BERKELEY, Calif.--(BUSINESS WIRE)--Thintronics Inc. is a California-based electronic materials startup supplying high-performance insulators for emerging AI datacenter, networking, and RF/millimeter-wave (mmW) applications.

Thintronics Inc. has raised a Series A funding round for $23M, led by Maverick Capital and Translink Capital. Series A funding will support commercialization of a novel insulator platform.

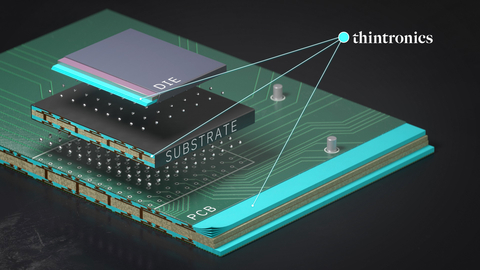

The company was founded on the idea that conventional assumptions guiding insulator material development limited the capacity of the industry to innovate. They have since developed a suite of high-performance materials that display electrical and mechanical characteristics that far outpace the state of the art. Thintronics’ CEO Stefan Pastine emphasizes that "the interconnect insulator is foundational to modern electronics; however, it has yet to be optimized to operate near the theoretical limit of insulation. Additionally, the supply chain is fragmented across multiple electronic architectures. It is our vision to optimize the insulator and unify it across the fabric."

Maverick Capital’s Kenny Safar is convinced that “to satisfy the explosive growth in demand for high performance compute, AI datacenters will need to incorporate faster data transfer speeds and wider bandwidth, while improving on power consumption and signal integrity. This is a formidable challenge that requires material redesign across all levels of the interconnect fabric, and we believe that Thintronics’ innovation in insulator film is a fundamental substrate-level enabler as AI servers adopt 224G standards and beyond. Additionally, Thintronics domestically sources all its components, and we believe this is a crucial step in onshoring advanced packaging technologies and ensuring that supply chains are vertically integrated in the U.S.”

Translink Capital’s Brendan Walsh is “thrilled to support the Thintronics team in realizing their vision to deliver novel materials solutions which elegantly solve critical electrical performance bottlenecks for the AI data center and other high-performance applications. As the industry grapples with the end of Moore’s Law, which has driven semiconductor scaling for decades, the increased adoption of multi-chip packaging and PCB-level solutions becomes paramount. Thintronics’ holistic solutions across technology disciplines are precisely what is urgently needed to realize higher performance from the global supply chain.”

To satisfy this growing demand Thintronics is entering the insulator market with technologies targeting chipsets, switches, and datacenter integrators for 224G links and beyond. For CTO Tristan El Bouayadi, "The combination of superior electrical and thermo-mechanical performance allows our customers to unlock new design possibilities and new applications in Networking, AI acceleration, RF mmW communication, and Radar. Additionally, by synthesizing ultra-thin dielectric layers, Thintronics enables form factor design optimization for Consumer and Infrastructure devices and products."

Pastine highlights that "Maverick and Translink bring deep connections and experience in our target entry markets, and a powerful ecosystem of partner companies here in the US and in Asia” and stresses “their expertise and networks in semiconductor and high-speed digital markets can ensure our success."

ABOUT THINTRONICS

Thintronics Inc. is reinventing interconnect insulator technologies to unlock next-generation computing, networking and wireless performance. The company's novel materials enable wider bandwidths, increased power efficiency, and highly integrated form factors for advanced computing and communication systems.

ABOUT MAVERICK CAPITAL

Maverick Capital is a global investment firm that has been investing in early-stage companies for over 30 years. By working with Maverick, early and growth stage entrepreneurs get the best of both worlds – a focused, agile team of venture partners – and the resources, reputation and relationships of a multi-billion-dollar manager.

ABOUT TRANSLINK CAPITAL

Headquartered in Palo Alto, California, Translink Capital is an early-stage venture capital firm investing in technology-based startups in the enterprise, infrastructure, sustainability, and robotics sectors. Founded in 2006, the firm has over $1 billion of assets under management and has been engineered to bring founders and their innovative companies together with a unique set of global resources and networks to support their journey to build foundational companies in their sector.