LONDON--(BUSINESS WIRE)--The FICO UK Credit Card Market Report for March 2024 suggests a fairly stable picture of consumer credit usage, with many trends following the usual annual patterns. However, spend dropped to its lowest level since March 2023, perhaps reflecting the influence of poor weather conditions on consumer activity. Missed payments also continue to be erratic, requiring lenders to remain vigilant.

Highlights

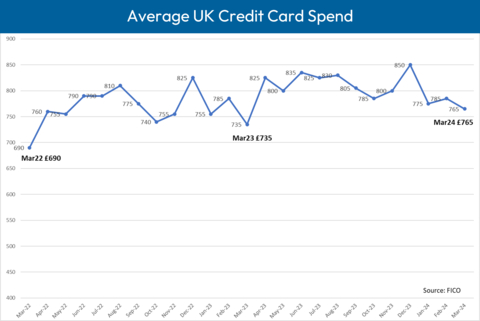

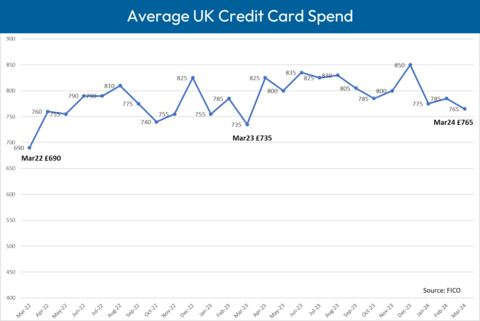

- Average UK credit card spending fell month-on-month to £765, the lowest level for 12 months

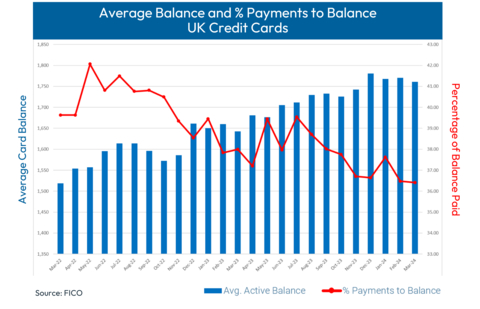

- Average credit card balances fell slightly on the previous month but remain 7.2% higher than 2023 at £1,760

- The number of accounts with one missed payment rose more than 15% compared to February 2024, but is slightly lower than March 2023

- More accounts missed two and three payments than in March 2023

- Average credit limits increased on the previous month as well as the previous year

Key Trend Indicators – UK Cards March 2024

Metric |

Amount |

Month-on-Month Change |

Year-on-Year Change |

Average UK Credit Card Spend |

£765 |

-2.8% |

+3.8% |

Average Card Balance |

£1,760 |

-0.5% |

+7.2% |

Percentage of Payments to Balance |

36.4% |

-0.2% |

-4.2% |

Accounts with One Missed Payment |

1.7% |

+15.3% |

-0.9% |

Accounts with Two Missed Payments |

0.3% |

+3.9% |

+5.5% |

Accounts with Three Missed Payments |

0.2% |

-1.1% |

+8% |

Average Credit Limit |

£5,655 |

+0.2% |

+1.9% |

Average Overlimit Spend |

£90 |

+4.7% |

-6.3% |

Cash Sales as a % of Total Sales |

0.9% |

-0.2% |

+0.1% |

Source: FICO |

FICO Comment

Having risen slightly in February, average spend fell by 2.8% month-on-month to £765 in March 2024, the lowest point since March 2023. With inflation remaining high, spending was naturally higher in March 2024 than the same month last year. However, with spending at its lowest point for 12 months, there’s a clear picture of a depressed consumer market with the poor weather and continuing inflationary pressures taking their toll on retail spending.

Whilst spending has been depressed, average credit card balances have risen 7.2% year-on-year to £1,760. Credit card providers should also be aware that the percentage of payments to balance is continuing its general downward trend, having fallen again – by 0.2% on the previous month and 4.2% year-on-year. With salaries not keeping pace with higher costs, and savings no longer able to fill the gap, this trend is likely to continue for some time.

Continuing an erratic trend, the percentage of customers missing one payment rose by 15.3% from February to March, having fallen by 10.9% from January to February. This up and down pattern has been seen for the last couple of years and although 0.9% down year-on-year, has been trending steadily upwards since April 2022.

The upward trend of missed payments is more noticeable for customers missing two payments, a percentage which has increased 3.9% on the previous month and 5.5% on the previous year. Customers missing three payments is 8% higher than this time last year, albeit 1.1% lower month-on-month.

Looking at the outstanding balances on those accounts with missed payments, there has been a month-on-month decrease for those missing one and two payments. However, for all customers missing one, two or three payments, there has been a year-on-year increase.

The other measure of financial stress is the percentage of customers using credit cards to take out cash. The percentage of accounts using their cash limit fell by 2% since the previous month. Despite this reduction, cash sales remain slightly higher than the same time last year and are likely to increase during the summer months.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 4 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and other countries, improving risk management, credit access and transparency. Learn more at www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.