SEATTLE--(BUSINESS WIRE)--An independent survey commissioned by ShareBuilder 401k, a leading digital 401(k) provider specializing in low-cost, all-ETF retirement products and resources for small- to mid-sized companies, reveals that only 24% of small businesses with 1-50 employees offer 401(k) benefits to their employees. The survey identified key barriers preventing wider adoption, including the belief by 55% of respondents that their business is too small to access a plan or that they cannot afford to offer a company match (28%). Additionally, 22% of owners believe providing a 401(k) plan is too expensive.

Any size business, including the self-employed, can offer a 401(k), and matching is not required to offer 401(k) benefits. In addition, most small business owners are unaware of recent legislative changes and the low-cost providers in the marketplace designed to make retirement plans affordable for businesses of any size. The Secure Act 2.0 enacted provides significant tax incentives for small businesses with tax credits that apply to many employer costs, including matching. In many cases, the tax credits make offering a 401(k) cost-neutral for the first three years after starting their benefits. Only 18% of small business owners know of the Secure Act 2.0 tax credits. Furthermore, providers like ShareBuilder 401k have developed retirement plans specifically catering to small businesses' needs and constraints.

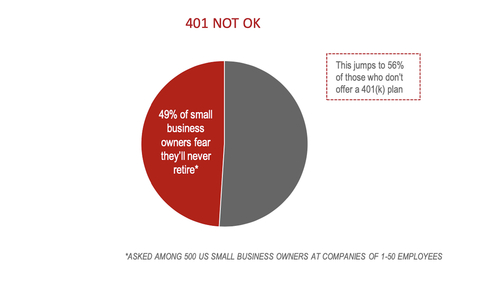

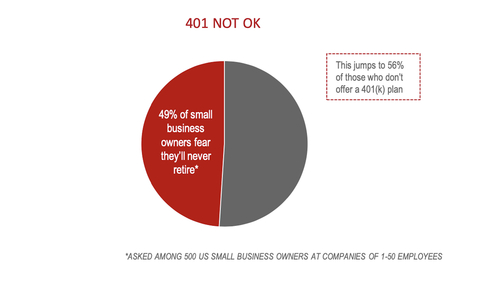

The survey also uncovered troubling trends in personal retirement savings among small business owners. A significant portion, 23%, are saving less than 1% of their income for retirement, 17% are saving between 1-9%, and a striking 25% are not contributing to their retirement. Most experts believe Americans must save 10-15% of their earnings over their careers to retire at their current standard of living. Nearly half (49%) of the respondents expressed doubt that they will ever be able to retire, highlighting the urgency of addressing these misconceptions and enhancing retirement readiness.

"Nearly half of all Americans work for small businesses, and 401(k)s have proven effective in helping employees build meaningful nest eggs for retirement," said Stuart Robertson, CEO of ShareBuilder 401k. "The need to debunk these misconceptions about the access and affordability of 401(k) plans for small businesses is essential to help a large swath of Americans to have the option to retire with financial security. As a country and industry, we must spread awareness about the Secure Act 2.0 tax credits and the tailored solutions available to any size business, including the self-employed, to help ensure a more secure financial future for all and avoid a retirement crisis many indicate lies ahead."

ShareBuilder 401k, a pioneer in creating cost-effective retirement plans for small businesses, emphasizes that tailored solutions are within reach. By leveraging the provisions of the Secure Act 2.0, small businesses can offer competitive retirement benefits without incurring prohibitive costs.

"As a 401(k) provider that serves thousands of small businesses, we understand the unique challenges these businesses face," continued Robertson. "Our mission is to make it easy and affordable for small businesses to provide their employees, including themselves, with a powerful 401(k) plan to help build for retirement security they deserve.”

The ShareBuilder 401k Survey was conducted by Wakefield Research on April 19 - 24, 2024, among 500 US small business owners at companies of 1 - 50 employees, using an email invitation and an online survey. The sample was selected to be representative of the small business landscape in the US, with companies from various industries and geographical locations. This survey has been conducted bi-annually since 2013, monitoring key trends in the small business retirement landscape.

For more information on how small businesses can take advantage of the Secure Act 2.0 and tailored 401(k) plans, visit www.sharebuilder401k.com

About ShareBuilder 401k

ShareBuilder 401k is a leading digital 401(k) provider specializing in low-cost, all-ETF retirement products and resources for small- to mid-sized companies, including owner-only businesses. Founded in 2005, and now serving more than 6,500 businesses across the US, ShareBuilder 401k is a pioneer of the index-based 401(k), digital quoting and purchasing of retirement plans, and providing investment management (ERISA 3(38)) services for every client’s fund roster. ShareBuilder 401k is committed to expanding access to retirement plans and leading more Americans to save through cutting-edge technology, low costs and quality education and support.