OAKLAND, Calif.--(BUSINESS WIRE)--Today, Square released the latest edition of its Quarterly Restaurant Report, which uses data across Square’s food and beverage sellers to examine dining trends, along with shifts in consumer spending and restaurant wages.

Full-service restaurants and bars see payroll costs increase

Labor continues to be one of the biggest operating expenses for restaurants. According to data from the Square Payroll Index, since 2017, average hourly earnings for restaurant workers have grown 66% compared to 40% for retail workers as of April 2024.

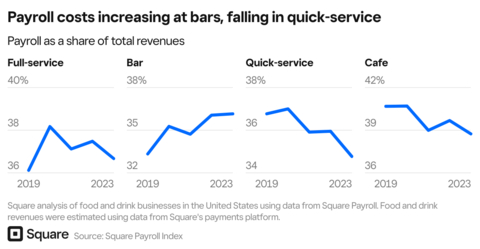

When looking at payroll as a share of revenue, Square found that payroll costs have grown faster in certain sub-sectors compared to others. Payroll has increased for full-service restaurants and bars since 2019, while conversely, cafes and quick-service restaurants have seen payroll costs fall.

Ming-Tai Huh, Head of Restaurants at Square, shared: “Bars and full-service restaurants rely more on higher-skilled employees who perform hard-to-automate tasks, which increases payroll costs. It’s the exact opposite situation for QSRs and cafes. These sellers can more easily use technology to automate and streamline operations, helping lower operating costs for front and back of house.”

Has Chicago already ended the tip credit?

Last year, Chicago approved an ordinance to end the tip credit, raising the minimum wage for tipped workers. This change will raise the minimum wage for tipped employees from approximately $9 to $15.80 per hour for businesses with 21 or more workers. The first increase will take place on July 1, 2024, happening every year until 2028 when the law goes into full effect.

As of April 2024, Square found that 62% of restaurant workers in Chicago are already paid a base wage of $15.80 per hour. Square Payroll Index also shows that the median restaurant worker in Chicago currently makes $16.12 per hour before tips and overtime, or $21.70 including tips and overtime.

“Twenty two states have already raised their minimum wage this year, with several more scheduled in the coming months. In addition, a number of state and local governments are working on similar bills to phase out tip credit,” said Ara Kharazian, Square Research Lead and principal developer of Square Payroll Index. “In an industry where profit margins are already tight, restaurants can increase staff efficiency with technology. This helps free up their time to focus on the customer-facing aspects of the business versus manual, tedious tasks.”

Weekday happy hour stays strong, while restaurant volume shifts to the weekends

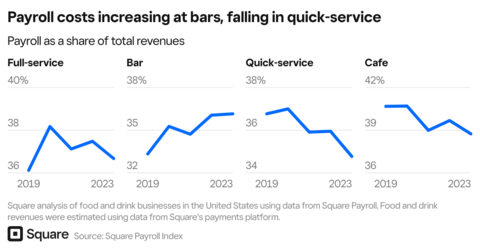

Although many office workers continue to prefer remote and hybrid-work schedules, Square data revealed that end-of-day happy hour remains a priority. Based on restaurant and bar traffic between 4 - 6 p.m., happy hour has remained resilient and is slightly above pre-pandemic levels when comparing 2019 to 2023. On the other hand, weekday lunch is down across the U.S. and all major cities and has yet to recover to pre-pandemic levels.

Kharazian adds: “There’s a perception that consumers are cutting back at restaurants, when in fact total spending has increased. The bigger change is in consumer behavior. Before COVID, consumers were going out more during the week to eat lunch by their office and grab drinks after work. Now with remote work, restaurant spend has shifted to the weekend and we now see that weekend traffic is at its peak.”

Tequila and vodka battle for top spirit

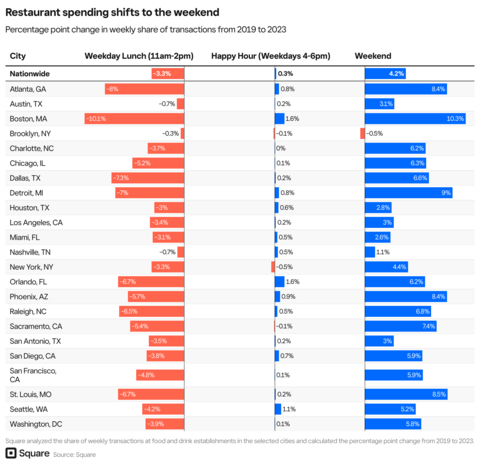

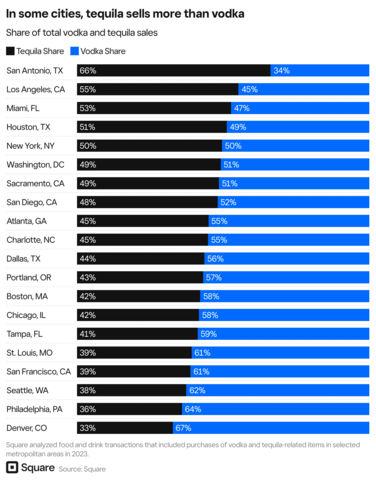

The weather has started to warm up and consumers are heading outside to soak up the beautiful weather and enjoy drinks with family and friends. Square analyzed consumer appetite between two summer cocktail staples – tequila and vodka. Results show that while vodka is the overall winner, there are some cities that prefer tequila.

In order, San Antonio, Los Angeles, and Miami have the strongest taste for tequila, followed by Houston and New York City. Whether it’s a moscow mule, margarita, or espresso martini, restaurants can anticipate a busy season ahead. Square found that every year, restaurant spend increases at the end of March as patio season kicks off. Busy season continues until the beginning of September, before a natural dip ahead of the holiday rush that spikes after Thanksgiving.

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.