EL DORADO HILLS, Calif.--(BUSINESS WIRE)--Patra, a leading provider of technology-enabled insurance outsourcing and software services, is excited to announce the extension of its PolicyCheckingAI to a Self-Service solution that provides access to all brokers and agencies across the industry. As the first company to introduce AI for Policy Checking over a year ago, Patra’s patent-pending PolicyCheckingAI (‘PCAI’) offers insurance professionals an innovative solution to streamline operations and ensure complete and accurate coverage for clients – whether you perform this task in-house through this Self-Service solution or choose Patra’s tech-enabled outsourcing services.

This new SaaS based Self-Service version of PCAI is introducing technologies that streamline workflows for users to automatically capture, compare, and validate policy data effortlessly. Leveraging AI, Patra automates labor-intensive extraction and comparison of policy data and form schedules, then enables quick and intuitive human review, ensuring a flawless process and achieving 100% accuracy. Patra’s AI-powered technology creates material efficiencies that save up to 85% of the time and effort typically needed for the critical task of policy checking. With PCAI, agency staff can now shift their focus from the policy checking process to customer acquisition and retention.

Since the introduction of PolicyCheckingAI, Patra's global service delivery teams have been using this proven capability to automate the checking of hundreds of thousands of commercial P&C insurance policies for dozens of Patra enterprise clients. That experience provided the necessary data to continue the evolution and material advancement of its AI models, leading to the introduction of this Self-Service offering. Insurance organizations that prefer to check policies in-house can now access this technology directly within their own offices and teams.

“Patra’s early adopter clients have leveraged the self-service version of PolicyCheckingAI since early 2024 and provided feedback that’s helped Patra prepare the product for this wider launch. We’ve seen growing excitement over the past few months as our initial users experience what the combination of advanced AI and an intuitive, start-to-finish workflow can do. Clients reported saving 80-90% of their effort checking large and complex policies,” said Will Dogan, Senior Vice President of Product Management at Patra. “Patra’s been benefiting from using PCAI within its service delivery teams for over a year now. With the launch of the self-service solution, Patra will reach a whole new audience eager to give their employees a powerful, easy-to-use software to automate this task – which has long been one of the biggest pain points for our industry. We're thrilled to now offer this to a broader audience and eager to see its impact grow.”

Both the full-service and self-service versions of Patra’s PolicyCheckingAI are powered by advanced automation technology, including Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP). The solution is built on ‘transformer-based’ AI models that have been fine-tuned by processing hundreds of thousands of policies across thousands of carrier and line-of-business combinations.

“By deploying a powerful type of AI known as large language model (‘LLM’) and other advanced techniques, Patra is able to transform complex, varied, and semi-structured documents into structured data, helping address the lack of openness, data standards, and connectivity in insurance,” said Tony Li, CTO of Patra. “By helping individual organizations gain access to their data, our technology not only opens many possibilities internally -- but can eventually allow organizations to share and move data in workflows that span the insurance ecosystem. This is just the beginning.”

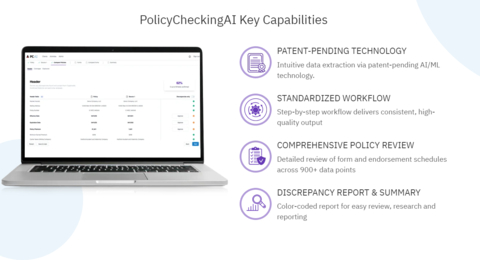

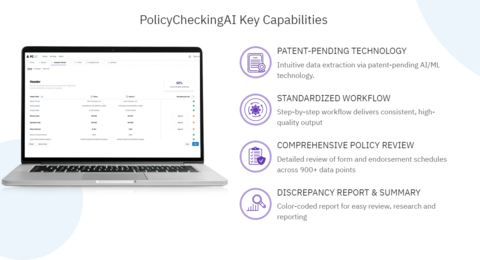

About Patra's PolicyCheckingAI Self-Service Solution

- Extracts key information from unstructured policy documents and converts it into structured data, which the product then compares with similar data from other policy documents. This process allows agencies to ensure their clients have the correct coverage in place, term after term, and across different carriers.

- Form Comparison automatically extracts and compares form schedules across multiple policy terms or source documents.

- Checklist Comparison automatically captures and compares policy header, coverage and limits, and exposures across multiple policy documents.

- The software displays results in an easy-to-interpret and downloadable summary, helping agency staff quickly identify policy gaps or changes needing attention.

- Patra offers broad automation support for 18 top commercial lines of business, with deeper automated analysis for five of those policy types. Additional line-of-business support is continuously being added with regular product releases.

- Leverages a large language model (“LLM”) AI model and other technologies, to transform complex, varied, and semi-structured documents into structured data for analysis.

- The solution runs on Patra’s entirely private cloud network, and no data is sent to any third parties.

Additional Resources

- Learn more about Patra's AI Based Policy Checking Technology

- Learn more about Patra Shield providing SOC2 Compliance

- Learn more about Patra's Self-Service Solution and Schedule a Demo

About Patra

Patra is a leading provider of technology-enabled outsourcing services and software solutions to the insurance industry. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra's global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies/brokerages, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.

For more information on Patra's insurance policy lifecycle and administrative services and software solutions, visit www.patracorp.com.