Activist Adam Arviv Announces Intent to Nominate New Slate of Directors to the Board of WonderFi

Activist Adam Arviv Announces Intent to Nominate New Slate of Directors to the Board of WonderFi

- Major shareholders representing ~22% of WonderFi stock are demanding urgent change as share price plummets during the strongest bull run in history for crypto currencies like Bitcoin

- KAOS Capital CEO Adam Arviv leading the charge to replace the entrenched and disorganized Board that missed opportunities to capitalize on the Company’s position as the only fully regulated crypto exchange in Canada

TORONTO--(BUSINESS WIRE)--KAOS Capital Ltd. (“KAOS”), a significant shareholder in WonderFi Technologies Inc. (TSX: WNDR) (OTCQB: WONDF) (“WonderFi” or the “Company”), today announced its intent to nominate five highly experienced individuals to the WonderFi Board of Directors (the “Board”) ahead of the annual general meeting scheduled to be held on May 21, 2024.

KAOS’s call for change in the Board reflects its dissatisfaction with WonderFi’s lifeless stock performance and its failure to capitalize on its position as the only fully regulated crypto exchange in Canada. The current Board has overseen extremely poor performance as compared to other public securities in the global crypto space during the strongest bull run in history for crypto currencies like Bitcoin.

The current Board has repeatedly refused to engage on plans to restore investor confidence, leading KAOS to this decision to nominate a more effective and engaged slate of directors. KAOS’ call for change has significant support from shareholders, and cumulatively represents approximately 22% of the issued and outstanding shares, including Mogo Inc. (TSX:MOGO) (NASDAQ:MOGO) (“Mogo”), the Company’s largest shareholder, which holds approximately 13% ownership interest, and with whom KAOS has entered into a voting agreement.

KAOS is confident that new leadership will enable WonderFi to realize its significant upside potential and gain traction within the re-accelerating crypto marketplace. KAOS has recognized that the current weak leadership is not capable of capitalizing on opportunities in the marketplace and is holding the Company back, resulting in the stock trading significantly below its comparable peers and Company’s intrinsic value.

“As the cryptocurrency market rebounds, WonderFi is uniquely positioned to leverage its position as the only fully regulated crypto exchange in Canada,” said Adam Arviv, CEO of KAOS. “Strong leadership is imperative to capitalizing on this opportunity and the current Board has not shown itself to be capable or engaged enough to lead the way. Rather than engaging constructively and identifying a path forward, the current Board has taken the approach of stonewalling its shareholders. A proxy contest was not our first choice, but unfortunately is now required if shareholder value is to be protected and enhanced.”

“This need for new leadership has already been identified by a large proportion of shareholders and every day more shareholders are joining our call for change,” added Arviv. “I encourage the Board not to waste more Company resources and to participate in an orderly transition, given that change is inevitable.”

MISSED OPPORTUNITIES: FAILURE TO CAPITALIZE ON STRENGTHS

As the only Canadian crypto exchange listed on the Toronto Stock Exchange, WonderFi has been unable to seize the opportunities presented by the cryptocurrency rebound. Comparison of WonderFi's performance with Coinbase and other industry peers highlights significant divergences and underscores ample room for improvement.

This failure is compounded by a lack of product strategy and fragmented brand positioning, eroding investor confidence and perpetuating value destruction. KAOS believes that a valuable asset with significant upside potential is being led astray by a weak Board and Management, squandering opportunities and driving the stock price far below its true intrinsic value.

SIGNIFICANT UNDERPERFORMANCE

Despite the thriving crypto market seeing double and triple-digit growth, the Company’s share price has witnessed significant value destruction this year.

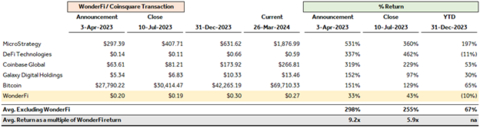

As of market close on March 26, 2024, WonderFi’s stock price performance indicates fundamental underperformance, resulting in shareholder value destruction when compared to similar issuers/assets. A comparison of WonderFi’s share price against Coinbase Global Inc. (NASDAQ: COIN), DeFi Technologies (NEO: DEFI), Galaxy Digital Holdings (TSX: GLXY), MicroStrategy Inc. (NASDAQ: MSTR), and Bitcoin (BTC), across three distinct periods highlights this trend: from the announcement of the WonderFi and Coinsquare deal, the close of the deal, and year-to-date.

During these periods, WonderFi's stock price performance was as follows: 33% return during the announcement period, 43% return at the close of the deal, and a decline of -10% year-to-date. However, when compared to the average return of the other five selected comparables, WonderFi's performance exhibited a notable downward variance. The average returns of the comparables were significantly higher in the same periods, demonstrating average returns of 298%, 255%, and 67%, respectively.1

The Company’s missteps lie not only in its financial performance but also in its investor relations strategy, which has favoured issuing superficial press releases over substantive engagement with shareholders. This flawed approach has done little to increase investor confidence, instead raising valid concerns regarding the transparency and credibility of the company’s communication practices.

SUPPORT FROM WONDERFI’S LARGEST SHAREHOLDER

To ensure that WonderFi is on the track to maximizing shareholder value, KAOS and Mogo have entered into a voting agreement where Mogo will support the five nominees put forth by KAOS. This agreement is significant given that Mogo is the Company’s largest shareholder representing approximately 13% ownership interest and brings intimate knowledge of the business and industry in which the Company operates.

Mogo was also the largest shareholder of Coinsquare, which was acquired by WonderFi last year. This alignment creates opportunities for decisive action in guiding WonderFi towards positive outcomes for the Company and all its stakeholders.

POOR CAPITAL ALLOCATION TRACK RECORD

- In assessing the Company’s capital allocation practices, several areas of concern have surfaced. This includes a lack of strategic coherence in mergers and acquisitions, coupled with inadequate follow-through on integrating acquired assets effectively.

- The haphazard integration of five acquisitions made over the last two years and the presence of multiple brands and platforms has contributed to market confusion. The Company's recent announcement on March 19, 2024, regarding the acquisition of FX Institutions Pty. Ltd. in Australia is another example of a misguided go-forward strategy that has confused investors. This acquisition appears to be following the same pattern of previous ill-advised acquisitions under the current Board.

- Significant impairments from past acquisitions have raised questions about the Board’s oversight. The earlier acquisition of three entities totaling $158 million by December 2022 resulted in impairment charges of $121 million, representing 77% of the acquisition value.

- In 2023, two additional acquisitions valued at $74 million led to a 70% dilution of shareholder value, with a looming threat of further impairments. This pattern has contributed to an accumulated deficit of approximately $200 million as of September 2023.

TUMULTUOUS TURNOVER IN LEADERSHIP

- Over the past two years, the Company has experienced a tumultuous turnover in leadership, with changes including the departure of the CEO, two CFOs, the CSO, and multiple directors. This whirlwind of personnel shifts at the executive level has raised concerns regarding the Company’s strategic trajectory and governance practices.

- As recently as last month, there were discussions around another major change in management with the board and third parties.

LOSS OF TRUST IN LEADERSHIP

- WonderFi's shareholders have lost trust in the Board’s ability to protect investors’ interests and lead the Company into the future.

- KAOS cautions the Board not to take any defensive or further entrenchment actions or attempt to delay the previously scheduled WonderFi shareholder meeting. Any sale, transaction or other fundamental change being contemplated should be halted until shareholders have the opportunity to vote for a refreshed board.

- Considering the views of a significant percentage of the Company's shareholders, the urgency of the situation and the likely disruption, distraction, and costs of a proxy contest, the shareholders request that the current Board carefully consider and do what is right for WonderFi and its shareholders.

- All shareholders are advised the current Board may try to shift focus with an aggressive smear campaign to distract shareholders from the core issue of ongoing value destruction and poor governance. The only thing consistent about this Board’s actions is dysfunction.

KAOS welcomes the opportunity to engage with fellow shareholders who believe that the Company needs better governance and a swift recovery in share price.

Interested parties can contact Kingsdale Advisors to share their concerns about the current leadership of WonderFi by calling 1-855-682-2031 (toll free in North America) or 1-437-561-5036 (text or call enabled outside North America) or emailing contactus@kingsdaleadvisors.com.

About KAOS

KAOS, a Miami-based hedge fund management firm with offices in Nassau, Bahamas, and Toronto, Canada, was founded in 2019 by its CEO, Adam Arviv.

The firm specializes in opportunistic investing in equities venture capital strategies and activist investing, principally in Canada. As an activist, KAOS has won board seats, challenged transactions, strengthened corporate governance, and ensured company leadership remains accountable to maximize shareholder value.

Advisors

Kingsdale Advisors is serving as KAOS’ strategic shareholder and communications advisor; Bennett Jones LLP is serving as legal advisor; and Canaccord Genuity Corp. is serving as the financial advisor.

Stikeman Elliott LLP is acting as legal advisor to Mogo.

Additional Information

The information contained in this press release does not and is not meant to constitute a solicitation of a proxy within the meaning of applicable corporate and securities laws. While KAOS intends to take additional steps in the future, which may include submitting director nominees pursuant to the advance notice requirements of the Company’s articles, soliciting proxies of shareholders, filing a dissident information circular and/or other actions or steps, shareholders are not being asked to execute or not execute a proxy with respect to any matter at this time (including any potential nominees of KAOS).

1 Financial figures are based on local currency; Bitcoin priced in USD.

Contacts

Kingsdale Advisors:

Aquin George

Director, Special Situations

Phone: 647-265-4528

Email: ageorge@kingsdaleadvisors.com