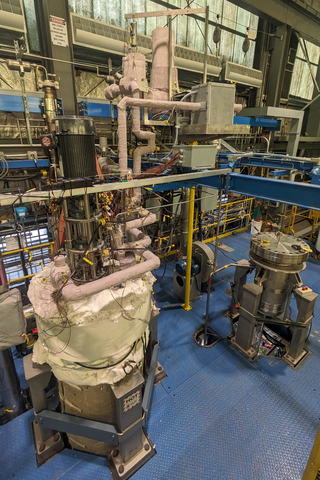

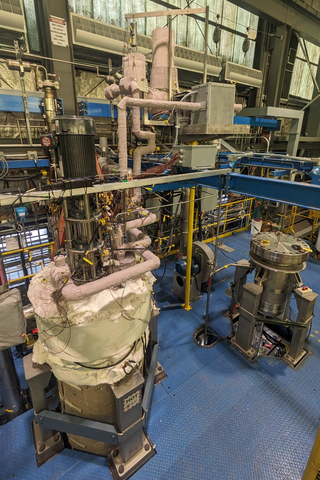

SANTA CLARA, Calif.--(BUSINESS WIRE)--Oklo Inc. (“Oklo”), a fast fission clean power technology and nuclear fuel recycling company, has successfully completed the second phase of the Thermal Hydraulic Experimental Test Article (“THETA”) testing campaign in collaboration with Argonne National Laboratory. THETA is a sodium fixture with world-class instrumentation installed at Argonne’s Mechanisms Engineer Test Loop facility.

The THETA testing campaign is strategically focused on key thermal-hydraulic behavior of Oklo’s fast fission reactor design. A better understanding of key thermal-hydraulic behavior enables design optimizations while providing high-fidelity data using high-fidelity instrumentation. Ultimately, the THETA testing campaign enables the opportunity to further improve the demonstrated safety and economic potential of bringing Oklo’s fast fission technology to market.

“Argonne’s leadership and technical expertise have been pivotal to THETA’s success, and the completion of the second phase of testing is a huge accomplishment. THETA has and will continue to play a major role in Oklo’s testing endeavors to support our commercialization plans for our Aurora Powerhouses,” said Patrick Everett, Deputy Senior Director of Product at Oklo.

Oklo shared costs for the work done at Argonne National Laboratory with funding from a Department of Energy Gateway for Accelerated Innovation in Nuclear voucher.

About Oklo Inc.: Oklo is developing fast fission power plants to provide clean, reliable, and affordable energy at scale. Oklo received a site use permit from the U.S. Department of Energy, was awarded fuel material from Idaho National Laboratory, submitted the first advanced fission custom combined license application to the Nuclear Regulatory Commission, and is developing advanced fuel recycling technologies in collaboration with the U.S. Department of Energy and U.S. National Laboratories.

On July 11, 2023, Oklo and AltC Acquisition Corp. (“AltC”) (NYSE: ALCC) announced that they have entered into a definitive business combination agreement that upon closing would result in the combined company to be listed on the New York Stock Exchange under the ticker symbol “OKLO.”

About AltC Acquisition Corp.: AltC Acquisition Corp. was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “goal,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding THETA’s role in Oklo’s commercialization plans, expected market opportunity for Oklo and the consummation of the proposed business combination between Oklo and AltC. These forward-looking statements are based on information available to us as of the date of this news release and represent management’s current views and assumptions. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control.

These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Oklo’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Oklo. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about Oklo that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties, include risks related to the deployment of Oklo’s powerhouses; the risk that Oklo is pursuing an emerging market, with no commercial project operating, regulatory uncertainties; the potential need for financing to construct plants, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that the approval of the shareholders of AltC or Oklo is not obtained; the effects of competition; changes in applicable laws or regulations; the outcome of any government and regulatory proceedings, investigations and inquiries; each case, under the heading “Risk Factors,” and other documents filed, or to be filed, with the Securities and Exchange Commission (“SEC”) by AltC, including the Registration Statement (as defined below). If any of these risks materialize or Oklo’s assumptions prove incorrect, actual results could differ materially from the results implied by the forward-looking statements relating to Oklo. There may be additional risks that Oklo does not presently know or that Oklo currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Oklo’s expectations, plans or forecasts of future events and views as of the date of this communication. Oklo anticipates that subsequent events and developments will cause Oklo’s assessments to change. However, while Oklo may elect to update these forward-looking statements at some point in the future, Oklo specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Oklo’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Business Combination and Where to Find It

The proposed business combination will be submitted to shareholders of AltC for their consideration. AltC has filed a registration statement on Form S-4 (as amended, and may be further amended from time to time, the “Registration Statement”) with the SEC, which includes a preliminary proxy statement/prospectus/consent solicitation statement to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s shareholders in connection with the proposed transaction and other matters described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of the proposed transaction. After the Registration Statement has been declared effective, AltC will mail a definitive proxy statement/prospectus/consent solicitation statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transaction. AltC’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation statement, in connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed transaction, as well as other documents filed with the SEC by AltC in connection with the proposed transaction (the “Special Meeting”), as these documents contain and will contain important information about AltC, Oklo and the proposed transaction.

Shareholders may obtain a copy of the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s shareholders in connection with the Special Meeting. Information regarding persons such persons who may, under SEC rules, be deemed participants in the solicitation of AltC’s shareholders in connection with the Special Meeting, is set forth in the preliminary proxy statement/prospectus/consent solicitation statement.

Information about the directors and executive officers of Oklo and a description of their direct or indirect interests is set forth in the sections entitled “Certain Relationships and Related Party Transactions – Oklo’s Related Person Transactions” and “Interests of Certain Persons in the Business Combination” included in the Registration Statement.

Information about the directors and executive officers of AltC, a description of their direct or indirect interests and their beneficial ownership of AltC’s capital stock is set forth in the sections entitled “Other Information about AltC – Management, Directors and Executive Officers,” “Certain Relationships and Related Party Transactions – AltC’s Related Person Transactions,” “Interests of Certain Persons in the Business Combination” and “Beneficial Ownership of Securities” included in the Registration Statement. The most recent amendment to the Registration Statement was filed on January 30, 2024, and is available at https://www.sec.gov/Archives/edgar/data/1849056/000110465924007900/tm2324337-10_s4a.htm.

Shareholders, potential investors, and other interested persons should read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.