in June 2023.

Allied’s production guidance for 2024 is 85 to 95 thousand ounces of gold. The current life-of-mine plan contemplates a minimum annual production profile of 90 thousand ounces until 2026, with total gold production of over 465 thousand ounces through 2028. As of December 31, 2023, Proven Mineral Reserves totaled 1,815 thousand tonnes at a grade of 2.01 g/t Au, containing 117 thousand ounces of gold, and Probable Mineral Reserves totaled 6,092 thousand tonnes at a grade of 1.79 g/t Au, containing 351 thousand ounces. Measured Mineral Resources totaled 2,219 thousand tonnes at a grade of 2.15 g/t Au, containing 154 thousand ounces of gold, Indicated Mineral Resources totaled 11,130 thousand tonnes at a grade of 1.96 g/t Au, containing 701 thousand ounces of gold, and Inferred Mineral Resources totaled 959 thousand tonnes at a grade of 1.84 g/t Au, containing 57 thousand ounces of gold. The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to derive the Mineral Reserves.

Further information can be found at: Allied Gold Corporation - Mineral Reserves and Mineral Resources

Bonikro

Bonikro is an open pit, producing gold mine with conventional gravity and CIL processing. The mine was built by Equigold in 2007 and acquired by Lihir in 2008, then operated by Newcrest from 2010 to 2017. Allied subsequently acquired the mine in 2019, which has produced over 1.5 million ounces of gold since start-up.

Allied’s production guidance for 2024 is 95 to 105 thousand ounces of gold, which is expected to increase to an average annual minimum of 110 thousand ounces of gold due to higher-grade material in 2025 and 2026 from Pushback 5. Proven Mineral Reserves totaled 4,771 thousand tonnes at a grade of 0.71 g/t Au, containing 108 thousand ounces of gold, and Probable Mineral Reserves totaled 8,900 thousand tonnes at a grade of 1.62 g/t Au, containing 462 thousand ounces. Measured Mineral Resources totaled 7,033 thousand tonnes at a grade of 0.98 g/t Au, containing 222 thousand ounces of gold, Indicated Mineral Resources totaled 25,793 thousand tonnes at a grade of 1.41 g/t Au, containing 1,171 thousand ounces of gold, and Inferred Mineral Resources totaled 19,588 thousand tonnes at a grade of 1.30 g/t Au, containing 816 thousand ounces of gold. The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to derive the Mineral Reserves.

Further information can be found at: Allied Gold Corporation - Mineral Reserves and Mineral Resources

About Triple Flag

Triple Flag is a pure play, precious-metals‐focused streaming and royalty company. We offer bespoke financing solutions to the metals and mining industry with exposure primarily to gold and silver in the Americas and Australia, with a total of 236 assets, including 17 streams and 219 royalties. These investments are tied to mining assets at various stages of the mine life cycle, including 32 producing mines and 204 development and exploration stage projects, and other assets. Triple Flag is listed on the Toronto Stock Exchange and New York Stock Exchange, under the ticker “TFPM”.

Forward-Looking Information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, respectively (collectively referred to herein as “forward-looking information”). Forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or terminology which states that certain actions, events or results “may”, “could”, “would”, “might”, “will”, “will be taken”, “occur” or “be achieved”. Forward-looking information in this news release include, but are not limited to, statements with respect to the closing of the acquisition of the two streams, and all related matters thereto and developments in respect of the Bonikro and Agbaou operations. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding possible future events or circumstances.

The forward-looking information included in this news release is based on our opinions, estimates and assumptions considering our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. The forward-looking information contained in this news release is also based upon a number of assumptions, including the ongoing operation of the properties in which we hold a stream or royalty interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; and the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production. These assumptions include, but are not limited to, the following: assumptions in respect of current and future market conditions and the execution of our business strategies, that operations, or ramp-up where applicable, at properties in which we hold a royalty, stream or other interest, continue without further interruption through the period, and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated, intended or implied. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Forward-looking information is also subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but are not limited to, those set forth under the caption “Risk Factors” in our most recently filed annual information form which is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. For clarity, mineral resources that are not mineral reserves do not have demonstrated economic viability and inferred resources are considered too geologically speculative for the application of economic considerations.

Although we have attempted to identify important risk factors that could cause actual results or future events to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this news release represents our expectations as of the date of this news release and is subject to change after such date. We disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities laws. All the forward-looking information contained in this news release is expressly qualified by the foregoing cautionary statements.

Cautionary Statement to U.S. Investors

Information contained or referenced in this press release or in the documents referenced herein concerning the properties, technical information and operations of Triple Flag has been prepared in accordance with requirements and standards under Canadian securities laws, which differ from the requirements of the U.S. Securities and Exchange Commission (“SEC”) under subpart 1300 of Regulation S-K (“S-K 1300”). Because the Company is eligible for the Multijurisdictional Disclosure System adopted by the SEC and Canadian Securities Administrators, Triple Flag is not required to present disclosure regarding its mineral properties in compliance with S-K 1300. Accordingly, certain information contained in this press release may not be comparable to similar information made public by US companies subject to reporting and disclosure requirements of the SEC.

Technical and Third-Party Information

Triple Flag does not own, develop or mine the underlying properties on which it holds stream or royalty interests. As a royalty or stream holder, Triple Flag has limited, if any, access to properties included in its asset portfolio. As a result, Triple Flag is dependent on the owners or operators of the properties and their qualified persons to provide information to Triple Flag and on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which Triple Flag holds stream, royalty, or other similar interests. Triple Flag generally has limited or no ability to independently verify such information. Although Triple Flag does not believe that such information is inaccurate or incomplete in any material respect, there can be no assurance that such third-party information is complete or accurate.

Qualified Person

James Lill, Director, Mining for Triple Flag Precious Metals and a “qualified person” under NI 43-101 has reviewed and approved the written scientific and technical disclosures contained in this press release.