INDIANAPOLIS--(BUSINESS WIRE)--Hospitals and health systems are seeing a sharp increase in the dollar value of claims that insurers are refusing to pay even after appeals, according to data collected by Kodiak Solutions (formerly Crowe healthcare consulting) and analyzed in its latest quarterly revenue cycle benchmarking report.

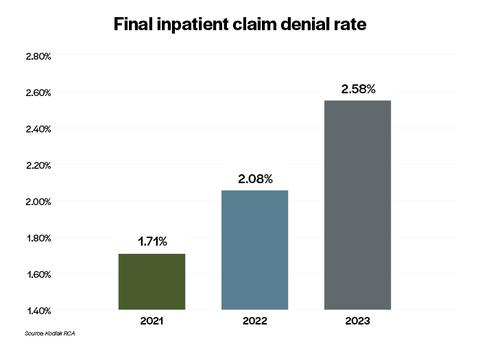

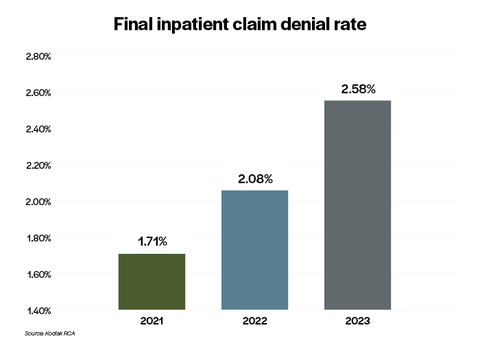

The final denial rate on inpatient claims, as measured by the dollar value of claims denied as a percentage of the total dollar value of inpatient claims analyzed in the report, increased by 51% from 2021 to 2023. That is according to analysis done using Revenue Cycle Analytics, Kodiak’s proprietary software that monitors every patient financial transaction from more than 1,850 hospitals and 250,000 physicians nationwide.

The increase in initial denials of inpatient claims by insurers for prior authorization and precertification errors mirrors the increase in the final inpatient denial rate: Initial denials for these errors has risen from 1.73% of the value of inpatient claims in 2021 to 2.18% in 2023, a 26% increase. Prior authorization and precertification initial denials also are up for outpatient procedures, from 0.93% of claims value in 2021 to 1.08% in 2023, a 16% increase.

“The increase in final inpatient claim denials drained $1.2 billion in revenue that hospitals and health systems rely on to provide care to their communities,” said Colleen Hall, senior vice president and Revenue Cycle leader at Kodiak Solutions. “On top of that, more initial claims denials mean hospitals are spending more money and other resources to appeal these denials, adding to the financial impact of the revenue loss from final denials.”

Hall recommends revenue cycle leaders work closely with clinical teams to align on the level of care provided to each patient, analyze the differences in prior authorization and precertification initial denials by payor, and communicate trends in payor behavior with their advocacy partners, such as state and national hospital associations and medical societies.

The May 2024 Kodiak RCA Benchmarking Analysis details the differences in prior authorization and precertification initial denials by payor type and provides additional insights on these issues.

To view the full report, please visit “Necessity is the mother of claim denials.”

About Kodiak Solutions

Kodiak Solutions is a leading technology and tech-enabled services company that simplifies complex business problems for healthcare provider organizations. For nearly two decades as a part of Crowe LLP, Kodiak created and developed our proprietary net revenue reporting solution, Revenue Cycle Analytics. Kodiak also provides a broad suite of software and services in support of CFOs looking for solutions in financial reporting, revenue cycle, risk and compliance, and unclaimed property. Kodiak’s 400 employees engage with more than 1,850 hospitals and 250,000 practice-based physicians, across all 50 states, and serve as the unclaimed property outsourcing provider of choice for more than 2,000 companies. To learn more, visit our website.