FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--Haig Partners LLC, released its closely followed Haig Report® for Q4 2023, which tracks trends in auto retail and their impacts on dealership values. Demand for dealerships was strong through the end of 2023, with an estimated 528 dealerships trading hands, the third-highest annual volume on record (as predicted in the Q3 2023 Haig Report®). Dealership profits, although ticking downward, were still 2.3x higher than pre-pandemic levels, keeping buyers and investors alike attracted to auto dealerships.

In 2023, Haig Partners advised on two record-setting deals, fetching the highest price for Toyota and Stellantis dealerships. Al Hendrickson Toyota sold for the highest price ever paid for a dealership of any kind at the time, and Lake Norman CDJR set a record for the highest value paid for a Stellantis store. In the first quarter of 2024, Haig Partners advised on the record-setting sale of South Motors / Vista Motors. Although the transaction price cannot be disclosed, it is believed that the sale represented the highest values ever paid for BMW and Honda dealerships.

Profits per dealership for the publicly traded retailers declined an estimated 23% from 2022 to 2023. In Q4 2023, average profits per store fell 31% from Q4 2022, and it seems likely the decline will continue for the foreseeable future due to rising inventories and higher floorplan expense. Even at this lower level, however, per dealership profits in Q4 2023 were still an estimated 78% higher than they were in Q4 2019, just before the pandemic struck. Dealers we speak with believe profits will decline again through 2024, perhaps ending up an estimated 15% below current levels.

Haig Partners estimates that the average blue sky value per publicly owned dealership at the end of 2023 declined by 14% from 2022, a little over 1% per month through the year. The decline in blue sky values was less than the decline in profits, as buyers had already factored in their expectations of declining profits. Haig Partners believes blue sky values for most dealerships will continue to decline in 2024 as their profits continue to moderate.

Highlights from the Q4 2023 Haig Report® include:

- 2023 was the third-busiest year in automotive history for dealership M&A, with an estimated 528 dealerships bought/sold.

- Approximately 90% of the dealerships were acquired by private dealers or investors.

- Public company spending on domestic auto dealership acquisitions reached $2.8B in 2023, the second-highest amount on record and 50% higher than in 2022.

- The average publicly owned dealership made $5M in FY2023, a 23% drop from year-end 2022.

- Average estimated profits per dealership were 78% higher in Q4 2023 compared to Q4 2019, before the pandemic hit.

- Average estimated blue sky values declined 14% from the record levels seen in 2022 but are still more than 2x 2019 levels.

Alan Haig, President of Haig Partners, shared, “We are seeing mixed trends in auto retail today, which are pushing down dealership profits and dealership values. Sharply rising inventories and floorplan expense are pushing down profits at most stores. At the same time, vehicle prices and loan rates for consumers are far higher than before the pandemic, and that is suppressing the pent-up demand that we believe exists in the market. Even with this decline in profits dealers are still making far more than they were before the pandemic. In Q4 2023, the average dealership still generated profits that we estimate were 78% higher than in Q4 2019.

We are seeing similar trends in dealership buy-sells. Sales of dealerships have fallen from the peak level in 2021 of 707 rooftops to an estimated 528 in 2023. And estimated average blue sky per dealership has fallen from a peak of $25M in 2022 to $21.4M in 2023. But even at these lower values, dealerships are still far more valuable today than in the past. Life is getting harder for auto dealers, but it’s still pretty darn good.

Our firm had the pleasure of representing sellers of 23 dealerships from five transactions so far this year, setting records for values paid for BMW and Honda dealerships. And, based on the number of other dealers we are advising, we believe that 2024 will be another strong year for dealership buy-sells. Sellers are still getting strong prices for their dealerships and buyers remain aggressive as they look to add to their growing portfolios. Our team prides itself on maximizing the value for dealers. Therefore we encourage owners to contact us to learn more about what their business might be worth, or trends impacting the value of their dealerships.”

Q4 2023 Haig Report® Highlights

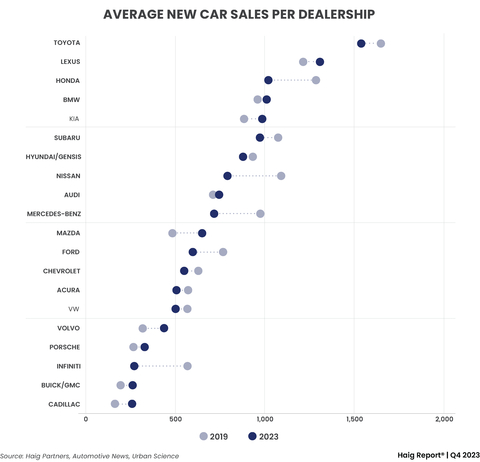

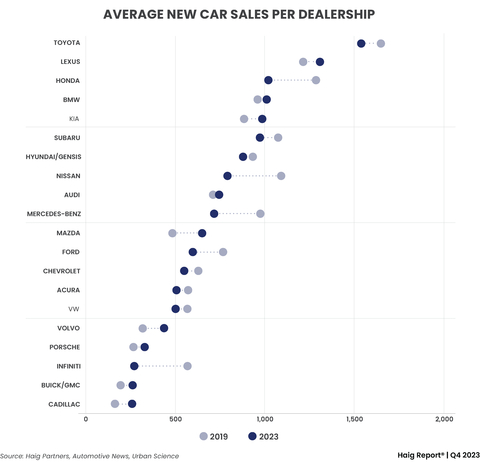

- Franchise valuation ranges and takeaways. There have been significant changes in market share since the pandemic. From 2019 to 2023, certain brands like Mazda and Kia have performed very well, while other brands like Honda and Infiniti have struggled significantly. These relative changes in volume also point to changes in the level of dealership profits, and therefore, dealership values for each of these brands.

- Buy-sell outlook. We expect the buy-sell market to remain highly active in 2024, possibly at the same levels we saw in 2023. Our pipeline of pending transactions is robust. Our newest clients have decided that with the best years of auto retail behind us, they prefer to take advantage before profits dip further. With valuations still elevated well above pre-pandemic levels, owners of high-value dealerships can sell their stores for high prices and move onto the next stages of their lives (or reinvest back into auto retail).

- New vehicle inventory surges. At the end of January, new vehicle inventories were at their highest level since June 2020, according to Cox Automotive. We had hoped that the OEMs would have learned a lesson during the post-pandemic era – to produce one less car than the market demands – but it appears that for many factories, they are looking at short-term incentives and missing the bigger picture.

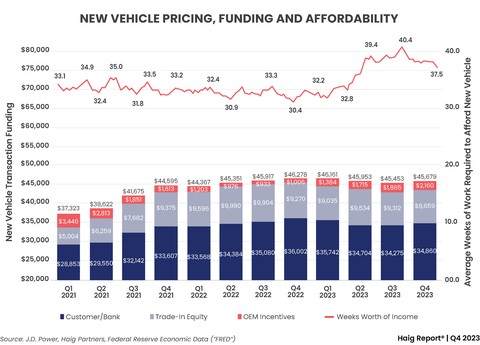

- New vehicle affordability is slightly improving. The average transaction price (ATP) for a new vehicle in Q4 2023 was $45,679, according to data from J.D. Power. This ATP represents a 1.3% decrease from Q4 2022, which saw the highest new vehicle ATP on record.

- Public auto retailers want to acquire platforms and divest underperformers in 2024. The publicly traded auto retailers remained acquisitive throughout 2023, spending 52% more than 2022 on US auto dealerships. Spending across the publics was lumpy, however, with a wide range of spending and strategies. Asbury spent $1.5B on a large platform, or more than half of all public company spending in 2023 on US auto dealerships. Lithia spent an estimated $500M on another platform, and one of the public retailers did not invest in any new dealerships. Based on Q4 2023 earnings calls, we expect the public auto retailers to remain acquisitive in 2024.

If you are interested in diversifying your group through acquisitions or considering what your business might be worth, contact any member of our team to have a confidential conversation.

______

About The Haig Report®

The Haig Report®, the leading industry quarterly report that tracks trends in auto retail and their impact on dealership values, includes data and analysis on the performance of auto dealerships, discusses noteworthy events impacting the automotive retail industry, identifies trends in the M&A market for dealerships, provides guidance on estimated value ranges for different franchises and shares an outlook for the automotive retail buy-sell market. The Haig Report® is based on data gathered from reputable public sources and interviews with leading dealer groups and dealers, bankers, lawyers and accountants who specialize in auto retail.

About Haig Partners

Haig Partners is a leading buy-sell advisory firm that helps owners of higher-value auto, truck, RV, and motorsports dealerships maximize the value of their businesses when they are ready to sell. The team at Haig Partners has advised on the purchase or sale of more than 575 dealerships with a total value of over $11 billion. It has represented 27 dealership groups that qualify for the Top 150 Dealership Groups list published by Automotive News, more than any other firm. Clients of Haig Partners benefit from the group's collective experience as previous executives with leading companies such as Ally Financial, AutoNation, Bank of America, Credit Suisse, Deloitte, FORVIS, J.P. Morgan, the Sewell Automotive Companies and Toyota Financial Services. Leveraging its unmatched expertise and extensive relationships, Haig Partners guides clients to successful outcomes through a confidential and customized sales process. The firm authors The Haig Report®, the leading industry quarterly report that tracks trends in auto retail and their impact on dealership values, and co-authors NADA’s Guide, “Buying and Selling a Dealership.” Haig Partners team members are frequent speakers at industry conferences and are regularly quoted in reputable media outlets, including Reuters, Forbes, The Wall Street Journal, The New York Times, CNBC, BBC, Automotive News, Wards, CarDealershipGuy and CBT News. For more information, visit www.haigpartners.com.