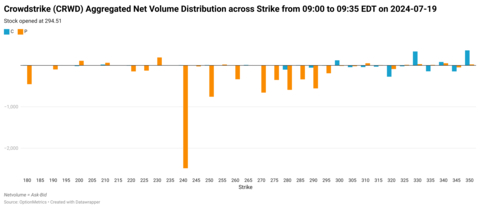

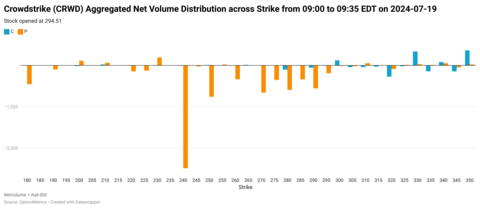

NEW YORK--(BUSINESS WIRE)--OptionMetrics, an options, equities, ETFs, and futures analytics provider for institutional investors and academic researchers worldwide, releases its new IvyDB Signed Volume intraday dataset, now available in five-minute and 30-minute snapshot intervals throughout the day, in addition to an end of day file. The new dataset gives quants, hedge fund managers, and other institutional investors even more timely insights on retail trading, zero days to expiration (0DTE) options, meme stocks, hedging flows, and other market-making activities.

OptionMetrics further advances accuracy and compresses file size in this new Signed Volume release, simplifying deliverability and enabling charts to be run even faster. End-of-day data will now be updated six hours earlier each day, at 4:45 p.m. versus 11 p.m.

OptionMetrics IvyDB Signed Volume offers a full history on buy/sell pressure, starting from January 2016, on over 4,000 unique stocks and indices. It tracks daily U.S. options trading volume, indicating whether trades occurred at bid, ask, or midpoint and can be used to:

- Track buying and selling pressure and parse intraday demand on 0DTE options and meme stocks

- Assess options activity surrounding CPI, Fed announcements, earnings, and other corporate actions

- Derive signals based on options order flow throughout the day

- Gain a better understanding of how options demand pressure impacts volatility

“IvyDB Signed Volume now provides information on intraday option activity. Using this data, hedge fund, risk and quantitative professionals can investigate and evaluate higher frequency signals, track and assess 0DTE options demand, and distinguish retail and institutional volumes,” said OptionMetrics CEO David Hait, Ph.D.

OptionMetrics IvyDB Signed Volume Intraday can be used as an add-on to OptionMetrics’ flagship IvyDB US or as a standalone product.

OptionMetrics’ suite of options, equities, ETFs, futures, and dividend data products also includes: IvyDB Europe, IvyDB Canada, and IvyDB Asia options databases; IvyDB Beta factor investing dataset for systematic risk on equities; IvyDB Futures to assess optionable futures, and real-time Dividend Forecast Data.

Contact info@OptionMetrics.com for details.