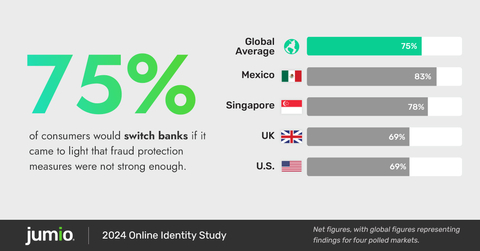

SUNNYVALE, Calif.--(BUSINESS WIRE)--Jumio, the leading provider of automated, AI-driven identity verification, risk signals and compliance solutions, today released new findings from its Jumio 2024 Online Identity Study. This year’s results highlight growing anxiety among consumers that weaknesses in their banks’ fraud-protection measures could leave them exposed to scammers, which would result in the vast majority (75%) switching providers.

Banks have long had to deal with impersonation fraud. But as deepfakes and voice cloning become easier to generate, schemes in which scammers pretend to be anything from a prospective romantic partner to a family member in crisis have the potential to target far more people and with a higher rate of success.

Jumio’s study examined the views of more than 8,000 adult consumers, split evenly across the United Kingdom, United States, Singapore, and Mexico. The data revealed that 75% of consumers feel their banking service provider bears ultimate responsibility for protecting them against cybercrime and fraud.

“This data should be a wake-up call to banks and financial institutions — your customers will take their business elsewhere if you don’t protect them from fraud,” said Anna Convery, Jumio CMO. “As cybercriminals become more savvy with their tactics, it’s essential to fight AI with AI. Banks must implement multimodal, biometric-based verification systems that layer in liveness detection and other advanced technologies to stop deepfakes, detect camera injection and presentation attacks, and prevent stolen personal information from being used.”

As the technology used by fraudsters becomes more sophisticated, the tools to prevent and detect scams must evolve as well. Deepfake videos are being used as clickbait to drive traffic to malicious websites to harvest card payment details. With high anxiety around deepfake technology at an all-time high, more than two-thirds of consumers (67%) are concerned about whether their bank is doing enough to protect customers against deepfake-powered fraud, while 69% demand stronger cybersecurity measures in general.

The rise in deepfake-powered fraud intensifies the pressure on financial services firms to compensate victims when their platforms are exploited for scams, highlighting the need for robust fraud detection platforms. Additionally, three-quarters of consumers (75%) expect a full refund from their bank if they are the victim of cybercrime.

Find additional data and insights here.

Methodology

The research was conducted by Censuswide, with 8,077 consumers split evenly across the United Kingdom, United States, Singapore and Mexico. The fieldwork took place between March 25 and April 2, 2024. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct which is based on the ESOMAR principles and are members of The British Polling Council.

About Jumio

Jumio helps organizations to know and trust their customers online. From account opening to ongoing monitoring, the Jumio platform provides advanced identity verification, risk signals and compliance solutions that help you accurately establish, maintain and reassert trust.

Leveraging powerful technology including automation, biometrics, AI/machine learning, liveness detection and no-code orchestration with hundreds of data sources, Jumio helps you fight fraud and financial crime, onboard good customers faster and meet regulatory compliance including KYC and AML. Jumio has processed more than 1 billion transactions spanning over 200 countries and territories from real-time web and mobile transactions.

Based in Sunnyvale, Jumio operates globally with offices and representation in North America, Latin America, Europe, Asia Pacific and the Middle East and has been the recipient of numerous awards for innovation. Jumio is backed by Centana Growth Partners, Great Hill Partners and Millennium Technology Value Partners.

For more information, please visit www.jumio.com.