SEATTLE--(BUSINESS WIRE)--Today, ShareBuilder 401k, a leading provider of all-ETF 401(k) plans for small- and mid-size businesses, launched a new Solo 401k Saver plan for the self-employed. According to the U.S. Bureau of Labor Statistics, the number of self-employed Americans grew to 17.0M in May 2024. ShareBuilder 401k’s new Solo 401(k) Saver product is designed to make it easier and more affordable for the growing number of one-person businesses in the United States, with many in the gig economy, to access the powerful saving and tax benefits of 401(k) plans.

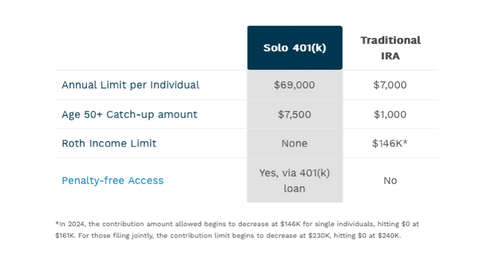

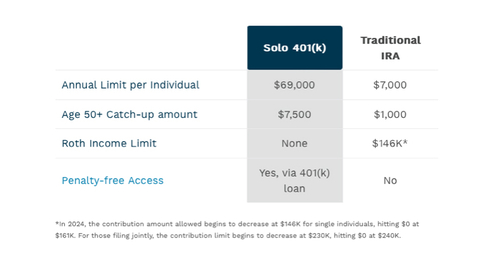

“Many self-employed persons want access to a 401(k)’s high annual contribution limit of $69,000 to help them save for retirement and lower taxes for the current year,” said ShareBuilder 401k CEO and President Stuart Robertson. “Moreover, they’re seeking an inexpensive solution that’s digitally straightforward, quick and easy to use and offers support from knowledgeable 401(k) professionals. That’s what we created with our new Solo 401k Saver offering. The Solo 401k Saver online setup and funding is so easy to use that it only takes about 15-20 minutes to be up and running.”

Since 2005, ShareBuilder 401k has offered a fully administered Solo 401(k) plan called Solo 401k Plus. This plan includes a broader array of features that allow multiple owners and spouses—but not employees—to participate, offer 401(k) loans against the plan, and for those who accumulate over $250,000, a signature-ready Form 5500 that simplifies reporting to the IRS.

The new Solo 401k Saver plan is designed for one owner only with carefully scrutinized investment model portfolios for retirement saving; but does not offer options for loans, hardship withdrawals, or the Form 5500 available with the Solo 401k Plus. The starting monthly cost of a Solo 401k Saver plan is $8, compared to only $25 for a Solo 401k Plus plan, and both prices decrease as the account value grows. For example, the Solo 401k Saver monthly service charge drops to $0 when a client surpasses $25,000 in retirement savings.

ShareBuilder 401k’s online shopping experience offers access to professional 401(k) advisors. These pros can walk users through the various plan options and educate them about what to consider for retirement investing as well as strategies for lowering taxes. The six model portfolios include core retirement-appropriate asset classes built of index funds, and they automatically rebalance to help make saving for retirement as easy and transparent as possible.

Robertson believes that the number of self-employed Americans could continue to rise with growing populations and the freedom more individuals seek by running their own businesses and defining their own work schedules.

“Many people’s views of employment changed during the pandemic,” said Robertson. “They took this time to reinvent their careers, including those deciding to start their own business and better manage their work-life balance. We believe small businesses are the creative, driving engine of our economy. And now, even the self-employed—no matter their budget—can access all the benefits of a 401(k) plan to support them as they grow.”

About ShareBuilder 401k

ShareBuilder 401k is a leading digital 401(k) provider specializing in low-cost, all-ETF retirement products and resources for small- to mid-sized companies, including owner-only businesses. Founded in 2005 and now serving more than 6,500 businesses across the US, ShareBuilder 401k is a pioneer of the index-based 401(k), digital quoting and purchasing of retirement plans, and providing investment management (ERISA 3(38)) services for every client’s fund roster. ShareBuilder 401k is committed to further expanding access to retirement plans and leading more Americans to save through intuitive technology, low costs and quality education and support. More information on the company can be viewed online at www.sharebuilder401k.com.