LOS ALTOS, Calif.--(BUSINESS WIRE)--Daffy.org, the modern platform for charitable giving, today announces the launch of Custom Portfolios, an innovative feature that allows Daffy members to tailor their portfolio’s investment strategy to match their giving preferences and timeline. In 2023, Daffy members set aside more than $105 million for charity, a 425% increase from 2022, and thanks to exceptional investment performance, their charitable accounts have grown by an additional $30 million in value.

Since its launch, Daffy, the Donor-Advised Fund for You™, has offered members an industry-leading set of portfolio options including fifteen different portfolios such as Conservative, Standard, ESG, and Crypto. Recognizing that tax-free investment growth is a significant benefit of donor-advised funds (DAFs), Daffy members have been seeking more options to enhance their giving potential. With the introduction of Custom Portfolios, Daffy will now support portfolios featuring over 460 low-cost, high-quality ETFs from top-quality providers like Vanguard, Blackrock iShares, Fidelity, Schwab, State Street, Van Eck, Bitwise, and State Street SPDR. Daffy will also be the first DAF to support both Bitcoin ETFs and Ethereum ETFs in their investment options.

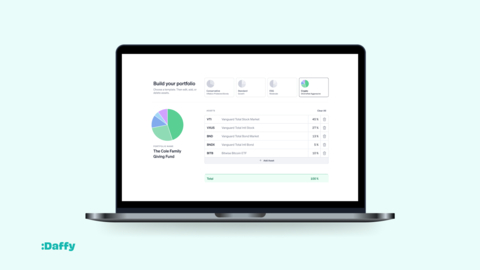

Daffy has built its own portfolio tool to make the process simple and helpful for members, allowing them to start with pre-approved portfolio templates and then modify the investments and percentages to better match their giving goals. Members can propose a portfolio of up to 10 ETFs, resulting in over 100 quintillion possible combinations to tailor their fund’s investment strategy to their specific giving needs.

“A big benefit of a DAF is growing your charitable dollars tax-free, but selecting the appropriate investments for a charitable fund is not trivial. Daffy members want to align their investment strategy with their investment theses, personal beliefs, and giving timeline,” said Adam Nash, Co-founder and CEO of Daffy. “By offering over 100 quintillion options to grow the money set aside for charity through investments in ETFs they believe in, we aim to fulfill our mission by unlocking even more money for charitable giving.”

Daffy is dedicated to helping people make giving a habit by setting up recurring, tax-free contributions and donations with cash, debit, credit, Apple Pay, stock, and over 200 crypto assets. As the first full-featured donor-advised fund mobile app, Daffy has previously launched innovative features such as Daffy for Advisors, Daffy APIs, Daffy Campaigns, Daffy for Families, and Daffy for Work. Since its initial launch in September 2021, the Daffy community has grown to thousands, with members’ account sizes ranging from $100 to over $10M.

To learn more about Daffy’s Custom Portfolios, visit: daffy.org/resources/custom-portfolios.

About Daffy

Named one of Fast Company’s “Most Innovative Companies of 2024”, Daffy is the Donor-Advised Fund for You™, the ground-breaking, modern platform for charitable giving. The first platform to make giving an easy habit to keep by setting up one-time or recurring contributions with cash, debit, credit, Apple Pay, stock, index funds, mutual funds, and 200+ crypto assets, Daffy innovates the donor-advised fund technology to bring it back to its original goal of helping people give more easily and more regularly. With no minimum to get started and industry-low fees, Daffy allows anyone to set money aside, watch it grow tax-free, and donate to over 1.7+ million charities in the US, like a 401(K) for charitable giving. With fundraising capabilities, family features for families to give together, and a real-time feed of members’ philanthropic activity, Daffy taps into the inherently social nature of giving, helping people discover, inspire, and support the causes they care about most. Since its launch in September 2021, the Daffy community has grown to thousands with members’ account sizes ranging from $10 to over $10M. To give with Daffy, visit daffy.org or search “Daffy” in the App Store.