ADA, Okla.--(BUSINESS WIRE)--For the third month running, LegalShield’s Consumer Stress Legal Index (CSLI) indicates that consumer stress levels in battleground states are favoring a re-election for President Biden. However, significant shifts in LegalShield’s bankruptcy and consumer finance indices hint at a possible reversal of that trend.

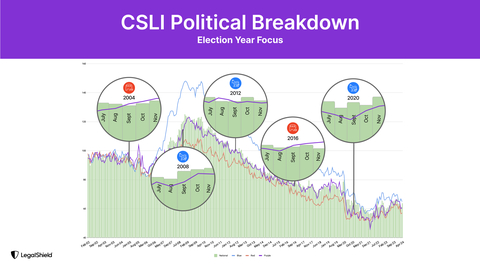

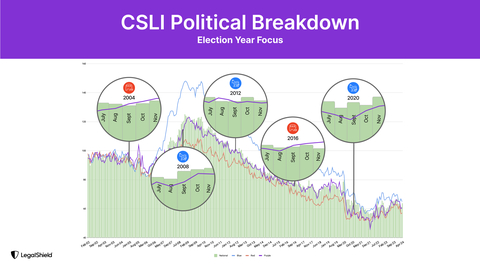

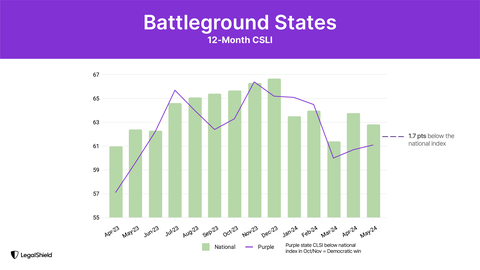

In the last five presidential election years, a Democrat secured or maintained the White House when consumer stress in battleground states remained lower than the national average in October and November. In May, consumer stress in battleground states was lower than the national CSLI average which currently indicates a Democrat win in November.

“The three-month trend is pointing to victory for Democrats,” said Matt Layton, LegalShield senior vice president of consumer analytics. “But, in 2016, battleground stress told a similar story until the trend reversed in late summer signaling a Republican win.”

LegalShield’s CSLI is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. On average, LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

Battleground States and the CSLI

This election cycle, LegalShield is reviewing consumer stress levels on a politically geographic basis, separating red, blue, and purple battleground states. LegalShield classified states based on the outcome of the 2020 election. Battleground states for 2024 are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin.

In May, battleground state consumer stress ticked up by 0.4 points to 61.1, still 1.7 points below the national consumer stress level. Blue state stress increased by 1.2 points, maintaining a consistently higher level than the national index, while red state stress remained relatively flat with a 0.1-point increase, staying well below the national average.

Rising Battleground Bankruptcy and Consumer Finance Issues Could Flip the Trend

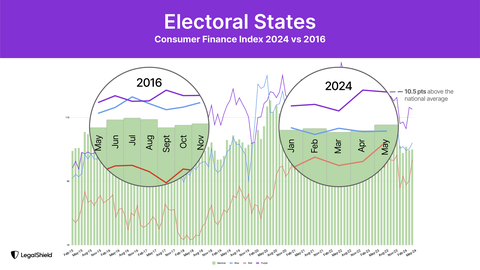

A closer examination of the subindices feeding the benchmark CSLI reveals an uptick in bankruptcy inquiries in battleground states, diverging from the national average. Additionally, consumers in these states are experiencing significantly more stress related to consumer finance issues than those in red and blue states, with stress levels more than 12 points higher than in blue states and about 16 points higher than in red states. In May, the Consumer Finance subindex in battleground states was more than 10 points higher than the national average.

“If the Bankruptcy or Consumer Finance subindex accelerate specifically in battleground states, as they did in 2016, the CSLI in battleground states is likely to rise above the national average,” said Layton. “The mixed results of the subindices are a sign that we might see a shift in the presidential frontrunner.”

National CSLI Holds Steady with Inflation and Interest Rates

Nationally, LegalShield’s benchmark CSLI remained almost flat in May at 62.8, just 0.1 points below April.*

Macroeconomic indicators showed cooling inflation, strength in hiring, and no change in interest rates.

“We expect consumers to face continued stress with interest rates staying put,” said Layton. “With mounting debt, I expect our network of attorneys will be spending a lot of time on these household issues if we don’t see a change in the interest rate environment.”

National Subindices: Bankruptcy’s Steady Climb, Consumer Finance and Foreclosure Flat

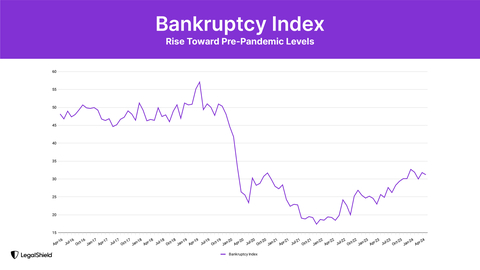

Nationally, the Bankruptcy subindex saw little month-over-month change, declining by 0.6 points to 31.2. However, the index has seen a 21.5% year-over-year increase, continuing a steady rise in bankruptcy inquiries since the end of 2021.

While May’s Consumer Finance subindex numbers show a 2.9% year-over-year decrease, the subindex rose two points over April to 102.1, and has remained relatively flat in 2024.

The Foreclosure subindex retreated by 1.4 points in May to 36.4, continuing a steady decline since last August, down 19.5% in that period. Historically, inquiries regarding foreclosure have been consistent since the spring of 2020, averaging 37.2.

*The April 2024 CSLI and subindices were slightly adjusted to include inquiries not initially tallied in April’s index.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three subindices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.