CHICAGO--(BUSINESS WIRE)--BDO’s 2024 Tax Strategist Survey, released today, finds that tax leaders are expected to play a critical role in informing business strategy, while still leading the tax function through changing tax legislation and regulation, spearheading tax innovation, and using insights to manage tax risk. Yet the survey also reveals that many tax leaders lack the resources necessary to execute these mandates.

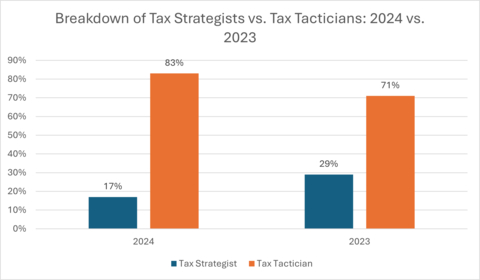

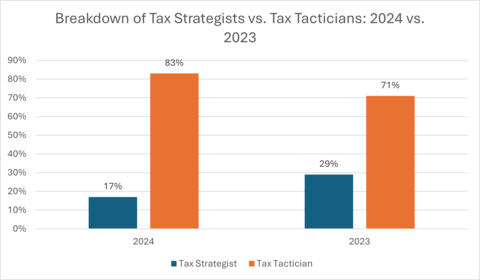

The 2024 survey shows that fewer tax leaders are operating at a highly strategic level, compared to last year’s study. As a result, fewer respondents were classified as Tax Strategists, a category of tax leader who has substantial influence over key business decisions. Instead, more survey participants fell into the Tax Tactician category – tax leaders who contribute strategically to the business but are more often consulted after business decisions are made.

The year-over-year decline in Tax Strategists suggests that in an increasingly complex tax environment, many leaders are likely becoming entrenched in the day-to-day reporting and compliance demands of the job. From navigating intricate global tax requirements to leading new technology initiatives, tax leaders may be overburdened and under-resourced, preventing them from taking on a larger role in shaping overall business strategy.

“To transition from Tactician to Strategist, tax teams need a shift in approach,” says Matthew Becker, National Managing Principal of Tax at BDO. “First, they should evaluate their team, processes, and technology to identify areas for improvement. Then they should consider how to bolster communication with key organizational leaders to build trust and advocate for the resources needed to execute effectively. Finally, they should involve the entire tax team in strategic efforts. This will foster a culture of collaboration, innovation, and growth.”

Tax leaders look to improve risk management

Nearly half of all organizations say they plan to increase investment in tax risk management in 2024. Top risks for tax leaders include an inability to keep up with changing regulatory requirements, technology challenges and/or outdated tax technology, and rapid growth, either organic or through an acquisition. One strategy for mitigating these risks is to invest in hiring and training. The survey shows that 36% of tax leaders are investing in training, while 29% are investing in hiring.

The unknowns of the 2024 election challenge tax planning

Tax leaders of all levels say the uncertainties of the 2024 election present challenges for tax planning. While Tax Strategists are most concerned about changes to the Inflation Reduction Act renewable energy subsidies (52%), Tax Tacticians are most concerned about changes to federal corporate income tax rates (44%). Another top concern shared by both Tax Strategists and Tax Tacticians is international tax and trade policy. Pillar Two of the Organisation for Economic Co-Operation and Development’s (OECD’s) framework to address base erosion and profit shifting places substantial compliance and financial reporting burdens on in-scope companies. And the fact that it remains unclear if the U.S. will adapt its laws to the OECD Pillar Two agreement only complicates the matter.

Tax-ESG intersection stumps tax leaders

Fewer tax leaders in the 2024 survey (28%) say they have a strong understanding of how tax and environmental, social and governance (ESG) strategy intersect at their organization compared to the 2023 survey (45%).

The majority (56% of tax leaders) also say that although they have a formal mandate to advance ESG strategy, they are not executing against that mandate effectively. By remaining involved in strategic business conversations and decision-making, tax leaders can identify areas where tax can collaborate to meet ESG goals.

AI’s potential to transform the tax function

The top technology that tax leaders say they are planning to deploy in the next 12 months is artificial intelligence (AI)/machine learning. Unsurprisingly, Strategists are more likely to have already begun implementing AI and machine learning (55%), compared to Tacticians (34%).

However, despite interest and enthusiasm for AI, tax leaders may not have the data foundation necessary to execute their lofty goals. Thirty-nine percent of tax leaders say they spend 25%-50% of the time dedicated to tax reporting on extracting and managing underlying data, suggesting that many tax teams still need to strengthen data management strategies and work to automate manual processes before they are ready for AI.

By tapping into technology, tax departments can provide strategic insights and cost savings – even when budgets are tight and regulations are evolving rapidly. By continuing to demonstrate the tax team’s credibility as a source of insight and value, more tax leaders can become Tax Strategists.

Download the full 2024 Tax Strategist Survey here.

About BDO USA

Our purpose is helping people thrive, every day. Together, we are focused on delivering exceptional and sustainable outcomes and value for our people, our clients and our communities. BDO is proud to be an ESOP company, reflecting a culture that puts people first. BDO professionals provide assurance, tax and advisory services for a diverse range of clients across the U.S. and in over 160 countries through our global organization.

BDO is the brand name for the BDO network and for each of the BDO Member Firms. BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. For more information, please visit: www.bdo.com.

About the Tax Strategist Survey

The 2024 Tax Strategist Survey was conducted in February 2024 and polled 180 senior tax leaders, including tax directors, chief tax officers, tax executives and chief financial officers (CFOs) at companies with revenues ranging from $250 million to $3 billion. The survey was conducted by Rabin Roberts Research, an independent marketing research firm, using Slice MR, a leading market research partner, that provides dependable and comprehensive survey panel services.