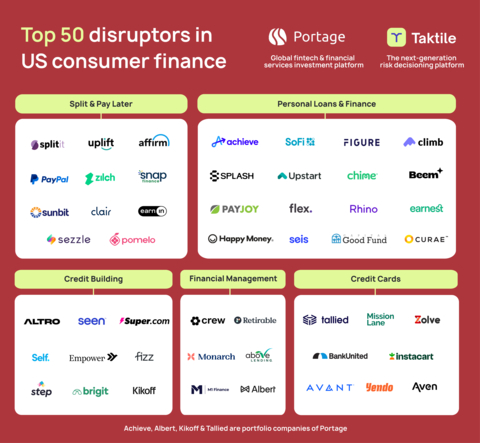

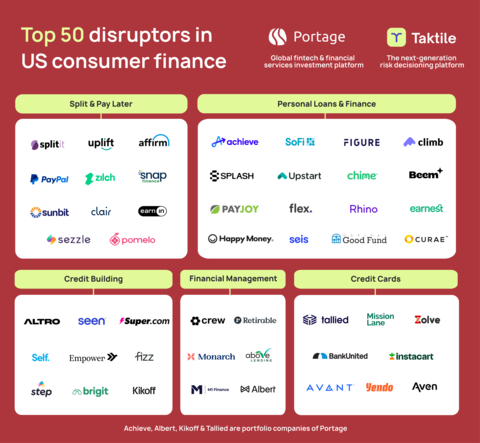

NEW YORK--(BUSINESS WIRE)--Portage, a global investment platform, in collaboration with Taktile, a next-generation risk decision platform, proudly presents "The Top 50 US Fintech Companies Disrupting Consumer Finance in 2024." This comprehensive list highlights the most innovative fintech companies ushering in a new era of financial inclusion and consumer empowerment in the United States.

The demand for hyper-personalized and convenient financial products in the US has surged. In response, innovative startups and established fintech leaders are not only making existing products more fair and accessible but also accelerating product development to better serve those traditionally underserved or marginalized by traditional establishments. This wave of innovation is reshaping the market landscape and addressing the evolving needs of US consumers.

“We’re excited about companies using technology to expand access to credit in traditionally underserved markets by creating brand new categories of products. From new credit-building products to asset-backed credit products to companies enabling and using income-based underwriting models. We’re looking forward to seeing the next generation of companies which we believe will be able to combine sophisticated hyper-targeted data models with a frictionless customer experience.” explains Portage Partner Stephanie Choo.

Key Trends and Highlights from the Top 50 Fintech Companies:

1. Pay Later Products Continue to Gain Momentum: Buy Now, Pay Later (BNPL) offerings have penetrated a considerable portion of the US consumer market. This year, products in this sector continue to expand beyond goods and services into adjacent offerings like "Transfer Now, Pay Later."

2. Personal Loans Get Hyper-Personal: The personal loan sector is experiencing a new wave of momentum as lenders become more sophisticated at leveraging internal and external data sources, enabling them to create hyper-personalized loan products for a broader range of marginalized consumers.

3. Personal Finance Gets A Makeover: Fintech companies are leading the charge in creating sophisticated personal finance tools for consumers no matter their financial expertise or literacy. Community, education, and guidance are the name of the game.

4. Empowering Credit-Building Products: As consumers seek greater transparency and control over their finances, fintech companies are developing innovative credit-building solutions that promote responsible financial behavior while integrating educational and financial management tools.

5. Inclusive Credit Card Offerings: The consumer credit card market is thriving, not through rewards but through personalization, innovative use of alternative data, and advanced risk assessment techniques.

Future Outlook

As the demand for consumer credit continues to evolve, fintech companies have endless opportunities to develop unique products that effectively address their customers’ needs. The key to more accurate risk assessments—and consequently, we believe the creation of new financial products—lies in accessing real-time, alternative data sources.

We anticipate the growing adoption of unique data sources, such as open banking and marketplace data, will be enabled by next-generation decision platforms like Taktile - where teams can experiment and iteratively test how to best onboard and underwrite both existing and future customer segments.

Read the full article here.

About Portage: Portage is a global investment platform focused on FinTech and Financial Services, with over US $2.5 billion in assets under management.

Our team partners with ambitious companies across all stages, through Portage Ventures and Portage Capital Solutions. We provide flexible capital and deliver a global network of investors, commercial partners, advisors, and value creation experts. With deep industry knowledge and entrepreneurial experience, Portage is committed to supporting the leaders who are reshaping financial services. Portage operates in the United States, Canada and Europe. Portage is a platform within Sagard, a global multi-strategy alternative asset management firm with over $25B under management. For more information, visit www.portageinvest.com.

About Taktile: Taktile is a next-generation risk decision platform that empowers subject matter experts to build, monitor, and experiment with automated decisions across the entire customer journey. Through advanced data analytics and machine learning, Taktile helps fintech companies and financial institutions make smarter, faster risk decisions and deliver innovative financial solutions to their customers. For more information, visit www.taktile.com.