BEAVERTON, Ore.--(BUSINESS WIRE)--Spot truckload rates continued to slide in March as demand for trucking services moved toward typical seasonal levels, reported DAT Freight & Analytics, which operates the DAT One online freight marketplace and DAT iQ data analytics service.

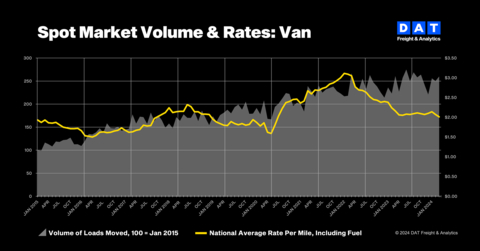

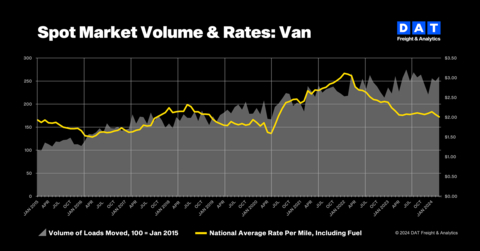

The DAT Truckload Volume Index (TVI), an indicator of loads moved in a month, increased modestly for all three equipment types compared to February:

- Van TVI: 260, up 4.0%

- Refrigerated TVI: 200, up 2.6%

- Flatbed TVI: 242, up 4.4%

Volumes typically increase from February to March, which had two more shipping days this year. “The decline in van and reefer spot rates coincided with the demand for truckload services picking up marginally toward the end of the month,” said Ken Adamo, Chief of Analytics, DAT Freight & Analytics. “There were no big swings or signs that spot-market volumes or capacity will change beyond what we expect from produce, construction materials, and summer retail goods starting to move.”

Van and reefer rates fell

The national average spot van and reefer rates fell for the third straight month.

- The van rate averaged $2.01 per mile, down 6 cents compared to February and 15 cents lower year over year.

- The reefer rate fell 8 cents to $2.35 a mile, down 15 cents year over year.

- The flatbed rate rose 1 cent to $2.50 a mile, down 21 cents year over year.

Line-haul rates subtract an amount equal to an average fuel surcharge (46 cents per mile for vans, 50 cents for reefers, and 55 cents for flatbeds). The line-haul van rate averaged $1.55 per mile, down 5 cents compared to February, and the average reefer rate was $1.85 a mile, down 7 cents month over month. The average line-haul flatbed rate was $1.95, up 2 cents month over month.

Contract rates made gains

Rates for contracted truckload freight declined for van and reefer freight. The DAT iQ benchmark contract van and reefer rates dipped 3 cents to $2.48 and $2.86 a mile, respectively. The flatbed rate gained 4 cents to $3.18.

The margin between spot and contract rates increased for all three equipment types. It was 47 cents for van freight, 51 cents for reefers, and 68 cents for flatbeds. A lower spread typically indicates more pricing power for motor carriers.

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a truckload pricing database and analysis tool with rates paid on an average of 3 million loads per month.

DAT benchmark spot rates are derived from invoice data for hauls of 250 miles or more with a pickup date during the month reported. Line-haul rates subtract an amount equal to an average fuel surcharge.

About DAT Freight & Analytics

DAT Freight & Analytics operates the largest truckload freight marketplace in North America. Shippers, transportation brokers, carriers, news organizations, and industry analysts rely on DAT for trends and data insights based on more than 400 million freight matches and a database of $150 billion in annual market transactions.

Founded in 1978, DAT is a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.