SEATTLE--(BUSINESS WIRE)--Milliman, Inc., a premier global consulting and actuarial firm, recently released its 2024 Retiree Health Cost Index which projects how much money, on average, a healthy 65-year-old can expect to spend on healthcare costs in retirement. The index explains how factors like when a person retires, where a person lives, and which coverage a person chooses will impact the total cost of premiums and out-of-pocket expenses.

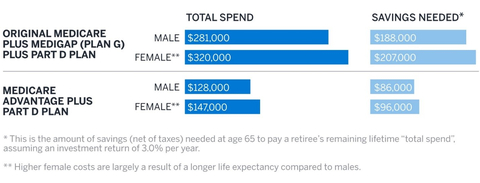

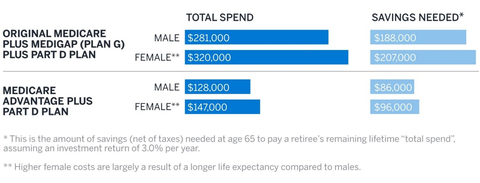

The two most common healthcare coverage options chosen by Medicare-eligible retirees are Medicare Advantage Part D (MAPD) and Original Medicare with Medigap plus Part D. A healthy 65-year-old male retiring in 2024 with an MAPD plan is projected to spend $128,000 on healthcare in his remaining lifetime. A female with the same coverage is projected to spend $147,000 in her remaining lifetime. The difference in cost is largely because women on average live longer than men.

Under Original Medicare with Medigap plus Part D instead, these projections increase to $281,000 for a male and $320,000 for a female, or a combined total of $601,000 for a 65-year-old couple. In today’s dollars (assuming a 3% investment return), this reflects $395,000 in savings needed.

In 2024, Medicare Advantage costs decreased about 4% and Medigap costs increased about 2% when compared to 2023. The largest drivers of these changes include:

- Increased drug spending, including weight-loss and diabetes drugs such as Ozempic and Jardiance

- Higher Medicare Part B premiums

- Lower MAPD premiums and out-of-pocket costs

- The Inflation Reduction Act, which required changes to Medicare Part D

"Healthcare expenses are an important and sometimes overlooked component of retirement planning," said Robert Schmidt, a Milliman principal and co-author of the Retiree Health Cost Index. "By taking a realistic look at their health status and healthcare expenses, and then budgeting accordingly, people can take steps to enjoy a less stressful, financially healthier retirement.”

To view the complete Retiree Health Cost Index, visit https://www.milliman.com/retireehealthcosts.

About Milliman

Milliman is among the world's largest providers of actuarial, risk management, and technology solutions. Our consulting and advanced analytics capabilities encompass healthcare, property & casualty insurance, life insurance and financial services, and employee benefits. Founded in 1947, Milliman is an independent firm with offices in major cities around the globe. Visit us at milliman.com.